An accredited portfolio management advisor is a professional designation awarded by the College for Financial Planning to financial advisors who specialize in managing investment portfolios for clients. APMA designees have completed a rigorous educational program that covers portfolio management, investment analysis, asset allocation, risk management, and other related topics. Having an accredited portfolio management advisor can offer several advantages to investors. A financial professional with APMA designation has demonstrated expertise in portfolio management, making them well-equipped to help investors achieve their investment goals. APMA professionals have a deep understanding of investment concepts, including asset allocation, diversification, and risk management. Working with an accredited portfolio management advisor can also provide a level of reassurance to investors. Investors can rest assured that they are working with a qualified professional who has undergone specialized training in portfolio management. APMA professionals are held to high standards of ethical conduct and must abide by the Code of Ethics and Standards of Professional Conduct. Furthermore, APMA professionals are regulated by government-authorized organizations like FINRA, which adds an extra layer of reassurance for investors that these professionals must adhere to strict ethical and regulatory standards. APMA professionals can also help investors navigate complex financial markets. They can guide how to invest in different asset classes and help investors adjust their portfolios as market conditions change. APMA professionals can also provide investors access to various investment products, including mutual funds, exchange-traded funds (ETFs), and individual securities. Here is a step-by-step process for the APMA Certification: Candidates interested in becoming an accredited portfolio management advisor must first complete a course of study that covers topics such as asset allocation, investment selection, risk management, and performance measurement. The course of study usually takes several months to a year. After completing the course of study, candidates must pass an exam to earn the APMA designation. The exam tests candidates' knowledge of portfolio management and investment concepts. It typically consists of multiple-choice questions and simulations. To maintain their APMA designation, professionals must complete continuing education requirements and abide by the Code of Ethics and Standards of Professional Conduct. This ensures that APMA professionals stay up-to-date with industry trends and maintain their knowledge and skills. The APMA certification process is rigorous and ensures that professionals who earn the designation have a deep understanding of portfolio management and investment concepts. This proficiency helps APMA professionals manage portfolios effectively and provides confidence to investors that their investments are in good hands. Accredited portfolio management advisors offer a wide range of services to investors. These services include portfolio analysis and assessment, asset allocation and diversification, investment selection and management, risk management and mitigation, and performance measurement and reporting. APMA professionals can analyze investors' existing portfolios and assess their performance. They can help investors identify areas of weakness and suggest adjustments to improve performance. APMA professionals can also provide investors with a comprehensive analysis of their portfolios, including asset allocation, risk exposure, and diversification. Asset allocation is a critical component of portfolio management. APMA professionals can help investors determine the optimal asset allocation based on their investment objectives, risk tolerance, and time horizon. They can also help investors diversify their portfolios across different asset classes, such as stocks, bonds, and alternative investments. APMA professionals can help investors select and manage investments. They can guide in selecting individual securities, mutual funds, and ETFs. They can also manage investors' portfolios, adjusting as market conditions change. Managing risk is a crucial aspect of portfolio management. APMA professionals can help investors identify and mitigate risks in their portfolios. They can provide guidance on strategies to minimize risks, such as diversification, hedging, and asset allocation. APMA professionals can provide investors with regular performance reports, including detailed information on their portfolio's performance. They can also help investors set performance benchmarks and track progress toward their investment objectives. Choosing an accredited portfolio management advisor is an important decision that requires careful consideration. Investors should consider the advisor's qualifications, experience, fees, investment philosophy, and communication practices when selecting an APMA professional. Additionally, the types of clients and portfolios the advisor typically works with should also be taken into account. Investors should look for an APMA professional with a strong educational background and relevant experience. APMA professionals typically have a degree in finance or a related field and have completed specialized training in portfolio management. They may also have professional designations such as the Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP). Investors should consider the types of clients and portfolios that an APMA professional typically works with. Some APMA professionals specialize in working with high-net-worth individuals, while others may work with a broader range of clients. Investors should also consider the types of portfolios that an advisor typically manages, such as retirement accounts or taxable investment accounts. Investors should consider an APMA professional's fees and compensation structure. Some APMA professionals charge a flat fee or hourly rate, while others charge a percentage of assets under management. Investors should also consider any additional fees, such as transaction fees or custodian fees. Investors should consider an APMA professional's investment philosophy and approach. APMA professionals may have different approaches to portfolio management, such as active or passive management. Investors should select an APMA professional whose investment philosophy and approach align with their investment objectives and risk tolerance. Investors should consider an APMA professional's communication and reporting practices. APMA professionals should communicate with investors regularly and provide them with performance reports and other relevant information. Investors should select an APMA professional who is responsive to their needs and provides clear and transparent communication. An accredited portfolio management advisor can provide investors with valuable expertise in portfolio management. APMA professionals have a deep understanding of investment concepts and can help investors achieve their investment objectives. The APMA certification process ensures that professionals who earn the designation have the knowledge and skills necessary to manage portfolios effectively. Investors must evaluate the APMA professional's qualifications, experience, fees, investment philosophy, and communication practices when choosing a financial advisor. Additionally, the advisor's typical clients and portfolios should also be considered. By carefully considering these factors, investors can select an APMA professional who is well-suited to their needs and can help them achieve their investment objectives. In conclusion, speaking with a qualified and experienced financial advisor, such as an accredited portfolio management advisor, can be a valuable step for investors looking to manage their portfolios effectively and achieve their investment goals.Definition of an Accredited Portfolio Management Advisor (APMA)

Benefits of Hiring an Accredited Portfolio Management Advisor (APMA)

Expertise in Portfolio Management

Reassurance to Investors and Ethical Standards

Navigating Complex Financial Markets

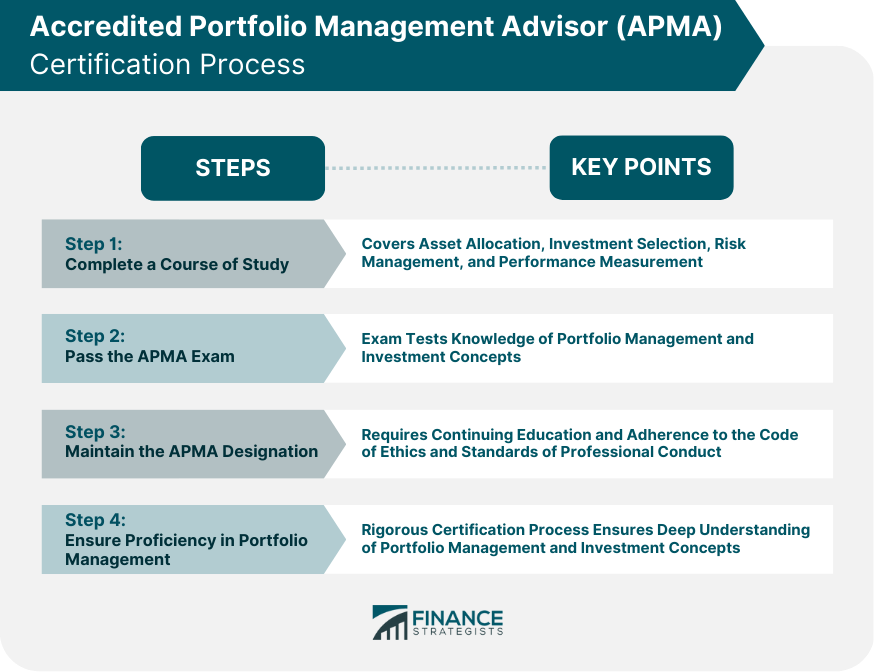

APMA Certification Process

Step 1: Complete a Course of Study

Step 2: Pass the APMA Exam

Step 3: Maintain the APMA Designation

Step 4: Ensure Proficiency in Portfolio Management

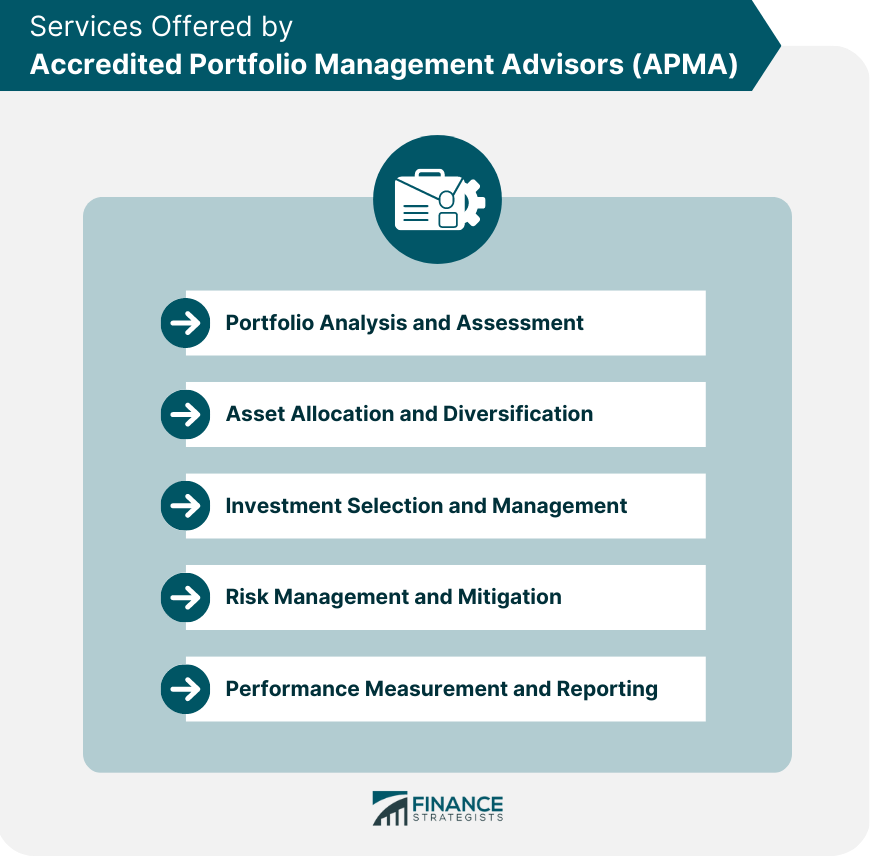

Services Offered by Accredited Portfolio Management Advisors

Portfolio Analysis and Assessment

Asset Allocation and Diversification

Investment Selection and Management

Risk Management and Mitigation

Performance Measurement and Reporting

Considerations When Choosing an Accredited Portfolio Management Advisor

Qualifications and Experience

Types of Clients and Portfolios

Fees and Compensation Structure

Investment Philosophy and Approach

Communication and Reporting Practices

Final Thoughts

Accredited Portfolio Management Advisor (APMA) FAQs

An accredited portfolio management advisor (APMA) is a financial professional who has undergone specialized training in portfolio management and passed a certification exam.

Working with an APMA professional can provide a level of reassurance to investors that they are working with a qualified professional who has undergone specialized training in portfolio management. APMA professionals have a deep understanding of investment concepts, including asset allocation, diversification, and risk management.

To become an APMA professional, candidates must complete a course of study and pass an exam. The course of study typically takes several months to a year and covers topics such as asset allocation, investment selection, risk management, and performance measurement.

APMA professionals offer a wide range of services to investors, including portfolio analysis and assessment, asset allocation and diversification, investment selection and management, risk management and mitigation, and performance measurement and reporting.

When selecting an APMA professional, investors should consider the advisor's qualifications and experience, the types of clients and portfolios the advisor typically works with, their fees and compensation structure, their investment philosophy and approach, and their communication and reporting practices.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.