An Accredited Tax Advisor (ATA) is a highly qualified tax professional who has demonstrated expertise in the field of taxation through specialized education, experience, and a rigorous examination process. ATAs are recognized for their ability to provide expert advice on various tax matters, including federal, state, and local taxation, tax planning, and representation in tax disputes. The ATA designation is granted by the Accreditation Council for Accountancy and Taxation (ACAT), an independent accrediting organization that sets and maintains high standards for tax professionals. By achieving the ATA designation, tax professionals can distinguish themselves from their peers and assure clients that they possess the knowledge and skills necessary to navigate the complexities of the tax system. In today's complex financial landscape, having access to expert tax advice is more important than ever. The tax code is constantly evolving, and individuals and businesses must navigate an ever-changing array of rules and regulations to ensure compliance and minimize tax liabilities. ATAs play a critical role in helping taxpayers understand and comply with these requirements while identifying tax savings and strategic planning opportunities. Moreover, ATAs contribute to the financial sector by providing businesses with valuable insights into the tax implications of various transactions and decisions. This knowledge allows companies to make informed choices that align with their overall financial goals while minimizing tax liabilities. For individuals, ATAs can assist with personal tax planning, retirement, and estate planning, ensuring that clients are well-prepared for their financial future. To become an Accredited Tax Advisor, candidates must meet certain eligibility requirements. First, they must have a bachelor's degree in accounting, finance, or a related field or demonstrate equivalent experience in the tax profession. Additionally, candidates must have at least five years of experience in tax preparation, planning, or consulting, with a minimum of 40% of their time devoted to tax-related activities. Lastly, applicants must submit three professional references from individuals who can attest to their qualifications and experience in the field of taxation. These references must be from individuals unrelated to the applicant and should include at least one reference from a current or former employer or client. Once candidates have met the eligibility requirements, they can apply for the ATA designation. This starts with registering for the ATA examination, typically offered twice yearly. Candidates should take the time to thoroughly prepare for the exam, as it covers a wide range of tax topics and requires a deep understanding of the tax code and regulations. The ATA examination consists of multiple-choice questions and is designed to test candidates' knowledge and skills in various areas of taxation, including federal income tax, corporate tax, estate and gift tax, state and local taxation, tax planning, tax research, and tax compliance. The exam is scored on a pass/fail basis, with a minimum passing score determined by the ACAT. Upon successfully passing the exam, candidates will be granted the ATA designation and will be required to complete ongoing continuing education requirements to maintain their certification. An essential aspect of an ATA's expertise is its understanding of federal taxation. This includes knowledge of the various types of income taxes, such as individual income tax, corporate tax, and the alternative minimum tax. ATAs must also be well-versed in the intricacies of the federal tax code, including deductions, credits, exemptions, and exclusions. Additionally, ATAs should have a solid understanding of other federal taxes, such as estate and gift taxes. This includes advising clients on the tax implications of transferring wealth, as well as strategies for minimizing potential tax liabilities through careful planning and using various estate and gift tax provisions. A thorough knowledge of federal taxation enables ATAs to provide comprehensive advice and support to their clients in navigating the complexities of the tax system. In addition to federal taxes, ATAs must be knowledgeable about state and local taxation. This includes understanding the various types of state and local taxes, such as sales and use, property, and franchise taxes. ATAs must also be familiar with the tax laws and regulations specific to the states and localities where their clients operate, as these laws can vary significantly across jurisdictions. By staying up-to-date on state and local tax developments, ATAs can help their clients ensure compliance with all applicable laws and regulations while identifying tax savings and strategic planning opportunities. This is particularly important for businesses operating in multiple states or jurisdictions, as the tax implications of various transactions and decisions can vastly differ depending on the location. A key component of an ATA's skill set is the ability to provide strategic tax planning advice to clients. This includes identifying tax-efficient investment strategies, advising on retirement planning, and helping clients choose the most advantageous business structures for tax purposes. Through proactive tax planning, ATAs can help their clients minimize their tax liabilities and achieve their financial goals. In order to provide effective tax planning advice, ATAs must stay current on tax law changes and developments and maintain a deep understanding of the various tax provisions and strategies available to their clients. This requires ongoing research and education and staying connected to industry trends and best practices. One of the most critical skills for an ATA is the ability to conduct thorough tax research and interpret complex tax laws and regulations. This involves understanding and navigating the Internal Revenue Code, tax case law, tax treaties, and international tax law. ATAs must be able to analyze and interpret these sources to provide accurate and reliable advice to their clients. Tax research and interpretation are particularly important when dealing with complex tax issues or disputes and when the tax law is unclear or subject to interpretation. By staying current on tax law developments and maintaining strong research skills, ATAs can help their clients navigate the complexities of the tax system and make informed decisions. ATAs are often called upon to assist clients with tax compliance, including preparing tax returns and ensuring compliance with all applicable laws and regulations. This requires a detailed understanding of the tax code and the ability to accurately and efficiently prepare various types of tax returns. In addition to tax compliance, ATAs may also represent clients in tax disputes and audits. This includes working with the Internal Revenue Service (IRS) to resolve issues and negotiate settlements on behalf of their clients. To be effective in this role, ATAs must have strong negotiation skills, a deep understanding of the tax law, and the ability to effectively communicate and advocate for their client's interests. One of the primary benefits of hiring an ATA is their expertise in tax matters. ATAs have demonstrated their knowledge and skills through rigorous examinations and have met strict eligibility requirements, including education and experience. By hiring an ATA, clients can be confident that they receive expert advice and guidance on various tax issues. ATAs are also held to high ethical standards and are expected to maintain a high level of professionalism in their work. This includes adhering to integrity, objectivity, and confidentiality principles and complying with all applicable laws and regulations. Thus, clients can trust that their tax professional is committed to providing the highest level of service and ethical conduct. Another benefit of hiring an ATA is their ability to provide proactive tax planning and strategy advice. ATAs are skilled in identifying opportunities for tax savings and can help clients develop strategies to minimize their tax liabilities and achieve their financial goals. By working with an ATA, clients can take advantage of tax planning opportunities they may have yet to be aware of or had the expertise to implement independently. ATAs are also equipped to represent clients in tax disputes and audits, providing valuable support and advocacy during what can be a stressful and challenging process. With their deep understanding of tax law and regulations, ATAs can help clients navigate the complexities of the tax system, resolve disputes, and negotiate favorable settlements with the IRS. This means that clients can be confident that they have an experienced and knowledgeable advocate on their side. State boards of Accountancy license Certified Public Accountants (CPAs) and have demonstrated their accounting, auditing, and taxation expertise through a rigorous examination process. While CPAs possess a broad range of financial expertise, they may specialize in something other than taxation. ATAs, on the other hand, have more focused expertise in tax matters, making them a valuable resource for clients with complex tax situations or those who require specialized tax advice. Enrolled Agents (EAs) are federally licensed tax practitioners who have demonstrated their knowledge of federal tax law through a comprehensive examination administered by the IRS. EAs are authorized to represent taxpayers before the IRS in tax disputes and audits. While EAs possess expertise in federal taxation, ATAs have a broader understanding of both federal and state tax issues, making them a valuable resource for clients with complex tax situations or those operating in multiple jurisdictions. Tax attorneys are licensed attorneys who specialize in tax law. They have completed a law degree and have passed a state bar examination. Tax attorneys are particularly well-suited for handling complex legal issues related to taxation, such as disputes and litigation, and advising on the tax implications of various transactions and business structures. While tax attorneys possess a deep understanding of the legal aspects of taxation, ATAs offer more comprehensive expertise in tax planning, strategy, and compliance, making them valuable resources for a wide range of tax issues. When selecting a tax professional, it is important to consider your specific needs and the expertise of the professional you are considering. ATAs, CPAs, EAs, and tax attorneys all bring unique skills and knowledge to the table, and the right choice will depend on the nature and complexity of your tax situation. By carefully evaluating your needs and the qualifications of each type of tax professional, you can make an informed decision and find the best fit for your unique circumstances. Accredited Tax Advisors play a critical role in helping individuals and businesses navigate the complexities of the tax system. With their specialized expertise in taxation, ATAs are well-equipped to provide expert advice on a wide range of tax issues, from compliance and planning to representation in disputes and audits. For tax professionals, achieving the ATA certification is a valuable way to distinguish themselves from their peers and demonstrate their commitment to excellence in the field of taxation. ATAs can showcase their expertise and dedication to their clients and the broader tax community by meeting the rigorous eligibility requirements and passing the comprehensive examination. As tax laws and regulations continue to evolve and become more complex, the need for qualified ATAs to assist individuals and businesses in navigating these changes is only expected to grow. By staying current on tax law developments, technological advancements, and the shifting needs of their clients, ATAs will continue to play an essential role in the financial sector and contribute to the success of individuals and businesses alike.What Is an Accredited Tax Advisor (ATA)?

ATA Certification Process

Eligibility Requirements

Application Process

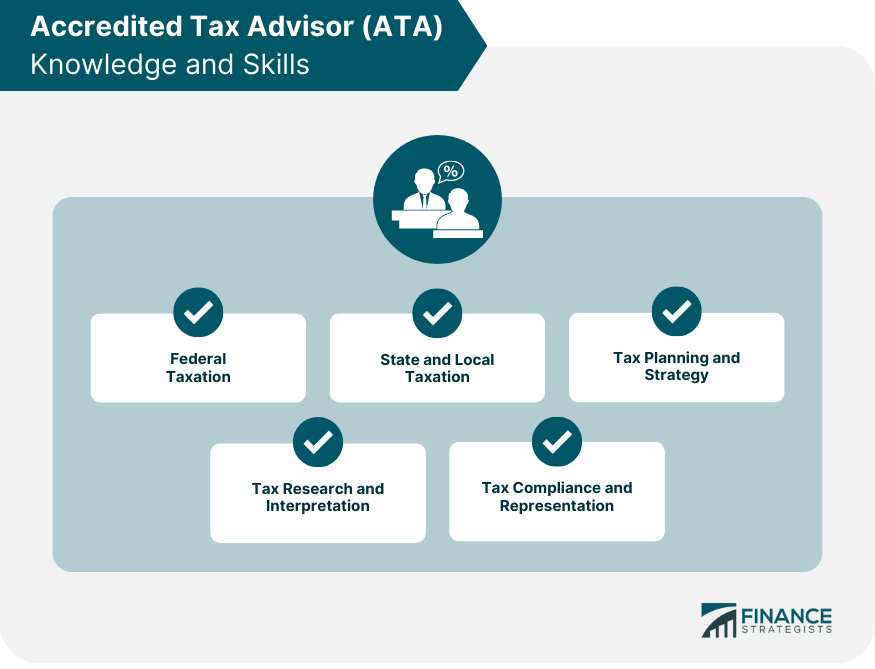

ATA Knowledge and Skills

Federal Taxation

State and Local Taxation

Tax Planning and Strategy

Tax Research and Interpretation

Tax Compliance and Representation

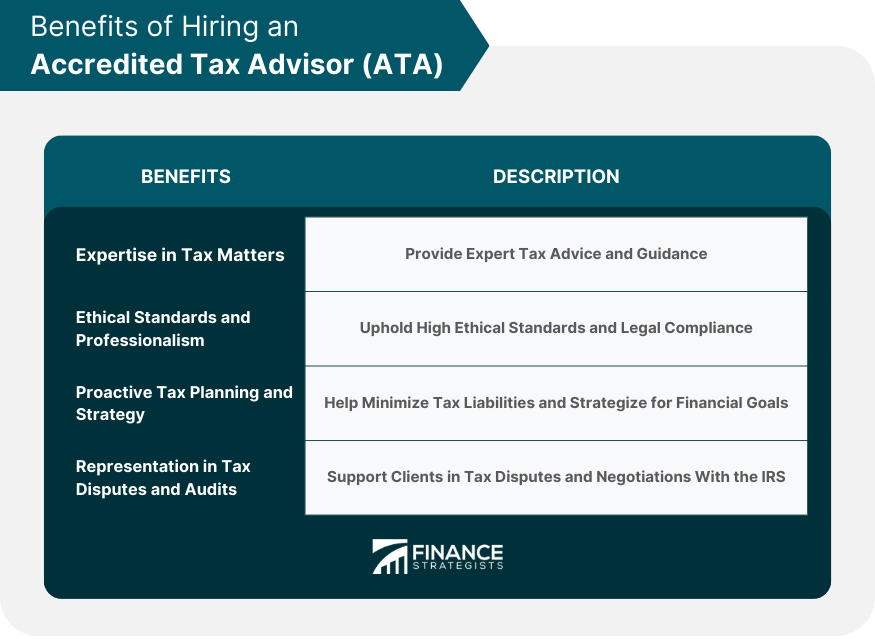

Benefits of Hiring an ATA

Expertise in Tax Matters

Ethical Standards and Professionalism

Proactive Tax Planning and Strategy

Representation in Tax Disputes and Audits

Comparison of ATAs With Other Tax Professionals

Certified Public Accountants (CPAs)

Enrolled Agents (EAs)

Tax Attorneys

Choosing the Right Professional for Your Needs

Conclusion

Accredited Tax Advisor (ATA) FAQs

An Accredited Tax Advisor (ATA) is a tax professional who has met specific educational, experience, and ethical requirements and has earned the ATA designation from a recognized accrediting organization. ATAs provide individuals, businesses, and organizations with expert tax advice, planning, and compliance services.

To become an Accredited Tax Advisor (ATA), you must meet certain educational and experience requirements, pass a comprehensive examination, and adhere to a code of ethics. The specific requirements may vary by the accrediting organization, so it's important to check with the organization that offers the ATA designation for detailed information.

Hiring an Accredited Tax Advisor (ATA) provides several benefits, including access to a tax professional with specialized knowledge and expertise, assurance of ethical and professional conduct, and the ability to receive expert advice on complex tax matters. ATAs must also participate in continuing education to stay current with tax laws and regulations.

An Accredited Tax Advisor (ATA) is a tax professional who specializes in providing tax advice, planning, and compliance services. A Certified Public Accountant (CPA) is an accounting professional who has met specific education and experience requirements and passed the Uniform CPA Examination. While both ATAs and CPAs can provide tax services, CPAs may also offer a broader range of accounting and financial services.

To verify if a tax professional is an Accredited Tax Advisor (ATA), you can check with the accrediting organization that offers the ATA designation. Most accrediting organizations have online directories or verification tools that allow you to search for ATAs by name, location, or other criteria. Additionally, you can ask the tax professional to provide proof of their ATA designation and credentials.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.