The College for Financial Planning, which awards the Accredited Wealth Management Advisor (AWMA) designation, is one of the most highly respected and well-known providers of financial planning education in the United States. The program has been around for quite some time and has helped to produce some of the most qualified financial professionals in the country. The goal of the AWMA designation is to identify experienced financial service professionals who have superior knowledge of providing comprehensive financial services. It is recognized among many financial professionals as a way to establish credibility in the area of wealth management. This can be beneficial when looking for a new job or trying to build relationships with potential clients. Have a financial question? Click here. AWMAs provide wealth management services for individuals with large amounts of accumulated assets. Their focus is on helping clients make decisions about their investments, insurance coverage, estate planning, retirement needs, and other areas that affect their overall quality of life. Although they are not specifically certified as investment advisors or planners, their work overlaps with these fields since many wealthy people use them for help in developing portfolios. An AWMA can help clients design a financial plan based on their unique needs and goals. They are expected to have at least five years' experience in the field, which includes two years of post-qualification experience. A typical client for an AWMA is over the age of 50 who has accumulated more than 1 million dollars in investable assets. Many are entrepreneurs, executives, or retired professionals with high incomes. The Accredited Wealth Management Advisor (AWMA) designation is attained by enrolling in a program that costs $1,300 by the College for Financial Planning. This year-long program consists of eight modules which include tax reduction alternatives, wealth strategies, financial trends, insurance coverage, estate management, and family governance. Within the course of the program, students are to undergo an exam every six months to test their knowledge. To gain the AWMA designation, the test taker must score 70% or higher in the final exam. The exam aims to test the applicant's ability to apply theoretical knowledge to practical situations. The Accredited Wealth Management Advisor (AWMA) Designation is recognized among many financial professionals as a way to establish credibility in the area of wealth management for those who have already attained their CFP certification. To maintain its credential, those who hold an AWMA designation are to complete 16 hours of continuing education every two years. These classes include topics such as new ethical laws and standards of conduct, new tax plans and strategies, and emerging trends in the financial industry. They should also reaffirm adherence to the AWMA code of ethics. A renewal fee worth $95 is due every two years. The Accredited Wealth Management Advisor (AWMA) designation allows professionals to increase their credibility with clients and employers, as well as with other members of the financial community. It is also seen as an advantage if you are transitioning between jobs or careers. For instance, it may be handy if you are changing from a position that does not involve financial planning into one that does. Below are some points that highlight the benefits of holding an AWMA designation: AAMS stands for Accredited Asset Management Specialist which is awarded by the College for Financial Planning. It is recognized as a certification in the field of tax, retirement, insurance, and estate issues. The AAMS designation is ideal for new financial advisors, while the AWMA designation is geared towards those who have already established their experience in the financial industry. The AAMS designation requires the completion of twelve courses, while the AWMA designation requires the completion of eight courses. In terms of exam rules, passing rate, adherence to code of ethics, and continuing education, the two designations are the same. The Accredited Wealth Management Advisor (AWMA) designation is proof that an individual has attained a high level of knowledge and experience in the area of wealth management. It is recognized among many financial professionals as a way to establish credibility in this field. It also allows for specialization in the area of wealth management, which can be advantageous for those looking to change careers or employers. What Does an AWMA Do?

AWMA Licensing

AWMA Continuing Education

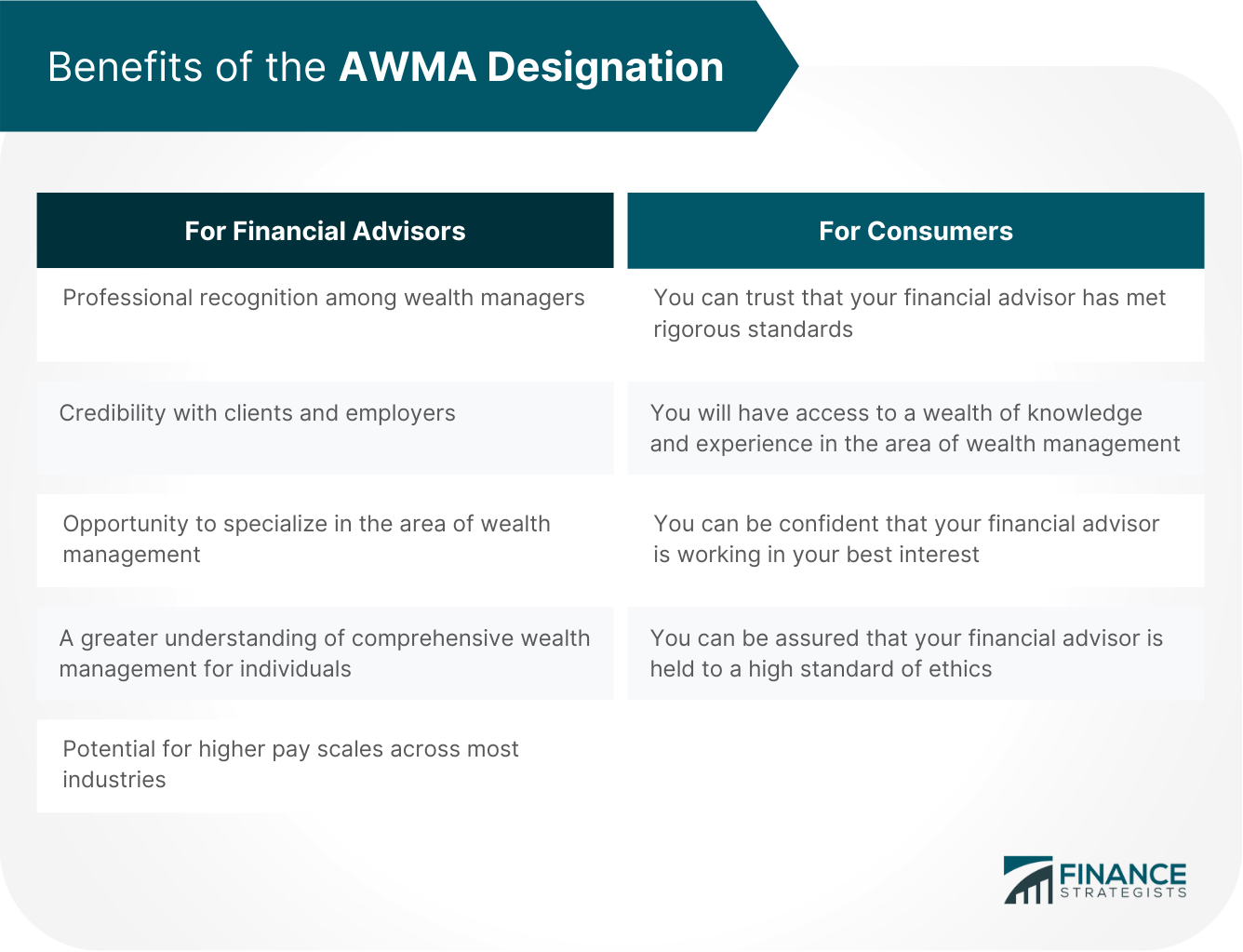

Benefits of the AWMA Designation

For Financial Advisors:

For Consumers:

How Is AWMA Different From AAMS?

The Bottom Line

Accredited Wealth Management Advisor (AWMA) FAQs

Accredited Wealth Management Advisor (AWMA) is a designation awarded by the College for Financial Planning to individuals who are knowledgeable and experienced in the area of wealth management. It is seen as an advantage if you are transitioning between jobs or careers.

The best way to find out is to ask. You can also check the advisor's profile on the Accredited Wealth Management Advisor website.

Accredited Wealth Management Advisor (AWMA) allows professionals to increase their credibility with clients and employers, as well as with other members of the financial community. It also allows for specialization in the area of wealth management, which can be advantageous for those looking to change careers or employers.

The Accredited Wealth Management Advisor (AWMA) designation is attained by enrolling in a program that costs $1,300 by the College for Financial Planning.

AAMS stands for Accredited Asset Management Specialist which is awarded by the College for Financial Planning. It is recognized as a certification in the field of tax, retirement, insurance, and estate issues. The AAMS designation is ideal for new financial advisors, while the AWMA designation is geared towards those who have already established their experience in the financial industry. The AAMS designation requires the completion of twelve courses, while the AWMA designation requires the completion of eight courses.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.