A Certified Management Accountant (CMA) is a professional designation earned by those who aspire to demonstrate their expertise in management accounting. CMAs have extensive knowledge of basic financial accounting systems, strategic management, and commercial decision-making. The CMA issued by the Institute of Management Accountants (IMA) is recognized worldwide as a mark of excellence in management accounting. Obtaining certification requires current IMA membership, CMA tests, professional certification, and continuing professional experience in financial accounting or financial management. CMAs must follow a strict code of conduct and live up to the highest standards of ethics and professionalism. Certified Management Accountants are responsible for providing financial analysis and guidance to organizations. While the specific duties of a CMA vary depending on the organization, they all play a vital role in ensuring the financial health of their organizations. To obtain a CMA certification, you must undergo a rigorous process. CMA certification requires a bachelor's degree in business administration or accounting from an accredited institution. Any four-year program focusing on business can help prepare you for the CMA exams by providing a broad foundation in business. As a bachelor's degree holder, you are given exclusive access to their exam registration system, including study guides and practice exams. You need at least two years of work experience in management accounting and financial management to be considered for this program. After your application has been approved, you can start studying for the IMA's 2-part exams. If you have fulfilled the educational and experience requirements, you can enroll in Part 1 and Part 2 of the exam series. You need to complete each set of exams within three years after enrollment. You must pass both exams to obtain the CMA certification. Part 1 focuses on different aspects of management, such as strategic planning, performance management, cost management, and internal controls. Part 2 focuses on analyzing financial statements and corporate finance, making investment decisions, and using tools like spreadsheets and business analytics software to make decisions. You must get at least a 70% on each test to pass. To maintain your CMA certification, you must obtain relevant work experience and pass the CMA exams. The required work experience must involve managing people or directly overseeing financial information systems. It must have taken place within five years of receiving your certification. Examples of such positions include controller, chief financial officer (CFO), internal auditor, and financial analyst. After completing steps 1 to 5, you can be a Certified Management Accountant (CMA). To keep this certification active, IMA members must get 30 hours of continuing professional education (CPE) credits every year. CPE credits are earned by attending seminars, classes, or workshops about management accounting. A CMA certification includes the most recent advancements in accounting, business, and finance. It will provide some of the following benefits: The key advantage of CMA certification is that it is regarded as the most significant accounting certification for management due to its excellent blend of business and accounting. Companies believe in their professional expertise and are given crucial organizational jobs. The CMA certificate indicates that you will do more than just accounting; you will take on more duties and manage the accounts. Other practitioners do not advance beyond a particular position and compensation. However, a CMA certification allows you to move quickly into a management role. Obtaining a CMA certification qualifies you for more significant compensation than other candidates. CMA-certified applicants advance faster into management after accumulating experience. Even when they change positions, they receive a more substantial raise because CMA-certified candidates are in high demand in the job market. CMA prepares you to better comprehend business, finance, and accounting. You will become the go-to person for significant issues. Many CMA-certified candidates have gone on to work as CFOs (Chief Financial Officers). These benefits make CMA an attractive option for anyone interested in a career in accounting or finance. The CMA and Certified Public Accountant (CPA) certifications share many similarities; however, several differences set them apart. CPAs' most common career opportunities are tax preparation and auditing. Other options include consulting or working for a financial institution. CMAs tend to specialize more in analytics, strategy, and decision-making. While some may still work within accounting or auditing roles, they often focus on budgeting/pricing risks management & financial modeling rather than numbers crunching alone. CMAs are also well-equipped to advise on strategic business decisions and resource allocations. CMAs tend to make slightly higher salaries than CPAs. According to PayScale, the average salary of a CMA is $97,000 per year, while the average salary of a CPA is $70,896 per year. The cost of taking the CMA exam is lower than that of the CPA exam. The CMA exam fee is $1,000, while the CPA exam is $1,500. A bachelor’s degree in accounting or a related field is required for both certifications. Similarly, they also require 2 years of experience in functions related to the respective specialization. CMA requires work experience relevant to management accounting or financial management. CPA requires work experience in public accounting. To become a CPA, you must pass all four parts of the CPA Exam and meet your state's education, experience, and ethics requirements. Both credentials are in high demand in the accounting sector. While there are variations between a CMA and a CPA certification, both provide employment options with the possibility of earning better salaries than people who do not have credentials. Individuals interested in accounting should explore both certificates and determine which is most suited to their goals. A Certified Management Accountant is a professional designation earned by those who wish to demonstrate their expertise in management accounting. To obtain a CMA certification, you must undergo a rigorous process that includes a series of exams and a practical experience requirement. Becoming a CMA has various benefits, like improved career prospects and the ability to help organizations make better decisions and advance in their field. The CMA certification is more of an advanced-level management accounting credential. At the same time, the CPA tends to focus on financial accounting. Earning a CMA certification is a valuable way to further your career and demonstrate your commitment to accounting. With its global recognition, exclusive resources, and potential for higher salaries, obtaining this certification is well worth the effort. What Is a Certified Management Accountant (CMA)?

Duties of Certified Management Accountants

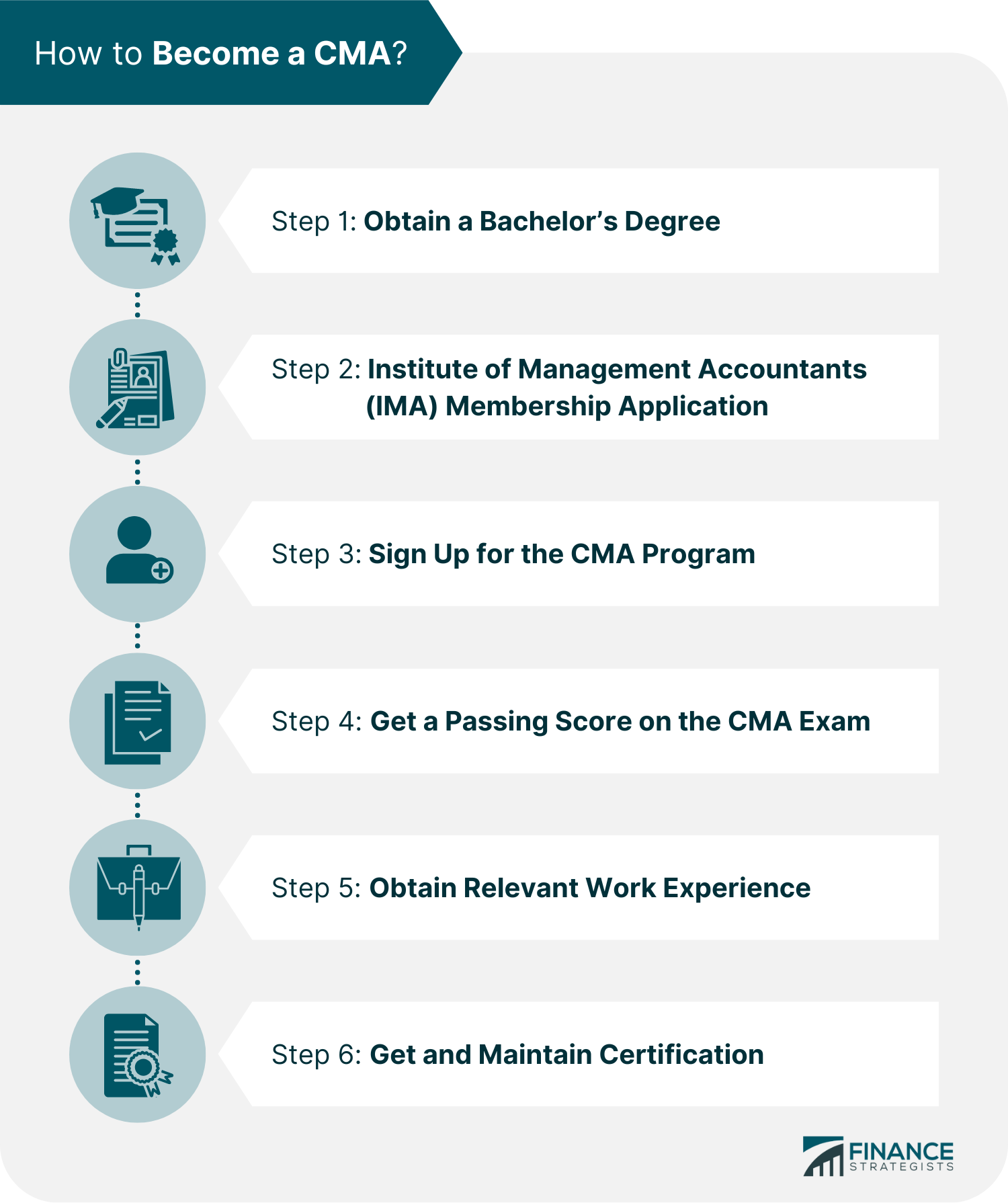

CMAs collaborate closely with senior management to ensure that the organization makes well-informed and strategic decisions regarding resource allocation. How to Become a Certified Management Accountant

Step 1: Obtain a Bachelor's Degree

Step 2: Institute of Management Accountants (IMA) Membership Application

Step 3: Sign Up for the CMA Program

Step 4: Get a Passing Score on the CMA Exam

Step 5: Obtain Relevant Work Experience

Step 6: Get and Maintain Certification

Benefits of Becoming a CMA

Business Appeal

Possibilities for Growth

Increased Earnings

Employee Recognition

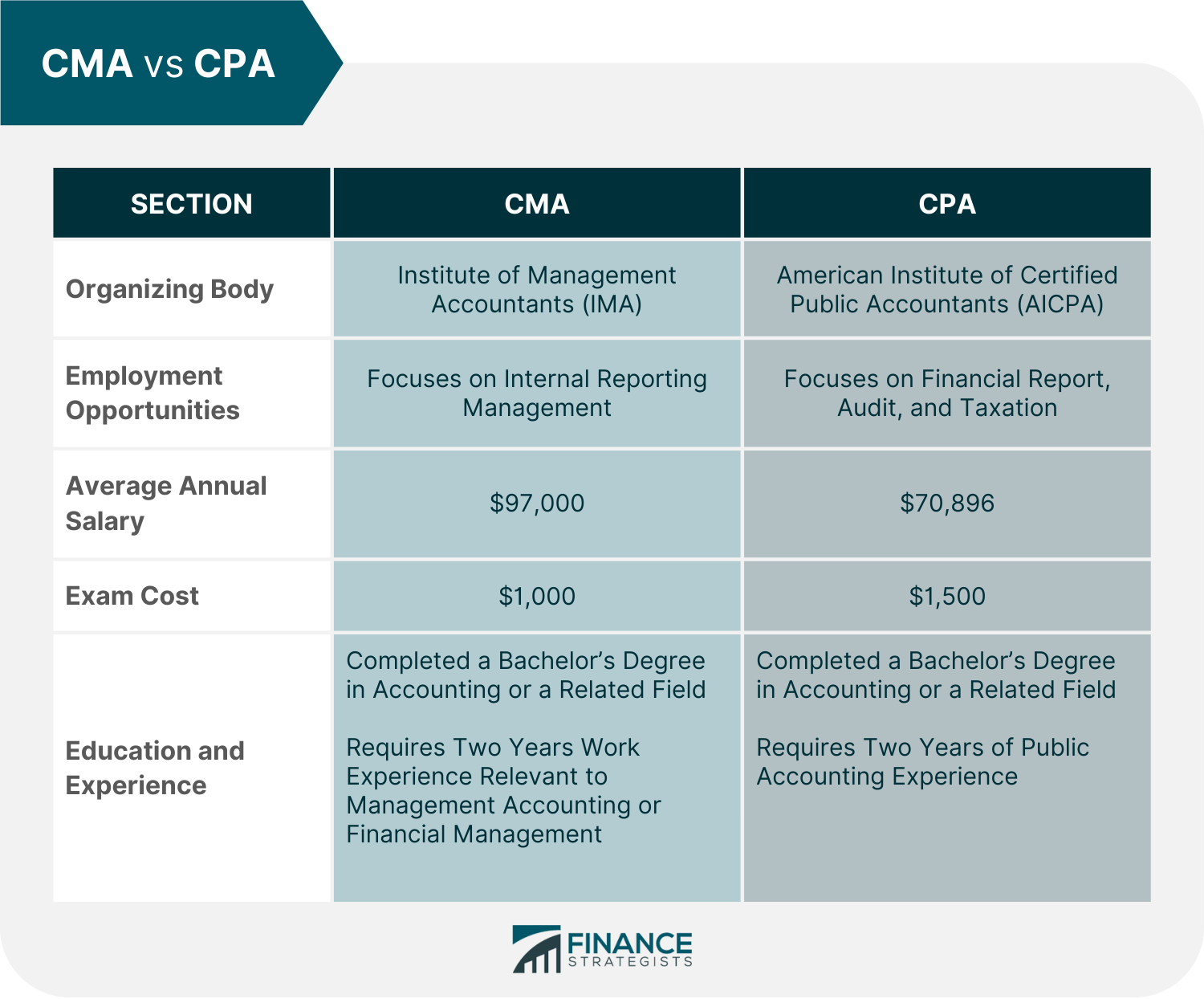

CMA vs CPA

Employment Opportunities

Salary

Exam Cost

Education & Experience Requirements

Final Thoughts

Certified Management Accountant (CMA) FAQs

Certified Management Accountants manage and process financial information within an organization. Preparing internal reports, assessing financial performance, analyzing data, developing strategies, and providing guidance on financial decisions are among the common functions of CMAs.

Both the CMA and CPA certifications are highly sought after in the accounting field. While there are some differences between the two certifications, they both offer career opportunities with the potential to earn higher salaries than those without certifications. It is important to research both certifications and decide which one is the best fit for your goals.

To become a CMA, you must be an IMA member and pass both parts of the CMA Exam. You must also have a bachelor’s degree in accounting or a related field, although work experience is not required.

In becoming a CMA, you can open up new career opportunities, network with other professionals, gain access to exclusive resources, and earn higher salaries than those without certification.

The initial registration fee for the CMA exam is $1,000. This includes both parts of the exam and any additional materials needed for taking the test. Additional fees for rescheduling or retaking a failed exam portion may apply.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.