The Chartered Financial Analyst (CFA) exam is a three-level test through the CFA Institute that evaluates candidates' knowledge of finance and investment principles. Passing the CFA exams indicates a combination of knowledge, intelligence, and diligence that provides a strong foundation for success in the financial industry. Candidates take Level I at the end of June, Level II in September, and Level III in March. The Level I test contains 240 questions to be completed over 150 minutes. The Level II test has 320 questions to be answered in 200 minutes. The Level III exam has 350 questions and is also completed in 200 minutes. Test takers must pass all three levels within three years of initial registration, otherwise they forfeit their membership status with the CFA Institute. Have a question about the CFA Exam? Click here. There are three levels of the CFA exam: The first level of the test covers ethical and professional standards, fundamental analysis, derivatives and other topics relevant to the investment decision-making process. Candidates must correctly answer 60 percent of the questions. The second level of the test covers portfolio management and corporate finance. This exam is divided into two three-hour sessions, and candidates must correctly answer 66 percent to pass. The third section is the most comprehensive and includes: The third level of the test is designed to test candidates' ability to make investment decisions under conditions of uncertainty. The test contains 350 questions to be completed over a period of six to eight hours. Candidates must correctly answer 73 percent of the questions to pass. The topics tested are extensive, including: Although candidates may incur expenses for study materials, the actual cost of the CFA exams is quite low relative to other professional investment management tests. In 2021, Level I has an exam fee of $725. Level II has an exam fee of $1,300. Level III has an exam fee of $1,445. CFA Institute members save up to 25% on the CFA exam fees. Nonmember fees are double those paid by CFA Institute members for each level of the exam. Candidates can waive the fees if they are employed in a full-time position in finance or have been unemployed for more than 12 months. You can also request fee waivers from CFA Institute by submitting a letter with supporting documents describing the specific situation that prevents them from paying the standard fees. For example, you can provide documentation of attendance at college or university, a letter from the registrar's office that confirms you are scheduled to graduate within six months of taking the exam, or a letter from your employer stating the company will pay the exam fees if you pass. There is also an alternative fee structure for candidates who have been unemployed for less than 12 months and do not fit any of these conditions. You will have to submit documentation of your circumstances, including proof that you are actively seeking employment. Those who have passed or are studying for a professional designation within finance or related fields may find the CFA exam useful. The test is also open to candidates who work in related areas, such as portfolio management and financial analysis. Those without a formal background in finance or investment may find the exam difficult to pass. The test is considered extremely difficult and requires a significant amount of preparation. The first level (CFA Level I) has a success rate of 46 percent. For Level II, the success rate is 47 percent and for Level III it is 82 percent. There are many self-study guides available to help you prepare for the CFA exams, and several training companies offer in-class review sessions. The CFA Institute also has a study guide you can use or order. This material is designed to emulate exam questions so that when you take the test, you will be more familiar with the format and the types of questions. Preparing for the exam involves much more than studying the CFA Institute's material. Candidates who prepare correctly will actually take practice exams under test-day conditions and allow themselves to receive the scores they earn. This information will help you understand where your weaknesses lie so that you can focus your preparation efforts. The exam is challenging but rewarding, and those who pass the tests find that the credential adds to their professional value as well as their earning potential. Those who wish to pass the exams need focus and commitment, and must be prepared to study outside of class hours. Other tips include: The CFA exams are designed to be difficult and require much dedication. Passing these tests is a challenge for any candidate with the drive and commitment to study sufficiently. With preparation and commitment, anyone can take and pass the three levels of the CFA exam.CFA Exam Levels and Passing Grades

Level I

Level II

Level III

The Cost of the CFA Exam

Who Should Take the Test and Who Shouldn’t?

CFA Exam Level of Difficulty

How To Prepare for the CFA Exam

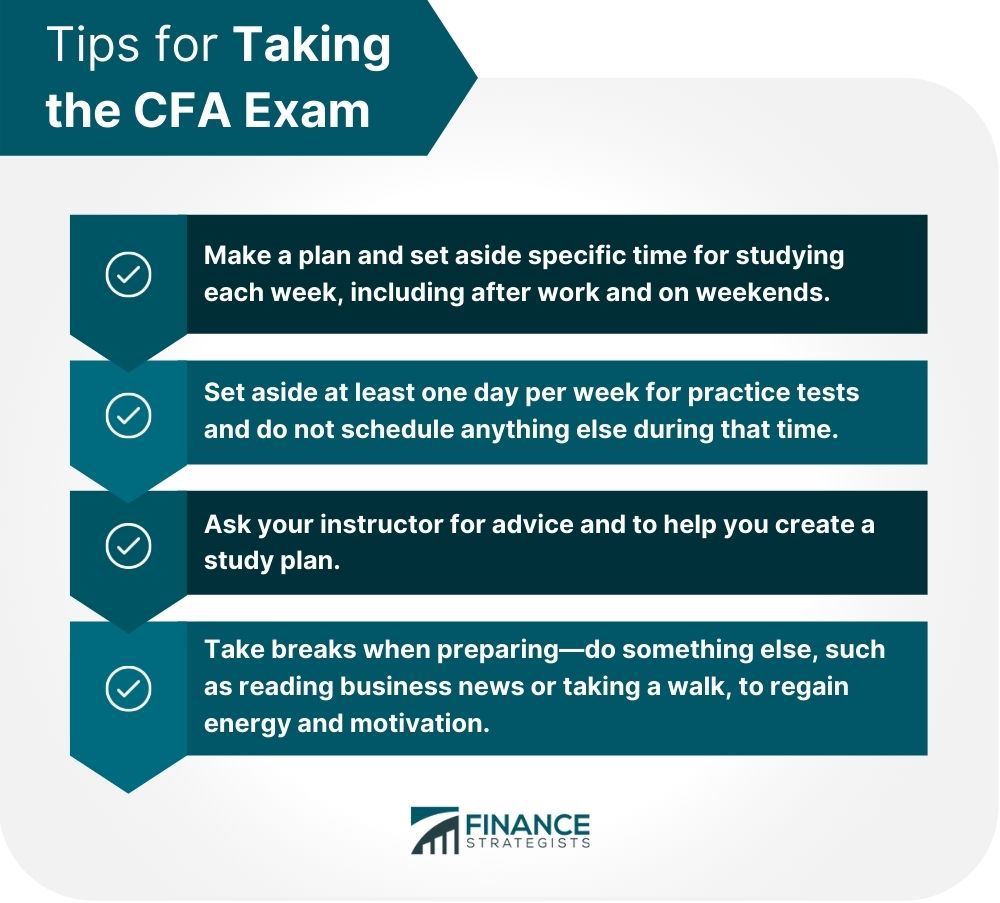

Tips for Taking the CFA Exam

Final Thoughts

Chartered Financial Analyst (CFA) Exam FAQs

The CFA (Chartered Financial Analyst) designation is a professional credential offered by the CFA Institute designed to measure one's knowledge and skill in investment decision making. The exams for this designation are extremely difficult and require extensive study and preparation. Candidates may need many months to prepare, and must pass three levels of exams to be granted the designation.

The CFA courses are difficult, and candidates must pass three exams in order to achieve certification. The first level (CFA Level I) has a 46 percent pass rate; this increases slightly for the second level (CFA Level II) with a 47 percent pass rate; the third level (CFA Level III) has an 82-percent pass rate.

The exams are composed of all multiple choice questions, which means that candidates cannot test their knowledge through essays or other types of writing.

In 2021, Level I has an exam fee of $725. Level II has an exam fee of $1,300. Level III has an exam fee of $1,445. These prices do not include the cost of registration or study materials, which can be quite expensive depending on your course of study.

The CFA exams are designed for those who work in the investment profession and wish to demonstrate their knowledge and skills. Candidates must be qualified and must register with the CFA Institute before taking the exam.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.