Chartered Advisor for Senior Living (CASL) is a professional certification program offered by the American College of Financial Services. The program is designed to provide financial advisors, insurance agents, attorneys, and other professionals with specialized knowledge in working with senior clients. The curriculum covers various topics, including retirement planning, long-term care, estate planning, and ethics. Upon completion of the program, individuals are awarded the CASL certification, which signifies that they have obtained a high level of expertise in senior financial planning and are committed to providing the best possible service to their clients. The importance of CASL certification cannot be overstated, as it provides financial professionals with the tools and knowledge necessary to meet the unique needs of senior clients. Seniors have different financial and legal concerns than younger clients, including retirement income planning, long-term care planning, and estate planning. CASL professionals are trained to address these concerns and provide comprehensive, customized solutions tailored to each client's specific needs and goals. Furthermore, obtaining the CASL certification demonstrates a commitment to continuing education and professional development. The financial services industry is constantly changing, and staying up-to-date on the latest trends and regulations is critical to providing the best possible service to clients. CASL professionals are required to complete ongoing education and training to maintain their certification, ensuring that they are always at the forefront of industry developments. Becoming a CASL offers a variety of benefits for financial professionals looking to specialize in senior financial planning. One of the primary benefits of becoming a Chartered Advisor for Senior Living is the increased knowledge and expertise in senior financial planning. The CASL curriculum covers a range of topics, including retirement income planning, long-term care planning, and estate planning, among others. The program is designed to provide financial professionals with a comprehensive understanding of the unique needs and concerns of senior clients and how to address them effectively. CASL certification also enhances credibility and professionalism in working with senior clients. Clients want to work with advisors who have the knowledge and expertise necessary to address their unique needs and concerns. The CASL certification demonstrates a commitment to providing the best possible service to senior clients and can help establish trust and credibility with potential clients. CASL certification can also lead to expanded career opportunities and the potential for increased income. As the population of seniors continues to grow in the United States, the demand for specialized financial and legal services for this demographic is increasing. CASL professionals are well-positioned to meet this demand and can earn more income as a result. Obtaining CASL certification requires individuals to meet certain education and experience requirements, complete a series of specialized coursework and training, and pass a final examination. To be eligible for CASL certification, individuals must meet certain education and experience requirements. The American College of Financial Services requires applicants to have at least three years of experience in financial services, insurance, or related fields, as well as a bachelor's degree or equivalent professional experience. Individuals who do not have a bachelor's degree but have significant professional experience may still be eligible for the program. The CASL program consists of five courses that cover a range of topics related to senior financial planning, including: Understanding the Older Client Health and Long-Term Care Financing for Seniors Financial Decisions in Retirement Estate Planning for Seniors Ethics for the Financial Services Professional The coursework is self-paced and can be completed online or through self-study. The program typically takes 18 months to complete, although individuals can take longer if needed. Upon completion of the coursework, individuals must pass a final examination to earn the CASL certification. The examination covers all the topics covered in the coursework and is designed to test the individual's knowledge and understanding of senior financial planning. In addition to passing the examination, CASL professionals are also required to complete ongoing education and training to maintain their certification. This includes completing 30 hours of continuing education every two years and adhering to a code of ethics. CASL professionals are experts in senior financial planning, providing a range of specialized services to address senior clients' unique needs and concerns. CASL professionals are experts in retirement planning and can help seniors develop comprehensive retirement plans that address their unique needs and goals. This may include developing a plan to maximize retirement income, managing retirement assets, and planning for tax-efficient withdrawals. Long-term care is a significant concern for many seniors, and CASL professionals are trained to help clients plan for this expense. This may include developing a long-term care insurance strategy, exploring other funding options, and developing a plan for care coordination. Estate planning is another important area of expertise for CASL professionals. This may include developing a comprehensive estate plan that includes wills, trusts, and other legal documents and exploring strategies to minimize estate taxes and ensure that assets are distributed according to the client's wishes. Medicare is a complex system, and many seniors struggle to understand their options and make informed decisions. CASL professionals are trained to help clients navigate the Medicare system, including exploring different plan options and ensuring that clients are maximizing their benefits. Social Security is another vital source of retirement income, and CASL professionals are experts in helping clients maximize their benefits. This may include exploring different claiming strategies, coordinating Social Security benefits with other retirement income sources, and developing a plan to maximize lifetime benefits. Working with an advisor with expertise and experience in senior financial planning is essential to ensure that your unique needs and concerns are being addressed. The American College of Financial Services maintains a directory of CASL professionals, which can be searched by location or area of expertise. This is a great resource for individuals seeking a qualified advisor in their area. When evaluating a potential advisor, it's important to check for credentials and experience. CASL professionals should have the CASL certification, as well as other relevant certifications or designations. It's also essential to evaluate the individual's experience working with seniors and their knowledge of senior financial planning. Finally, it's important to evaluate the advisor's approach and philosophy. Senior financial planning is a personal and complex process, and it's important to work with an advisor who takes a holistic approach and prioritizes the client's goals and values. When evaluating an advisor, it's important to ask questions about their approach to senior financial planning, their process for developing customized solutions, and their philosophy on working with clients. The Chartered Advisor for Senior Living certification provides financial professionals with specialized knowledge and expertise to meet the unique needs and concerns of senior clients. By obtaining the CASL certification, professionals can enhance their credibility, expand their career opportunities, and provide comprehensive, customized solutions for clients. Seniors and their families can benefit greatly from working with a CASL professional who can help them navigate the complex financial and legal issues related to aging and retirement. If you are a senior or a family member of a senior, it is essential to seek the guidance of a qualified financial advisor who has the expertise and experience in senior financial planning. A CASL professional can provide you with personalized solutions to help you achieve your financial goals and plan for the future. Take action today and start your search for a qualified CASL professional who can help you navigate the complex financial and legal issues related to aging and retirement.Definition of Chartered Advisor for Senior Living (CASL)

Importance of CASL Certification

Benefits of Becoming a Chartered Advisor for Senior Living (CASL)

Increased Knowledge and Expertise in Senior Financial Planning

Enhanced Credibility and Professionalism in Working With Senior Clients

Expanded Career Opportunities and Potential for Increased Income

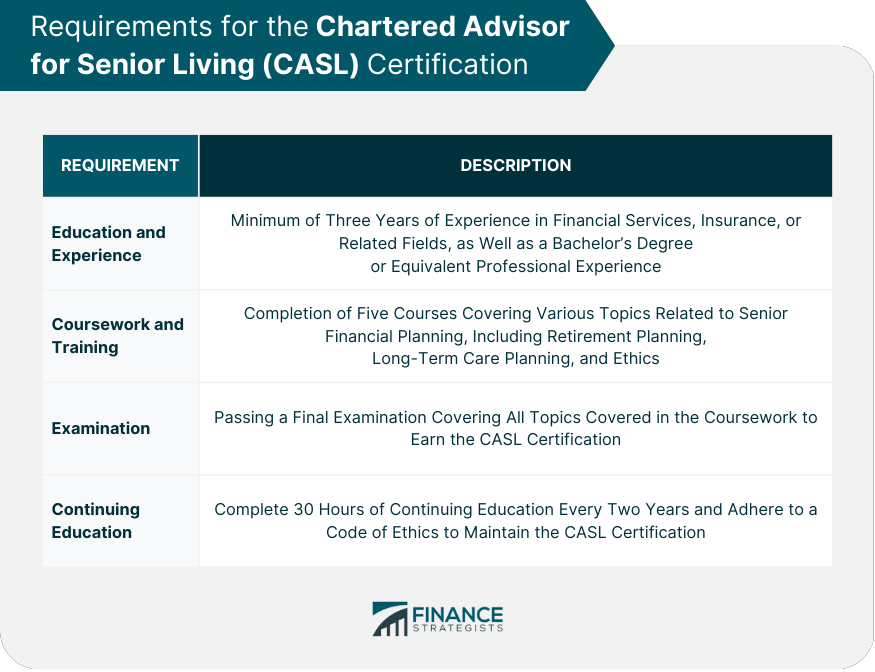

Requirements for the Chartered Advisor for Senior Living (CASL) Certification

Education and Experience

Coursework and Training Requirements

Examination and Continuing Education Requirements

Services Provided by a Chartered Advisor for Senior Living (CASL)

Retirement Planning Services

Long-Term Care Planning Services

Estate Planning Services

Medicare Planning Services

Social Security Planning Services

How to Find a Qualified Chartered Advisor for Senior Living (CASL)

Search for CASL Professionals Through the American College of Financial Services

Check for Credentials and Experience

Evaluate the Advisor's Approach and Philosophy

Final Thoughts

Chartered Advisor for Senior Living (CASL) FAQs

A Qualified Chartered Advisor for Senior Living (CASL) is a financial professional who has obtained specialized knowledge and expertise in working with senior clients, specifically in the areas of retirement planning, long-term care, estate planning, and Medicare planning.

To find a Qualified Chartered Advisor for Senior Living (CASL), you can search for professionals through the American College of Financial Services or check for credentials and experience. It's also important to evaluate the advisor's approach and philosophy to ensure that they prioritize your goals and values.

Working with a Qualified Chartered Advisor for Senior Living (CASL) can provide personalized solutions to help you achieve your financial goals and plan for the future. CASL professionals have the expertise and experience to address the unique needs and concerns of senior clients and can provide comprehensive, customized solutions.

To obtain Chartered Advisor for Senior Living (CASL) certification, individuals must meet certain education and experience requirements, complete a series of specialized coursework and training, and pass a final examination. CASL professionals are also required to complete ongoing education and training to maintain their certification.

Becoming a Qualified Chartered Advisor for Senior Living (CASL) can enhance your credibility, expand your career opportunities, and potentially increase your income. As the population of seniors continues to grow in the United States, the demand for specialized financial and legal services for this demographic is increasing, and CASL professionals are well-positioned to meet this demand.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.