The Chartered Financial Consultant designation is a professional credential for financial planners and consultants awarded by The American College of Financial Services. The ChFC designation signifies that a financial professional has met rigorous educational, ethical, and experience standards, demonstrating their expertise in providing comprehensive financial planning services to clients. The ChFC designation plays a significant role in the financial planning industry by establishing a high standard of competency and professionalism among financial planners and consultants, ensuring that clients receive knowledgeable and competent advice. To earn the ChFC designation, candidates must meet the following requirements: Candidates must complete a series of core and elective courses covering various aspects of financial planning, such as insurance, investment, retirement, and estate planning. Candidates must pass a series of proctored examinations that test their knowledge and competence in the areas covered by the ChFC curriculum. Candidates must have at least three years of relevant work experience in the financial planning industry or a related field. Candidates must adhere to The American College's Code of Ethics and agree to comply with continuing education requirements. The ChFC designation is an important credential for financial professionals, as it demonstrates their commitment to providing high-quality, comprehensive financial planning services and adhering to strict ethical standards. The core curriculum of the ChFC designation covers essential aspects of financial planning, including: An overview of the financial planning process, including goal setting, data gathering, and plan development. Understanding various insurance products and their role in a comprehensive financial plan, including life, health, disability, and long-term care insurance. Developing investment strategies to help clients achieve their financial goals, including asset allocation, risk management, and portfolio construction. Understanding the impact of income taxes on financial planning and developing tax-efficient strategies for clients. Assisting clients in planning for retirement, including Social Security, pension plans, and retirement income strategies. Helping clients develop estate plans to transfer wealth efficiently and minimize estate taxes. In addition to the core curriculum, ChFC candidates can choose from a range of elective courses that cover specialized areas of financial planning, such as: Developing financial plans for families with special needs individuals, including government benefits, special needs trusts, and estate planning considerations. Understanding the psychological factors that influence financial decision-making and developing strategies to help clients overcome biases and make better financial choices. Helping business owners plan for the orderly transfer of their business interests, including buy-sell agreements, valuation methods, and tax considerations. Assisting clients in navigating the financial complexities of divorce, including property division, spousal support, and tax implications. Advising clients on the financial planning aspects of executive compensation packages, including stock options, deferred compensation, and other benefits. Helping clients plan for the financial challenges of aging or elder care, including long-term care, healthcare costs, and estate planning considerations. Both the ChFC and CFP designations represent high standards of competency and professionalism in the financial planning industry. Both designations require candidates to complete a comprehensive course of study, pass examinations, and adhere to ethical standards. The primary difference between the ChFC and CFP designations lies in their educational requirements and curriculum focus. The ChFC curriculum tends to be more extensive, covering a broader range of topics, including elective courses that allow candidates to specialize in specific areas of financial planning. In contrast, the CFP curriculum focuses primarily on core financial planning concepts. When deciding between a ChFC and CFP professional, consider your specific financial planning needs and whether a professional with a broader range of expertise or one with a more focused approach would be better suited to address your goals. ChFC professionals possess extensive knowledge and expertise in various aspects of financial planning, ensuring that they can address a wide range of financial needs and goals. ChFC professionals are held to high ethical standards, ensuring that clients receive unbiased, competent, and professional advice. ChFC professionals are required to engage in ongoing education and professional development, ensuring that they stay current with industry developments and best practices. By working with a ChFC professional, clients can have confidence in the financial planning process, knowing that their financial consultant has met rigorous standards of competence and ethical conduct. When selecting a ChFC professional, it is important to evaluate their qualifications and credentials to ensure that they have the necessary expertise in financial planning. Consider the ChFC professional's years of experience and the specific areas of financial planning in which they specialize, ensuring that they can address your unique needs and goals. Choose a ChFC professional with whom you feel comfortable discussing sensitive financial matters and who communicates effectively in a way that you understand. Ask for referrals from friends, family members, or other professionals who have had positive experiences working with a ChFC professional. Select a ChFC professional with a clear and transparent fee structure, ensuring that you understand the costs associated with their services. The Chartered Financial Consultant designation holds significant importance within the financial planning industry, as it signifies a financial professional's dedication to providing comprehensive and competent financial planning services. With its extensive and specialized curriculum, the ChFC designation equips professionals with the knowledge and skills necessary to address a wide range of financial needs and goals, ensuring that clients receive well-informed guidance and advice. When selecting a ChFC professional, it is essential to consider their qualifications, experience, communication style, and fee structure. By partnering with a ChFC professional, clients can feel confident that their financial planner has met rigorous standards of competence and ethical conduct. Ultimately, working with a ChFC professional can have a substantial impact on clients' financial well-being, leading to more successful financial planning outcomes.What Is a Chartered Financial Consultant (ChFC)?

The ChFC Designation

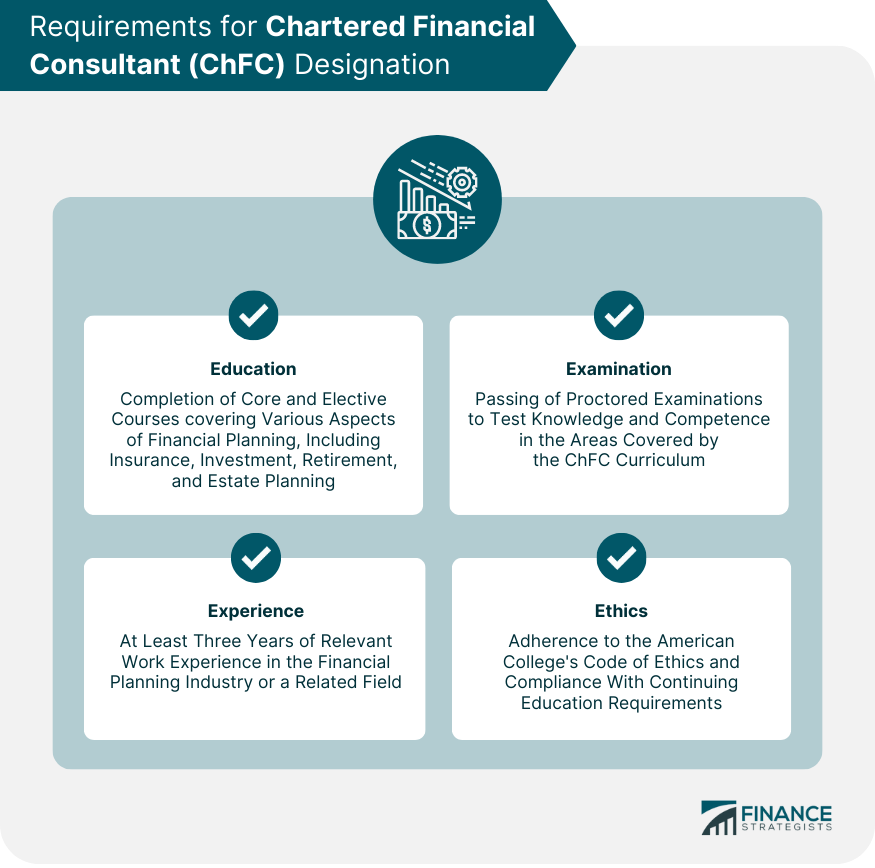

Requirements for ChFC Designation

Education

Examination

Experience

Ethics

Importance of ChFC Designation for Financial Professionals

ChFC Curriculum and Areas of Expertise

Core Curriculum

Financial Planning Process

Insurance Planning

Investment Planning

Income Taxation

Retirement Planning

Estate Planning

Elective Courses

Special Needs Planning

Behavioral Finance

Business Succession Planning

Divorce Planning

Executive Compensation

Elder Care Planning

Comparing ChFC and CFP Designations

Similarities

Differences

Choosing the Right Designation for Your Needs

Benefits of Working With a ChFC Professional

Comprehensive Financial Planning Expertise

Adherence to Ethical Standards

Ongoing Education and Professional Development

Confidence in the Financial Planning Process

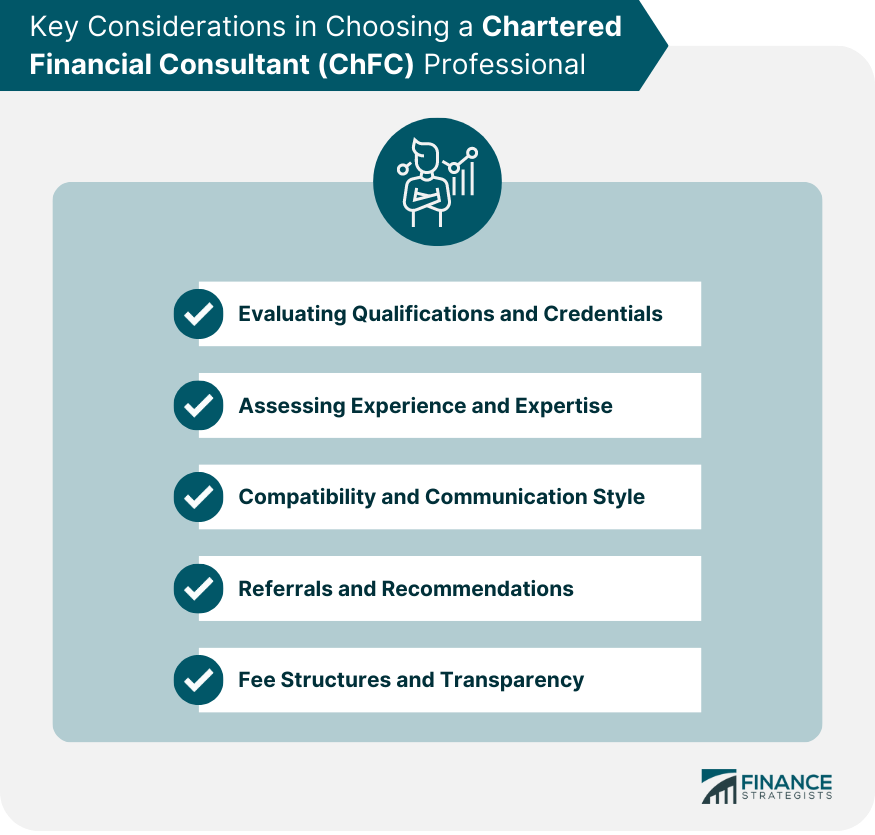

Key Considerations in Choosing a ChFC Professional

Evaluating Qualifications and Credentials

Assessing Experience and Expertise

Compatibility and Communication Style

Referrals and Recommendations

Fee Structures and Transparency

Conclusion

Chartered Financial Consultant (ChFC) FAQs

The ChFC designation is a professional credential for financial planners. It is awarded by the American College of Financial Services to individuals who complete a comprehensive course of study in financial planning, insurance, investment management, and retirement planning.

To earn the ChFC designation, an individual must complete eight college-level courses in financial planning, insurance, investment management, and retirement planning. They must also have at least three years of experience in the financial services industry.

Chartered Financial Consultants provide a range of financial planning services, including retirement planning, investment management, estate planning, tax planning, and insurance planning. They work with clients to develop a comprehensive financial plan that takes into account their unique needs, goals, and risk tolerance.

The ChFC designation is similar to the Certified Financial Planner (CFP) designation in that it requires a comprehensive course of study in financial planning. However, the ChFC program focuses more on insurance and retirement planning, while the CFP program has a broader focus on all areas of financial planning. The ChFC designation is also less well-known than the CFP designation.

You can find a Chartered Financial Consultant by visiting the American College of Financial Services' website and using their "Find a Designee" search tool. This tool allows you to search for ChFC designees in your area and filter by areas of specialization, compensation method, and more. You can also ask for referrals from friends, family, or other professionals such as attorneys or accountants. It is recommended that you interview multiple candidates and select a Chartered Financial Consultant who you feel comfortable working with and who has experience in your specific needs and goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.