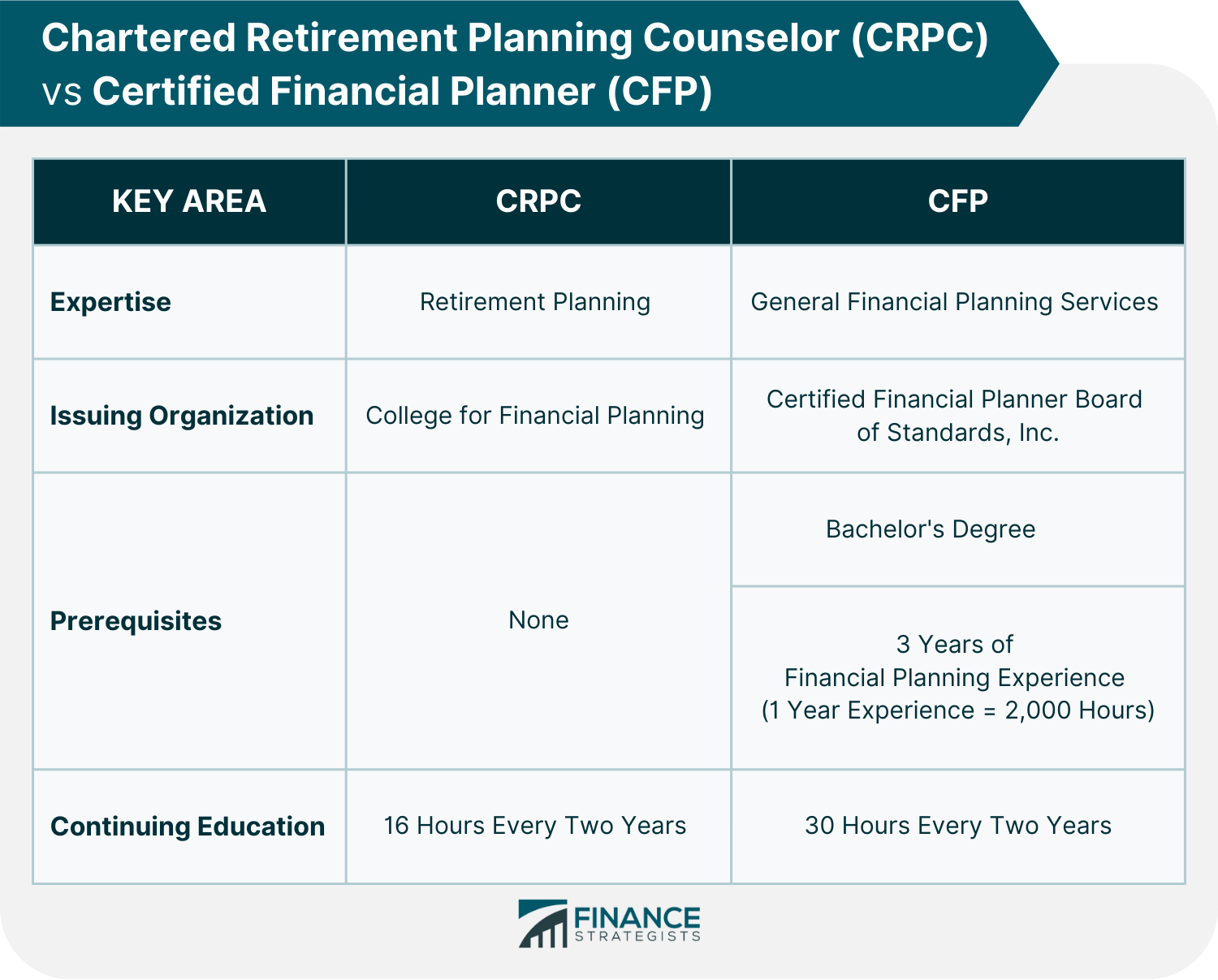

A Chartered Retirement Planning Counselor is a financial professional providing expert advice related to retirement planning. CRPCs are working in a specialized field and have earned the designation through course completion, extensive training, and passing the CRPC qualification exam. The scope of CRPCs services includes, but is not limited to, retirement preparation, financial risk reduction, and estate and tax planning. Have questions about retirement planning? Click here. Financial management covers a huge scope of personal finance management aspects. Certified Financial Planners (CFP) are financial professionals who provide general financial planning services. This may include tax planning, analyzing cash flows, budgeting, and more. CRPCs focus on navigating the transition to the longest holiday of our lives - retirement. While the retirement stage is wonderful to look forward to, the living expenses attached to it must be considered. For this reason, the professional services of a CRPC are needed. CRPCs offer comprehensive retirement advice. Some of these are discussed below: Planning and preparation are required to maximize the retirement stage. It has many facets that need to be considered ahead of time. A CRPC can help build the foundation of a financially secure retirement. Strategies that support the financial transition, including investment and income options, are designed and recommended. Income flow during the retirement stage is limited. However, financial risks are unpredictable as these are affected by external political and economic situations. It is, therefore, important to mitigate these risks through appropriate financial vehicles like insurance policies. A CRPC can help design an insurance policy for this specific purpose. Federal programs available during the retirement phase are also important to revisit ahead. A CRPC can handle issues concerning Social Security and the health care provider, Medicare. Retirees are eligible for Medicare at age 65. It is helpful to discuss this with a CRPC if you plan to retire before 65. As they say, two things are certain, death and taxes. If planning for uncertainties is advised, much more for these eventualities. A CRPC can assist clients in crafting a plan to manage their assets and the appropriate tax settlement in case of death, thereby making sure that a worthwhile legacy is passed on. Below are the important details of the CRPC certification: The CRPC is designed for experienced financial professionals as well as the newbies in the industry who want to pursue career expertise in retirement planning. The program's purpose is to create a roadmap for retirement that takes into account pre- and post-retirement needs. The CRPC designation is the financial industry standard for retirement planning credentials. Top financial firms highly recommend it. A company with CRPC-designated financial advisors reflects competence in asset management, estate planning, tax planning, and many more. This designation is earned and awarded by completing the CRPC program of the College of Financial Planning. To earn the CRPC designation, candidates must complete the study course and pass the qualifying final exam. Students spend approximately 90-135 hours on course-related activities. Students may choose to enroll in online self-study or instructor-led sessions. Online self-study courses and exams must be completed within 120 days of receiving the program access. The instructor-led sessions are based on availability. The final qualifying exam is a closed-book, online exam. The candidates who complete the process earn the right to use the CRPC designation, which is valid for two years. After this, CRPC professionals must complete 16 hours of continuing education and a minimal fee to continue earning the designation. The CRPC study program covers a comprehensive assessment of an individual’s financial needs and resources throughout the retirement period. This includes sources of retirement income, personal savings, investment returns, tax settlement, estate planning, and many more. The course may be taken online or in person. The coursework covers the following topics: Following the completion of the coursework is the qualifying exam. Candidates must have at least a 70% score to pass. They are allowed two attempts and have three hours to finish the test. The CRPC Professional Designation Package costs $1,350. Candidates may choose between two learning modalities: Live Online Classes and OnDemand Classes. Live Online Classes are for candidates who prefer a structured instructor-led class with a predetermined schedule. OnDemand Classes are best for candidates who need time flexibility and prefer to learn at their own pace. Since the OnDemand Classes option is self-paced, the candidates may begin the program any time. If you are a financial advisor who wants to enroll in the CRPC program, refer to this link. Both CRPCs and CFPs are financial professionals but develop different fields of expertise. CFPs encompass a broader range of financial services, such as analyzing cash flows, budgeting, and tax planning, including retirement planning. CRPCs focus on the preparation for retirement and the transition to it. Different institutions issue the two certifications. The CFP is awarded by the Certified Financial Planner Board of Standards, Inc., while the CRPC is earned from the College for Financial Planning. To be eligible to take the certification course, CFP candidates must have: On the other hand, taking the CRPC does not have prerequisites at all. CRPC and CFP designations are earned thru coursework, training, and a qualifying exam. Both certifications have continuing education requirements. For CFP, 30 hours every two years and 16 hours every two years for CRPC. In all things, preparation is key! The same goes for retirement. To fully enjoy the retirement years, it is important to make the right decisions in the years leading to it. Careful planning and preparation can only be achieved by working with a Chartered Retirement Planning Counselor. CRPCs are equipped with strategic skills and knowledge in multiple areas of retirement planning. Good collaboration will result in a smooth retirement planning process. What Is a Chartered Retirement Planning Counselor (CRPC)?

What Do CRPCs Do?

Retirement Preparation

Financial Risk Reduction

Social Security and Medicare Planning

Estate and Tax Planning

CRPC Certification

Designation Essentials

Qualification and Training Requirements

Training Course Topics

Training Cost

CRPC vs Certified Financial Planner

The Bottom Line

Chartered Retirement Planning Counselor (CRPC) FAQs

A Chartered Retirement Planning Counselor (CRPC) is a financial professional providing expert advice related to retirement planning. They have earned the designation thru course completion, extensive training, and passing the CRPC qualification exam.

CRPCs offer comprehensive financial retirement services such as retirement preparation, financial risk reduction, social security and medicare planning, and estate and tax planning.

Certified Financial Planners are financial professionals who provide general financial planning services. This may include tax planning, analyzing cash flows, budgeting, and more. CRPCs, however, focus on navigating the transition to retirement.

To earn the CRPC designation, candidates must complete the CRPC study course and pass the qualifying final exam.

People nearing retirement need the services of a CRPC for proper planning and preparation for retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.