In the finance industry, there are different professions from which you can choose. One profession is a Certified Investment Management Analyst or CIMA. The other one is a Certified Financial Planner or CFP. Both of these roles have their own set of responsibilities and offer many opportunities to those who dedicate themselves to this field. Deciding between CIMA and CFP? Click here. A Certified Investment Management Analyst (CIMA) is a professional designation that serves as an assurance to the public and potential employers of the holder’s knowledge in investment management. A CIMA candidate needs to prove to the Institute of Certified Investment Management Analysts (ICIMA) that he or she possesses an expertise level in areas such as financial analysis, portfolio management, and investment ethics. The CIMA designation is awarded after a candidate successfully passes examinations. In order to be eligible to take the CIMA examinations, you must be employed as an investment analyst yourself or by a firm that provides investment consulting services. In addition, you need to have at least two years of experience in the field. If you meet these requirements, applying to take CIMA examinations will cost approximately $900. The Certified Financial Planner (CFP) designation is awarded by the Certified Financial Planner Board of Standards after candidates pass examinations designed to test their knowledge of financial planning. To be eligible to take the CFP Board exams, you need to have at least three years of experience in the field. This period of time must include two years as a financial planning practitioner along with 26 hours of continuing education throughout this time period. If you meet these requirements, applying to take the CFP examinations will cost about $1,000. The main purpose of a CIMA is to manage your clients’ money and investments effectively and responsibly. If you plan on working for a financial investment firm or becoming an investment manager, this designation will be essential for gaining credibility in the field. On the other hand, a CFP is designed for those who want to work as financial planners and create financial plans for their clients. These professionals will be responsible for ensuring that their client's money is invested well and that all of their needs are met as they progress toward their goals. If you want to be involved in the investment management industry, then obtaining a CIMA designation will be highly beneficial for your career. On the other hand, if you plan on working as a financial planner, getting the CFP certification is beneficial since it shows clients that you are knowledgeable about financial planning and can help them reach their financial goals. Both of these professions are beneficial for your career, but it’s important to note the differences between them. Knowing these distinctions, along with evaluating your career goals, will help you make an informed decision about which degree to obtain to ensure that you can achieve your dreams and be successful in your chosen career path. Both of these designations can help you achieve your goals, but it’s important to consider the differences between them. If you want to work in investment management, get a CIMA designation. However, if your goal is to be a financial planner or adviser get a CFP designation. Before choosing either one, make sure that you know which degree will be most beneficial for your career.What Is a CIMA?

What Is a CFP?

Why Do I Need to Choose One Over the Other?

Which Degree Will Be Most Beneficial For Your Career Goals?

The Pros and Cons of Each Degree

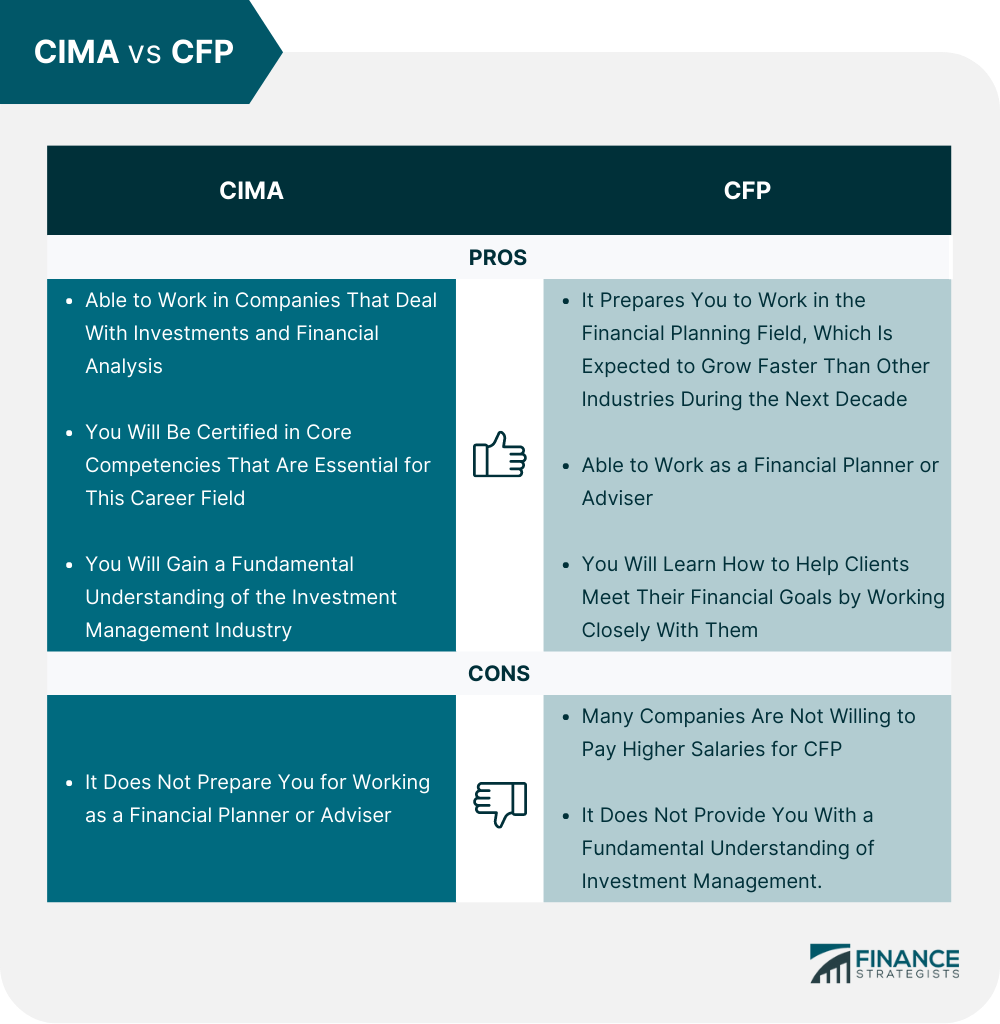

Pros of Having a CIMA:

Cons of Having a CIMA:

Pros of Getting a CFP:

Cons of Getting a CFP:

The Bottom Line

CIMA vs CFP FAQs

Getting certified as a Certified Investment Management Analyst (CIMA) shows that you have the knowledge and skills to manage investments more effectively. Getting this certification can make you stand out from other candidates in the field of investment management. After earning this designation, you will be able to work in companies that deal with investments and financial analysis. You can also use it as a stepping-stone for gaining other relevant designations.

As Certified Financial Planner (CFP) professionals, you will be responsible for helping clients meet their financial goals by ensuring they are investing well. This designation prepares you for working as a financial planner or adviser. You will also learn how to help clients reach their financial goals by working closely with them under the guidance of a financial planner.

While each certification has its own requirements, you will have to pass the exam for both before being able to use them. For example, getting a CIMA requires about 300 hours of study and passing two exams. It may take more than five years for you to be eligible to take the CIMA exam.

When deciding which designation process to pursue, it is important that you know what each of them involves and how they can benefit your career. If your goal is to get a job in investment management after graduation, then getting a CIMA is the way to go. However, if you want to work as a financial planner or adviser after graduation, get CFP designation instead.

There are several factors that will influence your decision about which certification to pursue. One factor is your career goals. If your goal is to get a job in investment management, then getting a CIMA designation will be most beneficial for you because it prepares you to work at companies that deal with investments and financial analysis. However, if your goal is to work as a financial planner or adviser after graduation, then get the CFP designation instead. This designation prepares you for working as a financial planner or adviser. You will also learn how to help clients reach their financial goals by working closely with them under the guidance of a financial planner.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.