A commission-based advisor is a financial professional who earns compensation through commissions on the sale of investment products and services to clients. These advisors may work for brokerage firms, insurance companies, or other financial institutions and often assist clients with investment planning, retirement planning, and insurance needs. In a commission-based compensation structure, advisors receive a percentage of the sales price or a flat fee for each financial product or service they sell to clients. This structure incentivizes advisors to recommend products and services that generate higher commissions. Commission-based advisors may be more cost-effective for clients who engage in infrequent transactions or require limited ongoing financial advice. In such cases, paying a commission for individual transactions can be less expensive than paying a flat fee or a percentage of assets under management. Commission-based advisors often have access to a diverse selection of investment products and services, allowing clients to choose from a wide range of options to meet their financial goals. Since commission-based advisors earn compensation based on the products they sell, they may be more motivated to recommend investments that perform well and help clients achieve their financial objectives. Commission-based advisors may face conflicts of interest when recommending financial products and services, as they may be incentivized to recommend options that generate higher commissions rather than those that are in the client's best interest. Unlike fee-only advisors, who are required to act in the best interest of their clients, commission-based advisors are typically held to a "suitability" standard. It means they must only recommend investments that are suitable for the client's needs and objectives, rather than the best available options. The suitability standard requires commission-based advisors to recommend investments that align with a client's financial situation, objectives, and risk tolerance. However, the best interest standard, which fee-only advisors follow, mandates that advisors put their clients' interests ahead of their own, ensuring that recommendations are based solely on what is best for the client. Fee-based advisors receive compensation through a combination of fees and commissions. They may charge clients a flat fee or a percentage of assets under management, while also earning commissions on the sale of specific investment products. Fee-based advisors may offer a more balanced approach to compensation, potentially reducing conflicts of interest. However, they still face some of the same challenges as commission-based advisors, including potential conflicts of interest and limited fiduciary responsibility. Fee-only advisors are compensated solely through fees paid directly by their clients, with no commissions or other incentives tied to the sale of investment products. They may charge hourly fees, flat fees, or a percentage of assets under management. Fee-only advisors are required to act in their clients' best interest, minimizing conflicts of interest and ensuring that recommendations are based on the client's needs and objectives. However, fee-only advisors may be more expensive for clients who require limited financial advice or engage in infrequent transactions. When selecting the type of financial advisor, consider your financial goals, investment preferences, and the level of ongoing advice you require. Evaluate the advantages and disadvantages of commission-based, fee-based, and fee-only advisors to determine which compensation structure best aligns with your needs. When considering a commission-based advisor, it is essential to evaluate their qualifications and credentials, ensuring that they have the necessary expertise in financial planning and investment management. Be aware of potential conflicts of interest arising from the commission-based compensation structure. Ask the advisor about their compensation, whether they receive incentives for recommending certain products, and how they manage potential conflicts of interest. Discuss the advisor's investment philosophy and approach to ensure it aligns with your financial goals, risk tolerance, and preferences. Ask for references or testimonials from past clients and review the advisor's track record to assess their ability to deliver results and provide satisfactory service. Maintain open lines of communication with your commission-based advisor and clearly articulate your financial goals and expectations, ensuring that they understand your needs and objectives. Regularly review your investment portfolio and monitor the performance of the financial products recommended by your commission-based advisor. Keep track of the fees and commissions you pay to ensure you are receiving value for your money. Financial planning is an ongoing process, and your financial goals and circumstances may change over time. Work closely with your commission-based advisor to review and update your financial plan regularly, ensuring that it remains aligned with your evolving needs and objectives. Choosing the right financial advisor is a critical decision, as it can significantly impact your financial well-being and the achievement of your financial goals. Commission-based advisors may offer potential cost savings and access to a wide range of investment products; however, they may also face conflicts of interest and limited fiduciary responsibility. It is essential to consider the advantages and disadvantages of commission-based, fee-based, and fee-only advisors to determine which compensation structure best aligns with your financial planning needs and goals. To make an informed decision, carefully assess the qualifications, experience, investment philosophy, and potential conflicts of interest of commission-based advisors, as well as those of fee-based and fee-only advisors. By evaluating different types of financial advisors and understanding their unique benefits and drawbacks, you can select the most suitable advisor to help you achieve your financial objectives and secure your financial future.What Is a Commission-Based Advisor?

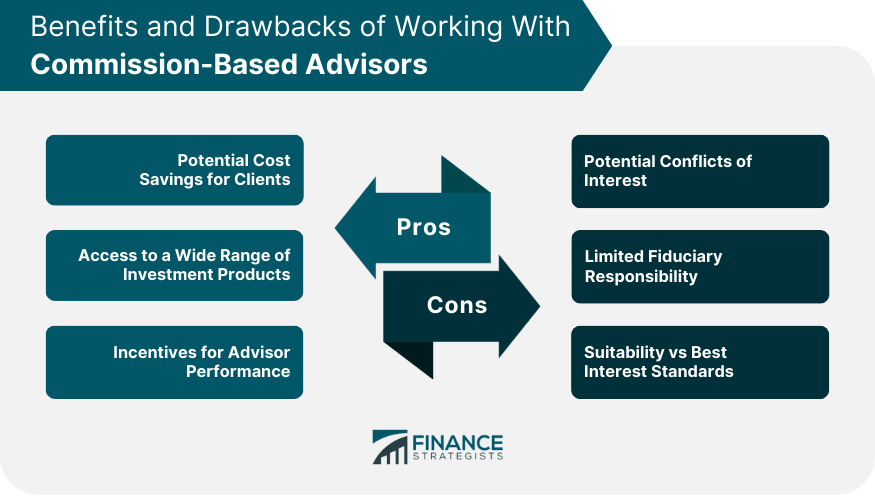

Advantages of Working With Commission-Based Advisors

Potential Cost Savings for Clients

Access to a Wide Range of Investment Products

Incentives for Advisor Performance

Disadvantages of Commission-Based Advisors

Potential Conflicts of Interest

Limited Fiduciary Responsibility

Suitability vs Best Interest Standards

Comparing Commission-Based Advisors With Other Advisors

Fee-Based Advisors

Definition and Compensation Structure

Pros and Cons

Fee-Only Advisors

Definition and Compensation Structure

Pros and Cons

Choosing the Right Type of Advisor for Your Needs

Evaluating Commission-Based Advisors

Assessing Qualifications and Credentials

Investigating Potential Conflicts of Interest

Understanding the Advisor's Investment Philosophy

Reviewing Past Performance and Client Testimonials

Working With a Commission-Based Advisor

Establishing Clear Communication and Expectations

Monitoring Investment Performance and Fees

Reviewing and Updating Your Financial Plan Regularly

Conclusion

Commission-Based Advisor FAQs

A commission-based advisor is a financial advisor who receives compensation for selling financial products to clients. They earn a commission on the products they sell, such as mutual funds, annuities, and insurance policies.

Commission-based advisors are compensated through commissions on the financial products they sell. The commission amount is typically a percentage of the total amount invested or the premium paid for an insurance policy.

No, commission-based advisors are not required to act in their clients' best interests. They are only required to recommend products that are "suitable" for their clients, meaning the product meets the client's investment objectives, risk tolerance, and financial situation.

One advantage of working with a commission-based advisor is that there are typically no upfront fees or charges for their services. Instead, they earn a commission on the products they sell, which may be more affordable for clients who cannot afford to pay a fee-based advisor.

One disadvantage of working with a commission-based advisor is that their recommendations may be influenced by their compensation structure. They may be incentivized to recommend products that offer higher commissions, even if those products are not the best fit for the client's needs. Additionally, commission-based advisors may not provide ongoing advice or financial planning services, since their income is based on selling products rather than providing ongoing advice.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.