Deciding whether you need a financial advisor for retirement is a personal choice dependent on several factors. If you have a complex financial situation, lack the time or knowledge for financial planning, or have a substantial retirement fund, the expertise of an advisor can be beneficial. They offer services such as income planning, risk management, and investment strategy guidance. However, remember to consider the cost of hiring a professional. If you're comfortable managing your finances and the cost outweighs the benefits, self-guided methods such as online resources, robo-advisors, or DIY planning may suit you better. Ultimately, the choice should align with your comfort level, financial capability, and retirement goals. A financial advisor is a professional who assists clients in managing their finances. Their role often includes advice on investments, retirement planning, tax planning, estate planning, and risk management. Financial advisors analyze your financial situation, understand your retirement goals, and develop a personalized plan to help you achieve them. In retirement planning, a financial advisor can help in several ways. They can help you calculate how much you need to save for retirement, advise you on where to invest your savings, guide you on when to take Social Security benefits and assist in estate planning. Moreover, they can help optimize your retirement income strategy, considering taxes and your specific spending needs. Financial advisors typically provide services like investment management, retirement income planning, risk management, and estate planning. They may also help with tax planning to minimize your tax liability during retirement. Additionally, some advisors offer budgeting help, financial education, and ongoing monitoring of your retirement plan. One of the first things to consider when deciding if you need a financial advisor for retirement is the complexity of your financial situation. If you have numerous income sources, substantial investments, or are running a business, navigating the financial landscape can be challenging. A financial advisor can help simplify this process and ensure your retirement plan aligns with your overall financial strategy. Your understanding and comfort with financial planning are crucial factors in this decision. If you're adept at managing your finances and making informed investment decisions, you may not require a financial advisor. On the other hand, if you find financial planning overwhelming or confusing, a financial advisor can provide the guidance and support you need. The size of your retirement savings and investments can significantly influence your need for a financial advisor. With a large portfolio, you stand to gain from professional advice on strategic asset allocation, risk management, and tax optimization. A financial advisor can help ensure your wealth is managed strategically and efficiently. Financial advisors charge for their services, and this cost is a critical factor to consider. Some advisors charge a fee based on the assets they manage for you, while others may charge a flat rate or hourly fee. You need to assess whether the potential benefits, such as higher returns or reduced risk, outweigh these costs. The process of managing your finances and planning for retirement can be time-consuming. If you enjoy this process and have the time, doing it yourself might be a feasible option. However, if you would rather spend your time on other pursuits, a financial advisor could handle these tasks for you. Financial advisors are experts in financial planning and can provide you with personalized advice and guidance. They can help you avoid common mistakes and make informed decisions, increasing the likelihood of achieving your retirement goals. By hiring a financial advisor, you can save a significant amount of time. The advisor can handle tasks like research, analysis, and paperwork, freeing up your time for other activities. Financial advisors can help create a comprehensive retirement plan that covers all aspects of your financial life. They can coordinate your savings, investments, taxes, insurance, and estate plans to ensure that everything works together toward your retirement goals. One of the main drawbacks of hiring a financial advisor is the cost. Advisors typically charge a fee based on a percentage of your assets under management, a fixed or hourly fee, or a combination of these. These costs can add up over time and reduce your overall return. Some financial advisors may have conflicts of interest. For example, they may receive commissions for selling certain products, potentially influencing their recommendations. It's important to choose an advisor who is transparent about their compensation and committed to acting in your best interests. Relying too heavily on a financial advisor could mean you don’t fully understand your own financial situation. You should always take the time to understand the advice given, ask questions, and feel comfortable with the decisions made about your financial future. With the abundance of financial information and tools available today, it's feasible to plan for retirement on your own. You'll need to be comfortable researching investment options, managing risk, and adjusting your plan as needed. While this approach can save you money, it requires time and a strong understanding of personal finance and investing. Online retirement calculators are a simple, low-cost tool for estimating how much you'll need to save for retirement. They typically allow you to input variables like your current savings, annual income, desired retirement age, and expected retirement expenses to calculate how much you need to save. While they're a useful starting point, they may not account for all aspects of your financial situation. Robo-advisors are automated online platforms that provide investment management services. They use algorithms to determine your risk tolerance and investment goals and then create and manage an investment portfolio for you. Robo-advisors are a lower-cost alternative to traditional financial advisors, but they offer less personalized advice. There are many resources available to help you educate yourself about personal finance and retirement planning, including books, online courses, blogs, and podcasts. Learning about these topics can help you make informed decisions and feel more confident about your retirement plan. When selecting a financial advisor, look for credentials like Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Personal Financial Specialist (PFS). These designations indicate the advisor has undergone rigorous training and adheres to high professional and ethical standards. Before hiring a financial advisor, ask them questions about their experience, services, investment philosophy, and fees. You should also ask how they handle conflicts of interest and whether they act as a fiduciary, meaning they're obligated to act in your best interest. Evaluating a financial advisor's performance isn't just about looking at investment returns. It's also about assessing whether they help you reach your financial goals, how well they communicate with you, and whether they provide a level of service that meets your expectations. If you're not satisfied with your current financial advisor, consider making a change. When changing advisors, consider the potential costs, how your investments will be transferred, and how to ensure a smooth transition. It's important to carefully vet potential new advisors to find one that better suits your needs. Deciding if you need a financial advisor for retirement is an important decision that hinges on your financial complexity, comfort level with financial planning, retirement savings size, professional advice costs, and the time you have available. The role of a financial advisor can be broad, encompassing strategic financial planning and providing peace of mind. However, it's crucial to weigh the pros, like expert advice and time-saving benefits, against the cons, including costs and potential conflicts of interest. Exploring alternatives like DIY planning or using robo-advisors can be viable options for some. If you choose to hire a professional, ensure they have reputable credentials, align with your financial goals, and uphold a fiduciary duty. By taking these factors into account, you can make a well-informed decision about managing your retirement planning.Do You Need a Financial Advisor for Retirement?

Role of a Financial Advisor in Retirement Planning

Explanation of What a Financial Advisor Does

How a Financial Advisor Can Assist in Retirement Planning

Common Services Offered by Financial Advisors Related to Retirement

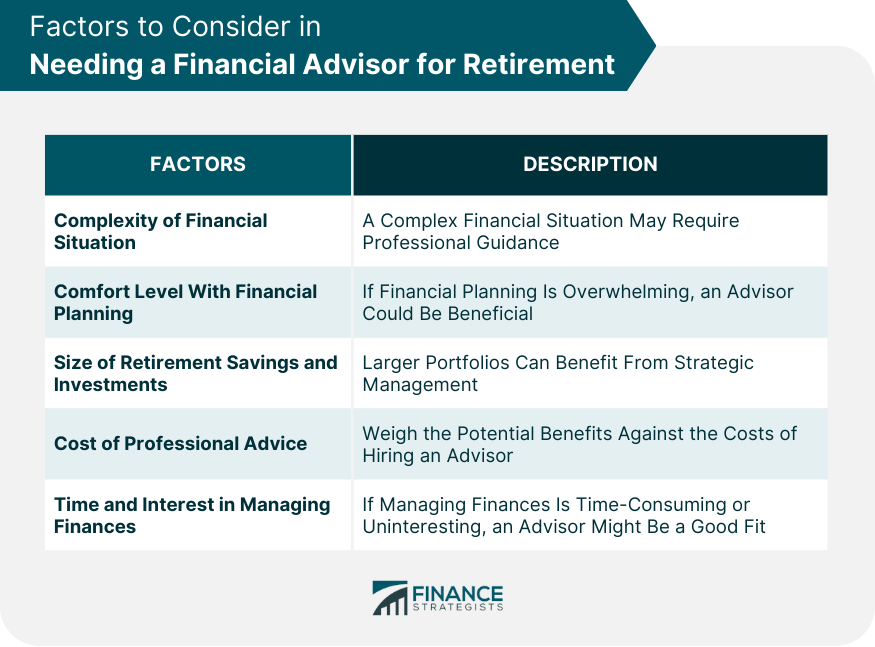

Factors to Consider in Needing a Financial Advisor for Retirement

Complexity of Your Financial Situation

Comfort Level With Financial Planning

Size of Retirement Savings and Investments

Cost of Professional Advice

Time and Interest in Managing Finances

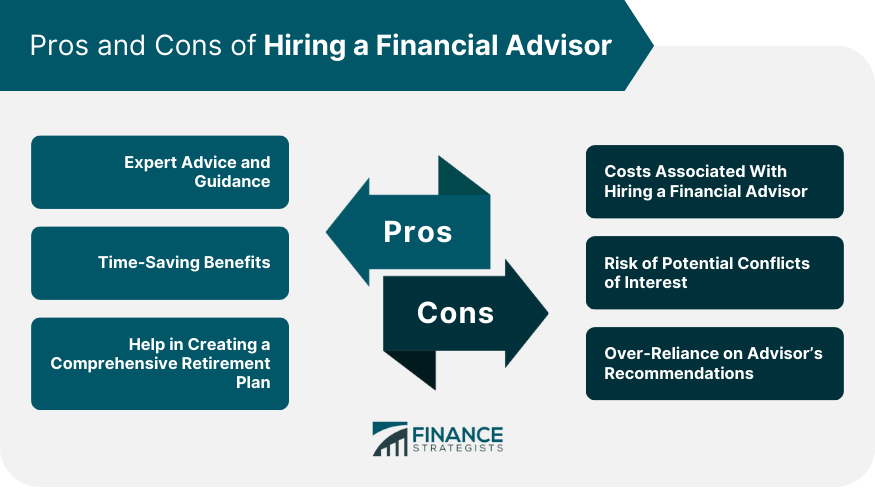

Pros of Hiring a Financial Advisor

Expert Advice and Guidance

Time-Saving Benefits

Help in Creating a Comprehensive Retirement Plan

Cons of Hiring a Financial Advisor

Costs Associated With Hiring a Financial Advisor

Risk of Potential Conflicts of Interest

Over-Reliance on Advisor’s Recommendations

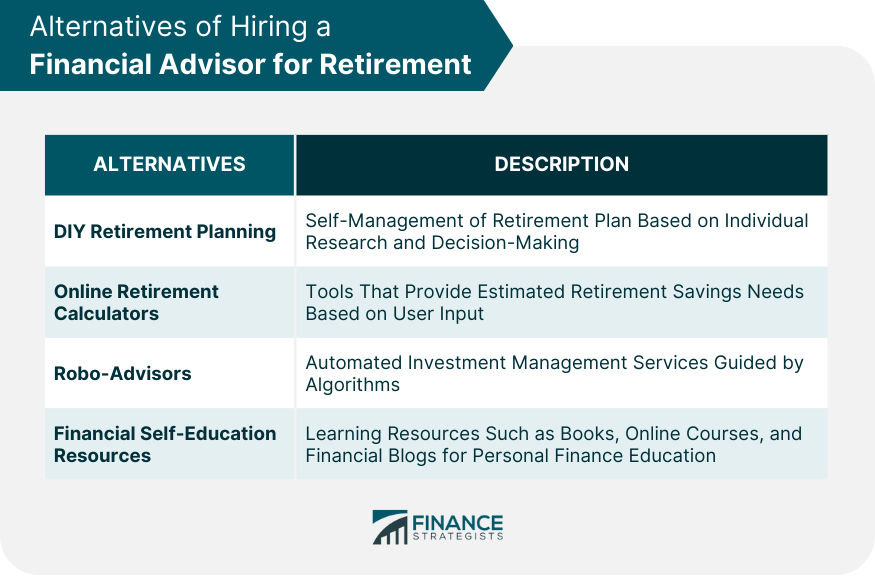

Alternatives of Hiring a Financial Advisor for Retirement

DIY Retirement Planning

Online Retirement Calculators

Robo-Advisors

Financial Self-Education Resources

How to Choose a Financial Advisor for Retirement, If Needed

Credentials to Look for in a Financial Advisor

Questions to Ask a Potential Financial Advisor

How to Evaluate a Financial Advisor's Performance

Considerations When Changing Financial Advisors

Conclusion

Do You Need a Financial Advisor for Retirement? FAQs

It depends on your individual situation. If you are comfortable with managing your own finances and making investment decisions, you may not need one. However, a financial advisor can still provide valuable guidance on how to grow your savings and prepare for retirement, no matter the size of your current nest egg.

A financial advisor can help with various aspects of retirement planning, including calculating how much you need to save for retirement, advising on investment strategies, planning when to take Social Security benefits, and assisting with estate planning. They can also help optimize your retirement income strategy considering taxes and your specific spending needs.

Pros include expert advice, time-saving benefits, and help in creating a comprehensive retirement plan. Cons include the costs associated with hiring a financial advisor, potential conflicts of interest, and the risk of over-reliance on the advisor's recommendations.

Alternatives include DIY retirement planning, using online retirement calculators or robo-advisors, or educating yourself about financial planning using various resources such as books, online courses, and financial blogs.

Look for advisors with relevant credentials, ask about their experience and services, understand their investment philosophy, and inquire about their fees. It's important to choose an advisor who acts as a fiduciary, meaning they are obligated to act in your best interest. Evaluating their performance beyond just investment returns is also crucial.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.