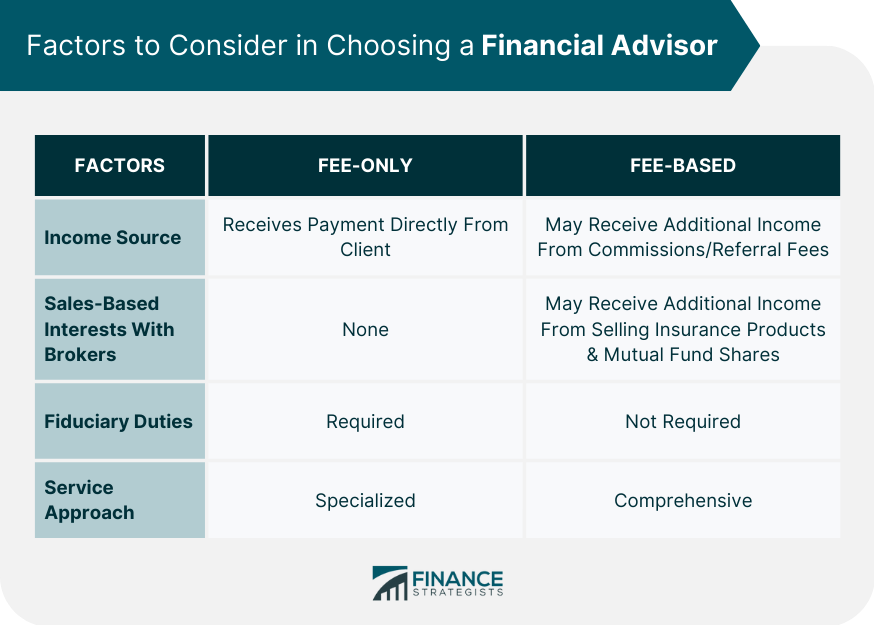

The main difference between a fee-only advisor and a fee-based advisor is how they get compensation for their services. A fee-only advisor only gets paid by clients through fees. Whereas a fee-based advisor gets paid by the clients and, in addition, receives a commission or other form of payment. Fee-only advisors are usually held to a higher fiduciary standard. They must follow a code of ethics that requires them to put their client's best interests ahead of their own. Fee-based advisors usually have licenses to sell securities or are agents or registered representatives of broker-dealers who sell their products, like mutual funds or insurance. These professionals are typically registered with and must adhere to the regulations of their country’s financial authority or regulator. A fee-only financial advisor is an independent professional who provides comprehensive financial planning and investment advisory services. Such an advisor is compensated solely by the client—not from commissions or referral fees. It may come from flat fees, hourly charges, or a percentage of assets managed. These advisors work with you to develop a customized plan that meets your long-term goals. These goals can be related to retirement and education savings, estate planning, asset allocations, tax strategies, and other essential needs. By not relying on commissions and referrals, fee-only advisors can provide unbiased advice tailored to your needs instead of pushing products. A fee-based financial advisor is a finance professional compensated through fees they charge customers. While they are primarily paid through fees they charge clients, they may also earn commissions when recommending an individual product or other asset purchase. To avoid a possible conflict of interest, fee-based advisors must disclose all sources of compensation they receive. Fee-based advisors can provide services such as preparing holistic financial plans, helping clients choose investments, analyzing assets and liabilities, and providing detailed advice on investment matters. There are several ways to identify a fee-only or fee-based financial advisor. The following are some useful points for distinguishing between the two: A fee-only financial advisor can be identified by reviewing their most recent Form ADV (Uniform Application for Investment Adviser Registration) on the SEC's public disclosure website. On the “Compensation Arrangements” section of the form, a fee-only financial advisor will not include commissions as part of their compensation. In their forms, these advisors typically display the following information: A fee-only financial advisor does not receive commissions or indirect compensation from outside sources. They only receive payment directly from their clients, usually in the form of a flat fee or percentage of assets managed. Fee-only advisors are not affiliated with any broker-dealers. They do not sell any securities or products on behalf of those organizations. They are independent and provide objective advice based solely on the client's goals. Since they are not connected to brokers, fee-only advisors do not have any sales targets they must meet to be paid by a brokerage firm. This helps ensure that their advice is unbiased and independent. Fee-based financial advisors typically receive a fee for service and commissions from third-party organizations, such as mutual fund companies or broker-dealers. Fee-based advisors are typically affiliated with one or more broker-dealers. They may receive additional income from commissions or referral fees in addition to the fees charged for their services. Fee-based advisors also serve as registered insurance agents and may receive additional income from selling insurance products. They must disclose this information to clients so there is complete transparency about all sources of income. Fee-based advisors may also receive commissions when they sell mutual fund shares on behalf of their clients. This can be an additional source of revenue for them, in addition to the fees charged for their services. You are more likely to receive unbiased and objective investing advice from a fee-only advisor because they only make money from client fees. It is always in the advisor's best advantage to increase the money in the client's account because the adviser will earn more in fees. They are governed by fiduciary rules, which make it impossible for advisors to conceal any potential conflicts of interest. Similarly, they must explicitly disclose all their fees and commissions to clients in monetary amounts. On the other hand, a fee-based advisor makes money from commissions, which might lead to conflicts of interest. Instead of focusing on boosting your total account value, the advisor could be incentivized to sell clients goods to generate more money. Fee-based advisors are frequently held to the suitability standard, which only requires them to sell their customers suitable products. Those looking for a more comprehensive approach should opt for the services of a fee-based advisor. At the same time, individuals who require more specialized guidance may benefit from finding a fee-only financial advisor. Always ensure you understand the types of fees you will be charged and how your advisor will be compensated. Know what questions to ask a financial advisor to get to know them more. Once you have this information, you can decide how to continue. The significant difference between fee-only and fee-based financial advisors is how they are compensated. A fee-only financial advisor is only paid an advisory fee by their client. They do not receive commissions, fees, or other payments from any other source related to their services. A fee-based financial advisor can receive fees and commissions for their services. A fiduciary standard governs a fee-only financial advisor, while a suitability standard governs a fee-based one. When deciding which type of financial advisor to use, it is essential to consider the advice provided and the charges. An equally important consideration is if the advisor can balance any conflicts of interest associated with their compensation structure. Fee-Only vs Fee-Based: Overview

What Is a Fee-Only Financial Advisor?

What Is a Fee-Based Financial Advisor?

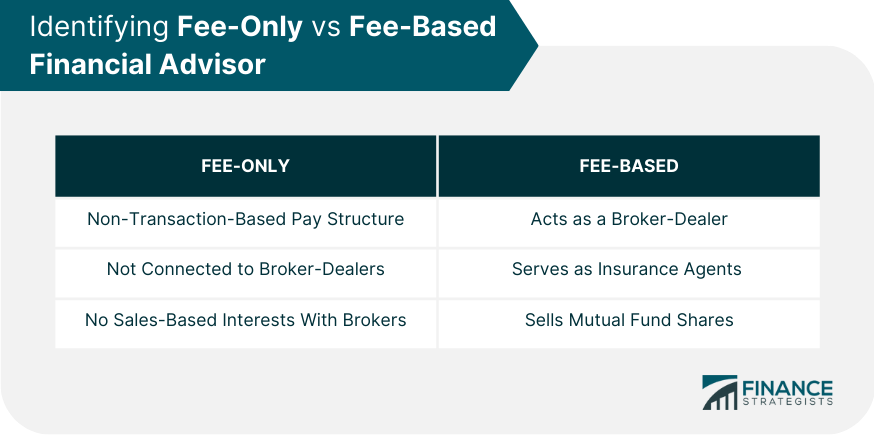

How to Identify a Fee-Only vs Fee-Based Financial Advisor

Fee-Only Financial Advisor

Non-Transaction-Based Pay Structure

Not Connected to Broker-Dealers

No Sales-Based Interests With Brokers

Fee-Based Financial Advisor

Acts as a Broker-Dealer

Serves as Insurance Agents

Sells Mutual Fund Shares

Fee-Only vs Fee-Based Financial Advisor: Which Is Right for You?

The Bottom Line

Fee-Only vs Fee-Based FAQs

Fee-only financial advisors typically charge a flat fee or percentage of assets managed. The exact cost will vary depending on the advisor and services provided. Fees may range from $100 to $500 per hour, $1,000 to $8,000 retainer per annum, 0.5% to 2% AUM per year, or a flat fee of $1,000 to $3,000 or more.

Fee-only advisors are not affiliated with any broker-dealers and only receive payment directly from their clients, usually in the form of a flat fee or percentage of assets managed. Fee-based advisors may be affiliated with one or more broker-dealers. They may receive additional income from commissions or referral fees in addition to the fees charged for their services.

Fee-based advisors may receive additional income from commissions when they sell insurance products or mutual fund shares on behalf of their clients. They must disclose this information to clients so there is complete transparency about all sources of income.

The main disadvantage of hiring a fee-based financial advisor is that they may have sales-based interests with broker-dealers, potentially leading to conflicts of interest when providing advice. Additionally, they may not be as objective or independent as fee-only advisors.

Fee-only advisors are best suited for clients who prioritize independence and objectivity. They can provide specialized advice without any conflicts of interest, as they receive their income solely from their clients through fees. Additionally, fee-only advisors can provide tax planning services, estate planning services, and retirement planning services.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.