Finance certifications are professional credentials earned by individuals who want to demonstrate their expertise and knowledge in various financial fields. These certifications are designed to validate the skills of an individual and provide them with recognition in their area of specialization. Finance certifications are highly regarded in the industry, and individuals who hold them are highly sought after by employers. Have a financial question? Click here. In the present fast-paced financial industry, having a finance certification has become increasingly important for individuals who want to succeed in their careers. A finance certification can provide individuals with the necessary knowledge and skills to become an expert in their field. Additionally, it can increase their earning potential, credibility, and professionalism. Finance certifications offer several benefits. These include: Finance certifications are highly regarded in the industry and are often a requirement for certain job positions. Individuals can demonstrate their expertise and knowledge by obtaining a finance certification, making them more attractive to employers. According to a survey conducted by the CFA Institute, individuals who hold a finance certification earn an average of 30% more than those who do not. This increased earning potential is due to the expertise and knowledge that comes with obtaining a finance certification. Finance certifications are designed to provide individuals with a comprehensive understanding of their area of specialization. By obtaining a finance certification, individuals can enhance their knowledge and skills in their field, making them more confident and proficient in their work. This can lead to increased job satisfaction and better job performance. Finance certifications can provide individuals with increased credibility and professionalism in their field. By obtaining a finance certification, individuals can demonstrate their expertise and knowledge to colleagues and clients, which can lead to increased trust and respect. Numerous finance certifications are available, each with its curriculum, exam format, benefits, and requirements. Here are some of the most popular finance certifications: The Chartered Financial Analyst (CFA) certification is one of the most prestigious finance certifications in the industry. It is designed for individuals who want to pursue a career in the finance industry and specialize in investment management. The CFA program covers a broad range of investment topics, including economics, financial reporting analysis, equity investments, fixed-income investments, derivatives, alternative investments, and portfolio management. The program requires passing three exams, which are known for their rigor and difficulty. The CFA certification is highly regarded in the industry and is recognized worldwide. The Certified Financial Planner (CFP) certification is designed for individuals who want to specialize in financial planning. The program covers a broad range of financial planning topics, including insurance planning, investment planning, retirement planning, tax planning, and estate planning. The program requires passing a comprehensive exam and meeting experience and ethics requirements. The CFP certification is highly regarded in the industry and is recognized by clients as a mark of professionalism and expertise. The Financial Risk Manager (FRM) certification is designed for individuals who want to specialize in risk management. The program covers a broad range of risk management topics, including quantitative analysis, market risk, credit risk, operational risk, and risk management best practices. The program requires passing two exams and meeting experience requirements. The FRM certification is highly regarded in the industry and is recognized by employers as a mark of expertise in risk management. The Certified Management Accountant (CMA) certification is designed for individuals who want to specialize in management accounting. The program covers a broad range of management accounting topics, including financial planning, analysis, control, and decision-making. The program requires passing two exams and meeting experience requirements. The CMA certification is highly regarded in the industry and is recognized by employers as a mark of expertise in management accounting. The Certified Public Accountant (CPA) certification is designed for individuals who want to specialize in accounting. The program covers a broad range of accounting topics, including auditing, financial accounting, reporting, regulation, and business environment and concepts. The program requires passing four exams and meeting experience requirements. The CPA certification is highly regarded in the industry and is recognized by employers as a mark of expertise in accounting. The Financial Modeling and Valuation Analyst (FMVA) certification is designed for individuals who want to specialize in financial modeling and valuation. The program covers a broad range of financial modeling and valuation topics, including financial statement modeling, DCF modeling, mergers and acquisitions modeling, and valuation techniques. The program requires passing a comprehensive exam and completing a series of case studies. The FMVA certification is highly regarded in the industry and is recognized by employers as a mark of expertise in financial modeling and valuation. The Chartered Alternative Investment Analyst (CAIA) certification is designed for individuals who want to specialize in alternative investments. The program covers a broad range of alternative investment topics, including hedge funds, private equity, real estate, and commodities. The program requires passing two exams and meeting experience requirements. The CAIA certification is highly regarded in the industry and is recognized by employers as a mark of expertise in alternative investments. When choosing a finance certification, there are several factors to consider. Here are some tips to help individuals choose the right finance certification: Individuals should choose a certification that aligns with their area of specialization. For instance, an individual who wants to specialize in financial planning should consider obtaining a CFP certification. Choosing a certification that aligns with the area of specialization of an individual can help them gain a deeper understanding of the field and enhance their expertise. Individuals should consider their career goals when choosing a finance certification. Individuals should research the job positions and employers that require a particular certification to ensure that obtaining that certification will lead to the desired career outcome. For instance, an individual who wants to become a financial analyst may consider obtaining a Chartered Financial Analyst (CFA) certification. Individuals should consider the recognition and reputation of the certification when choosing a finance certification. Certifications that are widely recognized and have a good reputation in the industry can help individuals stand out in the job market and increase their chances of career success. Individuals should consider the prerequisites and requirements for obtaining the certification. Some certifications may require specific education or work experience, while others may require passing a rigorous exam. Individuals should ensure that they meet the prerequisites and requirements before choosing a certification. One of the most important factors to consider when choosing a finance certification is matching the certification to career goals. Individuals should research the job positions and employers that require a particular certification to ensure that obtaining that certification will lead to the desired career outcome. For instance, if an individual wants to become a financial analyst, they may consider obtaining a CFA certification, as it is widely recognized in the industry and may be required for some financial analyst positions. Another important factor to consider when choosing a finance certification is cost and time commitment. Some certifications are more expensive and time-consuming than others. Individuals should weigh the cost and benefits of each certification before deciding. Additionally, individuals should consider the time commitment required to obtain the certification. Some certifications may require several years of study and work experience, while others may require only a few months. It is also essential to consider the ongoing costs of maintaining the certification. Some certifications require individuals to complete continuing education courses or pay an annual fee to maintain the certification. Individuals should consider these costs when choosing a certification. Obtaining a finance certification can provide individuals with numerous benefits, including improved career prospects, increased earning potential, enhanced knowledge and skills, and increased credibility and professionalism. However, choosing the right finance certification that aligns with your career goals and interests is important. Individuals can choose the right finance certification to enhance their career and expertise in the financial industry. It is important to note that obtaining a finance certification does not guarantee success. Individuals must also have relevant work experience, strong interpersonal skills, and a commitment to continuous learning to succeed in the financial industry. Finance certifications can provide individuals with the necessary knowledge and skills to become an expert in their field, increase their earning potential, and enhance their credibility and professionalism. Individuals can enhance their careers and expertise in the financial industry by choosing the right finance certification that aligns with their career goals and interests.What Are Finance Certifications?

Importance of Finance Certifications

Benefits of Obtaining a Finance Certification

Improved Career Prospects

Increased Earning Potential

Enhanced Knowledge and Skills

Credibility and Professionalism

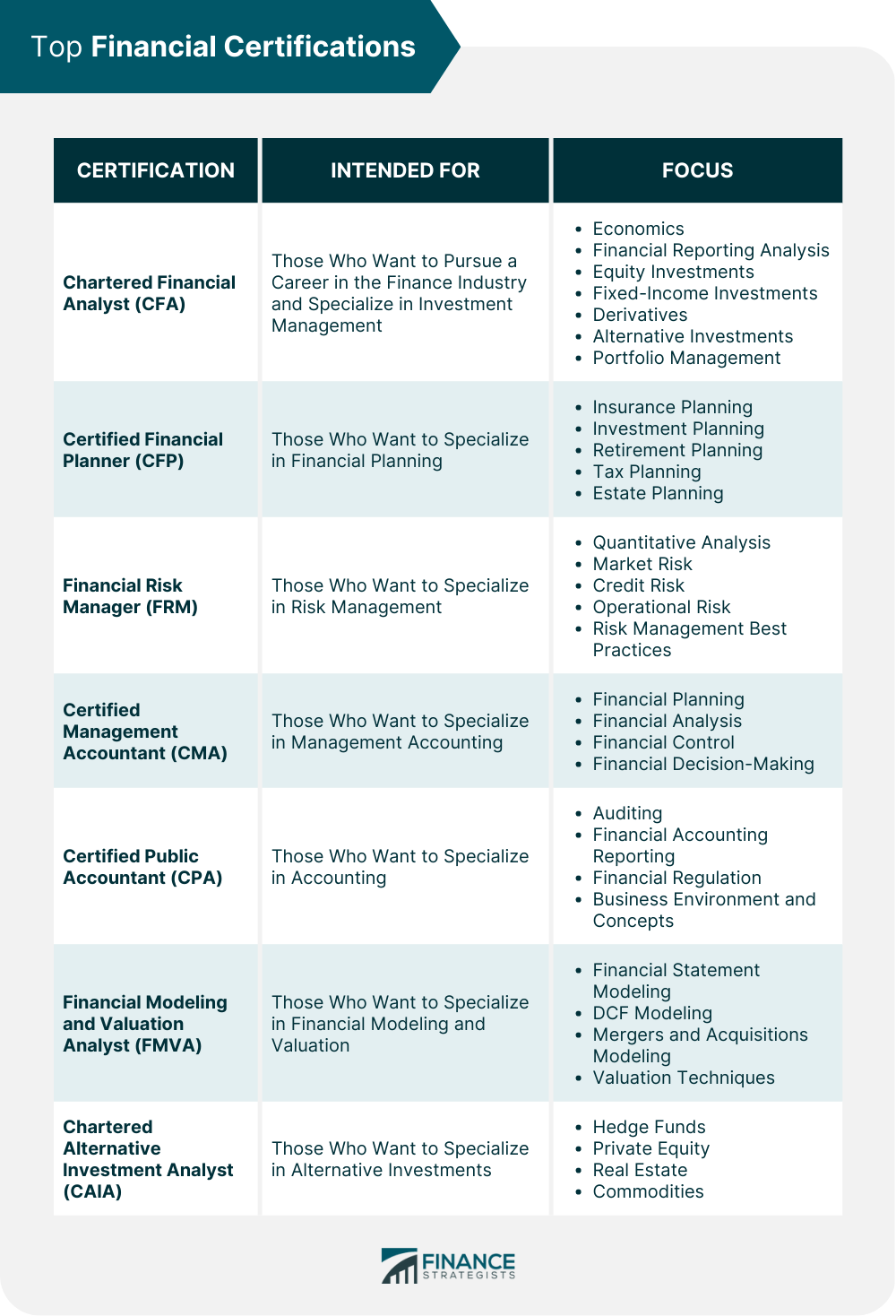

Top Finance Certifications

Chartered Financial Analyst (CFA)

Certified Financial Planner (CFP)

Financial Risk Manager (FRM)

Certified Management Accountant (CMA)

Certified Public Accountant (CPA)

Financial Modeling and Valuation Analyst (FMVA)

Chartered Alternative Investment Analyst (CAIA)

Choosing the Right Finance Certification

Area of Specialization

Career Goals

Recognition and Reputation

Prerequisites and Requirements

Matching Certification to Career Goals

Cost and Time Commitment

Final Thoughts

Finance Certifications FAQs

Finance certifications are professional credentials earned by individuals who want to demonstrate their expertise and knowledge in various financial fields.

Finance certifications are important in the industry because they validate the skills of an individual, provide them with recognition in their area of specialization, and make them more attractive to employers.

The benefits of obtaining a finance certification include improved career prospects, increased earning potential, enhanced knowledge and skills, and increased credibility and professionalism.

Some of the top finance certifications available include Chartered Financial Analyst (CFA), Certified Financial Planner (CFP), Financial Risk Manager (FRM), Certified Management Accountant (CMA), Certified Public Accountant (CPA), Financial Modeling and Valuation Analyst (FMVA), and Chartered Alternative Investment Analyst (CAIA).

Factors that should be considered when choosing a finance certification include the area of specialization, career goals, recognition and reputation, prerequisites and requirements, matching the certification to career goals, and cost and time commitment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.