A financial advisor is a professional who provides financial guidance and advice to individuals or businesses. They help their clients make informed financial decisions by providing expertise in areas such as budgeting, saving, investing, and retirement planning. Financial advisors can be classified into different types, including: Millennials, born between 1981 and 1996, face unique financial challenges that differ from previous generations. They came of age during the Great Recession, had high student loan debt, and faced a more uncertain economic future. As such, millennials can benefit from the services of a financial advisor for the following reasons: Millennials have been observed to carry substantial levels of student loan debt, credit card debt, and other forms of consumer debt. In this regard, the services of financial advisors can prove beneficial in creating a budget, devising a strategy to pay off high-interest debt, and developing a comprehensive plan to manage their finances effectively. Millennials are facing significant financial challenges, which have resulted in delaying major life events such as getting married, buying a home, and starting a family. The economic uncertainty has made it challenging for them to plan for the future. However, working with financial advisors can help millennials develop a plan to achieve their goals. These goals include saving for a down payment, creating a retirement plan, and developing a strategy for long-term financial stability. Millennials have experienced considerable market instability, which has led to their lack of confidence in traditional investment methods. Financial advisors can guide them through the intricacies of investing by helping them comprehend risk tolerance, creating a diversified portfolio, and establishing an investment strategy consistent with their values and objectives. As millennials enter the workforce, they face a multitude of complex tax regulations that can be difficult to navigate. However, financial advisors can provide invaluable assistance by helping them understand their tax obligations, identify available tax breaks, and develop a tax strategy that aligns with their financial goals. Millennials, who are more likely to work as freelancers or in the gig economy, are at a higher risk of experiencing financial shocks, such as job loss or unexpected expenses. In order to safeguard their assets, financial advisors can offer insurance and other risk-management strategies to help mitigate these risks. Millennials face specific financial challenges and have unique financial goals, such as saving for a home, starting a business, or pursuing a passion project. Collaborating with a financial advisor can help them develop a tailored plan to achieve these goals and adapt their strategy as their circumstances evolve. A financial advisor can also help millennials navigate the complex financial landscape and stay up-to-date with the latest industry trends and regulations. They can assist in creating a realistic timeline to reach their goals and adjusting their plan if unexpected changes occur, such as job loss, illness, or other financial challenges. As a millennial, choosing a financial advisor can be a daunting task. There are various factors to consider before selecting an advisor that can help you achieve your financial goals. Here are some key considerations: As a millennial with unique financial goals, such as saving for a home, starting a business, or pursuing a passion project, you must understand the services a potential financial advisor offers. You should match the services with what you need based on your financial situation and goals. Most financial advisors provide some form of investment management or portfolio management service. Other services offered vary from advisor to advisor but may include retirement planning, budgeting, cash flow management, tax planning, estate planning, charitable or legacy planning, and insurance evaluation. Ensure you choose an advisor who offers services that fit your financial needs. It is important to choose a financial advisor who is a fiduciary, meaning they are legally bound to act in your best interest when providing advice and managing investments. Financial advisors registered with the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) must abide by fiduciary standards when advising clients. They are also expected to disclose any potential conflicts of interest due to their services. Financial advisors serve various clients, ranging from individuals and families to large businesses. They also work with all income strata, from those with little to invest to high-net-worth clients. Knowing the typical clients of a potential financial advisor can help millennials decide if they are a good fit for their needs. For example, an advisor who primarily works with businesses may not be the most suitable to advise individuals and vice versa. Financial advisors use different fee structures, such as an hourly rate or a flat fee, a percentage of the total assets under management (AUM), or commissions from selling certain financial products. Millennials should compare fees between different advisors and ask questions about the services included in their fee structure. It is essential to understand what you are paying for and the value being provided in return. It is important to check the background of a potential financial advisor. Millennials must know their experience and education and whether they have had any disciplinary action taken against them. After all, they are going to entrust them with their hard-earned money. They may use the SEC Action Lookup - Individuals (SALI) tool or the Investment Adviser Public Disclosure (IAPD) website to check the disciplinary records of potential advisors. They may also check FINRA's BrokerCheck feature and other local state regulatory websites. Financial advisors must obtain specific certifications and licenses to practice. Certifications ensure the financial advisor has the knowledge and expertise to give sound advice. As a millennial, choosing a financial advisor with the necessary certifications and licenses is essential. They typically require taking courses and passing exams covering topics like portfolio management, retirement planning, financial statement analysis, and taxation. Certifications provide peace of mind that millennials are working with an expert and help protect their assets from any potential risks associated with unlicensed advisors. Millennials can find a financial advisor through a variety of channels, including: Millennials can ask family members, friends, colleagues, or mentors if they can recommend a financial advisor. They can also contact other professionals, such as attorneys or accountants, for referrals. These referrals can provide a good starting point in the search for a financial advisor. Millennials can search for financial advisors online through search engines or social media. They can use keywords like "financial advisor for millennials" to narrow their search. They can also check the websites of professional organizations, such as the National Association of Personal Financial Advisors (NAPFA), the Financial Planning Association (FPA), or the Certified Financial Planner Board of Standards. Robo-advisors are automated investment platforms that use algorithms to manage portfolios. They offer low-cost investment management services and may also provide financial planning services. Millennials who prefer a more hands-off approach to invest may consider robo-advisors as an option. Professional organizations, such as the NAPFA and FPA, offer directories of their members. Millennials can search for financial advisors who specialize in working with millennials or who have experience in areas relevant to their financial goals. Millennials can also consider working with financial advisors at brokerage firms like Merrill Lynch, Charles Schwab, or Fidelity. These firms offer a wide range of investment products and services and have financial advisors who can provide personalized advice. Fee-only financial advisors are compensated only by the fees their clients pay, rather than receiving commissions for selling financial products. As such, they may be more likely to act in their clients' best interests. Millennials who prefer fee-only financial advisors can search for them through the NAPFA or the Garrett Planning Network. Millennials can also look for financial advisors in their local area. They can search for financial planners in their city or town and check their reviews and credentials online. This option can be especially useful for millennials who prefer in-person meetings with their financial advisor. There are many benefits to working with a financial advisor for millennials, including: Millennials can benefit from the help of a financial advisor to set financial goals and create a plan to achieve them. A financial advisor can analyze their financial situation, identify areas for improvement, and recommend strategies to achieve their objectives. With a financial plan in place, millennials can have a roadmap to follow and stay on track to meet their goals. Investing can be intimidating for millennials who may not have much experience in financial markets. A financial advisor can help them make informed investment decisions by providing guidance on asset allocation, diversification, and risk management. They can also recommend suitable investment products based on their risk tolerance, financial goals, and investment time horizon. Many millennials may not prioritize retirement planning due to competing financial obligations, such as student loan debt and saving for a home. However, starting early and planning for retirement can be critical for building wealth over time. A financial advisor can help millennials create a retirement plan that takes into account their current financial situation, projected expenses in retirement, and other factors that may affect their retirement savings. Tax planning can be a complex and ever-changing aspect of personal finance. A financial advisor can help millennials minimize their tax liability and use tax-efficient investment strategies. They can also provide guidance on tax-deferred retirement accounts, tax deductions, and credits. Working with a financial advisor can provide valuable education and support for millennials who may not have a strong financial background. A financial advisor can explain financial concepts and help them understand how to make informed decisions about their money. They can also provide ongoing support and advice as their financial situation evolves over time. A financial advisor can provide accountability and motivation for millennials to stay on track with their financial goals. Regular meetings with financial advisors can help keep them accountable for following their financial plan and making progress towards their objectives. They can also provide encouragement and support during times of financial stress or uncertainty. Millennials may have unique financial needs or goals, such as starting a business, buying a home, or pursuing a passion project. A financial advisor with specialized expertise in these areas can provide tailored advice and support to help millennials achieve their objectives. They can also help millennials navigate complex financial situations, such as managing inheritance or financial crises. A financial advisor can be a valuable resource for millennials to manage their finances and plan for the future. As millennials face unique financial challenges, such as high levels of debt and economic uncertainty, a financial advisor can provide guidance in managing debt, planning for the future, investing, managing taxes, protecting assets, and achieving financial goals. Millennials should consider the services offered, fiduciary status, client type, fee structure, disciplinary records, and certifications obtained when selecting a financial advisor. There are various channels to find a financial advisor, including personal referrals, online searches, robo-advisors, fee-only financial advisors, brokerage firms, professional organizations, and local financial planners. Working with a financial advisor can offer many benefits, such as goal-setting and planning, investment advice, retirement planning, tax planning, education and support, accountability and motivation, and specialized expertise. It is essential for millennials to take action and work with financial advisors to achieve their financial goals and plan for a secure future.What Is a Financial Advisor?

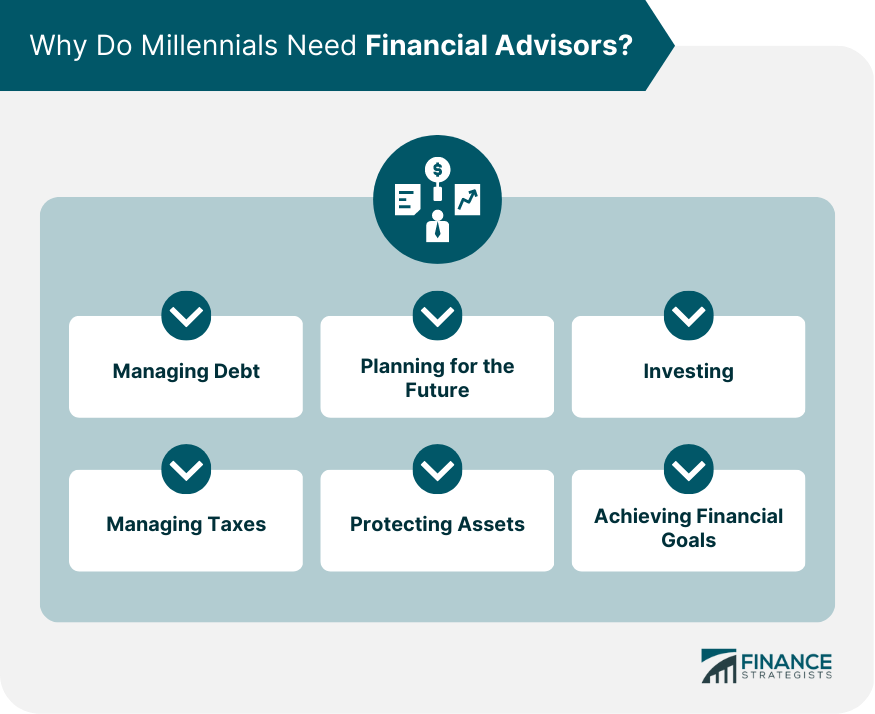

Why Do Millennials Need Financial Advisors?

Managing Debt

Planning for the Future

Investing

Managing Taxes

Protecting Assets

Achieving Financial Goals

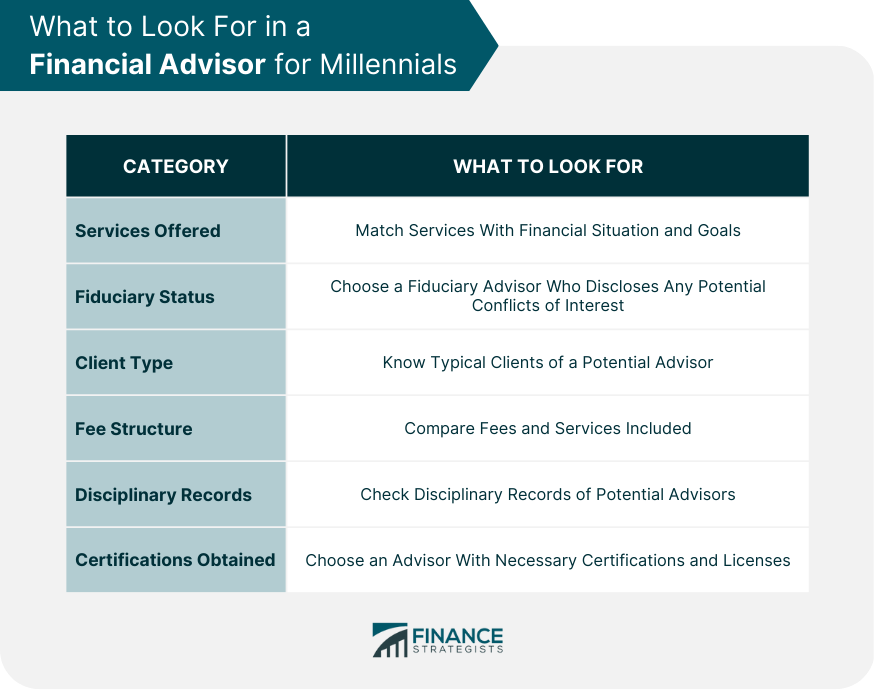

What to Look For in a Financial Advisor for Millennials

Services Offered

Fiduciary Status

Client Type

Fee Structure

Disciplinary Records

Certifications Obtained

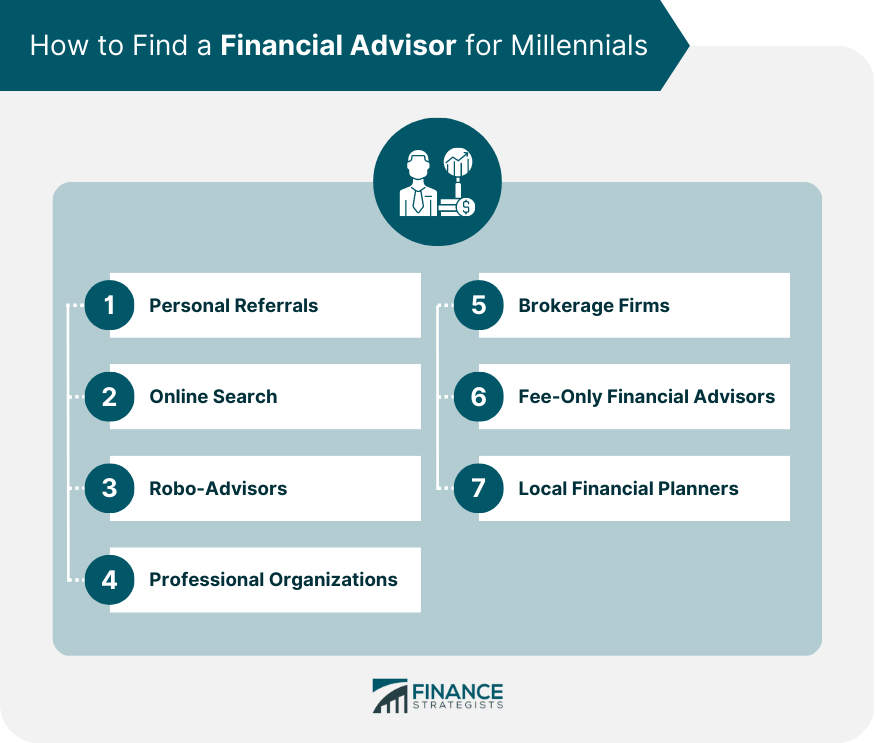

How to Find a Financial Advisor for Millennials

Personal Referrals

Online Search

Robo-Advisors

Professional Organizations

Brokerage Firms

Fee-Only Financial Advisors

Local Financial Planners

Benefits of Working With a Financial Advisor for Millennials

Goal-Setting and Planning

Investment Advice

Retirement Planning

Tax Planning

Education and Support

Accountability and Motivation

Specialized Expertise

The Bottom Line

Financial Advisor for Millennials FAQs

A financial advisor is a professional who provides financial guidance and advice to individuals or businesses in areas such as budgeting, saving, investing, and retirement planning.

Millennials face unique financial challenges such as managing debt, planning for the future, investing, managing taxes, protecting assets, and achieving financial goals, which can be addressed by working with a financial advisor.

When choosing a financial advisor, millennials should consider factors such as the services offered, fiduciary status, client type, fee structure, disciplinary records, and certifications.

Millennials can find a financial advisor through personal referrals, online searches, robo-advisors, professional organizations, brokerage firms, fee-only financial advisors, and local financial planners.

Working with a financial advisor can help millennials set financial goals, receive investment advice, plan for retirement, manage taxes, receive education and support, stay accountable and motivated, and receive specialized expertise for unique financial needs or goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.