A financial analyst is a professional who analyzes financial data and evaluates investment opportunities to support decision-making in businesses, investment firms, and other organizations. They use their finance, economics, and data analysis expertise to provide insights and recommendations to clients and stakeholders. Financial analysts play a crucial role in the financial industry, helping organizations make informed investment decisions, manage risks, and allocate resources efficiently. They contribute to the overall financial health and success of businesses, investment firms, and other institutions by providing valuable insights and guidance based on their research and analysis. There are several types of financial analysts, and each type specializes in analyzing different types of financial instruments or data. The three primary types of financial analysts are: Equity analysts are financial professionals who specialize in analyzing stocks and equity investments. They research individual companies and analyze financial data, industry trends, and economic factors that may affect the company's financial performance. Equity analysts often recommend which stocks to buy, hold, or sell based on their analysis. Credit analysts are financial professionals who evaluate the creditworthiness of individuals or organizations seeking credit or debt investments. They assess the borrower's ability to repay the loan or investment and evaluate the risks associated with the investment. Credit analysts also review credit reports, financial statements, and other relevant data to determine the borrower's creditworthiness. Quantitative analysts, also known as "quants," are financial professionals who use advanced mathematical and statistical techniques to analyze financial data and develop investment strategies. They work with large data sets to identify patterns and trends that can inform investment decisions. Quantitative analysts use computer programs and algorithms to automate their analysis and decision-making processes. Title: Financial Analysts Education and Skills Educational Requirements for Financial Analysts Essential Skills for Financial Analysts Financial analysts typically hold a bachelor's degree in finance, economics, accounting, or a related field. Some analysts may also have advanced degrees, such as a master's in business administration (MBA) or a master's in finance, which can provide additional expertise and opportunities for career advancement. Several professional certifications are available for financial analysts, including the Chartered Financial Analyst (CFA) designation, the Financial Risk Manager (FRM) certification, and the Chartered Alternative Investment Analyst (CAIA) designation. These certifications can enhance a financial analyst's credibility and expertise in their field. Financial analysts must possess strong analytical and critical thinking skills to evaluate complex financial data, identify trends and patterns, and draw meaningful conclusions to support decision-making. Effective communication and presentation skills are essential for financial analysts, as they must be able to convey their findings and recommendations clearly and persuasively to clients, colleagues, and other stakeholders. Financial analysts need strong technical skills, including proficiency in financial modeling, spreadsheet software, and, in some cases, programming languages like Python or R. These skills enable analysts to analyze data efficiently and develop financial models to support their research and recommendations. A deep understanding of the industries and sectors they cover is crucial for financial analysts. This knowledge allows them to make informed judgments about the companies and investments they analyze and to better anticipate future trends and developments. Financial analysts are responsible for collecting and analyzing financial data from various sources, such as financial statements, market data, and economic indicators. This analysis helps them gain insights into the financial performance and prospects of companies, industries, and investment opportunities. Financial analysts evaluate investment opportunities by assessing their potential risks and returns. This involves analyzing financial data, comparing investment alternatives, and determining the suitability of various investments based on clients' or organizations' objectives and risk tolerance. Staying informed about market trends and economic conditions is a key responsibility of financial analysts. They must constantly monitor developments in their areas of expertise and consider how these factors may impact the investments and companies they analyze. Financial analysts often prepare financial statements and reports for internal or external use. These documents provide a comprehensive overview of a company's financial performance and position, helping stakeholders make informed decisions about the organization's future. Financial analysts create financial models and projections to forecast future performance, assess risks, and evaluate investment opportunities. These models help analysts and other stakeholders understand potential outcomes under various scenarios and make more informed decisions. A key responsibility of financial analysts is to assess the risks and opportunities associated with different investments and financial decisions. They must evaluate the potential impact of various factors on the investments they analyze, such as market conditions, economic trends, and company-specific developments. Financial analysts play a crucial role in advising clients and colleagues on investment decisions. They provide insights and recommendations based on their research and analysis, helping stakeholders make informed choices about where to allocate their resources. Presenting findings to stakeholders is an important aspect of a financial analyst's job. They must be able to clearly and persuasively communicate their research, analysis, and recommendations to clients, colleagues, and other decision-makers. Financial analysts contribute to strategic decision-making within organizations by providing insights and guidance based on their research and analysis. Their finance and industry expertise enables them to support executive teams and other stakeholders as they develop and implement strategies to achieve organizational goals. Investment banking and securities firms employ financial analysts to help them identify, evaluate, and execute various financial transactions, such as mergers, acquisitions, and initial public offerings. Financial analysts in these firms also provide research and analysis on specific companies, industries, or market trends to support investment decision-making. Asset management and mutual fund companies rely on financial analysts to research and analyze investment opportunities, manage investment portfolios, and develop investment strategies. Financial analysts in this sector help firms identify undervalued assets, assess risks, and optimize asset allocation to achieve desired investment outcomes. Corporations and businesses across various industries employ financial analysts to support financial planning, budgeting, and decision-making. Financial analysts in these roles analyze financial performance, develop forecasts, and provide recommendations to help companies achieve their financial goals and objectives. Government and regulatory agencies hire financial analysts to monitor financial markets, analyze economic trends, and evaluate the financial health of companies and industries. Financial analysts in this sector contribute to developing and implementing economic policies, regulations, and guidelines to maintain market stability and promote economic growth. Consulting firms and independent research providers offer financial analysis and advisory services to clients across various industries. Financial analysts in these roles conduct research, provide insights, and develop recommendations to help clients make informed decisions about investments, financial planning, and business strategy. Entry-level financial analyst positions typically involve conducting research, collecting data, and performing basic financial analysis. New analysts often work under the supervision of experienced professionals to develop their skills and expertise. As financial analysts gain experience and expertise, they may advance to mid-level roles with increased responsibilities, such as leading research projects, managing client relationships, or developing investment strategies. Mid-level analysts may also specialize in specific industries, asset classes, or market segments. Experienced financial analysts can progress to senior-level positions, such as portfolio managers, research directors, or chief financial officers. These roles involve leading teams, overseeing investment portfolios, and making strategic decisions that impact the organization's financial performance and growth. Financial analysts can choose to specialize in niche areas within their field, such as environmental, social, and governance (ESG) investing, cryptocurrencies, or emerging markets. Specialization can enhance an analyst's expertise and create opportunities for career advancement. Financial analysts must stay informed about industry trends, market developments, and new analytical tools and techniques. Continuing education and professional development opportunities, such as conferences, workshops, and certification programs, can help analysts maintain their expertise and advance their careers. Advancements in technology and automation are transforming the financial analyst profession by streamlining data analysis, reducing manual tasks, and enabling more sophisticated financial modeling. Financial analysts must adapt to these changes by developing new skills and leveraging technology to enhance their research and analysis capabilities. Financial analysts must navigate an increasingly complex regulatory environment, which impacts investment decisions and business practices. Staying current with regulatory developments and compliance requirements is essential for analysts to provide accurate and timely guidance to clients and organizations. Globalization and cross-border collaboration present both challenges and opportunities for financial analysts. Working with international markets and diverse teams requires financial analysts to develop cultural awareness and an understanding of global economic trends and market dynamics. Ethics and professional standards play a critical role in the financial analyst profession. Financial analysts must uphold high ethical standards and adhere to industry best practices to maintain trust and credibility with clients, colleagues, and other stakeholders. Financial analysts play a crucial role in the financial industry by providing research, analysis, and insights that inform investment decisions and business strategies. Their expertise is essential for maintaining market stability, promoting economic growth, and helping individuals and organizations achieve financial goals. Financial analysts can pursue a wide range of career opportunities across various industries and sectors, such as investment banking, asset management, corporations, government agencies, and consulting firms. The profession offers numerous opportunities for growth, specialization, and leadership. To succeed in the rapidly evolving financial industry, financial analysts must continually learn and adapt to changes in technology, regulations, and market trends. Embracing continuous learning and professional development is crucial for staying current and maintaining a competitive edge in the field. For those interested in pursuing a career as a financial analyst or seeking the services of one, it's important to find a financial advisor who can provide guidance and expertise tailored to your needs and goals. A well-informed financial advisor can help you navigate the complexities of the financial industry and make informed decisions to achieve long-term success.What Is a Financial Analyst?

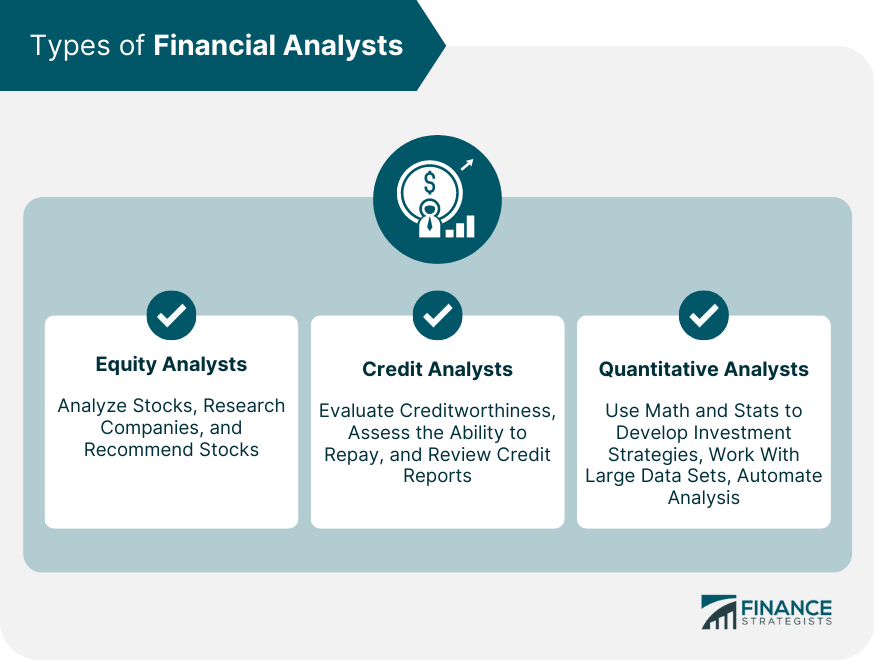

Types of Financial Analysts

Equity Analysts

Credit Analysts

Quantitative Analysts

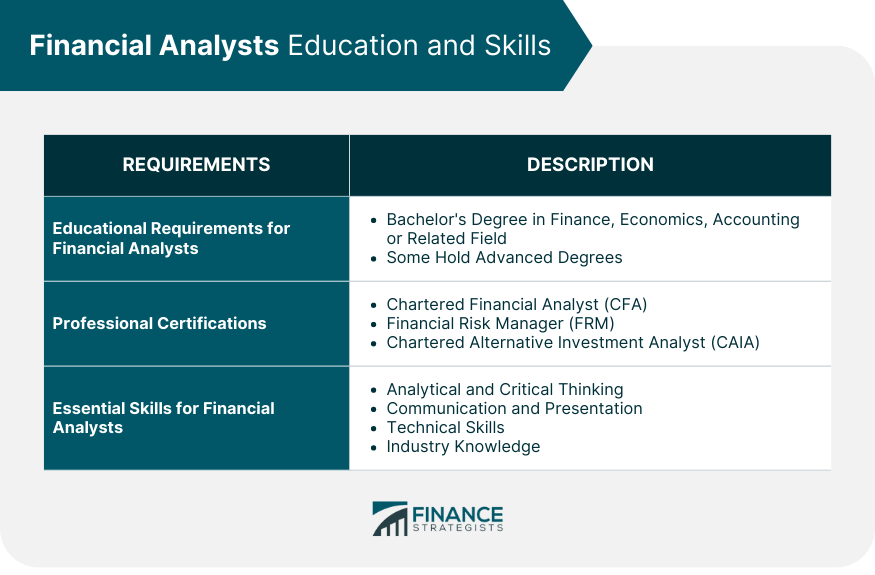

Financial Analysts Education and Skills

Educational Requirements for Financial Analysts

Degrees and Majors

Professional Certifications

Essential Skills for Financial Analysts

Analytical and Critical Thinking

Communication and Presentation

Technical Skills

Industry Knowledge

Job Responsibilities of Financial Analysts

Research and Analysis

Collecting and Analyzing Financial Data

Evaluating Investment Opportunities

Monitoring Market Trends and Economic Conditions

Financial Reporting and Forecasting

Preparing Financial Statements and Reports

Developing Financial Models and Projections

Assessing Risks and Opportunities

Providing Recommendations and Guidance

Advising Clients and Colleagues on Investment Decisions

Presenting Findings to Stakeholders

Supporting Strategic Decision-Making

Industries and Sectors Employing Financial Analysts

Investment Banking and Securities Firms

Asset Management and Mutual Funds

Corporations and Businesses

Government and Regulatory Agencies

Consulting Firms and Independent Research Providers

Career Path and Advancement for Financial Analysts

Entry-Level Positions and Responsibilities

Mid-Level Roles and Career Progression

Senior-Level Roles and Leadership Opportunities

Specialization and Niche Areas

Continuing Education and Professional Development

Challenges and Trends in the Financial Analyst Profession

Impact of Technology and Automation on Financial Analysts

Evolving Regulatory Environment and Compliance Requirements

Globalization and Cross-Border Collaboration

Importance of Ethics and Professional Standards

Final Thoughts

Financial Analyst FAQs

A financial analyst is a professional who analyzes financial data and evaluates investment opportunities to support decision-making in businesses, investment firms, and other organizations.

The three primary types of financial analysts are equity analysts, credit analysts, and quantitative analysts. Equity analysts analyze stocks, credit analysts evaluate creditworthiness, and quantitative analysts use math and statistics to develop investment strategies.

Financial analysts typically hold a bachelor's degree in finance, economics, accounting, or a related field. Some may also have advanced degrees, such as an MBA or master's in finance. Professional certifications like CFA, FRM, and CAIA can also enhance credibility and expertise.

Financial analysts are responsible for conducting research and analysis, evaluating investment opportunities, monitoring market trends and economic conditions, preparing financial statements and reports, providing recommendations and guidance, and supporting strategic decision-making.

Financial analysts must adapt to advancements in technology and automation, navigate complex regulatory environments, work with international markets and diverse teams, and uphold high ethical standards and professional practices. Continuous learning and professional development are essential for success in the rapidly evolving financial industry.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.