A financial coach is an individual who educates clients on the fundamentals of managing money so that they can create solid, long-lasting financial habits and routines. Unlike other professionals, who may primarily focus on wealth management, financial coaches consider the behavioral aspect of finance to determine what motivates people to save and spend. There is no official training for financial coaches unless they actively seek it. They are also not required to procure any certification or license before they can practice. Consequently, most of them cannot sell financial products or provide detailed investment advice. However, the Consumer Financial Protection Bureau (CFPB) does outline the top skills essential to an effective financial coach. These include motivational skills, financial content knowledge, cultural responsiveness, and systemic understanding. A financial coach’s primary role is to provide information and motivation to guide clients along their journey. Using a comprehensive approach around a client’s behavior and relationship to money, financial coaches offer the support needed for them to make lasting changes. Financial coaches can help clients with various needs, from daily financial management to long-term goal planning. They do this by evaluating how clients spend their money, determining their areas of strength, and recommending the practices that need to be improved. A financial coach also functions as a partner in accountability to ensure that clients stay on course to reach their objectives and improve their money management practices. There are several scenarios where a financial coach might be beneficial. Generally, they are most helpful for individuals struggling with money management or needing individualized, holistic support to reach their financial goals. For example, you may hire a financial coach if you have difficulty controlling your spending resulting in being unable to save money each month. In this case, a financial coach can help you create a workable budget to reduce overspending. Financial coaches may also be helpful if you are experiencing a persistent debt problem. For instance, they can suggest a plan to track and pay off your debt in the most cost-effective way possible. They can also advise you on how to avoid future debt. A financial coach does not just create actionable steps. They can also help you recognize, understand and overcome the complicated emotions that sometimes guide monetary decisions. With their support, you can manage your emotions and make sound decisions with your money. Poor money management habits can be hard to break without help. A financial coach can help you overcome these habits, establish better practices and get back on track financially. There are various ways in which financial coaches structure their payment schedules. They can charge per hour or for each session. They may also provide coaching packages for a flat fee. According to the National Financial Educators Council (NFEC), hourly-paid financial coaches earned between $75 and $600 per hour, with the national average at $257. For coaches that offer packaged services, their price range begins at a few hundred dollars and sometimes reaches up to $5,900 annually. Choosing the right financial coach for you begins with creating a list of prospects. You can do this by asking for recommendations from people that you trust. If your friends and relatives are presently working with someone they like, they will gladly refer you to their services. You can also conduct an online search. Many financial coaches have an online presence. This can help with your selection because you can read reviews and compare rates among service providers. Looking for financial coaches in online directories such as the Association for Financial Counseling & Planning Education (AFCPE) website is also a good option. Alternatively, if you are currently employed, you can check to see if your employer offers financial coaching services as part of their employee benefits package. Once you have a list of candidates, you can interview some of them to check if they are a good fit for you. Here are some questions that you can ask so you can learn more about your prospects: A good relationship between you and your financial coach will be crucial in achieving your desired growth and goals. Thus, after you have conducted your interviews, weigh your options carefully and make sure to select someone you can trust. If you are interested in becoming a financial coach, below are a few tips to help you get started. A financial coach is expected to possess some level of financial experience. Thus, while no official qualifications are required to become a financial coach, many coaches choose to earn certifications to distinguish themselves from other service providers. There are some formal training programs that you can take to set you up for success as a financial coach, including the Accredited Financial Counselor (AFC) certification. Many financial coaches specialize in a specific area, such as retirement planning or debt management. This allows them to provide targeted advice and services to their clients. You may consider your personal experiences when selecting which area to specialize in. For example, if you were close to declaring bankruptcy but managed to avoid it, you can choose to work on cash flow management and debt elimination. Alternatively, if you have experienced divorce, you can consider specializing in financial planning for divorce. Many financial coaches are self-employed and thus bear the burden not just of providing services but also of bringing in new clients. One way to outsource some of the tasks involved in client acquisition is to partner with an organization or company. This can provide you with a pre-existing client base and help you build credibility. Many financial coaches partner with accounting firms, banks, or credit unions. Below are some differences between financial coaches and financial advisors: Financial advisors provide advice on investing and financial planning. They can also help clients manage money, but their primary focus is on growing wealth. On the other hand, a financial coach helps clients with basic financial management to help them reach their goals, such as lessening overspending or getting out of debt. A financial advisor must have a license to provide advice on investments and securities. To obtain this license, they must pass an exam governed by the Financial Industry Regulatory Authority (FINRA). There are no official qualifications required to become a financial coach. However, many coaches have experience in personal finance and investing. Financial coaches typically charge an average of $257 hourly or per-session fees for their services. Some coaches also offer coaching packages that range from a few hundred dollars and reach up to $5,900. Unlike financial coaches, financial advisors may earn commissions on the products they sell. Some of them also charge based on the percentage of assets their clients have under management. However, financial advisors generally charge an hourly rate of around $200 to $400 and an average of $2,400 for a stand-alone financial plan. Below is a summary of some differences between financial coaches and financial advisors. A financial coach is an individual who educates clients on the fundamentals of managing money and supports them in creating solid, long-lasting financial habits and routines. Financial coaches usually have motivational skills, a good understanding of consumer behavior, and strong financial content knowledge. Financial coaches can help clients with various needs, from daily financial management to long-term goal planning. They do this by evaluating how clients spend their money, determining their areas of strength, and recommending the practices that need to be improved. Hiring a financial coach may be appropriate if you need help with your spending and saving habits. They can also offer support if you have a persistent debt problem or become emotional with money concerns. If you are interested in hiring a financial coach, you can begin by asking for recommendations from friends or family members. Alternatively, you can search for prospects through online databases or seek help from your employer. Once you have a list of prospects, you can interview them to help you make an informed decision. After weighing your options, choose someone you feel comfortable with and know you can trust. On the other hand, if you are considering a career in financial coaching, you can earn certifications to distinguish yourself from other service providers. You can also select a niche or specialty that resonates with your experience. Finally, you can explore partnership opportunities with complementary organizations or companies. This might reduce the time you need to spend marketing your services and increase your credibility in the eyes of potential clients.What Is a Financial Coach?

What Does a Financial Coach Do?

When Should You Hire a Financial Coach?

Cost of Hiring a Financial Coach

How to Find a Financial Coach

How to Become a Financial Coach

Earn Certifications

Find a Niche

Explore Partnership Opportunities

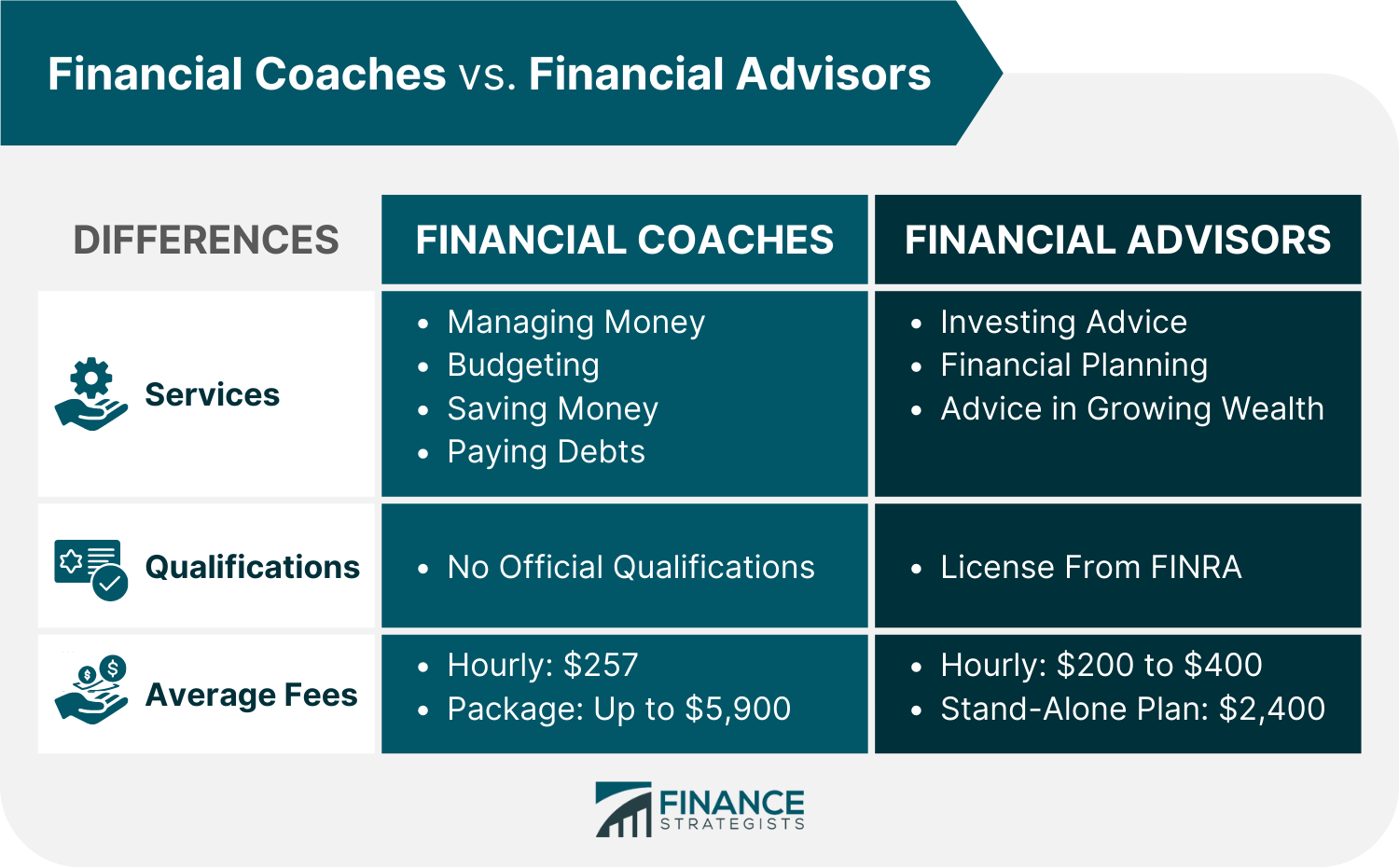

Financial Coach vs Financial Advisor

Services

Qualifications

Averages Fees

Final Thoughts

Financial Coach FAQs

A financial coach is an individual who educates clients on the fundamentals of managing money and supports them in creating solid, long-lasting financial habits and routines.

Hiring a financial coach may be appropriate if you need help with your spending and saving habits. They can also offer support if you have a persistent debt problem or become emotional with money concerns.

The average hourly rate for a financial coach is $257. Some coaches also offer package rates, which can cost up to $5,900.

A financial coach helps clients improve their relationship with money and teaches them how to develop good financial habits. On the other hand, a financial advisor provides advice on investments and focuses on helping clients grow wealth.

To find a financial coach, you can ask for recommendations from friends or family members, search for prospects through online databases, or seek help from your employer. Once you have a list of prospects, you can interview them to help you choose someone you feel comfortable with and know you can trust.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.