The Financial Risk Manager (FRM) is a globally recognized certification program for risk management professionals. The FRM certification is designed to enhance candidates' knowledge and skills in the field of risk management and open up new career opportunities. Candidates must pass two levels of exams and meet several requirements to obtain the FRM certification. The exam covers a range of risk management topics, including market risk, credit risk, operational risk, and investment risk. Candidates can prepare for the exam using various study materials, review courses, and self-study resources. Several program providers offer FRM certification programs, including The Global Association of Risk Professionals (GARP), Kaplan Schweser, and Bionic Turtle. Have a financial question? Click here. To obtain the FRM certification, candidates must meet several requirements. These requirements include educational, work experience, ethics, and exam requirements. Candidates must have a bachelor's degree or equivalent from an accredited institution. Alternatively, candidates may qualify for the FRM certification with a combination of work experience and other professional qualifications. Candidates must also complete a rigorous self-study program to prepare for the FRM exam. Candidates must have at least two years of full-time work experience in risk management or a related field, such as trading, portfolio management, or academia. Candidates must agree to abide by the FRM Code of Ethics and Standards of Professional Conduct. The code of ethics outlines the ethical principles FRM holders must follow in their professional activities. The standards of professional conduct specify the conduct required of FRM holders, including the requirement to maintain the confidentiality of client information and avoid conflicts of interest. Candidates must pass two levels of exams to obtain the FRM certification. Each level of the FRM exam is four hours long and consists of 100 multiple-choice questions. The questions test the candidate's knowledge and understanding of risk management concepts and techniques. The FRM exam is designed to test candidates' knowledge and understanding of risk management concepts and techniques. The exam is divided into two levels, each consisting of 100 multiple-choice questions. The FRM exam is computer-based and consists of multiple-choice questions. Each question has four possible answers, and candidates must choose the best answer. The questions are designed to test the candidate's knowledge and understanding of risk management concepts and techniques. Candidates have four hours to complete each level of the FRM exam. The exam is divided into two parts, with a break between the two parts. Candidates must complete the first part of the exam before they can take the second part. The FRM exam covers various risk management topics. Level 1 of the exam covers topics such as foundations of risk management, quantitative analysis, financial markets and products, and valuation and risk models. Level 2 of the exam covers more advanced topics, such as market risk measurement and management, credit risk measurement and management, operational and integrated risk management, and risk management and investment management. Candidates preparing for the FRM exam can access a wide range of study materials. These materials include recommended study materials, review courses, self-study resources, and tips for preparing for the exam. GARP lists recommended study materials for the FRM exam. These materials include textbooks, study guides, practice exams, and online learning tools. Candidates can purchase these materials from the GARP website or other sources. Several companies offer review courses for the FRM exam. These courses are designed to help candidates prepare for the exam by providing in-depth coverage of the exam topics, practice questions, and test-taking strategies. Review courses can be taken in person or online, and they are typically led by experienced instructors who have passed the FRM exam themselves. Besides recommended study materials and review courses, candidates can also use self-study resources to prepare for the FRM exam. These resources include online forums, study groups, and study apps. Self-study resources can be beneficial for candidates who prefer to study at their own pace or have limited time to prepare for exams. Preparing for the FRM exam can be a challenging and time-consuming process. To help candidates prepare effectively, we recommend the following tips: Start Early: Begin studying for the exam as early as possible to give yourself enough time to cover all the material. Create a Study Schedule: Develop a study schedule that allows you to cover all the material in a systematic and organized manner. Take Practice Exams: Practice exams are a great way to test your knowledge and identify areas where you need to improve. Focus On Your Weaknesses: Identify your weak areas and focus on improving them. Use Multiple Study Materials: Use a variety of study materials to get a well-rounded understanding of the exam material. Obtaining the FRM certification can provide a range of benefits, including enhanced career prospects, increased earning potential, and recognition and credibility in the field of risk management. Employers highly seek FRM holders in various industries, including banking, insurance, and consulting. The FRM certification demonstrates to employers that you have the knowledge and skills to manage risk and make informed decisions effectively. FRM holders typically earn higher salaries than their non-certified peers. The salary range for a financial risk professional can also vary per annum. The FRM certification is globally recognized as a leading credential in the field of risk management. Holding the FRM certification demonstrates to colleagues, clients, and employers that you have achieved high professional competence and are committed to upholding ethical standards. FRM holders have access to a global network of risk management professionals. This network can provide valuable opportunities for learning, collaboration, and career advancement. Several program providers offer FRM certification programs, including GARP, Kaplan Schweser, and Bionic Turtle. These providers offer a range of study materials, review courses, and other resources to help candidates prepare for the FRM exam. When choosing a provider for your FRM certification program, consider the provider's reputation, experience, and resources. Look for providers with a proven track record of helping candidates pass the FRM exam and offering a range of study materials and resources to suit your learning style and needs. A Financial Risk Manager is a professional who specializes in identifying, assessing, and mitigating risks within an organization. To become a successful FRM, candidates should possess strong analytical and problem-solving skills and excellent communication and interpersonal skills. The FRM certification is a well-respected credential for a financial advisor and is designed to help professionals develop a detailed understanding of financial risk management. The FRM exam is rigorous, but candidates can increase their chances of passing by following study tips and taking advantage of study resources. Earning the FRM certification can open up a wide range of career opportunities in the financial services industry and beyond. What Is a Financial Risk Manager (FRM)?

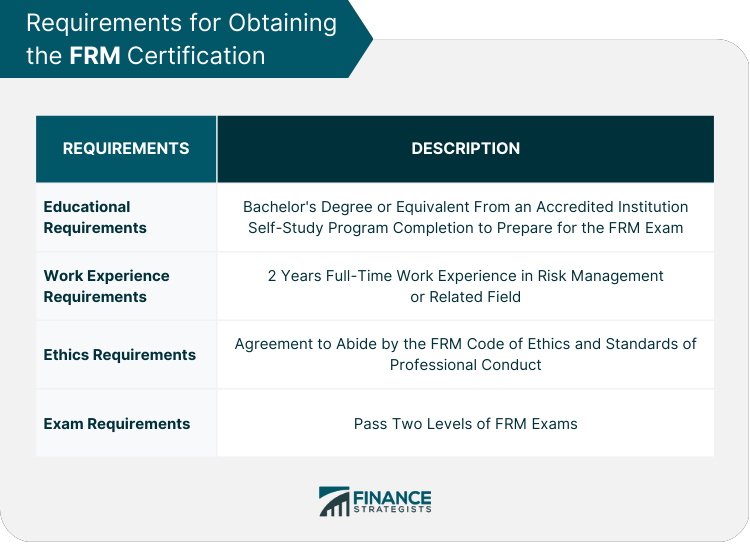

Requirements for Obtaining the FRM Certification

Educational Requirements

Work Experience Requirements

Ethics Requirements

Exam Requirements

Exam Format for the FRM Certification

Exam Structure

Time Allocation for the Exam

Exam Topics and Weights

Study Materials for the FRM Exam

Recommended Study Materials

Review Courses for the FRM Exam

Self-Study Resources

Tips for Preparing for the FRM Exam

Benefits of the FRM Certification

Career Prospects for FRM Holders

Salary Expectations for FRM Holders

Recognition and Credibility of the FRM Certification

Networking Opportunities for FRM Holders

FRM Certification Program Providers

The Bottom Line

Financial Risk Manager (FRM) FAQs

The role of a Financial Risk Manager (FRM) is to identify, assess, and manage financial risks within an organization.

FRM certification is important as it demonstrates the candidate's knowledge and expertise in financial risk management. It also increases their professional credibility, enhances their employability, and opens up new career opportunities.

To become an FRM, candidates must have a bachelor's degree and two years of full-time work experience in the financial services industry or risk management. They must also pass the two-part FRM Exam.

The FRM Exam is a two-part exam covering financial risk management topics. The Global Association of Risk Professionals (GARP), Kaplan Shcweser, and Bionic Turtle offer the exam.

FRMs can work in various industries, including banking, insurance, and consulting. Common job titles for FRMs include risk manager, risk analyst, and chief risk officer. Some FRMs also choose to specialize in areas such as quantitative analysis or portfolio management.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.