A Chartered Financial Planner (CFP) is a professional who has attained a distinguished level of expertise in financial planning by fulfilling rigorous academic requirements, practical experience, and successfully passing a series of comprehensive examinations. This status is often recognized internationally and is awarded by professional bodies, such as the Chartered Institute for Securities & Investment (CISI) in the UK or the Certified Financial Planner Board in the US. In addition to their deep understanding of financial markets, investment strategies, and regulatory environments, CFP’s are bound by a strict code of ethics. This ensures that they operate with the highest level of integrity and prioritize clients' best interests. The designation not only sets them apart in the industry, demonstrating commitment to professional development and excellence, but it also provides assurance to clients that they are receiving advice from a highly qualified and trustworthy professional. Becoming a Chartered Financial Planner is a rewarding endeavor that exemplifies excellence in the financial planning industry. Below is a detailed breakdown of the necessary steps to achieve this esteemed designation: A bachelor's degree serves as the initial step in building a strong foundation for a career in financial planning. Choosing a major in fields like finance, business, or accounting is especially beneficial. Each of these fields offers unique insights: Finance: Delve into the intricacies of financial markets, portfolio management, risk assessment, and investment strategies. Understanding financial instruments and market dynamics is fundamental to advising clients. Business: Grasp the broader spectrum of the business world, including management principles, operations, marketing, and strategy. This holistic view can aid financial planners in understanding their clients' needs, especially for business owners or entrepreneurs. Accounting: Familiarize oneself with the principles of accounting, tax implications, balance sheets, and financial statements. This knowledge is crucial when analyzing a client's financial health and planning strategies. Hands-on experience is essential in bridging the gap between theoretical knowledge and practical application in the financial planning industry. Most certifying bodies stipulate 3 to 5 years of pertinent work experience, emphasizing both the depth and breadth of professional exposure. During this phase, financial advisor, investment consultant, portfolio manager, or tax advisor allow aspirants to engage directly with varied financial scenarios, from navigating market fluctuations to crafting personalized financial strategies. Moreover, internships and trainee programs can offer a foundational understanding of the sector, while networking and mentorship from seasoned professionals provide invaluable guidance. Administered by the Certified Financial Planner Board of Standards, the CFP exam is widely recognized globally. It covers the comprehensive financial planning process, risk management, investment planning, tax planning, retirement, and employee benefits planning. The exam typically consists of multiple-choice questions, case studies, and scenario-based questions. The duration is approximately 6 hours, usually split into two sessions. Offered by The American College of Financial Services, the ChFC designation requires multiple course examinations. Topics include financial planning, insurance, income taxation, retirement planning, investments, and estate planning. The exam varies per course but is generally around 2 hours each. Offered by the American Institute of CPAs, the PFS exam focuses on personal financial planning, emphasizing areas like insurance, benefits, investments, and estate planning. The exam typically consists of multiple-choice questions, simulations, and written communication tasks. Recognized in the UK and many other countries, CISI offers a pathway to becoming a Chartered Financial Planner. Exams cover areas like investment management, financial planning, and wealth management. The exams can include multiple-choice questions, written answers, case studies, and short-answer questions. Membership in recognized professional bodies is a pivotal step for CFP’s, underscoring their commitment to industry standards, ethical practices, and continuous professional development. Affiliation with esteemed organizations not only bolsters credibility among peers and clients but also offers invaluable resources like networking events, educational seminars, research publications, and advocacy initiatives. Embracing such memberships signifies a dedication to excellence and positions planners at the vanguard of the ever-evolving financial planning landscape. CFP’s are entrusted with the financial well-being of their clients, making it essential to operate with integrity, transparency, and a commitment to the client's best interests. Adhering to ethical standards ensures trust, strengthens the planner-client relationship, and upholds the reputation of the profession as a whole. Governing bodies and professional associations often have a code of ethics that members are expected to follow, reinforcing the importance of honesty, confidentiality, and diligence in every professional endeavor. Staying updated is not just a necessity but a responsibility. Continuing Professional Development (CPD) ensures that professionals remain at the cutting edge of knowledge, skills, and best practices. Through seminars, workshops, courses, and conferences, CPD fosters lifelong learning, enabling planners to offer the most relevant and informed advice to their clients. Moreover, many professional bodies mandate a certain number of CPD hours annually, underlining its significance in maintaining competency and delivering excellence in the field. Holding the CFP designation signifies a rigorous level of training, experience, and expertise. This title bolsters trust among clients, employers, and peers, establishing the holder as a knowledgeable and committed professional in the financial planning landscape. The Chartered designation can open doors to premium job positions, higher salary brackets, and specialized roles within the financial sector. Many top-tier firms and discerning clients specifically seek chartered professionals for their recognized expertise. CFP’s possess a comprehensive understanding of diverse financial strategies, tools, and regulations. This breadth and depth of knowledge enable them to craft tailored financial solutions for clients, navigating complex scenarios with ease. Being chartered often comes with a commitment to ongoing professional development. This ensures that planners are always updated with the latest industry trends, tools, and regulations, positioning them at the forefront of their profession. The Chartered designation is synonymous with a stringent code of ethics and standards of conduct. Clients can have peace of mind knowing they are working with a professional who upholds the highest levels of integrity, confidentiality, and responsibility in their dealings. Rigorous Examination Process: The exams required for chartered status are comprehensive and demanding, testing both theoretical knowledge and practical application, which can be daunting for many aspirants. Time Commitment: Balancing work, studies, and personal commitments can be challenging, especially given the extensive study hours needed for preparation and the requirement for several years of relevant work experience. Staying Updated: The financial landscape is constantly evolving with new regulations, products, and market dynamics. Aspiring CFP’s must stay informed and adapt to these changes, which can be taxing. High Initial Investment: Pursuing chartered status often involves significant costs, including tuition for preparatory courses, examination fees, and membership dues for professional bodies, which might deter some individuals. Navigating Ethical Dilemmas: While the profession emphasizes a strong ethical framework, real-world scenarios can present complex dilemmas. Aspiring planners must cultivate the ability to make decisions that align with both client interests and professional integrity, even when faced with challenging situations. A Chartered Financial Planner stands as a beacon of excellence in the financial planning realm. This distinction is achieved through a combination of rigorous education, practical experience, and successful completion of comprehensive examinations. The journey to becoming a CFP involves educational prerequisites, relevant work experience, and the successful passage of demanding examinations. Membership in professional bodies and a dedication to ethical standards further reinforce their credibility and trustworthiness. While the path is marked by challenges such as the demanding examination process, time commitment, staying updated in a dynamic field, and initial financial investment, the benefits are substantial. Enhanced credibility, greater career opportunities, in-depth knowledge, continuous learning, and ethical practice are among the rewards that await those who aspire to attain this prestigious designation.What Is a Chartered Financial Planner (CFP)?

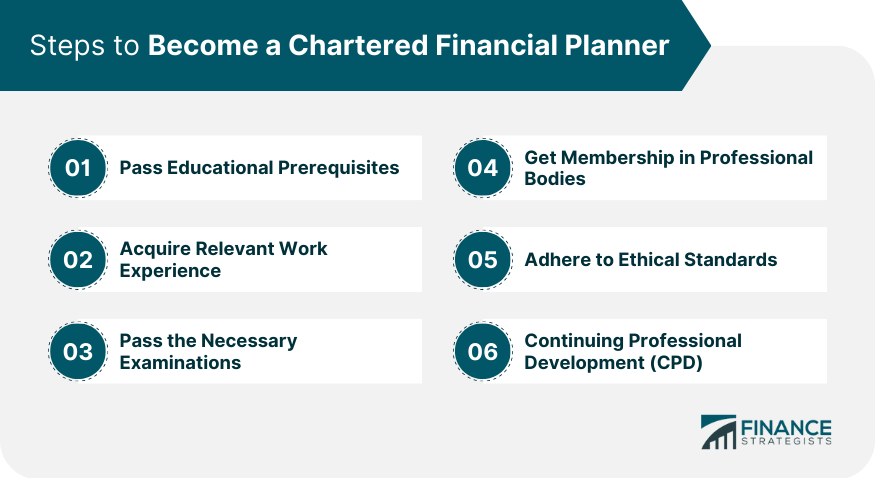

Steps to Become a Chartered Financial Planner

Educational Prerequisites

Acquire Relevant Work Experience

Pass the Necessary Examinations

Certified Financial Planner (CFP) Examination

Chartered Financial Consultant (ChFC) Examinations

Personal Financial Specialist (PFS) Examination

Chartered Institute for Securities & Investment (CISI) Examinations

Membership in Professional Bodies

Adherence to Ethical Standards

Continuing Professional Development (CPD)

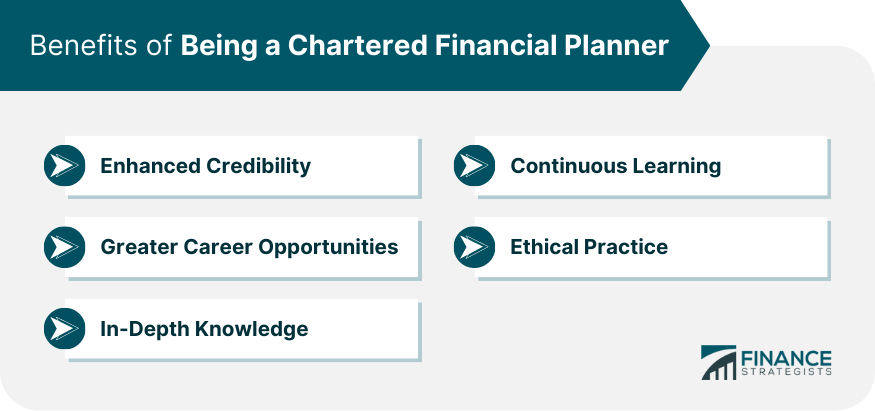

Benefits of Being a Chartered Financial Planner

Enhanced Credibility

Greater Career Opportunities

In-Depth Knowledge

Continuous Learning

Ethical Practice

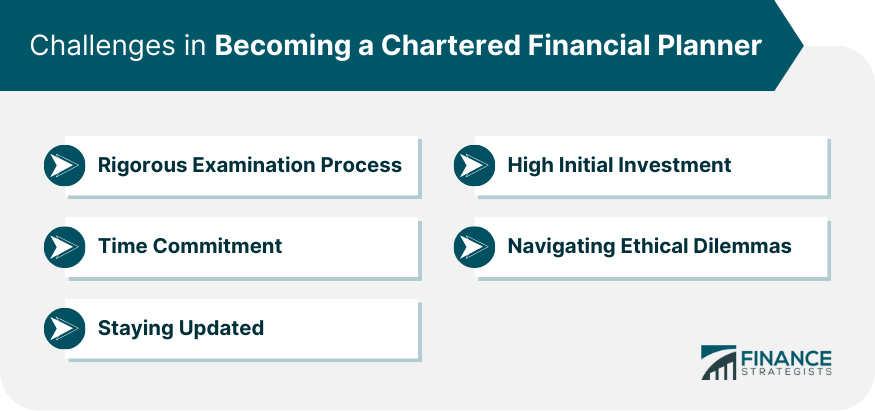

Challenges in Becoming a Chartered Financial Planner

Conclusion

How to Become a Chartered Financial Planner FAQs

A Chartered Financial Planner is a professional who achieves expertise in financial planning through education, experience, and examinations.

To become a Chartered Financial Planner, you need to complete educational prerequisites, gain relevant work experience, pass comprehensive examinations, and adhere to ethical standards.

You typically need a bachelor's degree in finance, business, or accounting to establish a solid foundation for a career in financial planning.

The specific examinations vary based on the certifying body, but they generally cover areas such as financial planning, risk management, investments, retirement planning, and ethics.

Becoming a Chartered Financial Planner enhances your credibility, opens up greater career opportunities, deepens your knowledge, commits you to continuous learning, and ensures ethical practice in your financial advisory role.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.