A Financial Planner is a professional trained and often certified in helping individuals and businesses meet their long-term financial goals. They assess the financial needs of their clients and offer tailored advice on topics such as investments, tax laws, and insurance decisions. The importance of having a Financial Planner cannot be overstated. In an age where financial instruments and markets are becoming increasingly complex, having a knowledgeable guide to navigate these waters is invaluable. Not only do they offer expert advice tailored to individual needs, but they also provide the peace of mind that comes with knowing one's finances are in competent hands. With the right financial planner, individuals can make informed decisions that safeguard their current assets and secure their future financial well-being. Making the right choice ensures a path that aligns with your financial objectives and provides peace of mind. Before initiating your search for a financial planner, take a moment to introspect and jot down your specific financial aspirations. These objectives are the pillars that will guide the rest of your financial journey: Short-Term Goals: Are you planning to buy a home or a car in the next few years? Maybe you're considering a significant career change or expecting to start a family soon. These goals might necessitate liquidity and saving plans. Medium-Term Goals: This could range from saving for your child's college tuition, or even starting a business venture. These goals often demand a mix of saving and prudent investment. Long-Term Goals: Retirement is a common long-term goal. But it's also essential to consider other aspects like legacy planning, estate distribution, or maybe achieving a specific financial net worth. Risk Tolerance: Recognize your risk appetite. Are you a conservative investor who prefers stable, low-risk investments, or are you more aggressive, willing to take calculated risks for higher returns? The financial industry has various designations that professionals use, indicating their area of expertise and the rigorous training they've undergone: • Certified Financial Planner (CFP): A CFP undergoes extensive training covering multiple facets of financial planning, from investments to estate planning. They have to pass a rigorous exam and adhere to a strict code of ethics. They are required to complete continuing education to maintain their certification, ensuring they are updated with the latest trends and practices. • Certified Public Accountant (CPA): Primarily known for their expertise in accounting, CPAs undergo rigorous training and exams. If you have intricate tax situations or need specialized tax advice, a CPA might be more apt for you. Some CPAs also offer financial planning services, especially when it's intertwined with tax planning. • Chartered Life Underwriter (CLU): This designation is especially relevant for individuals seeking expertise in life insurance and estate planning. CLUs have in-depth knowledge about risk management, making them suitable for those looking to safeguard their financial future and provide for their loved ones after they're gone. Understanding how a financial planner is compensated is crucial, as it can influence the advice they offer and the financial products they recommend. Planners can be: Fee-Only: Whether it's a flat fee for a particular service, an hourly rate for consultation, or a percentage of the assets they manage for you, their compensation isn't influenced by external commissions or incentives. Fee-Based: Fee-based planners have a mixed compensation model. While they do charge their clients fees for services or asset management, they also earn commissions on certain financial products they might sell. Commission-Only: Planners in this category earn their income purely from the commissions on the financial products they sell to clients. They don't charge direct fees for advice or consultation. A planner with a substantial history typically has encountered various financial scenarios and has honed their problem-solving skills over time. Examine their portfolio to see if they've dealt with financial situations similar to yours. Additionally, the number of years they've been in business can provide insight into their stability and dedication to the profession. Client testimonials can offer a firsthand perspective on the planner's expertise and reliability. A consistent track record of satisfied clients often indicates a planner who is both knowledgeable and trustworthy. Word-of-mouth recommendations from trusted acquaintances can provide invaluable insights into a planner's capabilities and professionalism. When a friend or family member has had a positive experience, it can be a testament to the planner's competence. However, the digital age has also made it possible to tap into a broader pool of experiences through online reviews. Platforms like Yelp, Google, or specialized financial forums can reveal how a planner interacts with various clients and if there are any consistent issues or praises. It's prudent to consider both personal referrals and online reviews to get a holistic view. Some planners might have a holistic approach, covering everything from investments to tax planning, while others may have a niche focus. If your primary concern is securing your family's future, you might prefer someone who specializes in estate planning or life insurance. On the other hand, if you're nearing retirement, a planner skilled in retirement strategies would be more apt. It's essential to ascertain the breadth and depth of services offered to ensure they align with your current and foreseeable needs. During your initial interactions, assess if they are genuinely attentive to your concerns and questions. It's crucial for the planner to be able to distill complex financial jargon into layman's terms, ensuring you're fully informed. A planner who is genuinely vested in your financial success will actively engage, offer insights, and work collaboratively to devise a plan that resonates with your objectives. The financial world is bound by regulations to protect consumers. It's essential that your chosen planner adheres to these regulations and is registered with relevant oversight bodies. Organizations like the Securities and Exchange Commission (SEC) or Financial Industry Regulatory Authority (FINRA) maintain records of registered financial professionals. Through these platforms, you can ascertain if a planner has faced disciplinary actions or if there have been complaints lodged against them. This step is crucial to ensure you're entrusting your finances to an ethical and compliant professional. The relationship between you and your financial planner is deeply personal, often delving into intimate details of your financial aspirations and concerns. It's of utmost importance that you feel a genuine connection and trust with this individual. Beyond their technical expertise, evaluate their interpersonal skills, empathy, and integrity. Feeling at ease and having confidence in your planner's intentions can make the financial planning journey more collaborative and fulfilling. When considering a potential financial planner, asking the right questions can provide invaluable insights into their expertise, approach, and suitability for your needs. This question helps ascertain the level of expertise and whether rigorous training in financial planning has been undertaken. Recognized certifications signify a standard of proficiency and ethics in the profession. Understanding the compensation method will highlight any potential conflicts of interest and determine if the fee model aligns with financial expectations and budgetary constraints. Obtaining references from past or current clients offers insights into the planner's capabilities, reliability, and approach. It also indicates if the planner has experience addressing financial situations comparable to the prospective client's. This question delves into the planner's approach towards regular updates and revisions. A financial plan isn't static; it requires periodic reviews to adjust for life changes, market conditions, and evolving objectives. A fiduciary is bound legally and ethically to act in the best interest of the client. This is vital to ensure that advice given is unbiased and genuinely tailored for the client's benefit. A Financial Planner plays a vital role in guiding individuals and businesses toward their long-term financial objectives. Selecting the right planner hinges on several key considerations. Defining your goals serves as the foundation for a well-suited partnership. Understanding planner designations helps align expertise with your needs. Diverse fee structures require careful consideration. Experience, track record, referrals, and reviews all contribute to gauging a planner's reliability. Moreover, the breadth of services, communication skills, regulatory adherence, and personal rapport are crucial factors for establishing a productive relationship. Asking pertinent questions about qualifications, fees, references, plan reviews, and fiduciary responsibilities aids in assessing a potential planner's suitability. Ultimately, with a skilled and trustworthy Financial Planner, individuals can navigate the complexities of financial planning, make informed decisions, and pave the way to a secure and prosperous financial future.What Is a Financial Planner?

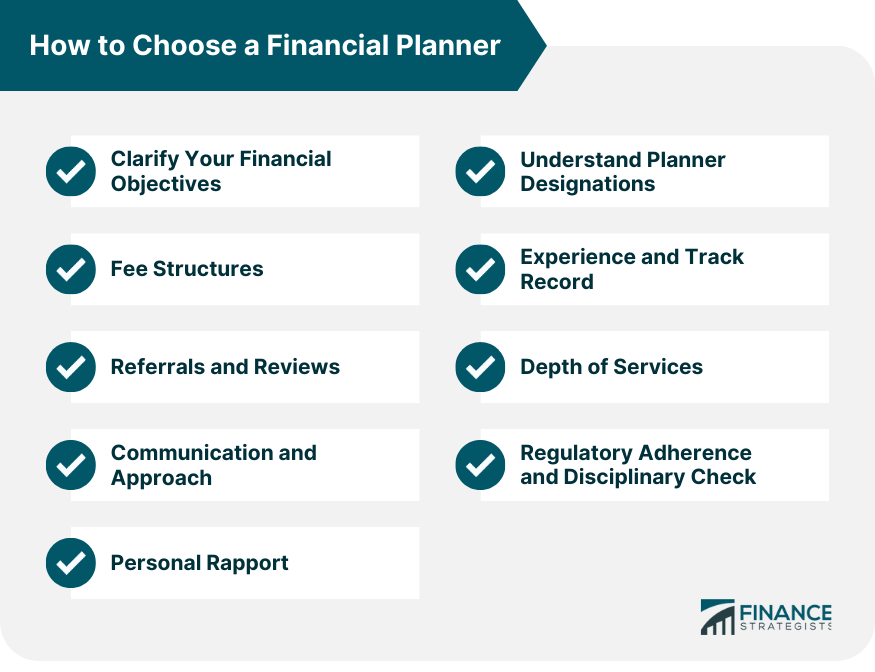

How to Choose a Financial Planner

Clarify Your Financial Objectives

Understand Planner Designations

Fee Structures

Experience and Track Record

Referrals and Reviews

Depth of Services

Communication and Approach

Regulatory Adherence and Disciplinary Check

Personal Rapport

Key Questions to Ask a Potential Financial Planner

What Are the Qualifications and Certifications Held?

How Are Services Charged and What Is the Fee Structure?

Can References Be Provided From Clients With Similar Financial Needs?

How Often Is a Financial Plan Reviewed and Adjusted?

Is There a Fiduciary Responsibility, and Will Actions Be in the Client’s Best Interest at All Times?

Conclusion

How to Choose a Financial Planner FAQs

A financial planner is a professional who assists individuals and businesses in achieving their long-term financial goals.

Choosing a financial planner involves considering factors like your goals, their qualifications, and fee structure. Look for designations like CFP, CPA, or CLU for expertise. Assess their experience, track record, and reviews to ensure a reliable choice.

Qualifications indicate a financial planner's expertise and commitment to ethical standards. Designations highlight their proficiency in different aspects of financial planning, helping you make an informed choice.

A fiduciary responsibility ensures that a financial planner is legally bound to act in your best interest. This commitment helps you make unbiased decisions that align with your goals and ensures the advice you receive is genuinely tailored to your benefit.

Ask about their qualifications, fee structure, and whether they act as a fiduciary. Inquire about their experience and track record, request references from clients with similar needs, and discuss how often they review and adjust financial plans.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.