What Is a NAPFA-Registered Financial Advisor?

A NAPFA-Registered Financial Advisor is a financial professional who has been certified by the National Association of Personal Financial Advisors (NAPFA), an organization dedicated to supporting financial advisors.

They particularly support financial advisors who are committed to providing fee-only holistic financial planning services to their clients. A NAPFA-Registered Financial Advisor is a fiduciary who is legally obligated to act in their client's best interest at all times.

They are required to provide objective and unbiased advice that is solely best for their clients and not influenced by any potential conflicts of interest or financial incentives. They also adhere to a set of criteria, credentialing and educational requirements.

What Sets NAPFA-Registered Financial Advisors Apart?

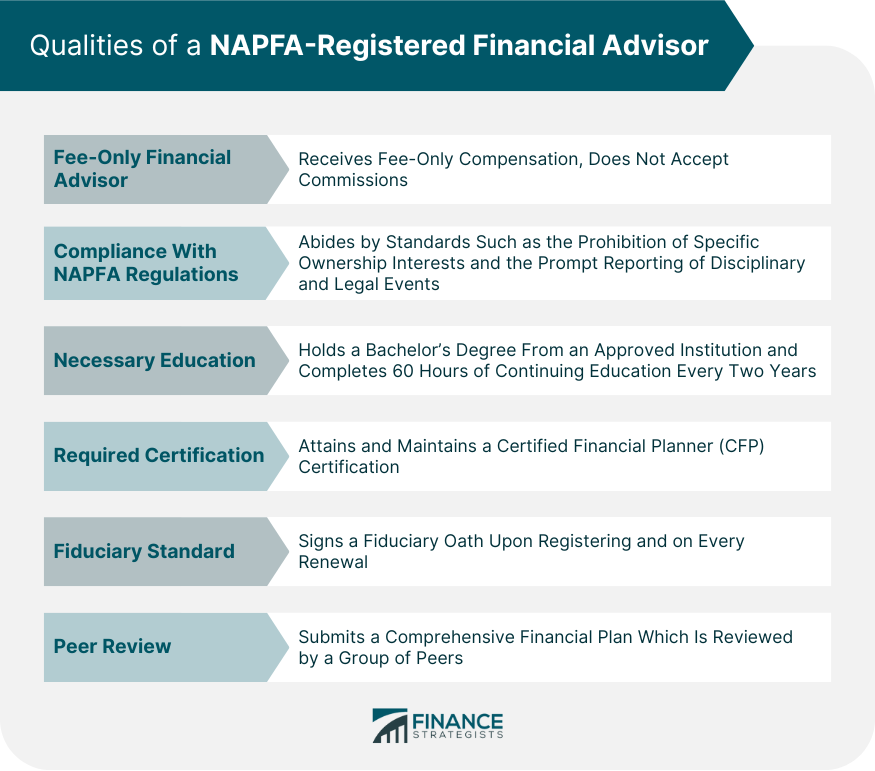

NAPFA-Registered Financial Advisors are set apart from others in the financial planning industry by several unique qualities.

Fee-Only Financial Advisor

One of the most significant requirements is that the financial advisor must receive only fee-based compensation and not receive commissions or any other compensation for recommending specific products or investments.

This fee-only structure helps ensure that NAPFA-Registered Financial Advisors have no conflicts of interest when providing advice to their clients.

Compliance With NAPFA Regulations

A key component of these regulations is the prohibition of certain ownership interests and employment relationships that could create conflicts of interest. NAPFA-Registered Financial Advisors cannot receive compensation or ownership interests from any entities.

NAPFA-Registered Financial Advisors must comply with NAPFA standards and industry regulations more broadly. This includes acting in their clients' best interests at all times, disclosing any conflicts of interest, and maintaining client confidentiality.

The organization expects its members to uphold the highest ethical standards and to always prioritize their clients' needs over their own. Finally, they provide prompt notification of certain disciplinary and legal events, such as lawsuits or regulatory investigations, to the organization.

Necessary Education

The financial advisor must have a bachelor's degree from an accredited university and complete coursework in financial planning. Furthermore, NAPFA-Registered Financial Advisors must complete 60 hours of continuing education every two years.

Required Certification

Another requirement is that the financial advisor must hold a Certified Financial Planner (CFP) certification, which is considered the gold standard in the financial planning industry and demonstrates the financial planner's mastery of the core competencies of financial planning.

Fiduciary Standard

As part of the NAPFA registration process, an applicant must sign and agree to a fiduciary oath upon registering and on every renewal. They commit to putting their client's interests first and are crucial to the organization's efforts to uphold the highest ethical standards.

They are making a public commitment to providing advice tailored to each client's needs and goals and making recommendations based solely on the client's best interests, without regard for their financial gain.

Peer Review

Individuals are required to submit a comprehensive financial plan for peer review. This plan must be comprehensive and consider all relevant aspects of the client's situation, including investment strategies, tax planning, retirement planning, and estate planning.

Once the financial plan has been submitted, it is reviewed by a group of peers who are also NAPFA-Registered Financial Advisors. These peers carefully evaluate the plan to ensure that it meets the highest standards of quality and professionalism.

How NAPFA-Registered Financial Advisors Get Paid

NAPFA-Registered Financial Advisors are only compensated through a fee-only payment structure. They receive compensation directly from their clients for their services and advice and do not receive commissions or other forms of compensation.

This fee-only payment structure is a significant distinction from other compensation models in the financial advisory industry, which often rely on commissions for recommending specific financial products or investments or other forms of indirect compensation.

This way of compensation is intended to minimize conflicts of interest that may arise when financial advisors have a financial stake in the investments or products they recommend to clients. This allows NAPFA-Registered Financial Advisors to offer more objective advice.

It also helps ensure that the advisor's interests are aligned with those of the client since the advisor's compensation is directly tied to the quality of their advice and service. The fee-only payment structure is a key factor that sets NAPFA-Registered Financial Advisors apart.

How to Find a NAPFA Advisor

Finding a NAPFA-Registered Financial Advisor is straightforward, and several resources are available to help consumers locate a qualified advisor. The first place to start is the NAPFA website, which features a comprehensive directory of all registered advisors.

Advisors are searchable by location and other criteria. This directory is an excellent resource for finding advisors who specialize in specific areas of financial planning, such as retirement planning, estate planning, and tax planning.

It is crucial to find a trusted, competent NAPFA advisor for personal financial planning and management, as they will be responsible for providing valuable guidance and recommendations on important financial decisions.

Opting for a NAPFA-Registered Financial Advisor ensures that the advisor is not influenced by commissions and always acts in the client's best interests. Thus, individuals can be assured of receiving unbiased financial advice and having their financial interests prioritized.

Final Thoughts

A NAPFA-Registered Financial Advisor is a highly qualified and experienced financial advisor who is committed to providing fee-only, unbiased financial planning advice that is solely in the best interests of their clients.

Their certification with NAPFA demonstrates their dedication to upholding the highest standards of ethics and professionalism in the financial planning industry. Clients who work with NAPFA-Registered Financial Advisors can trust that they are receiving high-quality advice.

The qualities that set NAPFA-Registered Financial Advisors apart include their adherence to a strict fiduciary standard, their fee-only compensation, their educational qualifications, and CFP certification, as well as their comprehensive financial plan peer review.

NAPFA-Registered Financial Advisors stand out from other advisors in the industry due to their fee-only payment structure. This feature is vital for clients and exemplifies NAPFA's pledge to maintain transparency, accuracy, and moral excellence.

These advisors can be found using the comprehensive directory on the NAPFA website. Ultimately, working with a NAPFA-Registered Financial Advisor can be an excellent investment to help secure financial well-being.

NAPFA-Registered Financial Advisor FAQs

Choosing a NAPFA-Registered Financial Advisor can provide numerous benefits for individuals seeking unbiased and trustworthy financial advice. NAPFA-Registered Financial Advisors are required to adhere to a strict set of standards, including receiving only fee-based compensation, acting as fiduciaries, and completing rigorous educational and ethical requirements. This fee-only compensation model ensures that advisors do not have any conflicts of interest when providing advice, allowing them to prioritize the clients' needs over their own financial gain.

You can find a NAPFA-registered financial advisor by visiting the National Association of Personal Financial Advisors (NAPFA) website. The website has a Find an Advisor feature that allows you to search for a qualified advisor by location, specialty, and other criteria.

NAPFA-registered financial advisors commit to prioritizing their clients' interests by taking the fiduciary oath. This means that they promise to offer advice that is customized to meet the specific needs and goals of each client, while recommending products and services that solely align with the client's best interests without considering any personal financial gain for the advisor. Additionally, the oath serves as a pledge to act honestly and ethically in their professional relationship with clients.

NAPFA-registered financial advisors must have a Certified Financial Planner (CFP) certification, which is a mandatory requirement. The CFP certification is widely recognized as the top credential in the financial planning industry. It indicates that the advisor has a high level of proficiency in the fundamental skills of financial planning.

It demonstrates a commitment to upholding the highest ethical standards and putting the client's interests first. By adhering to NAPFA's regulations and standards, advisors can build a strong reputation as a trustworthy and competent financial professionals. Additionally, NAPFA provides resources and networking opportunities to help advisors improve their skills and knowledge and keep up with the recent developments in the financial planning industry.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.