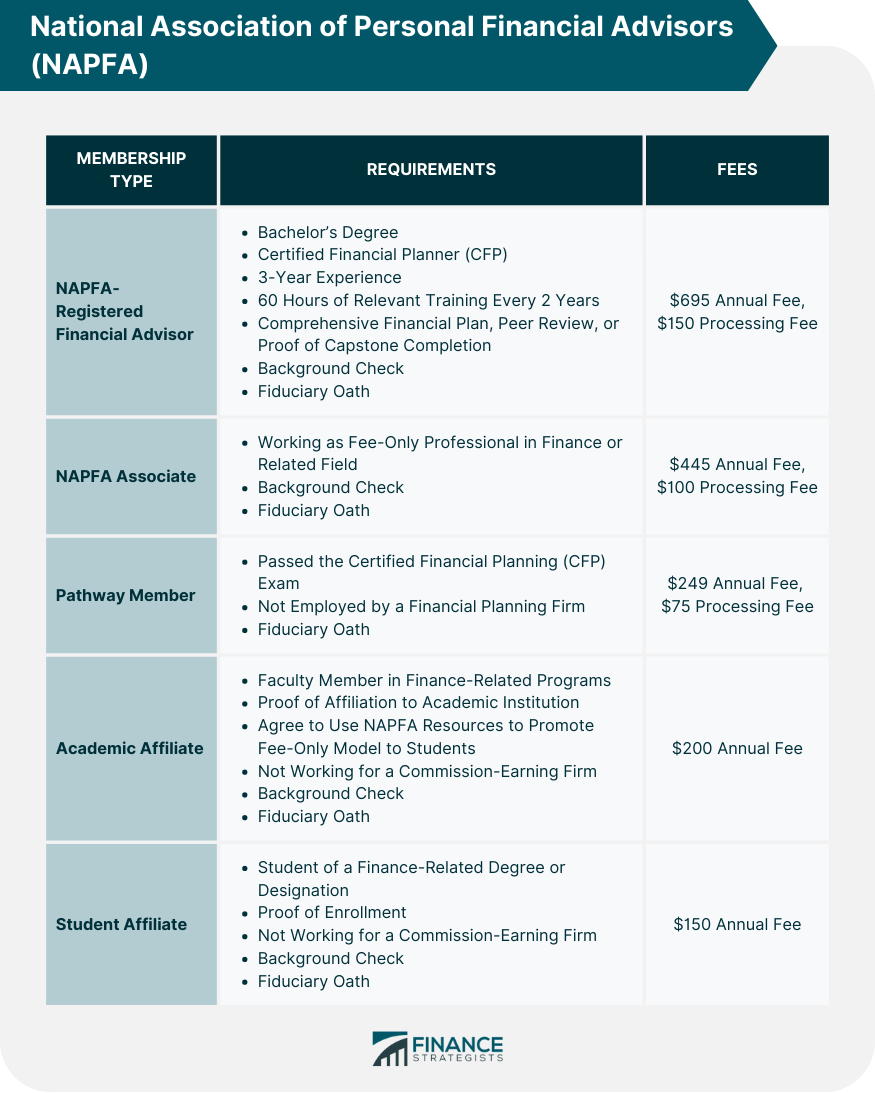

NAPFA is a premier professional association for independent, fee-only financial advisors. Headquartered in Illinois, the U.S. leading organization promotes the highest standards of comprehensive financial planning. As a membership organization, NAPFA provides educational resources, networking opportunities, and advocacy initiatives that help advisors stay on top of their field and offer clients quality guidance. The NAPFA promotes these core values: members are expected to give independent and objective financial advice, deliver services tailored toward the public interest, uphold standards, and represent the financial planning profession well. NAPFA was founded in February 1983 by a group of financial advisors who wanted to create an association to support the development and delivery of independent, fee-only advice. These professionals believed this type of guidance was best for client outcomes, as it allowed advisors to provide unbiased advice without being motivated by commissions or profits from product sales. Since its inception, NAPFA has grown substantially. From the initial 125-plus advisors who heeded the call for a fee-only financial planning model, the organization now boasts over 4,400 members nationwide, including registered financial advisors, associates, and student affiliates. NAPFA continues to advocate fee-only and independent advising by holding annual national and regional conferences and symposia. NAPFA is also an active member of the Financial Planning Coalition, supporting public policy beneficial for the financial planning profession. Additionally, NAPFA provides resources on investment management, tax planning, retirement planning, estate planning, insurance products, employee benefits plans, and more, making it an authority on everything related to financial planning. Consistent with its history of advocacy and its core values, discussed below are the main stances of NAPFA on critical issues: NAPFA is a strong supporter of the advancement of financial planning as a recognized profession. It advocates for developing appropriate regulations and standards that protect consumers from fraud, incompetence, or misrepresentation. It can include requiring financial professionals to pass examinations to measure essential competencies and setting other qualifications. At present, virtually anyone can call themselves a financial advisor or planner because there is no unified minimum set of requirements. Developing such standards will lead to professionalization, helping secure the financial planning field, its workers, and, most importantly, its customers. Additionally, NAPFA believes that a higher standard is needed for registered investment advisors (RIAs) when providing client services. Continuous education and frequent examinations are suggested to ensure RIAs know the field's current state. While the Securities and Exchange Commission (SEC) regularly holds examinations, NAPFA supports levying fees from RIAs to cover additional tests to ensure the quality and accuracy of their services. Financial planning is constantly evolving, and professionals working in it should, too. As an organization, NAPFA requires all its members to be fiduciaries, meaning they must always act and provide advice that is best for their client's interests. However, you cannot say this of other financial planners or advisors. NAPFA supports upholding the fiduciary standard universally. Holding all professionals offering finance-related advice to the same standard ensures all customers are given the same level of protection against ethical lapses or negligence. The uniform fiduciary standard of care should also include an explicit duty of loyalty and a commitment to disclose conflicts of interest, in addition to more generally required tasks such as prudence, honesty, and transparency. Members can be classified as registered financial advisors, associates, pathway members, academic affiliates, and student affiliates. All are required to agree to follow the fiduciary oath. Other qualifications are discussed below: This title is reserved for professionals who meet NAPFA's rigorous requirements. To be a NAPFA-registered financial advisor, one must have a bachelor's degree, at least three years of experience, and the Certified Financial Planner (CFP) designation. Furthermore, they are required to pursue continuous learning and undertake 60 hours of relevant training every two years. Their backgrounds are reviewed through the SEC's Investment Adviser Public Disclosure (IAPD) website. Other requirements include submitting a comprehensive financial plan, undergoing peer review, or providing proof of completing a capstone course. An $845 fee is also charged: $695 as annual dues and $150 as a nonrefundable processing fee. This title is for those already working as fee-only advisors but has yet to meet the educational qualifications and the three-year minimum experience. NAPFA associates must undergo the IAPD background check. Associates retain their status until they gain the necessary experience and education. They must pay an annual membership fee of $445 and a one-time nonrefundable processing fee of $100. This category is for those who are in the process of transitioning to fee-only financial planning. Individuals must not yet be working in any capacity as financial planners but have passed the CFP exam. They will be reviewed by NAPFA and must pay an annual membership fee of $249 and a nonrefundable processing fee of $75. This classification is open to finance-related faculty members as part of NAPFA's advocacy of promoting the fee-only model. Academic affiliates must agree to use the organization's resources to teach students about fee-only financial planning. An academic affiliate is charged a flat fee of $200 and must submit documentary proof of affiliation to an academic institution. If they are financial advisors themselves, they must not work in any commissioned-based firm. An IAPD background check is also mandatory. This title is for full- or part-time students of a financial planning degree or designation course. They are charged a $150 membership fee, with the possibility of a $35 discount for full-time students of accredited universities. Student Affiliates must also submit documentary proof of enrollment, like a course schedule or letter from the University registrar. Those employed as financial planners must not work in a commission-earning firm and undergo a background check through the IAPD. The rigorous requirements highlighted above — education, experience, history and background check, designation, skills, and continuous training — ensure that any registered financial advisors with NAPFA are knowledgeable and can perform their tasks competently. Most importantly, they are sworn to abide by the fiduciary responsibility, so you are assured that the financial advisor works for your best interests, is transparent, and gives holistic and objective advice. All NAPFA-registered financial advisors subscribe to the fee-only model, so you can trust that their motivations are aligned with yours and have no hidden agenda. They do not sell products or promote investment strategies for commissions. All these make NAPFA-registered financial advisors the ideal choice for those looking for personalized, comprehensive advice on a wide range of personal finance issues. The process is quite simple. Start by visiting the Find an Advisor page on the NAPFA website. From there, you can enter your state and city to find a list of nearby advisors registered with NAPFA. Each listing includes information about the advisor's services, credentials, specialties, and contact information. You can also filter your search results by factors such as area of expertise, typical clients served, language spoken, and fee structure. Once you have narrowed down your list of potential advisors, doing additional research about them is crucial. You may check if they have been defendants in court actions and administrative proceedings through the SEC Action Lookup - Individuals (SALI) tool. Additionally, the Financial Industry Regulatory Authority (FINRA) BrokerCheck tool can provide supplementary information, especially regarding brokers and dealers. NAPFA is an organization that sets and enforces the highest standards for financial advisors. The registered advisors must adhere to strict requirements as fiduciaries, from education, designation, and background checks to fee structure. Aside from this, NAPFA advocates professionalizing the financial planning industry, increased SEC oversight on investment advisors, and uniform fiduciary standards for all financial professionals. It is also dedicated to empowering its members and the general public with information, guidance, and support through sponsored conferences, symposia, focus groups, and other learning materials. A NAPFA-registered financial advisor is knowledgeable and committed to providing the best advice to clients.What Is the National Association of Personal Financial Advisors (NAPFA)?

NAPFA History

NAPFA Key Policy Issues & Positions

Recognition and Regulation of Financial Planning

Investment Advisor Oversight

Uniform Fiduciary Standard of Care

NAPFA Membership

NAPFA-Registered Financial Advisor

NAPFA Associate

Pathway Member

Academic Affiliates

Student Affiliates

Why You Should Choose a NAPFA-Registered Financial Advisor

How to Find a NAPFA Advisor

Final Thoughts

National Association of Personal Financial Advisors (NAPFA) FAQs

No. NAPFA members are bound by a Code of Ethics that prohibits them from taking commissions on any financial transactions. All NAPFA registered advisors work under the fee-only model and offer services for an hourly rate, flat fee, or asset-based fee.

NAPFA is dedicated to safeguarding the financial well-being of individuals and families. It advocates for professionalizing the industry, increased SEC oversight advisors, and uniform fiduciary standards for all financial professionals.

Yes. NAPFA requires all its members to be qualified CFPs as part of their registration requirements. It guarantees that NAPFA-registered advisors have the necessary education, experience, and knowledge to handle your financial needs.

There are five NAPFA membership categories: NAPFA-Registered Financial Advisors, NAPFA Associates, Pathway Members, Academic Affiliates, and Student Affiliates, with varying requirements, benefits, and fees.

NAPFA advocates for the betterment of the financial planning industry. It provides members various learning opportunities, such as conferences, symposia, and focus groups. Additionally, it empowers individuals by providing them with information and guidance about personal finance issues.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.