Robo-Advisor vs Financial Advisor: An Overview

Robo-advisors and financial advisors provide financial advice. The significant difference is that robo-advisors are automated programs, while financial advisors are humans.

Robo-advisors use technology to manage investments, create portfolios, and offer personalized advice without human interaction. They are based on algorithms and are not necessarily able to give complex financial advice. Robo-advisors provide a more cost-efficient option.

On the other hand, financial advisors provide clients with a broad range of financial services and advice through a traditional relationship. The cost may be prohibitive, but they can cater to complex situations related to your goals, lifestyle, and current financial situation.

Robo-advisors are required to register with the U.S. Securities and Exchange Commission (SEC). Financial advisors are governed by the Financial Industry Regulatory Authority (FINRA) and SEC.

What Is a Robo-Advisor?

A robo-advisor is an automated online investment service that uses an algorithm to provide personalized investment advice. It is designed to help investors make sound financial decisions without needing a human advisor.

Clients who use robo-advisor services provide basic information on their financial goals, timeline, income, liabilities, investments, and savings via an online questionnaire.

Robo-advisors can automate investing methods such as real-time portfolio monitoring and rebalancing, tax-loss harvesting, and dividend investing. Such can optimize hundreds of portfolios instantly and accurately.

The most popular robo-advisors in the U.S. include Betterment, Schwab Intelligent Portfolios, and Wealthfront. They can manage portfolios with minimum investments.

What Is a Financial Advisor?

The presence of human interaction and a professional relationship sets financial advisors apart from robo-advisors. Financial advisors guide various financial matters, including investing, retirement savings, and debt management.

Consulting with a financial advisor can provide tailored solutions regarding your unique financial concerns. They typically have a good understanding of the local economic climate. They can offer insight into which investments are performing best in your area.

They usually charge higher fees than robo-advisors but may provide more value since their advice is customized instead of a generalized algorithm. These fees can range from a flat rate to an hourly fee to a percentage of assets under management (AUM).

Financial advisors receive certifications from issuing organizations that allow them to provide advice on specific financial topics and enhance their core expertise.

Some popular certifications include Certified Financial Planner (CFP) and Chartered Financial Analyst (CFA).

Differences Between Robo-Advisor & Financial Advisor

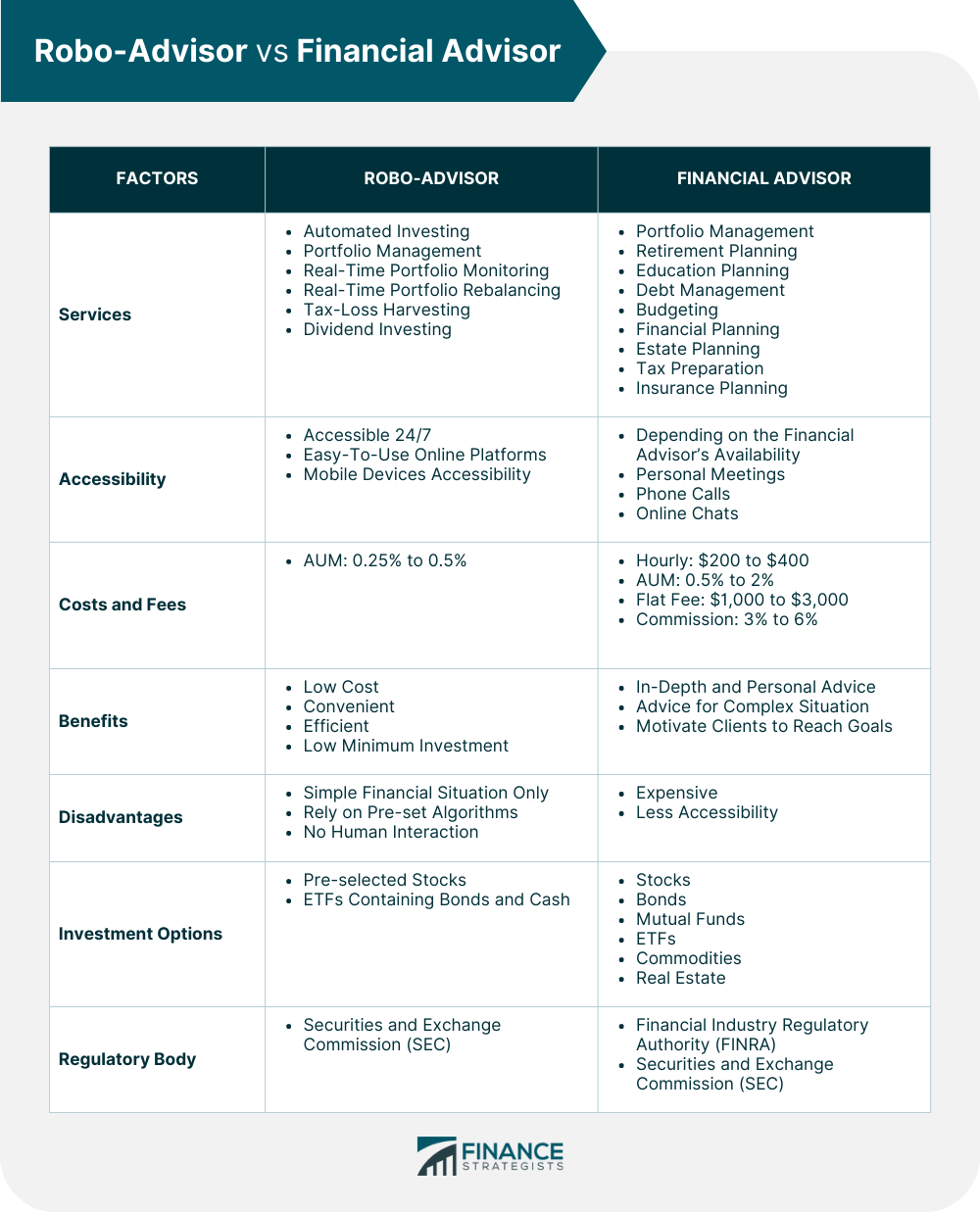

Aside from human interaction, there are other key differences between robo-advisors and financial advisors:

Services

Robo-advisors mainly offer automated investing and portfolio management services, including real-time portfolio monitoring and rebalancing, tax-loss harvesting, and dividend investing.

Robo-advisors make use of asset allocation and diversification. They automatically develop a portfolio using up to a dozen exchange-traded funds (ETFs) that contain stocks, bonds, cash, and other assets.

Financial advisors can do what robo-advisors do and even extend advice on a broader range of topics. They can cover retirement planning, education planning, debt management, and budgeting.

Depending on their expertise, financial advisors can advise on more complex financial situations, such as financial and estate planning, tax preparation, and insurance.

Accessibility

Robo-advisors are accessible 24/7 and provide easy-to-use online platforms that mobile devices can access.

Clients can consult with financial advisors at different times, depending on the availability of their advisors. Financial advisors can be available for meetings, phone calls, or online chats.

Costs & Fees

The cost of utilizing a robo-advisor is usually based on a percentage of AUM, with fees ranging from 0.25%-0.50%.

Financial advisors charge 0.5% to 2% in AUM fees, an hourly rate ranging from $200 to $400, a flat fee of around $1,000 to $3,000, or a commission equivalent to 3% to 6% of the security value.

Benefits

The advantage of using robo-advisors is the combination of low cost and convenience. Robo-advisors provide advice quickly, with low minimums required for investment accounts.

Financial advisors offer more in-depth and personal financial services for complex situations. They help motivate clients to make better financial decisions by focusing on their long-term goals.

Disadvantages

Robo-advisors may not be able to provide advice on complex financial situations. They cannot offer customized solutions as they rely on pre-set algorithms when constructing portfolios.

On the other hand, financial advisors can be expensive, making them less accessible for individuals with smaller portfolios or those who do not require in-depth advice.

Investment Options

Robo-advisors offer a limited range of investments in pre-selected stocks and ETFs containing bonds, cash, and other assets.

Financial advisors can access a wide range of investments, including stocks, bonds, mutual funds, ETFs, commodities, and real estate for their clients.

Regulatory Body

Robo-advisors are required to register with the SEC.

Financial advisors are governed by the FINRA and SEC.

FINRA oversees the marketing of financial goods such as insurance policies, annuities, and mutual funds. SEC's objective is to protect investors, ensure fair, orderly, and efficient markets, and promote capital formation.

Robo-Advisors vs Financial Advisors: Which Option Is Best For You?

Choose a robo-advisor when looking for a passive way to manage your investments. However, you should work with a financial advisor when you need specific, hands-on, and personalized advice on complex financial matters.

Another thing to consider is the amount of money you have to invest and the services you need. Robo-advisors are usually more cost-effective for individuals with smaller portfolios or just starting.

Those with large portfolios, more wealth, and finances to manage or have the budget to afford them should consider working with a financial advisor for individualized and comprehensive advice.

Ultimately, the decision between a robo-advisor and a financial advisor comes down to personal preference, what services you need, and how much money you have. Make sure to research both options and their pros and cons before making a final decision.

The Bottom Line

The presence of human interaction and a professional relationship sets financial advisors apart from robo-advisors. Robo-advisors use technology to manage investments, create portfolios, and offer personalized advice without human interaction.

Financial advisors perform the same functions as robo-advisors and provide advice on various issues, including retirement planning, education planning, debt management, and budgeting.

Robo-advisors mainly offer automated investing and portfolio management services, including real-time portfolio monitoring and rebalancing, tax-loss harvesting, and dividend investing. They focus on ETF trading that contains pre-selected stocks.

The appeal of robo-advisors lies in their efficiency, accessibility, and low cost, with fees ranging from 0.25% to 0.50% of the assets and the low minimums needed for investment accounts.

Financial advisors, however, motivate clients to reach their goals with personalized advice. This advice comes at a higher cost.

Depending on the fee structure, financial advisors typically charge 0.5% to 2% in AUM fees, an hourly rate ranging from $200 to $400, a flat fee of around $1,000 to $3,000, or a commission worth 3% to 6% of the security value.

When choosing a robo-advisor or financial advisor, consider factors such as the size of your portfolio, the complexity of your finances, investment goal, plans for wealth building, and budget considerations. Consider how you feel about human interaction in your investments.

Robo-Advisor vs Financial Advisor FAQs

The main drawback of using a Robo-advisor is that they lack human interaction and fail to offer personalized advice, which can benefit investors with more complex needs. They also have limited investment options and do not offer tax or estate planning services.

The amount of money you should put into a Robo-advisor depends on the size of your portfolio, budget, and investment goals. Generally speaking, start with a small sum you are comfortable investing in, getting a feel for the platform before committing more significant sums of money.

Suppose you have a complex financial situation or are looking to achieve long-term wealth-building goals. In that case, you may benefit from the services of a financial advisor. Financial advisors can provide personalized advice and help you manage your investments and finances to reach your goals.

Robo-advisors are a good option for investors who want to start investing but do not have the time or knowledge to manage their portfolios. They offer low fees and provide automated services that make investing easier and more accessible.

The main difference between Robo-advisors and financial advisors is the presence of human interaction. Robo-advisors offer automated investing and portfolio management services with no human interaction. At the same time, financial advisors provide personalized advice on various issues, including retirement planning, education planning, debt management, and budgeting.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.