Securities licenses are certifications granted by the Financial Industry Regulatory Authority (FINRA) to authorize individuals to conduct securities transactions and activities. These licenses enable professionals to provide services, such as investment advice and trading financial instruments in the securities industry. Individuals who wish to pursue a career as a broker, investment agent, securities salesman, or any other job in the securities sector need to obtain one or more of these licenses. Different license types are required depending on the specific activity a professional is seeking to offer. Professionals are allowed to hold more than one license if they qualify. Having a securities license provides recognition of the individual's professional qualifications, expertise, and ability to handle securities transactions in a responsible manner. Below are some financial industry careers requiring at least one securities license: FINRA is a non-profit organization authorized by the government to oversee the securities industry in the United States. It is responsible for writing and enforcing rules, regulations, and standards designed to protect investors and maintain orderly markets. FINRA administers securities license exams, and successful candidates receive the appropriate license needed to work within the securities sector. Each license is associated with certain types of investments or securities. Most representatives and advisors usually obtain one of these three general FINRA-issued licenses: The Series 6 license is designed for individuals who want to work as a limited representative or an investment company and variable contracts product representatives. This license authorizes an individual to sell packaged investment products, including mutual funds, unit investment trusts, municipal fund securities, variable annuities, and variable life insurance. To pass the exam, applicants must answer 70% of the 50 questions correctly within 90 minutes. The series 6 exam costs $75 and requires that applicants take and pass the Securities Industry Essentials (SIE) exam first. The Series 7 license is the most comprehensive of all FINRA licenses. It enables individuals to act as a general securities representative. It also allows them to trade in both packaged investment products and individual securities, such as stocks, bonds, warrants, money market funds, and government securities. The exam is administered for 3 hours and 45 minutes and costs $300. It is composed of 125 items and requires a score of 72% or better to pass. However, applicants must also take and pass the SIE exam before they can obtain the license. The Series 3 license is necessary for individuals who want to work as a commodities futures representative. This license authorizes them to trade in futures contracts on US exchanges. Professionals with this license usually focus on commodities and rarely do business outside of that area. This is because this investment is generally considered to be more complex and riskier than other investments that are publicly traded. The Series 3 exam is composed of 120 items, and applicants must answer 70% of these questions correctly to pass. The cost of the exam is $130. Applicants must complete this exam in 2 hours and 30 minutes. In addition, no corequisite exam is necessary to get the Series 3 license. The North American Securities Administrators Association (NASAA) is an organization for the provincial, territorial, and state securities regulators in the United States, Canada, and Mexico. The organization works to protect investors from fraudulent or manipulative practices. NASAA administers Series 63, Series 65, and Series 66 licenses. These exams are designed to ensure that individuals understand the laws and regulations governing investment advice. The examination aims to provide state securities administrators with a framework for evaluating an applicant's knowledge and comprehension of state law and regulations. Examinees must finish the exam in 75 minutes and get 43 correct answers out of 65 items. Most states require a Series 63 license for certain financial practitioners to be authorized to transact business, together with the Series 6 and Series 7 licenses. This exam costs $147 and focuses on the ethical and fiduciary obligations that investment professionals must fulfill. Often referred to as the Unified Investment Advisor Law Examination, it tests an applicant's knowledge of investment advice, portfolio management, and related topics. This exam is for financial professionals who want to offer a non-commissioned investment advisory service. Applicants must get at least 94 correct answers to pass. The exam is composed of 130 questions, with a time limit of 180 minutes. Financial planners and financial advisors need to get this license so that they are authorized to provide guidance to clients. The exam costs $187. Also known as the Uniform Combined State Law Examination, this test combines the Series 63 and 65 exams into one, testing an individual's knowledge of both state law and investment advice. Series 66 license holders no longer need to take the Series 63 or Series 65 exams. This exam is restricted to candidates who currently possess a Series 7 license. It lasts for 150 minutes, is composed of 100 questions, and has a passing score of at least 73 correct answers. If you are interested in obtaining a securities license, here are some steps to follow: The SIE Exam is the first step in obtaining a securities license. This 75-item exam covers capital markets, the different products, their risks, how to trade, customer accounts, and an overview of the regulatory framework. It takes 105 minutes to complete and costs $80. Different types of licensure may be required depending on the type of business you prefer to do and your educational background. For example, stockbrokers must obtain a Series 7 license, and if they want to do business in any state, they also need a Series 63 license. Each state has its requirements for securities licensure. Depending on where you live, you may need to take additional exams or meet certain prerequisites. For example, some states may require a background check or a minimum amount of experience in the field. Once you have identified the needed exams, it is time to study and pass them. Most exams require a 70% or better score to pass. Be sure to take practice tests and use other online resources to prepare yourself for the exam. Securities licenses are FINRA-granted certifications that authorize individuals to conduct securities-related transactions. Different licenses are required for different types of services. Individuals wishing to pursue careers in this sector must obtain at least one of these licenses. These licenses ensure that financial professionals, such as stockbrokers, investment bankers, financial advisors, and insurance agents, understand the rules and regulations of securities trading and investor protection. The most notable licenses held by industry experts are Series 6 for variable contracts and packaged investment products, Series 7 for professionals in general securities trading, and Series 3 for commodities futures contracts. NASAA also administers other securities licenses, including Series 63 for financial professionals who want to operate in any state, Series 65 for non-commissioned financial advisors, and Series 66, which combines the Series 63 and Series 65 exams. To get a securities license, applicants must first take the SIE Exam and then identify which additional licenses they need based on the service they want to offer. Researching state-specific requirements is also necessary, as some states may have other prerequisites. Acquiring a securities license demonstrates a finance professional's skills, knowledge, and responsibility while handling securities transactions. Being a license holder also proves credibility and generates trust with potential clients.What Are Securities Licenses?

Who Needs Securities Licenses?

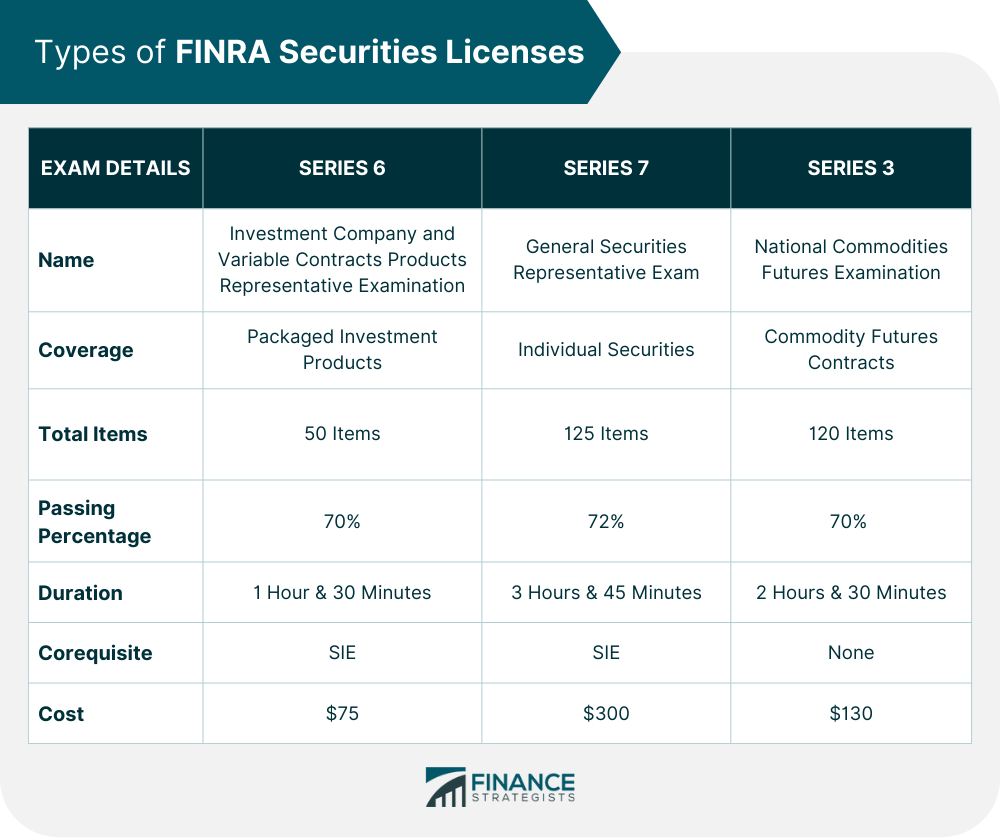

Types of FINRA Securities Licenses

Series 6

Series 7

Series 3

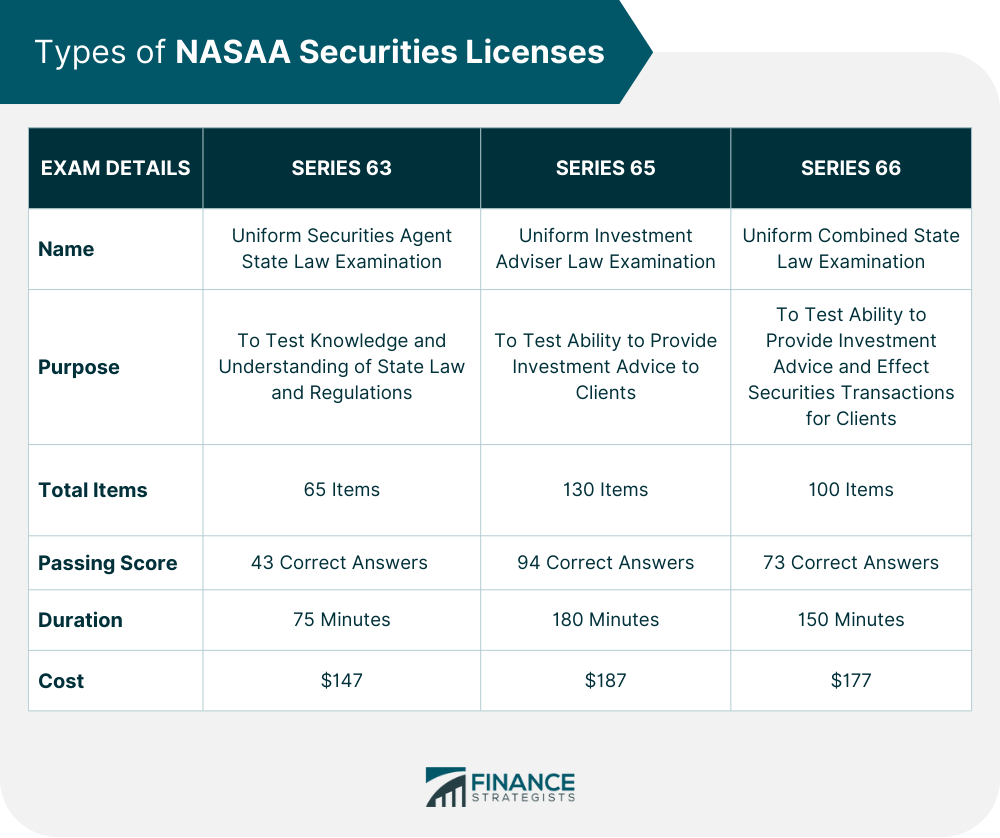

Types of NASAA Securities Licenses

Series 63

Series 65Series 66

How to Get a Securities License

Step 1: Take the SIE Exam

Step 2: Identify Which Securities License or Licenses You Need

Step 3: Research Your State Requirements

Step 4: Study and Pass the Exams

Final Thoughts

Securities Licenses FAQs

The cost can vary depending on which exams you decide to take. The SIE Exam, typically a co-requisite for the other licenses, costs $80. Meanwhile, the Series 6 license costs $75, the Series 7 license costs $300, and the Series 3 license costs $130. In addition, the Series 63 license costs $147. The Series 65 license costs $187, and the Series 66 license costs $177.

A securities license may qualify an individual for various jobs in the financial services industry. These positions include stockbrokers, investment bankers, financial advisors, insurance agents, and other related professions in the securities trading industry.

A securities license is beneficial for individuals working in the securities trading industry. It demonstrates knowledge, responsibility, and trustworthiness to potential customers. It also opens doors to career advancement opportunities, increases salaries, and strengthens job security.

Securities licenses are certifications granted by FINRA authorizing individuals to conduct securities transactions. These licenses ensure customers that the financial professionals they are working with understand the rules and regulations of securities trading.

To get a securities license, applicants must first take the SIE Exam and then identify the other licenses they need. They must also fulfill additional and specific state requirements. Upon passing the exams, they can register with FINRA and receive their respective license.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.