Series 24 is an exam and license that grants the holder the authority to supervise and manage general securities at a broker-dealer. Passers of the exam earn the title of General Securities Principal. Otherwise known as the General Securities Principal Qualification Exam (GP), Series 24 evaluates the readiness of an entry-level principal to carry out the critical functions of a principal, such as advertising, market making, trading, and underwriting. The Financial Industry Regulatory Authority (FINRA) is responsible for its development and operation, costing $175. The examination demands an in-depth understanding of real estate investment trusts (REITs), investment banking, corporate securities, trading, and other major financial topics. Series 24 exam is a 150-item multiple-choice exam divided into five sections that take 3 hours and 45 minutes to complete. To pass, examinees must get 105 correct answers or at least 70%. The five sections of the exam are as follows: This section contains 9 items and evaluates knowledge of regulatory requirements and exemptions, distinctions between different kinds of registrations, hiring requirements for specified positions, and registration maintenance. Candidates must distinguish between Registered Investment Advisers (RIA) and broker-dealers, as well as the required registrations. There are 45 items in this section where examinees showcase their skills in establishing and implementing the policies and procedures of an organization. In addition, they must refer to the regulatory obligations to handle conflicts of interest. It also includes supervision of the conduct of relevant persons, disciplinary action, and compensation. This part also covers how products and services are made, evaluated, and delivered. There are 32 questions about the supervision of new account openings, the maintenance of existing accounts, and the monitoring of public communication. Included are reviewing transactions, ensuring proper disclosures, and providing recommendations. The critical areas covered are ensuring customer information privacy and identifying theft prevention. This exam content covers 32 items on the responsibilities of a trader and what is required to operate as one. The main topics covered are those related to supervising order entry, from routing to execution. As a trader, you must know how to implement trader mandates, including assignment restrictions. Other topics related to trading are trading systems, volatility trading pauses, prohibited trading activities, and addressing prohibited activity. It also covers compliance with Securities and Exchange Commission (SEC) regulations. The role of candidates in investment banking and research is measured in the last 32 items of the exam. These responsibilities include developing and maintaining policies, procedures, and controls related to investment banking activities and research. It requires a thorough understanding of public and private offering regulations and how to conduct due diligence of issuers. Other topics covered are tender offers, corporate financial advisory, loan services, loan documents, bankruptcy, and others. The applicant must be connected with and sponsored by a FINRA member firm or any other suitable self-regulatory organization (SRO). Additionally, applicants must first qualify in any one of the following to register for the series 24 examination: To hold an appropriate principal registration, candidates are required to pass the Securities Industry Essentials (SIE) Exam and a representative-level qualification exam, or the Series 16 exam, on top of the Series 24 exam. Depending on the corequisite qualifications, Series 24 passers will receive the following principal registrations: The exam can be taken online or through a local examination center. The candidate can access the scheduling page and select according to preference. Exam candidates should enroll for an exam and submit a FINRA Online Exam Administration Request Form before the appointment. Upon approval, FINRA will issue a 120-day window during which the exam must be completed. A toll-free center can assist during business hours at (800) 578-6273. In some firms, the compliance department can help with scheduling as well. Preparation guarantees performance to the best of one's ability. Review the subjects and information available through different resources. Stay updated on financial news and the market to understand current developments. Familiarize terminologies used in trading and market-making to answer questions accurately. Seek guidance from an expert to improve comprehension of the questions. Study reference materials with sample questions to become acquainted with the questions that will appear on the exam. When reading through the questions, read them attentively and eliminate options that may not be correct responses. The Series 24 exam is for financial professionals who want to get a license to work at a broker-dealer to manage and oversee general securities. An applicant must be sponsored by a FINRA member or an equivalent self-regulatory entity. The examination is centered on the duties of a General Securities Principal. It ensures that the qualified candidate is the best person for the job. Candidates should thoroughly prepare for the exam. They should study the content areas and familiarize themselves with the question types. It is recommended that they use practice exams to become comfortable with the format and timing of the exam.What Is Series 24?

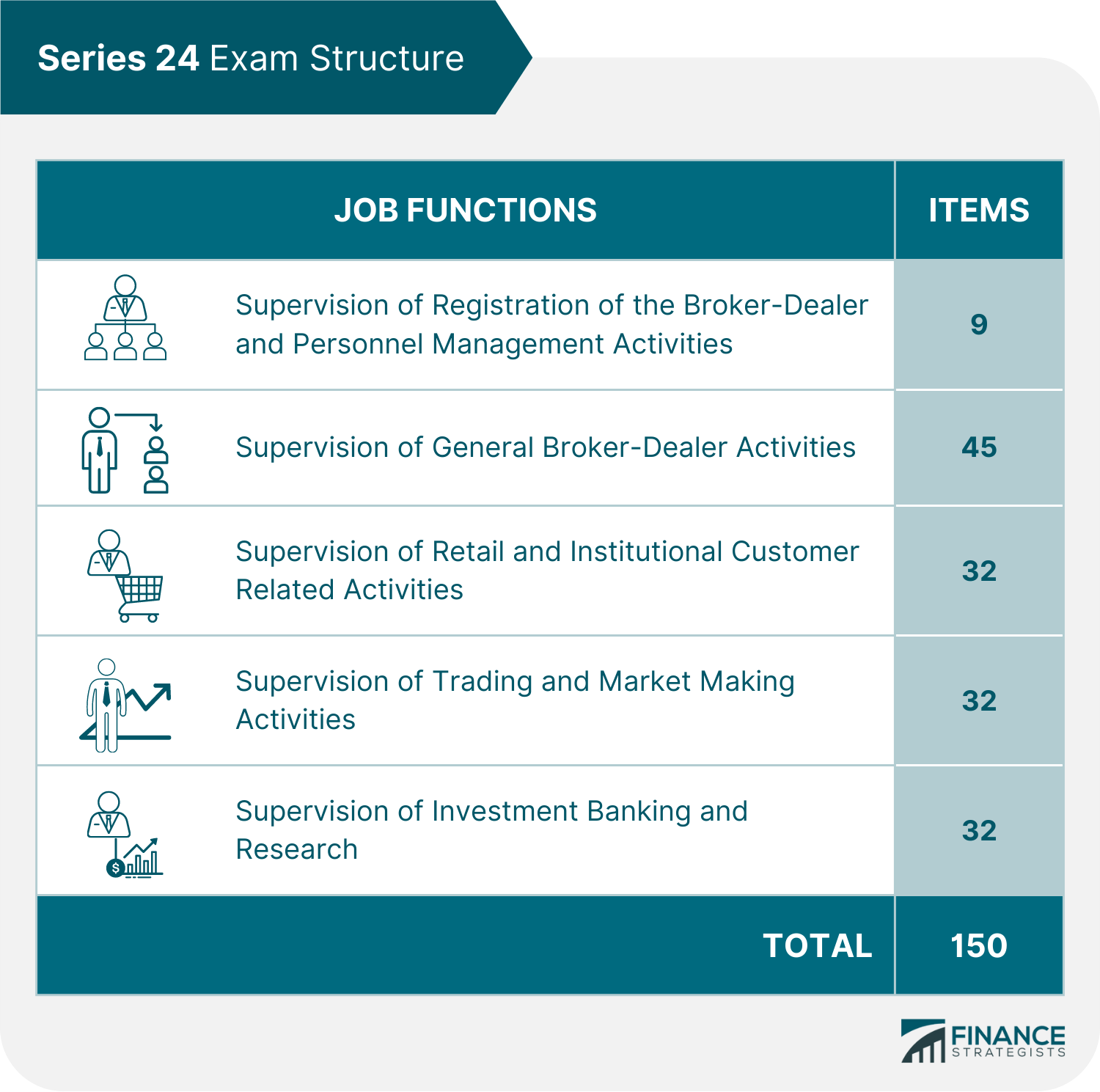

Series 24 Exam Structure

Supervision of Registration of the Broker-Dealer and Personnel Management Activities

Supervision of General Broker-Dealer Activities

Supervision of Retail and Institutional Customer-Related Activities

Supervision of Trading and Market-Making Activities

Supervision of Investment Banking and Research

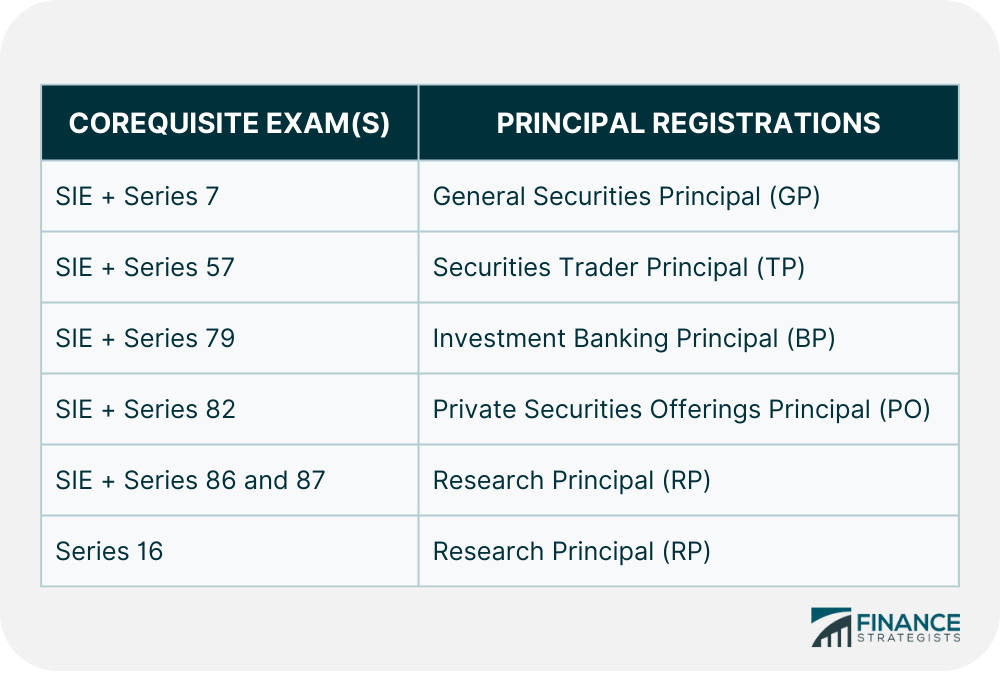

Series 24 Exam Eligibility Requirements

Schedule a Series 24 Exam

Online Exam

Local Exam Center

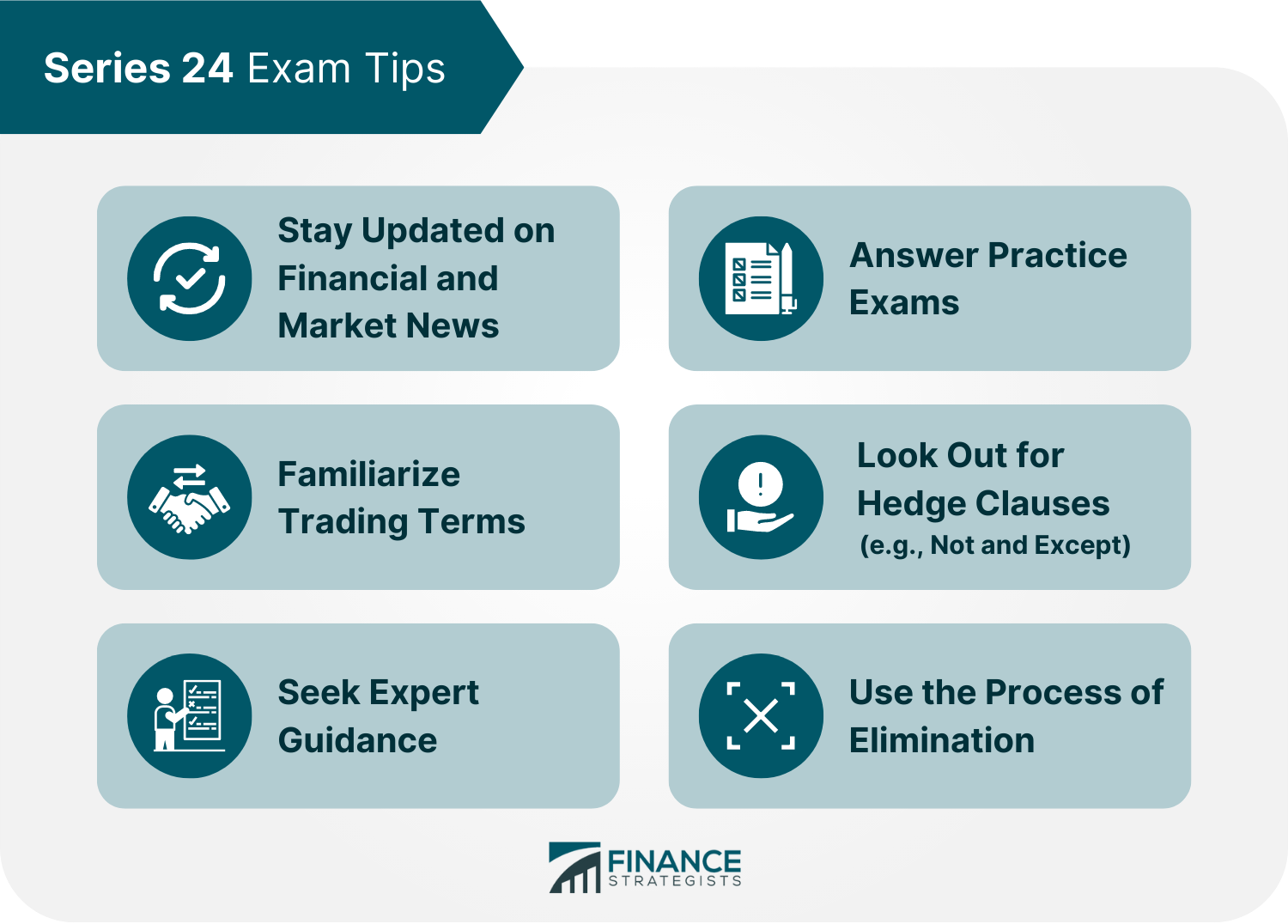

Series 24 Exam Tips

Final Thoughts

Series 24 FAQs

The Series 24 exam is a securities license exam that allows financial professionals to become principal brokers and dealers of corporate securities, investment banking, and private placements.

The Series 24 General Securities Principal Qualification Exam is required for people responsible for managing or supervising a member's investment banking or securities company. Series 24 recognizes the holder as a General Securities Principal.

The fee for the Series 24 exam is $175.

Applicants for the Series 24 examination must be sponsored by a FINRA member firm or another self-regulatory organization. They must also be a qualified license holder of any of the following: Series 7, Series 17, Series 37 or 38, Series 57, Series 62, or Series 82.

The pass rate for the Series 24 test is not publicly disclosed by FINRA.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.