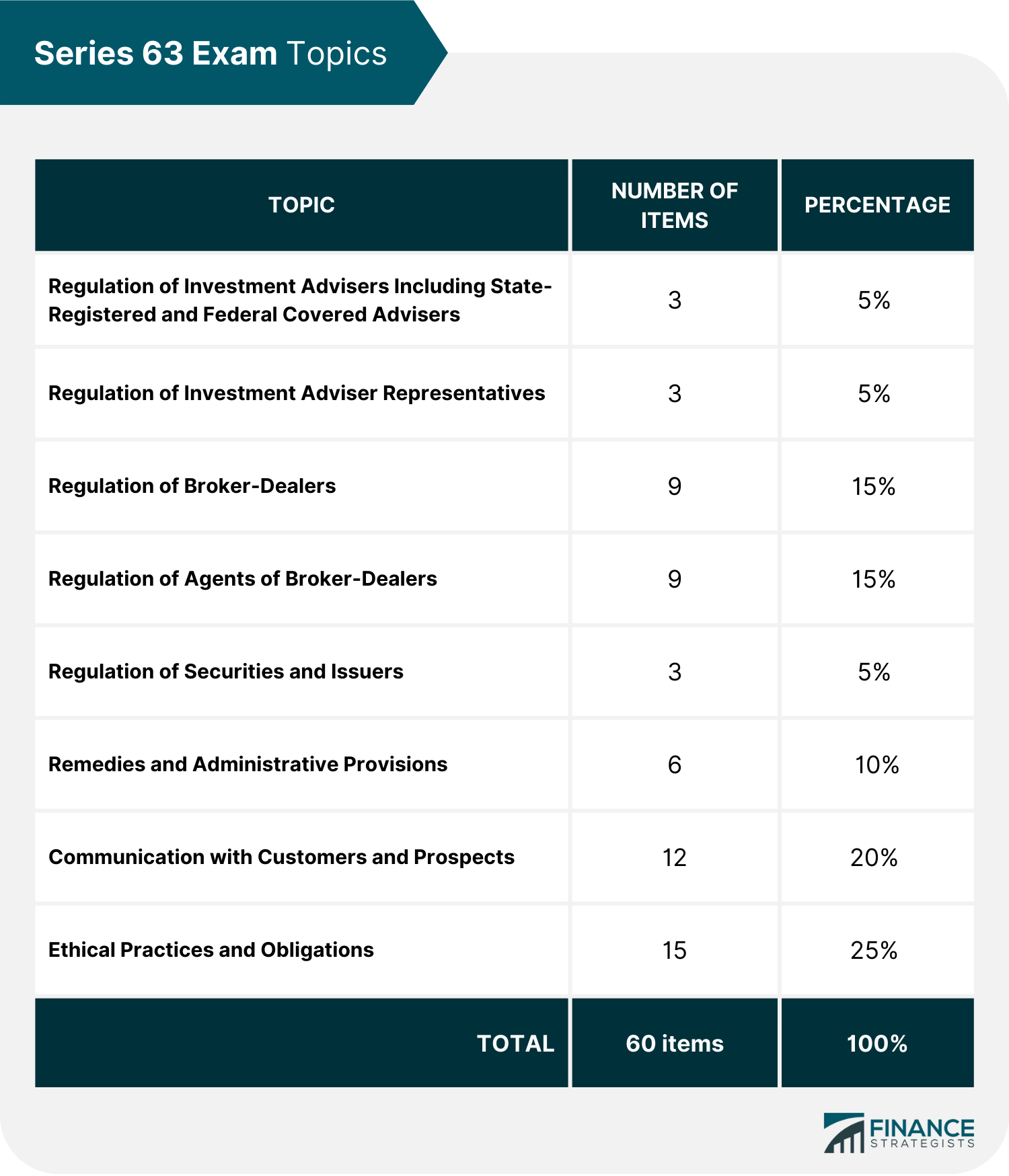

The Series 63 exam, also known as Uniform Securities State Law Examination, is intended to qualify candidates as securities agents. The examination is administered by the Financial Industry Regulatory Authority (FINRA) on behalf of the North American Securities Administrators Association (NASAA). The exam covers the concepts of state securities regulation embodied in the Uniform Securities Act (USA). Achievable’s FINRA Series 63 course guides you through a personalized learning experience, reinforcing what you’ve learned and giving you certainty that you’re ready to pass your exam. Achievable FINRA Series 63 is all you need to pass, and include an easy-to-understand online textbook, dozens of videos on key topics, 300+ chapter review questions backed by their memory-enhancing algorithm, and 6+ full-length practice exams. Achievable’s course content is produced by Brandon Rith, who was formerly Fidelity’s top instructor nationwide. Achievable has industry leading pass rates on all of their FINRA courses, and they will give you a full refund if you don’t pass on your first try. The USA provides a framework for balancing state and federal regulatory authority when prosecuting securities fraud. The examination aims to offer a foundation for state securities administrators to assess an applicant's knowledge and grasp of state law and regulations, including its application to the investment industry. You must pass the Securities Industry Essentials Exam (SIE) to qualify for the Series 7 and 6 license tests, but not the 63. Broker-dealers must obtain the Series 63 license in addition to the Series 7 or Series 6 to sell securities. Holders of Series 63 licenses can practice securities trading, selling, and other related activities on behalf of investors. The Uniform Law Commission (ULC) drafted the first edition of the Uniform Securities Act in 1956. This version serves as the foundation for the majority of state statutes as well as the Series 63 exam. It establishes a template for uniform securities regulations, allowing flexibility at the state level while retaining legal consistency with neighboring jurisdictions. NASAA drafted several revisions, but only a few states adopted them. In 2002, the ULC finalized the design of a new Uniform Securities Act to align the state law model with recent critical federal legislation. Currently, state acceptance of the new law is still limited. NASAA released the memorandum and rules to help regulators bring state securities legislation into compliance with federal securities laws. FINRA creates the Series 63 exam, and each question in the pool includes two parameters used in the assembly: a content parameter and a difficulty parameter. Each exam is built to match the content standards and be at the same difficulty level as the other examinations in the same Series. The exam consists of 60 multiple-choice questions, which candidates must complete in 75 minutes. To pass the Series 63 examination, a candidate must correctly answer at least 43 of 60 scored questions. The Series 63 examination covers the fundamentals of state securities legislation and rules preventing unethical or dishonest conduct. There are 27 items on rules and regulations, 6 on administrative provisions, 12 on customer communication, and 15 on business obligations and ethical practices. The following are the Series 63 exam topics: Consider the following steps to obtain the Series 63 License and advance your career. To be eligible for the Series 63 exam, the individual must be at least 18 years old. There is no firm sponsorship requirement, although some may prefer to have a sponsor to gain the necessary knowledge. Independent candidates must register with FINRA using the Test Enrollment Services System (TESS) to file an exam request. Candidates with firm sponsorships must file Form U4 with FINRA. Pay the Series 63 exam costs of $147. It is essential to prepare properly. The NASAA provides a series of study materials and practice exams to help candidates get ready. The Series 63 exam is considered a stand-alone qualification. Successful completion of any other securities industry licensing exams is not required. Once the exam is passed, candidates can register with the state using their score and can get their license. You have two years after passing Series 63 to become licensed with a state; otherwise, the exam will expire in the Central Registration Depository (CRD), and you will have to retake the exam. The exam is valid for as long as you remain registered. When you leave a firm, your employer will file Form U5 to cancel your registration. You then have two years to find new work and re-register. Your new employer will file a Form U4, re-registering you. Your Series 63 license will stay valid if you do not go more than two years between jobs. State regulators may offer waivers to employees who continue working in the financial services industry but in a different role that does not typically require state registration. Exam candidates need to check with their employers and state regulators to find state-specific policies that apply to the professional financial careers that interest them. When studying for Series 63, do not presume that the content you have already mastered for another exam will be enough. This exam is unique, and it pays to be prepared. Taking practice tests and study materials will help to ensure candidates are ready for the exam. Utilize reference materials such as textbooks, online courses, and mock exams to help test-takers become more familiar with the material. Make sure to review the terminology and definitions that are used in various questions. Knowing the terms thoroughly and how they are used in different scenarios can help candidates answer questions more accurately. The exam covers state and federal securities laws, regulations, suitability requirements, and ethical standards. The exam structure determines which topics demand more percentage and number of items so candidates can allot more attention to them. Before answering any questions on the exam, it is essential to read them carefully and understand the meaning of each question. Candidates should be careful since choices may seem correct; it is crucial to think through and choose the best answer. Most regulations include exclusions or situations in which they do not apply. In some questions, your objective is to identify what is false rather than factual. It frequently involves double-negative thinking, which adds to the complication. Managing your time is key to success on the exam. Allotting appropriate amounts of time for each section or question can help maintain focus and will help manage stress levels during the test. If a concept is complex, skip it and return later instead of spending too much time on it. The Series 63 Exam is a state securities licensing exam designed to test an individual's knowledge of securities law and its application to the investment industry. This exam is a companion qualification exam. License holders must pass the SIE exam and either the Series 6 or Series 7 exam to be fully authorized to trade securities. The exam was established in response to the need for uniform economic regulation to protect investors and promote fair securities practices. The test consists of 60 multiple-choice questions, good for 75 minutes, and candidates must correctly respond to at least 43 questions. An applicant must be 18 years old and can take the exam without a sponsor. Candidates must register within two years to be eligible for a license. The exam score is valid for two years. Candidates may take advantage of practice tests and online courses to pass the exam. They must pay attention to the terms and the exam structure. Getting the Series 63 license is a qualifying step to be a registered and authorized securities trader such as bonds, stocks, annuities, and mutual funds.What Is Series 63 Exam?

Our Trusted Partner

Achievable

History of Series 63 Exam

Series 63 Exam Structure

Exam Format

Exam Topics

Series 63 License Requirements

Step 1: Be 18 Years Old

Step 2: Register With FINRA or File Form U4

Step 3: Study for the Exam

Step 4: Pass the Exam and Get the License

Validity of Series 63 Exam Score

Series 63 Exam Tips

Practice Leads to Mastery

Pay Attention to Definitions

Bear in Mind the Exam Structure

Read Carefully

Manage Your Time

Final Thoughts

Series 63 Exam FAQs

The Series 63 exam is a state securities licensing exam created by NASAA and conducted by the Financial Industry Regulatory Authority (FINRA). The exam measures an individual's knowledge of securities law and its application to the investment industry. The Series 63 exam is a companion qualification exam. To be fully authorized to trade securities, license holders must also pass the SIE exam and either the Series 6 or Series 7 exam.

The Series 63 exam costs $147.

To earn a Series 63 license, candidates must first be 18 years of age and register with FINRA. Once registered, they can schedule and take the exam at a testing center in their state. If the candidate has passed, they will receive instructions on completing their registration process and must get their license.

Individuals who have passed the Series 63 exam can work in various positions. These include registered representatives, investment advisers, and broker-dealer operations personnel. The license is also required for individuals who wish to work as private bankers or securities compliance officers.

Candidates must get a passing score of 72%. To pass, the candidate must get at least 43 questions right out of the 60 questions on the exam.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.