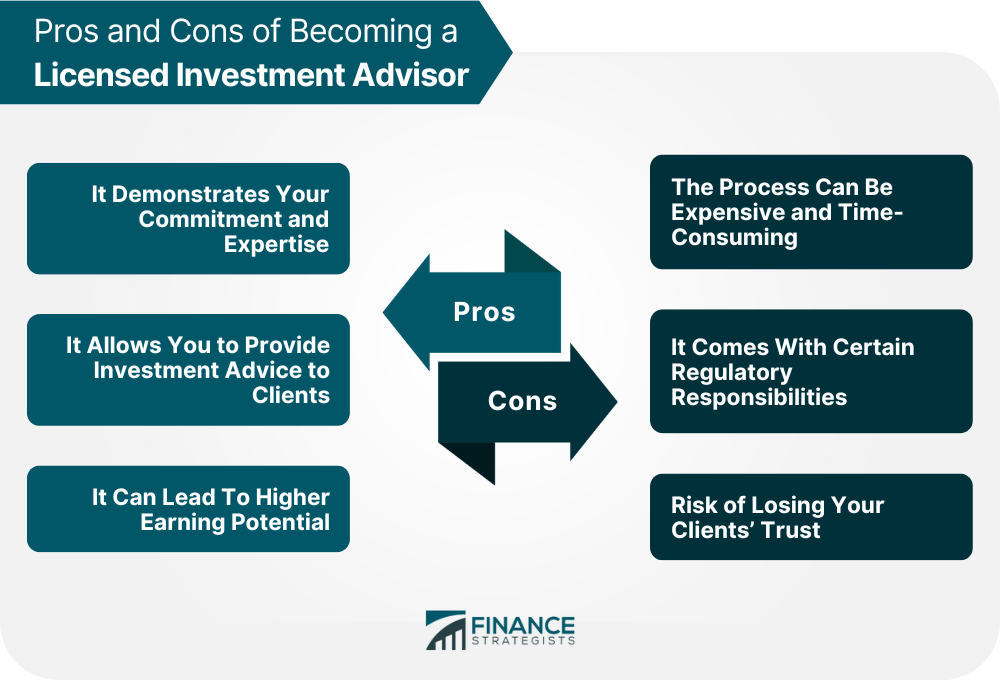

Series 82 is a multiple-choice exam that securities license applicants must pass in order to obtain their Investment Advisor and/or Broker Dealer licenses. The exam covers a wide range of topics, including investment strategies, financial planning, securities analysis, and client relationships Have questions about Series 82 Exam? Click here. The Series 82 exam is required for anyone looking to obtain an Investment Advisor or Broker Dealer license. This includes individuals working in the securities industry who wish to provide investment advice to their clients, as well as fresh college graduates entering the industry with little to no experience. Series 82 is administered by FINRA, formerly known as the National Association of Securities Dealers (NASD). Applicants for this exam must be sponsored by an Investment Advisor or Broker Dealer firm that's already licensed with FINRA. In addition, you must be at least 18 years old and have a valid Social Security number. There is no one-size-fits-all answer to this question, as the best way to prepare for the Series 82 exam will vary depending on your experience and knowledge level. However, FINRA provides suggested study materials on their website, including the Securities Industry Essentials (SIE) test that covers all topics included in Series 82. Organizations like InvestmentAdvisorPro also offer comprehensive exam prep packages composed of books, online courses, and one-on-one tutoring at an affordable cost. First, licensure demonstrates your commitment and expertise in the securities industry, which can give you a competitive edge when looking for jobs. Additionally, being licensed allows you to provide investment advice to clients - an activity that comes with certain legal protections. Finally, licensure can also lead to higher earning potential. However, there are some cons to becoming a licensed investment advisor. First, the process of obtaining your license can be expensive and time-consuming. Additionally, licensure comes with certain regulatory responsibilities that must be adhered to. Finally, as with any profession, there is always the risk of losing your clients' trust. The Series 82 examination is sponsored by FINRA and given at Prometrix testing centers across the country. You must be sponsored by an SEC-registered firm in order to take the examination. Other than that, there are no further requirements. The exam has a one-hour time limit and 50 multiple-choice questions. There are also five open ends that must be completed before the test is complete. To pass the exam, you must score at least 70 percent. The test costs $40 and takes 60 to 80 hours of study time. To assist you in studying for the examination, you may use FINRA's content outline. The Series 82 Exam has four sections: This includes all sorts of securities available on the market. Candidates are evaluated on equities, debt, preferred stock, asset-backed securities, common stock, real estate investment trusts, and rights and warrants in this section. It also covers investment companies, different fund variations, and how they are structured. This exam tests applicants' understanding of the private placement techniques used when issuing securities. Topics in this section also include financing proposals, underwriting commitments, pricing, and distribution. Candidates must analyze company equities in this portion of the exam. This section also covers debt analysis, call provisions, including bond ratings, interest rate risk, yield curves, investment planning features like suitability, investment objectives, risk, constraints, portfolio construction, and tax treatment. This section covers regulatory expectations and account documentation. It also discusses FINRA rules, documentation, client account forms, investment disclosures, and regulatory filings with the SEC. The Series 82 Exam is a challenging but important exam for those looking to become licensed investment advisors. The test covers a variety of topics related to the securities industry, so it is important to be well-prepared before sitting for the exam. By studying hard and utilizing FINRA's content outline, you can give yourself the best chance of passing on the first try.Who Should Take This Exam?

What Are the Requirements for Taking the Exam?

How to Prepare for the Exam?

Why Would I Want to Become a Licensed Investment Advisor?

There are a number of pros to becoming a licensed investment advisor. Series 82 Exam Topics

Section One — Characteristics of Corporate Securities:

Section Two — Regulation of the Market for Registered and Unregistered Securities:

Section Three — Analyzing Corporate Securities and Investment Planning:

Section Four — Handling Customer Accounts and Industry Regulations:

The Bottom Line

Series 82 Exam and License FAQs

The Series 82 Exam is a FINRA-sponsored exam that assesses an individual's knowledge of the characteristics of corporate securities, the regulation of the market for registered and unregistered securities, and the analysis of corporate securities and investment planning.

The experience requirements vary depending on your previous work experience.

You must score at least 70 percent on the Series 82 Exam to pass.

The Series 82 Exam covers a variety of topics, including the characteristics of corporate securities, the regulation of the market for registered and unregistered securities, debt analysis, interest rate risk, investment planning, and customer account handling.

The Series 82 Exam costs $40 to take.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.