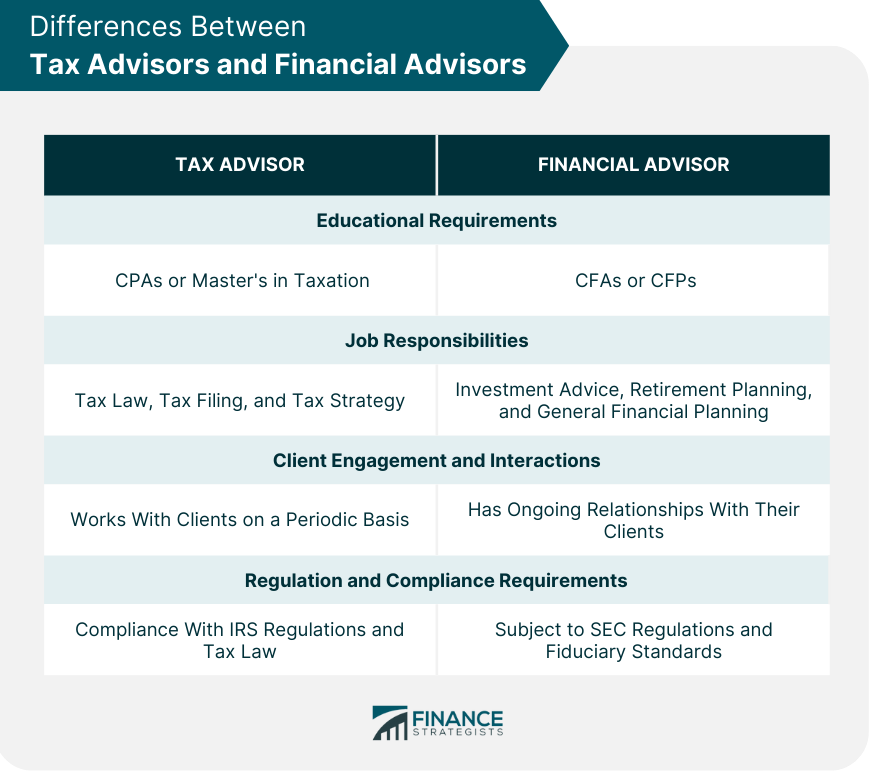

A tax advisor and a financial advisor play unique yet interrelated roles in managing personal finance. A tax advisor, with specialized training in tax law, provides advice on tax matters, ensures tax compliance, and strategizes to minimize tax liabilities. They focus on tax-efficient approaches to financial transactions, inheritance, and business sales, offering potentially substantial tax savings. On the other hand, a financial advisor navigates broader financial strategies. They guide on matters such as retirement planning, investment management, and insurance needs, working towards achieving clients' financial goals. Their role is holistic, encompassing all aspects of personal finance. Both roles are crucial, often needing to work in tandem. A tax advisor ensures tax efficiency in the strategies laid out by a financial advisor. Together, they offer a comprehensive approach to personal finance, aligning financial strategies with favorable tax implications. While both roles typically require a bachelor's degree in a finance-related field, the specific advanced degrees and certifications can differ. Tax advisors are often CPAs or hold a Master's in Taxation, while financial advisors may be CFAs or CFPs. The job responsibilities of tax advisors are typically more focused on tax law, tax filing, and tax strategy, while financial advisors have a broader role that includes investment advice, retirement planning, and general financial planning. The nature of client interactions also differs. Tax advisors often work with clients on a periodic basis, such as during tax season or when a significant financial transaction occurs. In contrast, financial advisors typically have ongoing relationships with their clients, monitoring their financial situation and adjusting financial plans as needed. Both professions are regulated, but the nature of the regulations differs. Tax advisors must comply with IRS regulations and tax law, while financial advisors are often subject to SEC regulations and fiduciary standards. One of the main responsibilities of a tax advisor is to have a thorough understanding of federal, state, and local tax laws. This knowledge is critical as it enables them to accurately interpret and apply these laws when assisting clients with their taxes. Tax advisors assist with the preparation and filing of tax returns. They ensure that all necessary financial information is reported accurately and that all deductions and credits that the client is entitled to are properly claimed. Tax advisors are responsible for developing effective tax strategies for their clients. These strategies aim to reduce tax liability while complying with all applicable laws. The strategy may include timing income and deductions, choosing the right investments, and making use of tax-advantaged accounts. If a client is subject to an audit by tax authorities, a tax advisor can represent them. The advisor can help to answer any queries raised by the tax authorities and assist with any required documentation. When a client is considering a significant financial transaction such as selling a business or receiving a large inheritance, a tax advisor provides advice on the tax implications. The advisor helps the client understand how the transaction will affect their tax situation and provides guidance on how to handle the tax-related aspects of the transaction. Tax laws and regulations can change frequently. Therefore, one of the key responsibilities of a tax advisor is to stay updated on these changes. By doing so, they can ensure that their advice and strategies reflect the most current tax laws and regulations. Finally, a tax advisor has a responsibility to educate their clients about tax matters. This education helps clients understand the tax implications of their financial decisions, which can empower them to make more informed decisions in the future. Most tax advisors begin their careers with a bachelor's degree in a related field such as Accounting or Finance. These degree programs provide students with a strong foundation in financial management principles and practices, which are essential for understanding and applying tax laws. It's not uncommon for those pursuing a career as a tax advisor to further their education by completing a Master's degree in Taxation. This degree program typically offers a more specialized and in-depth study of tax laws and regulations, tax planning, and corporate and international taxation. Professional certifications can significantly enhance a tax advisor's credentials and credibility. The most common certification for tax advisors is the Certified Public Accountant (CPA) designation. To become a CPA, one must meet educational and experience requirements, pass the Uniform CPA Examination, and adhere to a code of professional conduct. Some tax advisors may choose to earn the Enrolled Agent (EA) designation by passing a comprehensive exam covering individual and business tax returns. They may also earn it by having worked for the IRS for a minimum of five years in a position that required the application and interpretation of the tax code. Tax advisors must possess several key skills to be successful in their role: Excellent Understanding of Tax Law: Tax advisors must have a thorough understanding of complex tax laws and regulations to provide accurate advice and create effective tax strategies for their clients. Analytical Abilities: Dealing with taxes involves a lot of numbers and details. Tax advisors must have strong analytical skills to assess clients' financial situations, understand tax implications, and develop strategic tax plans. Strong Communication Skills: Tax advisors must be able to communicate complex tax information in an easily understandable manner. They must be adept at explaining tax laws and strategies to clients who may not have a strong understanding of tax matters. Attention to Detail: Mistakes in tax calculations can lead to severe consequences, including financial penalties. Therefore, a keen eye for detail is crucial for a tax advisor to ensure accuracy in all their work. One of the first and most important tasks of a financial advisor is to understand their client's financial goals. They work closely with clients to gain a comprehensive understanding of their financial needs, concerns, and long-term objectives. This knowledge serves as the foundation for the financial plan the advisor will ultimately create. Based on the client's financial goals, a financial advisor is responsible for creating a customized, comprehensive financial plan. This plan could cover a wide range of financial elements, including investments, retirement, education savings, tax strategies, and insurance. One of the key roles of a financial advisor is to provide sound investment advice. They assess the client's risk tolerance, financial status, and investment objectives to recommend the most appropriate investment strategies. These strategies may involve a variety of asset types such as stocks, bonds, mutual funds, or real estate. Financial advisors play an integral role in helping clients plan for retirement. They help clients determine their retirement needs, assess their current retirement savings, and recommend strategies to meet those retirement goals. This could involve suggestions for retirement accounts such as 401(k)s or IRAs. While not tax experts, financial advisors still need to have a solid understanding of tax laws as they relate to investments and financial planning. They advise clients on the tax implications of their financial decisions and help devise strategies to minimize tax liabilities where possible. Financial circumstances and goals evolve over time, and financial advisor has a responsibility to periodically review and adjust their clients' financial plans as necessary. This might involve changing investment strategies, adjusting retirement savings plans, or re-evaluating insurance needs. In addition to providing advice and recommendations, financial advisors have a responsibility to educate their clients on various aspects of finance. This empowers clients to make informed decisions about their money and promotes financial literacy. A bachelor's degree in finance provides a broad understanding of financial management, corporate finance, banking, and financial decision-making. This background offers a solid foundation for a future financial advisor. An economics degree focuses on economic principles, economic analysis, and critical thinking skills. It provides an understanding of how economies work, which is essential in giving financial advice. A business degree often includes courses in finance, management, and economics. This comprehensive approach to understanding the business world can be particularly helpful for financial advisors who work with corporate clients. Further, financial advisors often pursue professional certifications to enhance their credentials and demonstrate their expertise. Some of the most prevalent ones include: CFP is one of the most respected certifications in the financial advisory industry. It demonstrates a professional's competence in all areas of financial planning. The CFA designation is another prestigious certification, especially for financial advisors dealing with investment management. It shows the advisor's expertise in investment analysis and portfolio management. Financial advisors need to analyze various investment opportunities, economic conditions, and client's financial status. Hence, excellent analytical skills are paramount. Financial advisors must be able to explain complex financial information in a way that clients can Tax advisors play a critical role in personal finance, helping individuals and families navigate complex tax situations and optimize their tax strategy. Through their understanding of tax law and individual financial situations, tax advisors can provide valuable guidance on minimizing tax liability. This can include advising on tax-efficient investment strategies, suggesting timing for income or deductions, and providing guidance on tax implications of various financial decisions. In estate planning, tax advisors help clients plan for the transfer of assets in a way that minimizes estate taxes and maximizes the wealth passed on to heirs. They might advise on strategies such as gifting during the client's lifetime or setting up trusts. For business startups, tax advisors can offer advice on the business structure with the most favorable tax implications, guide on potential tax credits or deductions, and assist with the initial tax registration and ongoing tax compliance. When disputes arise with tax authorities, tax advisors can play a crucial role in negotiating and resolving these disputes. They represent the client in discussions with the tax authorities, prepare documentation to support the client's case, and advise on the best course of action. Financial advisors play a broad role in personal finance, guiding clients on many aspects of their financial lives. Financial advisors help clients understand their risk tolerance and financial goals, and then advise on an investment strategy that aligns with these. They can recommend specific investments and manage the investment portfolio on the client's behalf. In retirement planning, financial advisors help clients understand how much they need to save for retirement, suggest strategies to achieve these savings goals and advise on how to draw down savings during retirement in a tax-efficient way. Financial advisors can also provide valuable guidance on managing debt. They can help clients understand the cost of their debt, suggest strategies for paying it down, and guide them on the use of debt in their overall financial plan. Insurance planning is another key area where financial advisors can provide guidance. They help clients understand their insurance needs, suggest appropriate insurance products, and guide on how insurance fits into their overall financial plan. Choosing between a tax advisor and a financial advisor depends on a person's specific financial needs, but often, people might find they benefit from the services of both. The first step is to understand your financial needs. If your needs are primarily tax-related – such as if you have a complex tax situation, need to file a tax return, or are dealing with a dispute with the tax authorities – a tax advisor may be the best choice. However, if you need guidance on broader financial planning issues such as investment, retirement, or debt management, a financial advisor may be more suitable. The cost of services is another factor to consider. You'll need to weigh the cost of the services against the potential financial benefit. Some advisors charge a flat fee, others a percentage of assets managed, and some may work on commission. Each profession has its benefits and drawbacks. A tax advisor might offer more specialized expertise in tax planning but may not be equipped to provide comprehensive financial planning. A financial advisor, on the other hand, may provide a broader range of services but may not have the depth of tax knowledge that a tax advisor has. Tax advisors and financial advisors have interrelated roles, they are distinct in their educational requirements, responsibilities, and interactions with clients. Tax advisors, often CPAs, specialize in interpreting and applying tax laws, helping clients minimize tax liabilities, and ensuring tax compliance. They play crucial roles during tax season and major financial transactions. On the contrary, financial advisors, typically CFAs or CFPs, guide clients across a broader range of financial aspects, including investments, retirement, and insurance. Their engagement with clients is ongoing, adjusting financial plans as required. Both professionals are indispensable for holistic personal financial management, with tax advisors ensuring tax efficiency in financial strategies. Their combined expertise offers a comprehensive approach to aligning financial strategies with favorable tax implications, ultimately helping clients achieve their financial goals.Tax Advisor vs Financial Advisor Overview

Key Differences Between Tax Advisors and Financial Advisors

Educational Requirements

Job Responsibilities

Client Engagement and Interactions

Regulation and Compliance Requirements

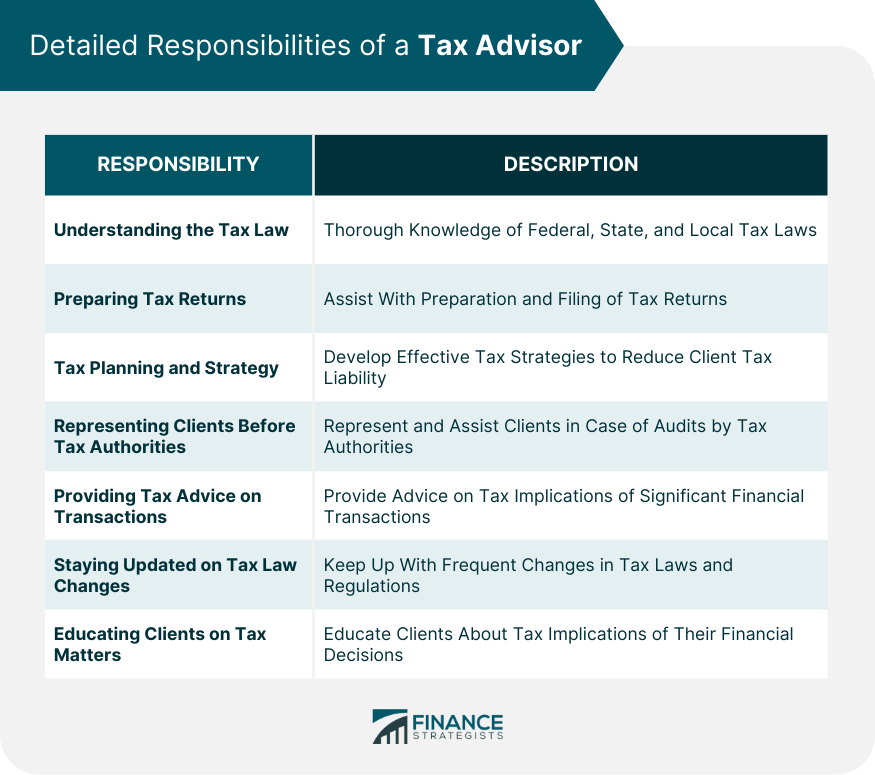

Detailed Responsibilities of a Tax Advisor

Understanding the Tax Law

Preparing Tax Returns

Tax Planning and Strategy

Representing Clients Before Tax Authorities

Providing Tax Advice on Transactions

Staying Updated on Tax Law Changes

Educating Clients on Tax Matters

Educational Background and Skills Required for a Tax Advisor

Typical Educational Background

Certifications

Key Skills

Detailed Responsibilities of a Financial Advisor

Understanding a Client's Financial Goals

Creating Customized Financial Plans

Offering Investment Advice

Retirement Planning

Tax Planning

Reviewing and Adjusting Financial Plans

Educating Clients

Educational Background and Skills Required for a Financial Advisor

Finance

Economics

Business

Certifications

Certified Financial Planner (CFP)

Chartered Financial Analyst (CFA)

Analytical Skills

Communication Skills

Role of a Tax Advisor in Personal Finance

Tax Planning

Estate Planning

Business Startups

Dispute Resolution With Tax Authorities

Role of a Financial Advisor in Personal Finance

Investment Planning

Retirement Planning

Debt Management

Insurance Planning

Deciding Between a Tax Advisor and a Financial Advisor

Determine Financial Needs

Assess the Cost of Services

Evaluate the Benefits and Drawbacks of Each Profession

Conclusion

Tax Advisor vs Financial Advisor FAQs

The primary difference lies in their areas of expertise. A tax advisor specializes in tax law, planning, and compliance, helping clients minimize tax liability and comply with tax laws. A financial advisor, on the other hand, offers advice on a broader range of financial issues, including budgeting, investing, retirement planning, insurance, and more.

While financial advisors are knowledgeable about many aspects of personal finance, including some tax-related issues, they typically do not have the depth of tax expertise that a tax advisor does. For complex tax planning or issues, consulting with a tax advisor is generally recommended.

The decision to hire a tax advisor, financial advisor, or both depends on your personal financial situation and needs. If you have complex tax issues or need specialized tax advice, a tax advisor would be suitable. If you need advice on a broader range of financial issues, a financial advisor may be more appropriate. In some cases, such as when planning for retirement or dealing with a large financial transaction, you may benefit from the services of both.

Typically, a tax advisor should have a degree in accounting, finance, or a related field, and many have advanced degrees or certifications such as a Master's in Taxation or Certified Public Accountant (CPA). Financial advisors usually have a bachelor's degree in finance, economics, or business, and often have advanced degrees or certifications like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

In an integrated approach, a tax advisor and financial advisor work together to provide a comprehensive financial strategy. The tax advisor ensures that the strategy is tax-efficient, while the financial advisor ensures it aligns with the client's overall financial goals and risk tolerance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.