Wealth managers and financial advisors are very common in the investment world. Both professions provide financial guidance to their clients, but many people are unfamiliar with their differences. For instance, individuals with more valuable investments might find wealth managers more helpful, while those just beginning their investment journey may benefit more from a financial advisor’s support. Have a financial question? Click here. A wealth manager is a subcategory of a financial advisor that is typically associated with wealthy clients. They offer comprehensive investment advice for high-net-worth individuals in the usual areas of retirement planning, estate planning, and risk management. However, their services also cover more advanced strategies, such as wealth preservation, investment management, and tax services. They often have additional certifications in accounting or taxation that enables them to provide more sophisticated advice. A financial advisor is a term given to a broad category of professionals who provide advice and services related to finance and investments. They help individuals make decisions about their finances to improve their overall economic situation. Financial advisors offer a wide range of services, from developing retirement plans to helping clients choose the best stocks for their portfolios. Depending on their background, certain types of financial advisors may also have additional certifications in areas such as insurance or real estate. Both wealth managers and financial advisors offer financial advice to their clients. Still, there are key differences in the scope of what they do. Wealth managers typically focus on high-net-worth individuals and offer sophisticated services. For most wealth managers, establishing an agreement with a client requires a certain amount of net worth. In contrast, financial advisors work with clients of all levels of wealth and offer a wide range of services. They do not set a minimum net worth requirement to start their professional relationship with their clients. As a subcategory of financial advisors, wealth managers provide more specific and refined services to their clients. This includes investment management, tax services, legal planning, philanthropic gifting, legacy planning, and wealth preservation. On the other hand, financial advisors provide a wide range of services with various specializations. However, a common overlap in their services includes basic financial planning, retirement planning, estate planning, and risk management. Wealth managers must register with local state agencies. They are also not strictly governed by the Financial Industry Regulatory Authority (FINRA), but some opt to register with them and get certifications. Wealth managers handling assets with a value of more than $100 million are encouraged but not required to register with the Securities and Exchange Commission (SEC). However, it is a must for those managing assets worth $110 million and above to register with the SEC. In comparison, financial advisors must register with FINRA and abide by its rules. They usually pass a series of tests provided by the agency and have special certifications in the specific area they are working in. The common fee structure for wealth managers is usually a blend of a percentage of assets under management (AUM) fees and hourly rates. The asset-based fee is typically around 1% to 3% per year, while their hourly rate ranges from $100 to $500. Meanwhile, financial advisors have a more varied fee structure. Financial advisors may charge 0.5% to 2% in AUM fees, an hourly rate ranging from $200 to $400, a flat fee of around $1,000 to $3,000, or a commission worth 3% to 6% of the value of the security they recommended. A degree in finance, economics, accounting, or business is usually required for both financial advisors and wealth managers. FINRA certifications are also encouraged. However, the particular designations they need to acquire may differ depending on their specialty. In addition, wealth managers are generally known to have more years of experience when compared with financial advisors. When deciding between a wealth manager and a financial advisor, the first consideration is how much money you have to invest. Some wealth managers working in firms may ask a minimum of $250,000, while others may want $1 million to start an account. Next is the type of service you need. If you are looking for advanced strategic and highly specific financial planning methods, you might want to work with a wealth manager, provided that you have the funds for it. However, a financial advisor might be better for you if you are a beginner investor or need a wide range of general services like budgeting and financial planning. This is also true if you know what specific services you need and want an advisor with that specialization. Lastly, consider what kind of relationship you want with your financial professional. Wealth managers are more hands-on, and they are more involved in the day-to-day operations of their clients and their family. Financial advisors, on the other hand, depending on your agreement, can work with you less frequently yet still provide you with ongoing advice as needed. Before selecting either a wealth manager or financial advisor, it is important to evaluate your needs. Although these two professions might be different, what is common between them is the need to choose one wisely. Here are some tips on how to ensure that you are hiring an excellent wealth manager or financial advisor: It is essential to know a prospect’s qualifications before choosing to work with them. The SEC has a public disclosure website that allows you to verify if a financial professional is registered with them. This can help you assess if your prospect can manage your investments safely. Before hiring a wealth manager or financial advisor, ask for references. Speak to their existing clients and get an idea of what it is like to work with them. Through this, you can discover if their existing clients are satisfied and sincerely recommend their services. Meeting a wealth manager or financial advisor in person is always the best way to get to know them and assess if their approach suits you. Asking them relevant questions is also an opportunity to see if your needs and interests align with their specialties and services. It is important to ask about and understand a wealth manager or financial advisor’s fee structure before choosing to work with them. Comparing your different prospects and their various price points will help you determine which one provides the most value for money. Before signing any documents, you must read all the fine print. Ask questions if anything needs clarification. Transparency is key to making sure both parties understand the agreement. The primary difference between a wealth manager and a financial advisor is the size of the accounts, assets, investments, and wealth they manage. Wealth managers typically require larger accounts from their clients than financial advisors do. The fees for wealth managers are also generally higher than those for financial advisors. In addition, different licenses and qualifications are required for both roles, so prospective clients should ensure that their chosen financial professional has the right credentials. When deciding between asset or wealth management, you must consider your needs. A wealth manager may be better if you prefer a hands-on approach and have substantial wealth invested. Meanwhile, a financial advisor may suit you if you require a wide range of services or are just beginning to invest. Ultimately, deciding whether you need to hire a financial professional who specializes in wealth management or a financial advisor should be based on your specific circumstances, your desired level of service, and your financial goals.Wealth Manager vs Financial Advisor: An Overview

It is essential to be aware of the distinctions between these two designations. This will help individuals select which type of financial professional suits their current situation and can adequately meet their needs. What Is a Wealth Manager?

What Is a Financial Advisor?

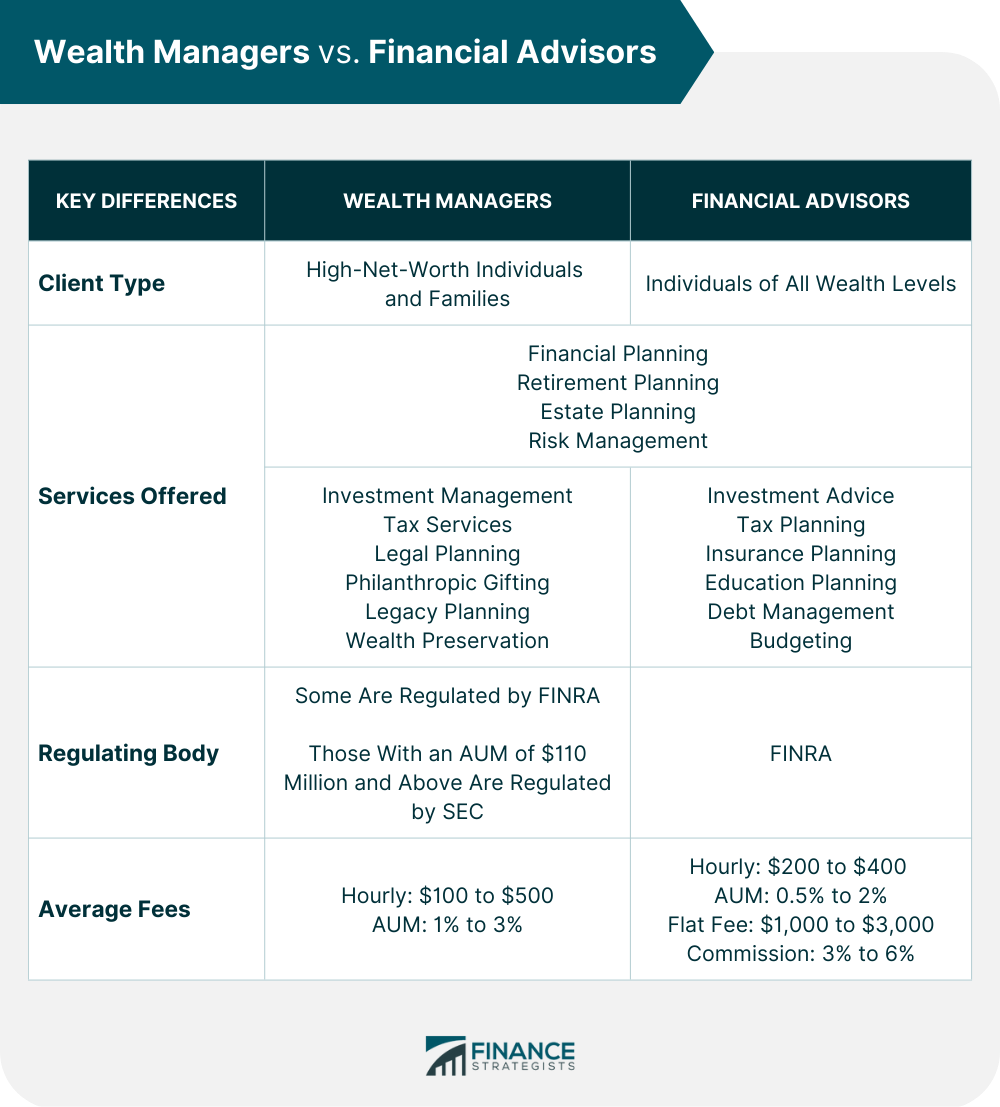

Key Differences Between Wealth Managers and Financial Advisors

Client Type

Services Offered

Regulating Body

Average Fees

Qualifications

Do You Need a Wealth Manager or a Financial Advisor?

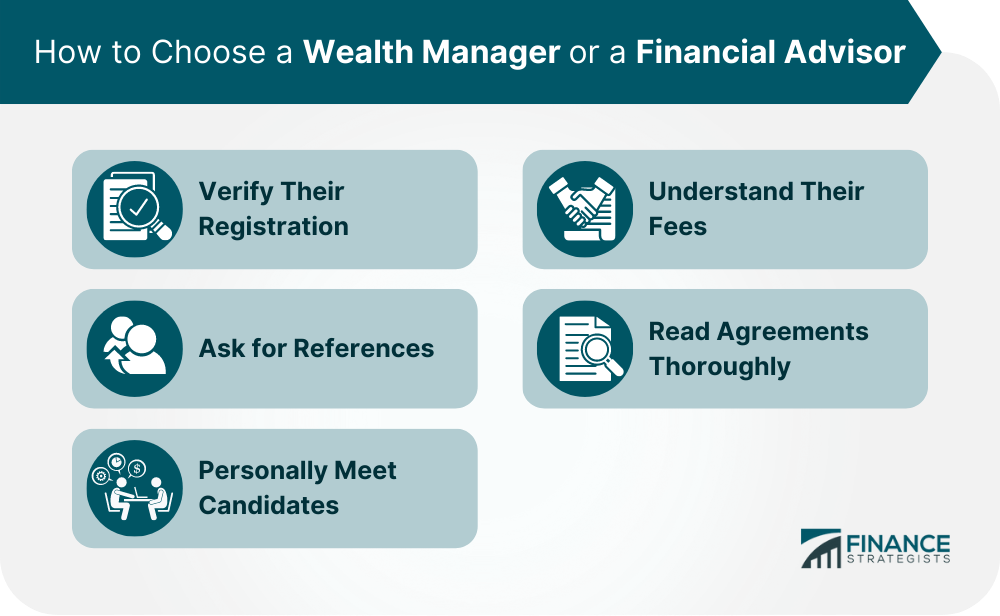

Tips for Choosing a Wealth Manager or a Financial Advisor

Verify Their Registration

Ask for References

Personally Meet Candidates

Understand Their Fees

Read Agreements Thoroughly

The Bottom Line

Wealth Manager vs Financial Advisor FAQs

A Wealth Manager typically offers comprehensive financial planning services, including investment guidance, estate planning, retirement planning, risk management, and tax planning. A Financial Advisor generally provides advice on investments such as stocks, bonds, and mutual funds.

No, a Wealth Manager typically focuses on the larger picture, offering comprehensive financial planning services. This may include helping to develop an overall plan for achieving long-term goals such as retirement and managing risk.

Wealth Managers typically work with clients with a high net worth or individuals who are looking for comprehensive financial planning services.

Financial Advisors usually provide advice on investments such as stocks, bonds, and mutual funds. They may also make recommendations on taxes, retirement plans, insurance policies, and real estate investments.

It is important to select an individual with the appropriate qualifications and experience in order to ensure you receive quality advice. Additionally, look for an advisor who is willing to work collaboratively with you and understands your overall investment goals. Finally, check that the advisor follows a fiduciary standard of care, which requires them to put your interests first.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.