Financial advisor fees were once tax-deductible under U.S. federal tax law as miscellaneous itemized deductions. However, the Tax Cuts and Jobs Act of 2017 eliminated these deductions for tax years 2018 through 2025. Therefore, most taxpayers cannot currently deduct financial advisor fees from their federal income taxes. Exceptions include fees paid directly from certain types of retirement accounts like IRAs or 401(k)s and fees related to advise on tax-exempt income. For businesses and self-employed individuals, these fees might be deductible as business expenses. Furthermore, some states may allow these deductions on state income taxes, even if they are not allowed federally. It's advisable to consult with a tax professional for personalized advice. The Tax Cuts and Jobs Act (TCJA), passed in 2017, brought significant changes to the tax code. One notable change was the suspension of miscellaneous itemized deductions subject to the 2% floor. Previously, taxpayers could deduct the amount of certain miscellaneous expenses that exceeded 2% of their adjusted gross income. This category of deductions included investment expenses, such as fees paid to financial advisors. However, this provision was eliminated under the TCJA, making these fees non-deductible for tax years 2018 through 2025. The IRS classifies fees paid to financial advisors as "investment fees." Prior to the TCJA, these fees were classified as miscellaneous itemized deductions. This classification allowed individuals to deduct expenses associated with the management of investments, including the fees paid to financial advisors, as long as the total expenses exceeded 2% of their adjusted gross income. However, with the suspension of miscellaneous itemized deductions by the TCJA, these fees are currently not deductible for most taxpayers. While the TCJA changed the deductibility of financial advisor fees for many taxpayers, there are still some instances where these fees may be deductible. For example, fees paid directly from certain types of retirement accounts, such as Individual Retirement Accounts (IRAs) or 401(k) plans, may be deductible. If the fees are taken directly from the account and not reimbursed, they may be considered as a reduction of the account balance rather than a taxable distribution. Another instance where financial advisor fees may be deductible is when they are associated with tax-exempt income. Fees paid for advice or assistance in earning or producing tax-exempt income are considered deductible. For instance, if a financial advisor provides specific advice related to investing in tax-exempt bonds, the fees associated with this advice could potentially be deductible. Businesses and self-employed individuals may also be able to deduct financial advisor fees. In this case, the fees would be considered ordinary and necessary business expenses. To qualify, the advice must be directly related to the business operations. For example, if a business hires a financial advisor to assist with business expansion plans or capital investments, the fees would likely be deductible. Before claiming a deduction for financial advisor fees, it's important to understand what qualifies as deductible financial advice. Generally, the IRS allows deductions for expenses incurred in connection with the production of taxable income. So, fees for advice on tax planning, investment strategies, estate planning, and retirement income planning could potentially be deductible if they meet the criteria outlined earlier. It is recommended to consult a tax professional to confirm if the fees are indeed deductible. If a taxpayer is eligible to deduct financial advisor fees, the next step is to know how to claim these deductions. Generally, these deductions are itemized on Schedule A of Form 1040. The taxpayer will need to provide detailed information about the fees paid, including the amount and the services for which they were paid. It is important to note that the IRS has stringent requirements for documentation, so it's vital to keep detailed records. Keeping proper documentation is crucial when claiming deductions for financial advisor fees. The IRS may require evidence of the fees paid and the services provided by the financial advisor. This could include invoices, receipts, or a detailed statement from the financial advisor outlining the services provided. Failure to provide adequate documentation could result in the denial of the deduction. The deductibility of financial advisor fees also depends on state tax laws. While federal law may not allow these deductions, certain states might. State tax laws vary widely, and some states may allow taxpayers to deduct financial advisor fees, even if they are not deductible on the federal return. Several states have tax codes that differ significantly from federal tax law and may permit the deduction of financial advisor fees. For instance, states like California and New York, among others, have their own itemized deduction rules and may still allow for certain deductions eliminated under federal law. State laws also affects residents and non-residents differently. For residents, the state tax laws of their home state apply. For non-residents, the tax laws of the state where they earn their income will apply. Therefore, the deductibility of financial advisor fees may vary depending on the individual's residency status and where they earn their income. The Tax Cuts and Jobs Act of 2017 generally disallowed the federal tax deductibility of financial advisor fees for tax years 2018 through 2025, which previously fell under miscellaneous itemized deductions. Exceptions include fees paid from specific types of retirement accounts (e.g., IRAs, 401(k)s) and expenses related to generating tax-exempt income or those classified as necessary business expenses for businesses and self-employed individuals. Despite federal restrictions, state tax laws might permit these deductions; states like California and New York have unique itemized deduction rules. As the deductibility varies, it is crucial to maintain detailed records of these fees and services for any potential deductions. Therefore, consult with a tax professional for precise guidance on navigating these complexities and maximizing your tax savings.Are Financial Advisor Fees Tax Deductible?

Examination of Tax Laws Pertaining to Financial Advisor Fees

Impact of the Tax Cuts and Jobs Act on Miscellaneous Deductions

IRS's Classification of "Investment Fees"

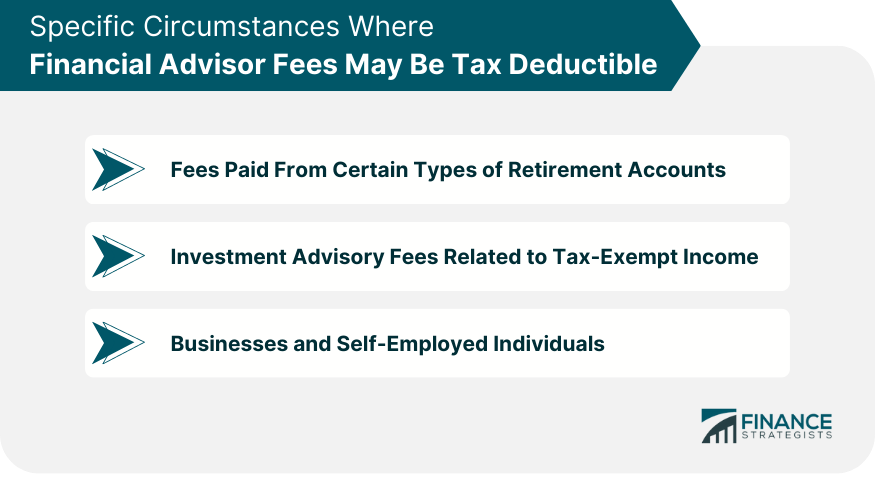

Specific Circumstances Where Financial Advisor Fees May Be Tax Deductible

Fees Paid From Certain Types of Retirement Accounts

Investment Advisory Fees Related to Tax-Exempt Income

Businesses and Self-Employed Individuals

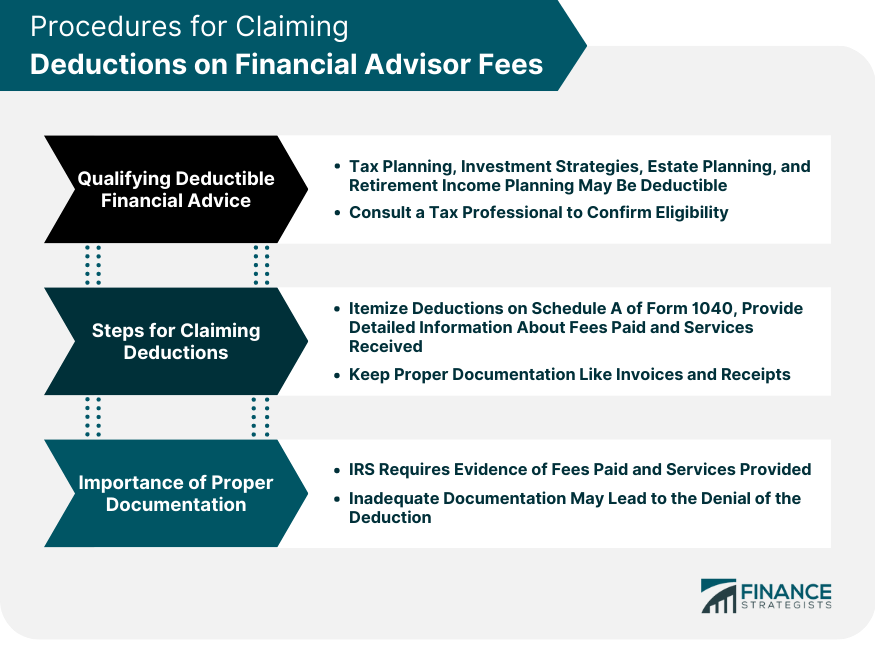

Procedures for Claiming Deductions on Financial Advisor Fees

What Qualifies as Deductible Financial Advice

Steps for Claiming These Deductions

Importance of Proper Documentation

Effect of State Laws on Deductibility of Financial Advisor Fees

Variation of Tax Laws From State to State

States Where Financial Advisor Fees May Be Deductible

Effect of State Laws on Residents vs Non-residents

Bottom Line

Are Financial Advisor Fees Tax Deductible? FAQs

Generally, as a result of the Tax Cuts and Jobs Act of 2017, financial advisor fees are not deductible on federal income taxes for tax years 2018 through 2025. However, there are some exceptions, such as fees paid directly from certain types of retirement accounts, fees associated with advice on tax-exempt income, or for businesses and self-employed individuals under certain conditions.

This will depend on your state's tax laws. Some states have tax codes that differ from federal tax law and may still allow the deduction of financial advisor fees. Always check your specific state tax laws or consult with a tax professional in your area.

The Tax Cuts and Jobs Act passed in 2017, suspended miscellaneous itemized deductions, which included financial advisor fees. This means that for tax years 2018 through 2025, these fees are generally not deductible from federal income taxes.

Fees paid directly from certain types of retirement accounts, such as IRAs or 401(k) plans, may be deductible. If the fees are taken directly from the account and are not reimbursed, they may be considered as a reduction of the account balance rather than a taxable distribution.

You will need to provide detailed information about the fees paid, including the amount and the services for which they were paid. This could include invoices, receipts, or a detailed statement from the financial advisor outlining the services provided. Always keep detailed records, as the IRS may require evidence to support your deduction.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.