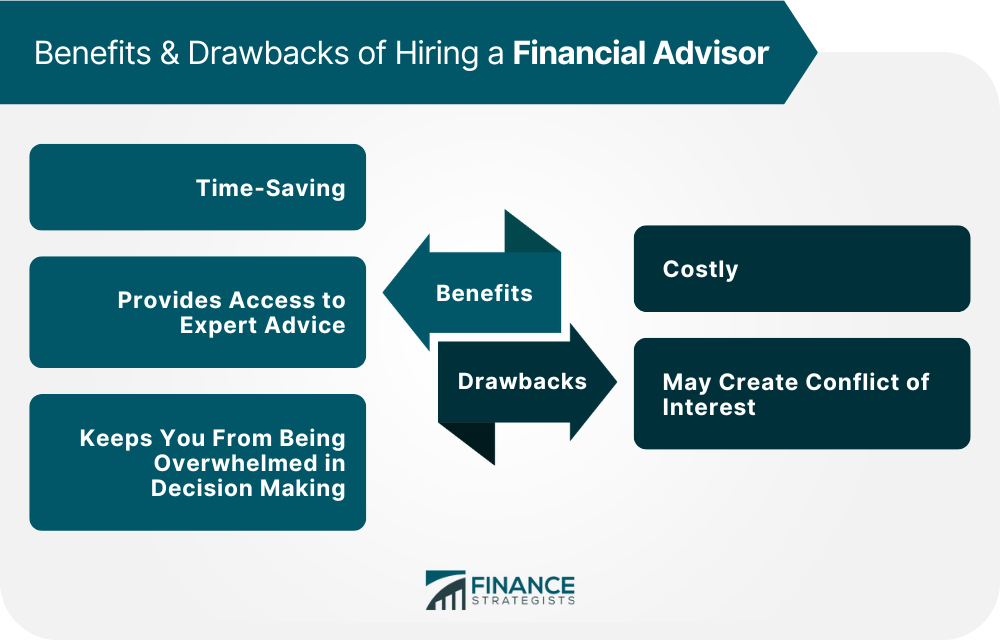

Several life events may require one to seek the services of a financial advisor. A financial advisor can help you make informed decisions about these critical matters. Financial advisors can help you understand how much of your income should be saved for retirement, emergency funds, and other investments. Further, they can advise you on how to take advantage of available tax deductions. When you receive an increase in salary or make more money from bonuses, commissions, or other sources of income, it is essential to ensure that any new money is used to its fullest potential. A financial advisor can help you avoid mistakes in investing and other crucial financial decisions. Marriage comes with many financial decisions and obligations. It involves determining how to manage incomes, expenses, and debts and how to make use of wills and trusts for the future. An advisor can also advise on any prenuptial agreements that must be signed before marriage and other important considerations. You can get help to determine what type of savings plan will work best for you, such as college funds or trust accounts. Further, they can also guide on budget reallocation to accommodate the expenses of raising children. Determining the best way to invest and manage a newfound wealth and any associated taxes is essential. Financial advisors can provide advice on preserving wealth for future generations. You may need help creating a plan and getting advice on topics such as managing cash flow, determining legal structure, obtaining financing, and filing taxes. You may need help determining how assets should be divided, such as knowing which asset classes each partner should take. Financial advisors can also help set up life insurance policies to protect your family from unforeseen circumstances. Working with a financial advisor can help you make sure you receive the maximum social security benefit amount while minimizing taxes associated with withdrawals. An advisor can also guide with other options for retirement income, such as pensions and annuities. A financial advisor can help evaluate your current savings and investments and advise on maximizing returns while minimizing taxes. They can also guide you on setting up trusts or other estate planning tools so that you can leave a legacy for future generations. When you hire a financial advisor, you invest in your future. Here are some key benefits of working with a financial advisor: When it comes to managing your finances, time is of the essence. Hiring a qualified financial advisor can save time by analyzing available investments and taking care of the paperwork. This way, you do not have to worry about researching every detail. A qualified financial expert has the experience and knowledge necessary to provide you with sound advice and guidance on a variety of topics. They can evaluate your investments and savings, recommend ways to increase profits without incurring taxes, and advise you on how best to plan for your loved ones' future. When it comes to money management, it is common for people to become overly interested or frustrated. Financial consultants offer impartial advice and caution you against making hasty judgments. Similarly, they can help you choose investments from many options. Although there are many benefits to hiring a financial advisor, some disadvantages should be considered. Financial advisors typically charge hourly or flat fees for their services. Depending on the type of financial service you need, these fees can add up quickly and may be more of a burden in the long run. Many financial advisors work on commission which means they get paid when you invest in certain products or services. This creates a conflict of interest as the advisor may focus more on making sales than providing unbiased advice. Before investing, you must ensure you understand the relationship between the advisor and any products they recommend. Hiring a financial advisor can be beneficial in many ways - from saving time to providing personal guidance and expert advice. However, it is also essential to consider all potential drawbacks before working with this particular profession, such as costly fees, and possible conflicts of interest. Whether or not it is worth hiring one depends mainly on your individual needs and financial goals. Working with a qualified financial advisor can be invaluable in helping you make informed decisions about your money - giving you peace of mind for years to come. Working with a qualified financial advisor is essential to make informed decisions about your finances as life changes occur. An experienced professional can assess your individual needs and create a personalized plan tailored specifically to you, helping you achieve financial success no matter your life stage. Although there are benefits and drawbacks to hiring a financial advisor, your current financial circumstances and the outcome of hiring one will ultimately define whether they are worth it.Life Events That May Require Financial Advice

On Your First Job or Shifting to a New Career

Getting a Pay Increase

Getting Married

Having Children

Receiving an Inheritance

Starting a Business

Dealing with Divorce

Taking Social Security

Nearing Retirement

Benefits of Hiring a Financial Advisor

Time-Saving

Expert Advice

Keeps You From Being Overwhelmed in Decision Making

Drawbacks of Hiring a Financial Advisor

Costly

May Create Conflict of Interest

Are Financial Advisors Worth It?

Final Thoughts

Are Financial Advisors Worth It? FAQs

A financial advisor is a professional who assists clients with investments and other financial decisions. In contrast, a financial planner provides comprehensive advice on all aspects of personal finance, from budgeting to retirement planning.

Whether or not hiring a financial advisor depends on your individual needs and goals. Most of the time, it may be beneficial to speak with a professional to gain access to their expertise and personalized advice.

No set amount of money is required before working with a financial advisor, as everyone's needs differ. However, it is generally recommended that you have some form of savings or investments before seeking professional help.

According to the U.S. Bureau of Labor Statistics (BLS), the latest median annual salary for a financial advisor is $94,170 or $45.27 per hour. However, this amount can vary depending on the professional's level of experience and expertise.

Consider consulting with a financial advisor if you are looking for investment advice or guidance in managing your finances more effectively. A financial advisor can provide personalized solutions tailored to your individual needs and goals - helping you make better decisions about your money now and in the future.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.