Bankruptcy Credit Counseling is a federally mandated process that individuals must complete before filing for bankruptcy. The counseling session, typically lasting 60 to 90 minutes, provides an in-depth review of one's financial situation, explores potential alternatives to bankruptcy, and assists in devising a personalized budget plan. The primary purpose of Bankruptcy Credit Counseling is to ensure that individuals understand the potential alternatives to and implications of bankruptcy. It plays a crucial role in helping individuals make informed decisions regarding their financial situations. If, after the counseling, bankruptcy is still the best option, individuals are then better prepared for the bankruptcy process. The aim is to equip individuals with the necessary financial knowledge and skills, ultimately enabling them to make well-informed decisions about bankruptcy and its alternatives. This system of counseling acts as a preventive measure, helping individuals avoid potential financial pitfalls in the future and fostering improved personal financial management. Bankruptcy Credit Counseling is a mandatory step in the U.S. bankruptcy process, designed to ensure that individuals fully understand their financial situation and the implications of filing for bankruptcy. In most bankruptcy cases, credit counseling is required before an individual can file for bankruptcy. This session needs to occur within 180 days before filing for bankruptcy. The counseling session typically lasts about 60 to 90 minutes. During the counseling session, the credit counselor will assess the individual's financial situation, explore possible alternatives to bankruptcy, and help create a personal budget plan. The session can take place in person, online, or over the phone, depending on the individual's preference and the facilities offered by the counseling agency. After completing the credit counseling, the individual will receive a certificate of completion. This certificate is essential as it is required when filing the bankruptcy petition with the court. When selecting a credit counseling agency, it's crucial to choose an agency approved by the U.S. Trustee Program. This ensures that the counseling session will meet the requirements set by the bankruptcy code. When selecting a credit counseling agency, one should consider several factors. These include the agency's fees, the qualifications of their counselors, the quality of their educational materials, and whether they offer free follow-up services. One of the main advantages of bankruptcy credit counseling is the financial education it provides. It offers a comprehensive understanding of financial management, which can help individuals better handle their finances in the future. Bankruptcy credit counseling prepares individuals for what to expect throughout the bankruptcy process. It can help make the process less daunting and more manageable. Credit counseling sessions aim to equip individuals with improved financial management skills. The budgeting techniques and financial tips imparted during these sessions can help individuals manage their finances effectively post-bankruptcy. Another crucial advantage of credit counseling is that it provides a platform to evaluate alternatives to bankruptcy. Some people may find that solutions like negotiating with creditors, consolidating debts, or modifying their budget can prevent the need for bankruptcy. Although credit counseling agencies are required by law to provide services regardless of an individual's ability to pay, there can be a fee for the counseling session. This fee might pose a challenge for those already struggling with their finances. While counseling sessions can take place online or over the phone, some individuals might not have easy access to these facilities. Those with limited internet access or restricted phone services could find it challenging to complete the counseling. For some individuals, the time investment required for credit counseling may be a disadvantage. Balancing the time required for counseling sessions and managing other responsibilities can be a challenging aspect of the process. Bankruptcy Credit Counseling plays a critical role in the bankruptcy process, offering debtors the opportunity to gain valuable insights and make informed decisions about their financial futures. Credit counseling is a prerequisite for filing for bankruptcy. Without the certificate of completion from a counseling agency, an individual cannot proceed with bankruptcy filing. While the primary purpose of credit counseling is not to influence the outcome of a bankruptcy case, the information and skills gained during the session can indirectly impact the course of bankruptcy. For instance, an individual might decide to pursue alternatives to bankruptcy after a counseling session. Completing bankruptcy credit counseling is not directly related to the discharge of debts in a bankruptcy case. However, the certificate of completion is a necessary document when filing for bankruptcy, and failure to present it can lead to a case dismissal. Bankruptcy Credit Counseling plays a vital role in the bankruptcy process, ensuring individuals understand their financial situation and the implications of filing for bankruptcy. It is mandatory before filing and typically lasts 60 to 90 minutes. The session assesses the individual's financial situation, explores alternatives to bankruptcy, and creates a personal budget plan. Upon completion, a certificate is issued, required when filing the bankruptcy petition. When selecting a counseling agency, it's important to choose an approved agency and consider factors like fees, counselor qualifications, and educational materials. Pros of credit counselling include financial education, preparation for bankruptcy, improved financial management skills, and evaluation of alternatives. Cons include cost, accessibility challenges, and time consumption. Credit counseling is a prerequisite for bankruptcy filing, influences the bankruptcy course and outcome, and the certificate is necessary for the filing process, though it does not directly impact debt discharge.What Is Bankruptcy Credit Counseling?

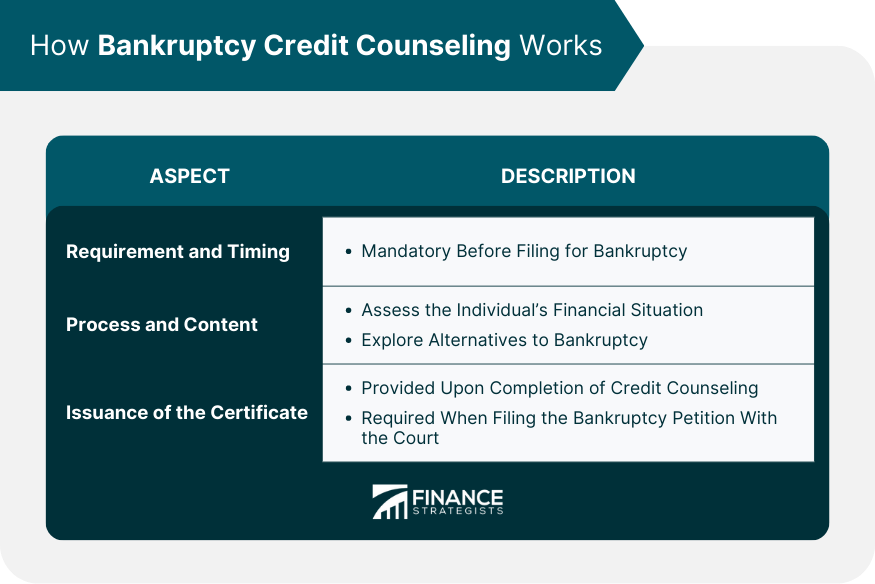

How Bankruptcy Credit Counseling Works

Requirement and Timing

Process and Content

Issuance of the Certificate

Selecting a Bankruptcy Credit Counseling Agency

Approved Agencies

Factors to Consider

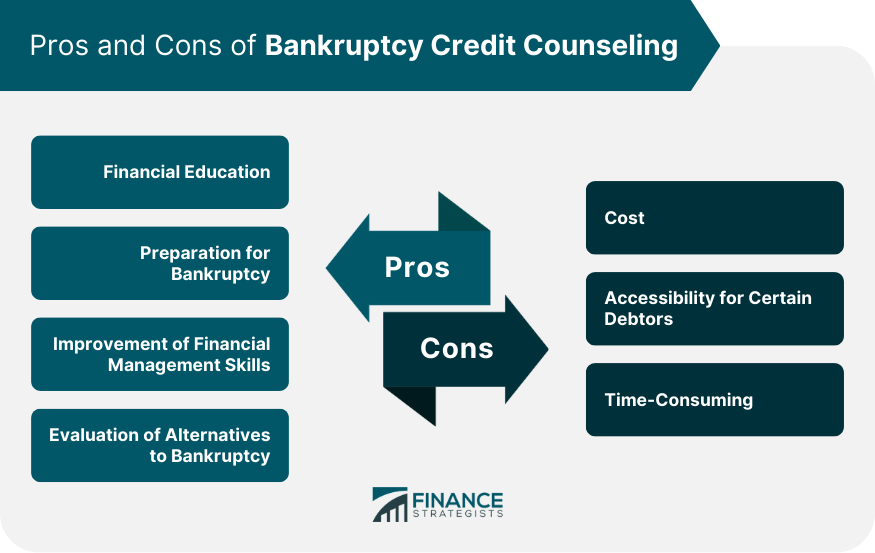

Pros of Bankruptcy Credit Counseling

Financial Education

Preparation for Bankruptcy

Improvement of Financial Management Skills

Evaluation of Alternatives to Bankruptcy

Cons of Bankruptcy Credit Counseling

Cost

Accessibility for Certain Debtors

Time-Consuming

Role of Bankruptcy Credit Counseling in Bankruptcy Proceedings

Prerequisite for Bankruptcy Filing

Influence on Bankruptcy Course and Outcome

Effect on Debt Discharge

Conclusion

Bankruptcy Credit Counseling FAQs

Bankruptcy Credit Counseling is a mandatory session that provides financial education for individuals considering filing for bankruptcy. It aims to equip these individuals with the necessary knowledge about bankruptcy and its alternatives.

Bankruptcy Credit Counseling involves a 60 to 90-minute session with a credit counselor, who assesses the individual's financial situation, explores possible alternatives to bankruptcy, and helps create a personal budget plan. After completion, the individual receives a certificate, which is required for filing for bankruptcy.

The benefits of Bankruptcy Credit Counseling include providing financial education, preparing individuals for the bankruptcy process, improving financial management skills, and evaluating alternatives to bankruptcy.

Drawbacks of Bankruptcy Credit Counseling may include the cost associated with the counseling session, limited accessibility for some individuals due to technology requirements, and the time-consuming nature of the process.

Bankruptcy Credit Counseling is a prerequisite for filing for bankruptcy. The certificate from the counseling session must be presented when filing for bankruptcy. While it doesn't directly influence the discharge of debts, the skills and information gained during the session can impact the overall course of bankruptcy proceedings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.