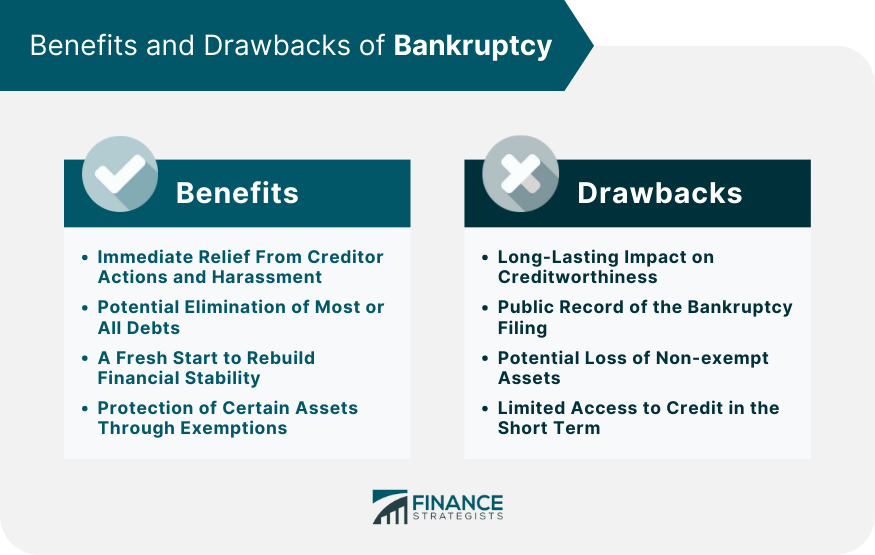

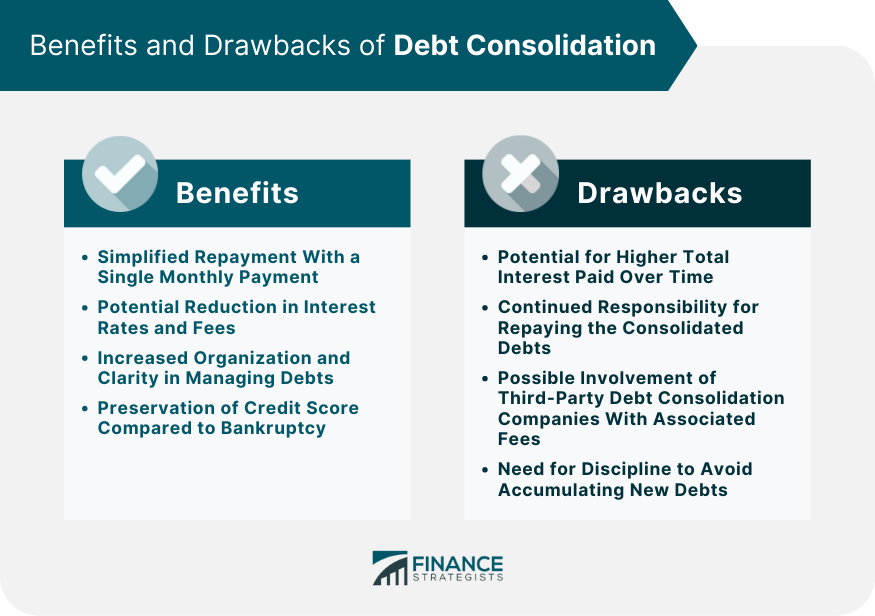

Bankruptcy is a legal process that aims to provide a fresh start by eliminating eligible debts. It involves a court-approved procedure that discharges debts and provides immediate relief from creditor actions. However, bankruptcy has long-term consequences for creditworthiness and may require the liquidation of assets. On the other hand, debt consolidation involves combining multiple debts into a single payment. This can be achieved through a consolidation loan or a debt management program. Debt consolidation simplifies repayment by streamlining multiple payments into one and potentially reducing interest rates. Unlike bankruptcy, debt consolidation does not eliminate the debts but makes them more manageable. • Immediate Relief From Creditor Actions and Harassment: Upon filing for bankruptcy, an automatic stay is initiated, halting most collection actions by creditors. This provides immediate protection from creditor harassment, collection calls, wage garnishments, and even potential lawsuits. • Potential Elimination of Most or All Debts: One of the primary benefits of bankruptcy is the potential discharge of eligible debts. This means that you are no longer legally obligated to repay those debts, providing a fresh start and relief from the burden of unmanageable financial obligations. • A Fresh Start to Rebuild Financial Stability: Perhaps one of the most significant advantages of bankruptcy is the opportunity for a fresh financial start. By eliminating or restructuring debts, individuals can begin rebuilding their credit and financial stability, paving the way for a better future. • Protection of Certain Assets Through Exemptions: Bankruptcy allows for the protection of certain assets through exemptions. These exemptions vary by state and can include your primary residence, vehicle, personal belongings, and retirement accounts. This means you can potentially keep these assets even after filing for bankruptcy. • Long-Lasting Impact on Creditworthiness : Bankruptcy has a significant and long-lasting impact on your credit score. It remains on your credit report for several years, making it challenging to access new credit or loans in the future. • Public Record of the Bankruptcy Filing : Filing for bankruptcy becomes a matter of public record, which means it can be accessed by potential employers, landlords, and others. This public record may affect future employment prospects and financial opportunities. • Potential Loss of Non-exempt Assets: Depending on the type of bankruptcy filed, you may be required to surrender non-exempt assets to repay creditors. This could include valuable possessions, real estate, or other property that you own. • Limited Access to Credit in the Short Term : After filing for bankruptcy, obtaining new credit can be difficult. Lenders may be hesitant to extend credit or charge high interest rates due to the perceived risk associated with bankruptcy. • Simplified Repayment With a Single Monthly Payment: By combining multiple debts into a single payment, individuals can streamline their monthly obligations and avoid the hassle of managing multiple due dates and payment amounts. • Potential Reduction in Interest Rates and Fees: By consolidating debts, individuals may qualify for a lower interest rate, which can save them money over time. • Increased Organization and Clarity in Managing Debts: Provides individuals with a structured approach to managing their debts, helping them regain control of their financial situation. • Preservation of Credit Score Compared to Bankruptcy: By making timely payments and effectively managing the consolidated debt, individuals can maintain or even improve their credit scores. • Potential for Higher Total Interest Paid Over Time: Consolidating multiple debts into one may lead to an extended repayment period, resulting in higher interest costs in the long run. • Continued Responsibility for Repaying the Consolidated Debts: Without addressing the root causes of debt accumulation, individuals may continue to accrue new debts even after consolidation, further exacerbating their financial situation. • Possible Involvement of Third-Party Debt Consolidation Companies With Associated Fees: These fees can add to the overall cost of debt repayment and should be considered when evaluating the viability of debt consolidation as an option. • Need for Discipline to Avoid Accumulating New Debts: It is crucial to carefully weigh the drawbacks and disadvantages of debt consolidation against its potential benefits, considering individual financial circumstances and long-term financial goals. The severity of the debt and individual financial circumstances play a significant role in determining the appropriate strategy. Bankruptcy may be more suitable for individuals with overwhelming debts and limited means to repay, while debt consolidation may work well for those with manageable debts and stable income. Understanding the legal and credit implications is crucial in making an informed decision. Bankruptcy has more significant legal consequences and a lasting impact on creditworthiness, while debt consolidation may have a more favorable credit impact. Consider long-term financial goals and the ability to repay debts over time. Bankruptcy provides a fresh start but with certain restrictions, while debt consolidation focuses on repaying debts in a structured manner without discharging them entirely. Assessing personal financial circumstances, debt levels, income stability, and long-term goals is essential. This evaluation helps determine the most suitable strategy to achieve financial stability and debt relief. Consulting with financial advisors, bankruptcy attorneys, or credit counselors is crucial to fully understand the options available. These professionals can provide personalized advice and guide individuals in making informed decisions based on their unique situations. Choosing between bankruptcy and debt consolidation requires a thorough understanding of their differences, benefits, drawbacks, and the individual's financial circumstances. Bankruptcy provides a fresh start by discharging debts but with long-term credit and legal implications. Debt consolidation offers the opportunity to simplify repayment and potentially reduce interest rates but requires continued responsibility for repaying the debts. Evaluating factors such as debt severity, legal implications, credit impact, and long-term financial goals is crucial in making an informed decision. Seeking professional guidance ensures that individuals receive personalized advice and navigate the complexities of their financial situations effectively. Ultimately, the right choice will depend on the individual's unique circumstances and goals for achieving financial stability and debt relief.Bankruptcy vs Debt Consolidation: Overview

Benefits and Risks of Bankruptcy vs Debt Consolidation

Bankruptcy Benefits and Advantages

Bankruptcy Risks and Disadvantages

Benefits-and-Drawbacks-of-Bankruptcy

Debt Consolidation Benefits and Advantages

Debt Consolidation Drawbacks and Disadvantages

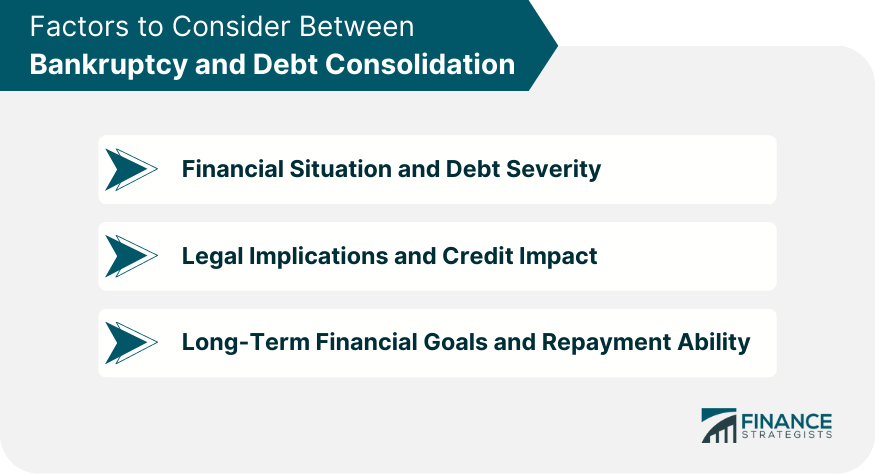

Factors to Consider Between Bankruptcy and Debt Consolidation

Financial Situation and Debt Severity

Legal Implications and Credit Impact

Long-Term Financial Goals and Repayment Ability

Making an Informed Decision Between Bankruptcy and Debt Consolidation

Evaluate Individual Circumstances

Seek Professional Guidance

Conclusion

Bankruptcy vs Debt Consolidation FAQs

Bankruptcy involves the legal discharge of debts, while debt consolidation combines multiple debts into a single payment. Bankruptcy provides a fresh start by eliminating debts, while debt consolidation simplifies repayment without eliminating the debts.

The choice between bankruptcy and debt consolidation depends on individual circumstances. Bankruptcy offers a clean slate but has long-term credit implications. Debt consolidation helps manage debts but requires continued repayment. Consulting a financial professional can help determine the best option.

Bankruptcy has a significant impact on credit, staying on your credit report for several years. Debt consolidation may have a temporary impact on credit, but with responsible payment, it can help improve your credit over time.

Yes, individuals with limited income can consider both bankruptcy and debt consolidation. Bankruptcy may be more suitable for those with overwhelming debts and limited means to repay, while debt consolidation can help manage debts with a structured repayment plan.

While it's possible to navigate bankruptcy or debt consolidation on your own, seeking professional help is highly recommended. Financial advisors, bankruptcy attorneys, or credit counselors can provide expert guidance, ensure you understand the implications, and help you make informed decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.