The answer to this question depends on several legal factors and options, including the type of bankruptcy and marital property laws. Bankruptcy is a legal process where individuals, businesses, or organizations can seek relief from overwhelming debt. However, for married individuals or those in domestic partnerships, filing for bankruptcy can be complicated. When considering filing for bankruptcy without a spouse, there are several factors to consider, including the type of bankruptcy, community property states, and marital property laws. The first factor to consider when filing for bankruptcy without a spouse is the type of bankruptcy. The two most common types of bankruptcy are Chapter 7 and Chapter 13 bankruptcy. Chapter 7 bankruptcy, also known as liquidation bankruptcy, is designed to help individuals or businesses discharge their debts by selling off their assets and using the proceeds to pay off their creditors. In this type of bankruptcy, a court-appointed trustee is responsible for overseeing the liquidation process and distributing the proceeds to creditors. If one spouse files for Chapter 7 bankruptcy, all assets, including those jointly owned by the other spouse, are considered part of the bankruptcy estate and are subject to liquidation. On the other hand, Chapter 13 bankruptcy, also known as reorganization bankruptcy, is designed to help individuals restructure their debt and repay their creditors over a three to five-year period. In a Chapter 13 bankruptcy, the debtor creates a repayment plan that outlines how they will repay their creditors. Unlike in Chapter 7 bankruptcy, in a Chapter 13 bankruptcy, the debtor's assets are not liquidated to pay off their creditors. The debtor makes monthly payments to a court-appointed trustee, who then distributes the funds to the creditors according to the repayment plan. If a couple files for Chapter 13 bankruptcy jointly, the repayment plan is based on the couple's combined income and debts. However, if only one spouse files for Chapter 13 bankruptcy, only their assets and income are considered in the repayment plan. In other words, the non-filing spouse's assets and income are not used to pay off the debtor's creditors. This can be advantageous if the non-filing spouse has significant assets that they do not want to liquidate to pay off the debtor's creditors. Another factor to consider is whether the state in which the couple resides is a community property state. In community property states, all property acquired during the marriage is considered joint property, and both spouses are responsible for debts incurred during the marriage. In such states, if one spouse files for bankruptcy, the other spouse may still be liable for any joint debts. However, if the couple files for bankruptcy jointly, the bankruptcy court can discharge joint debts, and both spouses can receive a fresh start. Marital property laws also vary by state and can impact bankruptcy filings. In some states, marital property includes all assets and debts acquired during the marriage, regardless of whose name is on the title or the account. In other states, marital property includes only assets and debts acquired jointly by the couple. In states where marital property includes all assets and debts acquired during the marriage, the bankruptcy court may consider all property, regardless of whose name is on it, when determining whether the filer qualifies for Chapter 7 bankruptcy. However, in states where marital property includes only joint assets and debts, only the debtor's property is used to determine eligibility for Chapter 7 bankruptcy. If one spouse wishes to file for bankruptcy without the other, there are several options available, including filing individually, filing jointly, and exceptions to the joint filing. Filing individually means that only one spouse files for bankruptcy. This option is appropriate when the spouse filing for bankruptcy has significant debt in their name alone or when the other spouse has good credit and wants to protect it. One of the advantages of filing individually is that it allows the non-filing spouse to keep their assets and credit score unaffected by bankruptcy. However, the disadvantage is that the non-filing spouse may still be responsible for any joint debts. Filing jointly means that both spouses file for bankruptcy together. This option is appropriate when both spouses have significant debt and want to discharge it and receive a fresh start. One of the advantages of filing jointly is that it allows both spouses to receive a fresh start, and the bankruptcy court can discharge all joint debts. However, the disadvantage is that both spouses' credit scores will be impacted by bankruptcy filing. There are exceptions to joint filing, including when one spouse is not eligible to file for bankruptcy or when joint filing is not in the best interest of both spouses. If one spouse is not eligible to file for bankruptcy, the other spouse may file individually. For example, if one spouse recently filed for bankruptcy and received a discharge, they may not be eligible to file again for several years. In this case, the other spouse may file individually to discharge their own debts. If joint filing is not in the best interest of both spouses, one spouse may file individually. For example, if one spouse has a significant amount of non-exempt assets that would be subject to liquidation in Chapter 7 bankruptcy, they may choose to file individually to protect their assets. In this case, the other spouse may not want to file jointly because their assets would also be subject to liquidation. Filing for bankruptcy is a complex legal process that can be even more complicated for married individuals or those in domestic partnerships. When considering filing for bankruptcy without a spouse, it is essential to consider the type of bankruptcy, community property states, and marital property laws. There are several options available, including filing individually, filing jointly, and exceptions to the joint filing. It is crucial to seek legal advice when considering bankruptcy filing without a spouse to ensure that the best option is chosen for both spouses. Seeking the assistance of a financial advisor is essential to ensure that the best option is chosen for both spouses. Can I File Bankruptcy Without My Spouse?

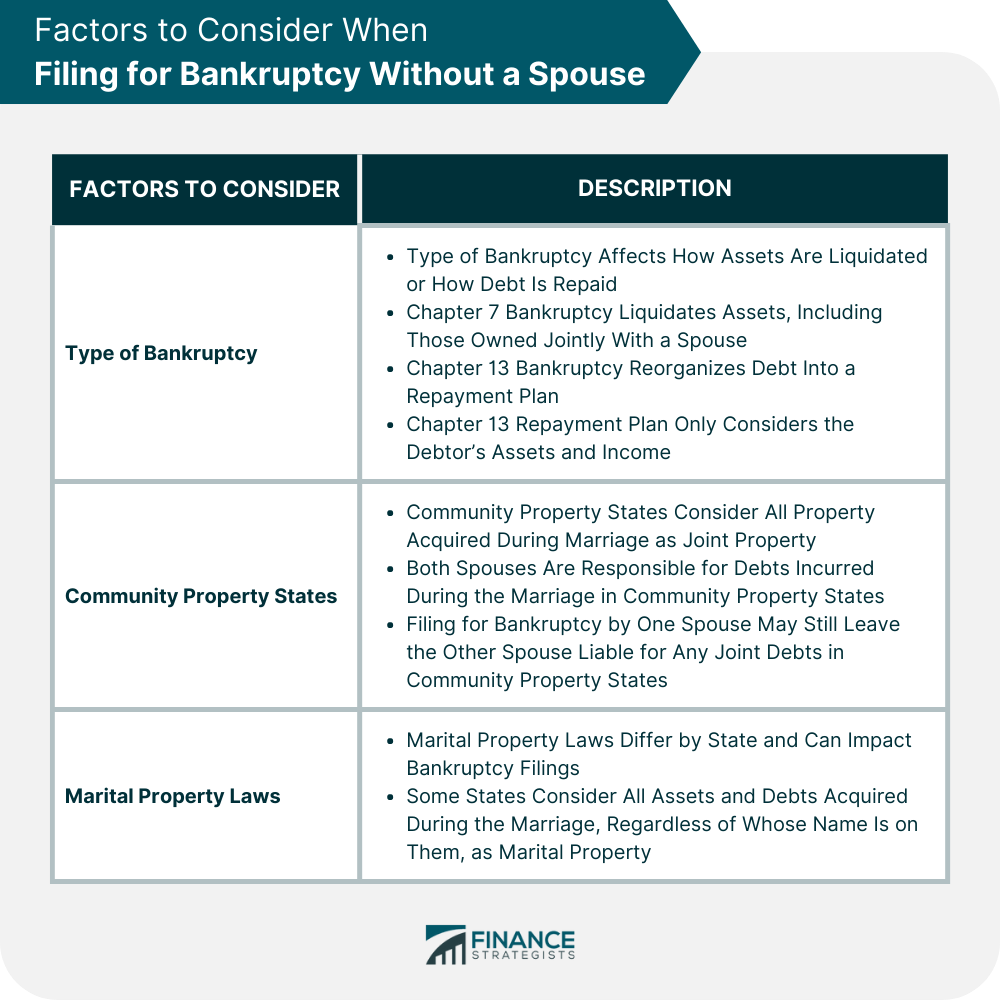

Factors to Consider When Filing for Bankruptcy Without a Spouse

Type of Bankruptcy

Chapter 7 Bankruptcy

Chapter 13 Bankruptcy

Community Property States

Marital Property Laws

Options for Filing Bankruptcy Without a Spouse

Filing Individually

Filing Jointly

Exceptions to Joint Filing

Final Thoughts

Can I File Bankruptcy Without My Spouse? FAQs

Yes, you can file for bankruptcy without involving your spouse if you live in a community property state. However, your spouse may still be responsible for any joint debts, and the bankruptcy court may consider all property acquired during the marriage.

If only one spouse has significant debt, it may be better to file individually. This option allows the non-filing spouse to keep their assets and credit score unaffected by bankruptcy. However, the non-filing spouse may still be responsible for any joint debts.

When one spouse files for bankruptcy, joint debts may be discharged in the bankruptcy. However, the non-filing spouse may still be responsible for any joint debts.

Yes, both spouses can file for bankruptcy separately. This option may be appropriate if both spouses have significant debt in their names alone, or if one spouse recently received a discharge in bankruptcy and is not eligible to file again.

Yes, seeking legal advice before filing for bankruptcy without your spouse is essential. Bankruptcy can have significant legal and financial implications, and an experienced attorney can help you navigate the process and choose the best option for your situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.