A judgment is a court's final decision in a lawsuit. When a creditor wins a judgment against a debtor, the latter is legally obligated to fulfill the court-mandated requirements. These may include repaying a debt or halting certain actions. Bankruptcy filings can have considerable implications on such judgments. They may provide a debtor relief from some judgments by discharging certain debts. However, the degree to which bankruptcy can aid a debtor largely depends on the nature of the debt and judgment, making an understanding of specific debt types crucial. Judgments can often be discharged in bankruptcy, but certain exceptions apply. In these situations, the debtor remains responsible for these debts even after bankruptcy proceedings. Several types of debts stand as exceptions to dischargeability in bankruptcy. Having a clear understanding of these exceptions is crucial when navigating the complex process of bankruptcy. Debts accrued through fraud or deliberate misbehavior are typically non-dischargeable in bankruptcy. If a debtor deliberately deceives a creditor to acquire funds or assets, this constitutes fraud. For example, a debt acquired by knowingly providing false financial information to a creditor would fall under this category. Similar to debts from fraudulent activities, debts that arise from deliberate and harmful actions are also typically non-dischargeable in bankruptcy. These might include damages awarded due to assault, defamation, or other intentional torts. Tax-related debts often maintain their steadfastness in the face of bankruptcy. These include recent tax obligations, tax liens, and certain payroll taxes. However, there can be exceptions, making it important to consult a bankruptcy professional for advice about specific situations. Bankruptcy law ensures the continued fulfillment of obligations toward one's family, which includes alimony and child support payments. These are considered non-dischargeable debts, highlighting the law's prioritization of these obligations. Student loan debts are notoriously difficult to discharge in bankruptcy. While it is possible in rare cases where the debtor can prove undue hardship, most student loan debts survive the bankruptcy process, leaving the debtor still responsible for repayment. Apart from the aforementioned categories, other non-dischargeable judgments include debts for personal injury caused by drunk driving and certain condo or cooperative housing fees. Again, it's essential to consult with a bankruptcy attorney for specific advice related to individual circumstances. Filing for bankruptcy is the first step in potentially discharging judgment debts. The type of bankruptcy filed, Chapter 7 or Chapter 13, can impact what debts can be discharged. An attorney can provide guidance on which option best suits a debtor's financial situation. During bankruptcy proceedings, full disclosure of all debts, including judgments, is required. This transparency allows the court to accurately assess a debtor's financial situation and determine what debts can be discharged. It is crucial for a debtor to provide complete and accurate information to avoid legal complications. This determination is often complex, fact-specific, and dependent on numerous factors, including the nature of the debt and any accompanying judgments. Legal counsel is invaluable in navigating these intricacies. Certain factors can influence whether or not a judgment is dischargeable in bankruptcy. These include the nature of the debt, the timing of the judgment, and any fraudulent or willful conduct associated with the debt. Certain types of debts, like domestic support obligations and criminal fines, are generally non-dischargeable. Other types, like credit card debt or personal loans, are usually dischargeable. The timing of the judgment can also impact its dischargeability. If a creditor has secured a judgment against a debtor shortly before the debtor files for bankruptcy, the creditor might allege that the debt is non-dischargeable due to fraud. If a debt arises from fraudulent or willful conduct on the debtor's part, it is typically non-dischargeable. Fraudulent conduct could involve incurring debts with no intention to repay them, while willful conduct might include deliberate actions that cause injury to another party. Judgments can often be discharged but specific types of debts and judgments may remain non-dischargeable. Exceptions to dischargeability include debts resulting from fraud or intentional wrongdoing, debts arising from willful and malicious injury, certain tax-related debts, debts for domestic support obligations, and student loan debts. Other non-dischargeable judgments may involve personal injury caused by drunk driving and certain housing fees. Filing for bankruptcy, disclosing judgment debts during proceedings, and working with an attorney are essential steps. Determining dischargeability involves analyzing factors such as the nature of the debt, timing of the judgment, and any fraudulent or willful conduct associated with the debt. By understanding these principles and seeking professional advice, individuals can make informed decisions about their financial future when facing judgments and considering bankruptcy.Overview of Judgments and Bankruptcy

Can Judgments Be Discharged in Bankruptcy?

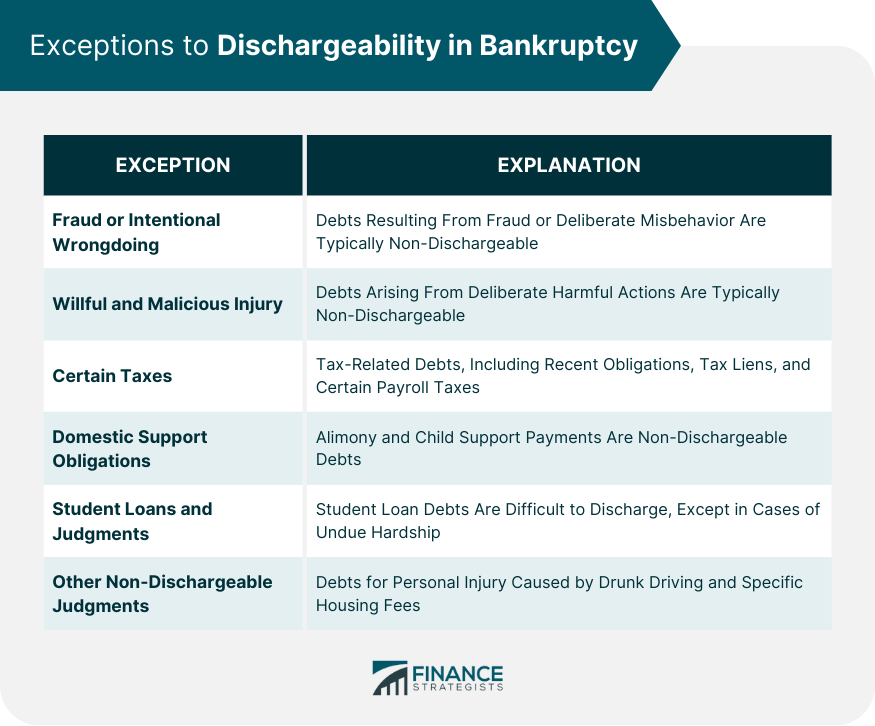

Exceptions to Dischargeability in Bankruptcy

Fraud or Intentional Wrongdoing

Willful and Malicious Injury

Certain Taxes

Domestic Support Obligations

Student Loans and Judgments

Other Non-Dischargeable Judgments

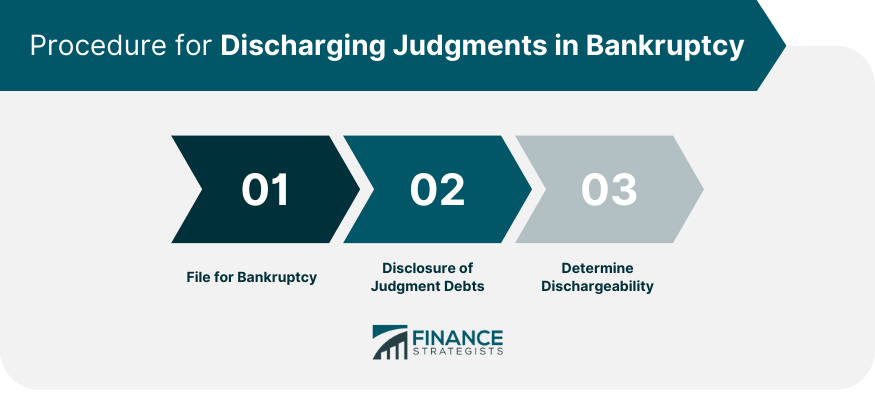

Procedure for Discharging Judgments in Bankruptcy

Filing for Bankruptcy

Disclosure of Judgment Debts

Determining Dischargeability

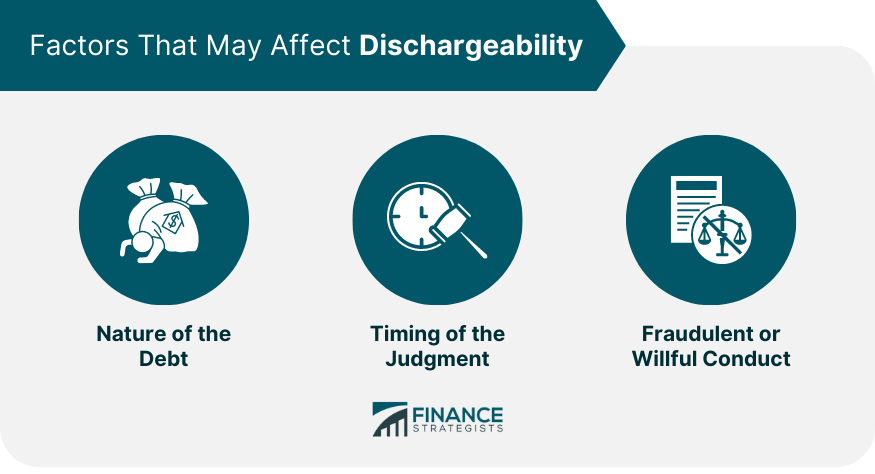

Factors That May Affect Dischargeability

Nature of the Debt

Timing of the Judgment

Fraudulent or Willful Conduct

Conclusion

Can Judgements Be Discharged in Bankruptcy? FAQs

A judgment is a court's decision in a lawsuit, often requiring a debtor to repay a creditor. In a bankruptcy context, some judgments can be discharged, providing relief to the debtor.

No, certain judgments cannot be discharged in bankruptcy. These typically include debts resulting from fraud, willful and malicious injury, certain taxes, domestic support obligations, and student loans, among others.

Non-dischargeable debts include those resulting from fraud or intentional wrongdoing, willful and malicious injury, certain taxes, domestic support obligations, student loans, and certain other specified debts.

The dischargeability of debts is determined during the bankruptcy process, depending on several factors. These include the nature of the debt, the type of bankruptcy filed, and the specific circumstances surrounding each debt.

The first step to potentially discharging judgments in bankruptcy is filing for bankruptcy. The type of bankruptcy filed, either Chapter 7 or Chapter 13, can impact the types of debts that can be discharged.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.