Medical debt is a major financial burden for many Americans. According to a survey conducted by the Kaiser Family Foundation, one in four Americans struggles to pay their medical bills. Medical debt can quickly accumulate, leaving individuals with few options for managing their finances. Bankruptcy is a solution that many individuals turn to when they are unable to pay off their medical bills. Bankruptcy can provide relief to people struggling with medical debt. There are two types of bankruptcy available for individuals filing for bankruptcy on medical bills: Chapter 7 and Chapter 13 bankruptcy. Also known as liquidation bankruptcy, it is the most common type of bankruptcy. It involves the liquidation of the debtor's non-exempt assets. The proceeds from the sale of these assets are used to pay off creditors. Medical bills are considered unsecured debt and can be discharged in Chapter 7 bankruptcy. To qualify, an individual must pass the means test, which compares the individual's income to the state average. If the individual's salary is below the median income, they are eligible for Chapter 7 bankruptcy. If their income exceeds the state average, they must pass a second means test to determine their eligibility. It is also known as a reorganization bankruptcy. It allows the debtor to keep their assets and create a repayment plan to pay off their debts over a period of three to five years. Medical bills can be included in the repayment plan. To qualify for Chapter 13 bankruptcy, the individual must have a regular income, their unsecured debt must be less than $419,275, and secured debt must be less than $1,257,850. To file for bankruptcy on medical bills, the individual must be a U.S. citizen or legal resident, and they must have lived in the state where they are filing for at least 90 days. They must also have completed credit counseling within 180 days before filing for bankruptcy. The individual must provide documentation, including proof of income, tax returns, bank statements, and a list of their assets and liabilities. They must also provide a list of their creditors, including medical providers. Outlined below are the crucial steps: Before filing for bankruptcy, the individual must receive credit counseling from an approved agency. This counseling is designed to help the individual evaluate their financial situation and explore alternative options to bankruptcy. Once the credit counseling is complete, the individual must file a petition and schedules with the bankruptcy court. The petition includes information about the individual's income, expenses, debts, and assets. The schedules include a list of creditors and their claims against the individual. It is important to note that the individual must provide accurate and complete information, as any omissions or false statements can result in the dismissal of the case or other penalties. A meeting of creditors is scheduled next. The individual must attend this meeting and answer questions under oath about their financial situation. This meeting is presided over by a trustee appointed by the bankruptcy court, who will review the case and ask questions about the individual's finances. The creditors are also given an opportunity to ask questions about the individual's finances, but it is rare for creditors to attend these meetings. Debtor Education The course can be taken online or in person. The individual filing for bankruptcy on medical bills must provide proof of completion to the bankruptcy court. The length of time for resolving medical debt through bankruptcy can vary depending on the bankruptcy type filed. Chapter 7 bankruptcy typically takes four to six months from the filing date to the discharge of debts. Chapter 13 bankruptcy can take three to five years to complete the repayment plan and receive a discharge of debts. Individuals filing for bankruptcy on medical bills must ensure compliance with all requirements and work with an attorney or other experts for timely resolution of their debts. Consider the following: Bankruptcy can provide relief by discharging medical debt, which means that the individual is no longer legally responsible for paying the debt. It can also put an automatic stay on creditor collection efforts, including phone calls, letters, and legal actions. Lastly, individuals a given a fresh start for finances. Medical debt elimination allows a person to rebuild their credit score and financial situation. Filing for bankruptcy on medical bills can have a long-term impact on an individual’s credit score. It can have a negative impact on an individual's credit score for up to ten years, depending on the bankruptcy type and other circumstances. Another disadvantage involves the costs and fees associated with bankruptcy. The process can be quite expensive, with expenses ranging from $1,500 to $3,000 or more in filing fees and attorney costs. Depending on the bankruptcy type, the process may also result in the loss of assets. In Chapter 7 bankruptcy, the individual may lose non-exempt assets in the liquidation process. Bankruptcy is not the only solution for managing medical debt and must be seen as a last resort. There are several alternatives that individuals can consider before filing for bankruptcy. Individuals can consult and try to reach an accommodation with medical providers to reduce their medical bills or establish a payment plan. Some medical providers may be willing to reduce the debt if the individual is experiencing financial hardship. It works by combining multiple medical bills into a single debt, which can be paid off over time through monthly payments. Debt consolidation can be done through methods such as obtaining a debt consolidation loan or a credit card balance transfer. However, debt consolidation may not be an effective solution for everyone and it is important to consider all options and consult with a financial professional or credit counselor. This alternative works by working with medical providers or debt collectors to settle medical debts for a reduced amount. The individual typically offers a lump sum payment or a payment plan to settle the debt. Debt settlement can also have negative consequences on credit scores and it is important to consider all options. Individuals can file for bankruptcy on medical bills. The two types of bankruptcy available are Chapter 7 and Chapter 13. Filing for bankruptcy requires eligibility and documentary requirements to be met. While bankruptcy can provide relief from medical debt, there are pros and cons to consider. On the one hand, bankruptcy can discharge medical debt and offer a fresh start for finances. On the other hand, bankruptcy can have a long-term impact on an individual's credit score, involve costly fees, and even result in the loss of assets. Before filing for bankruptcy, individuals should consider alternative options such as negotiation with medical providers, debt consolidation, and debt settlement. Bankruptcy must be considered a last resort. Consult with a qualified financial advisor or debt manager for expert guidance about the best course of action for their medical debt.Medical Bills and Bankruptcy: Overview

Can You File Bankruptcy on Medical Bills?

Individuals must also pass certain eligibility requirements and submit pertinent documents in filing for bankruptcy due to medical debt.Chapter 7 Bankruptcy

Chapter 13 Bankruptcy

Eligibility and Documentary Requirements for Filing Bankruptcy on Medical Bills

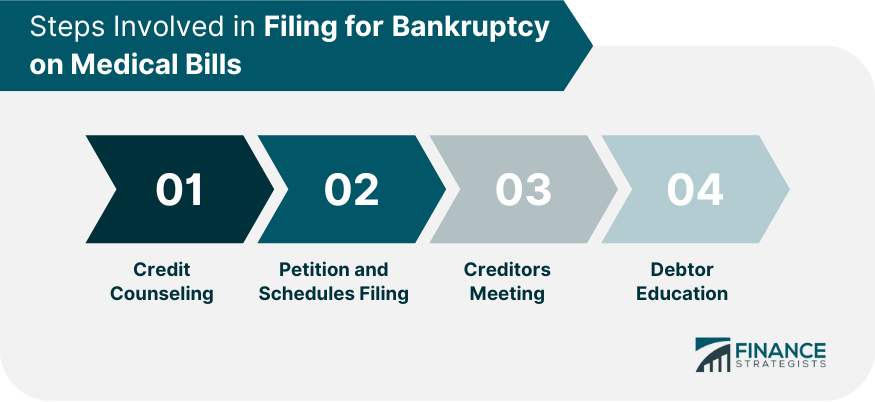

Steps Involved in Filing for Bankruptcy on Medical Bills

Credit Counseling

During the counseling session, the individual will receive an evaluation of their financial situation, a discussion of their options for bankruptcy, and a personal budget plan.Petition and Schedules Filing

Creditors Meeting

The individual then completes a debtor education course before the discharge of debts can be granted. This course is designed to help individuals better understand how to manage their finances and avoid financial problems in the future.

Timeframe for Resolving Medical Debt Through Bankruptcy

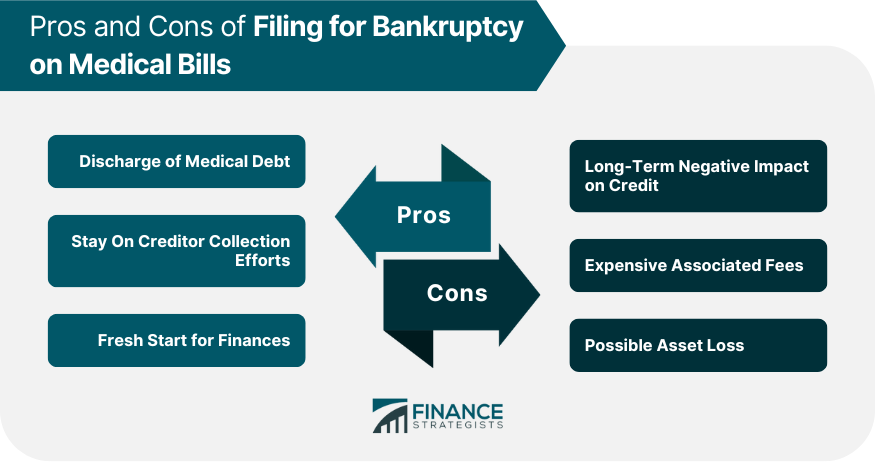

Other factors that can extend the timeframe include the case's complexity, court backlog, disputes from creditors or trustees, and failure to comply with bankruptcy requirements.Pros and Cons of Filing for Bankruptcy on Medical Bills

Advantages

Disadvantages

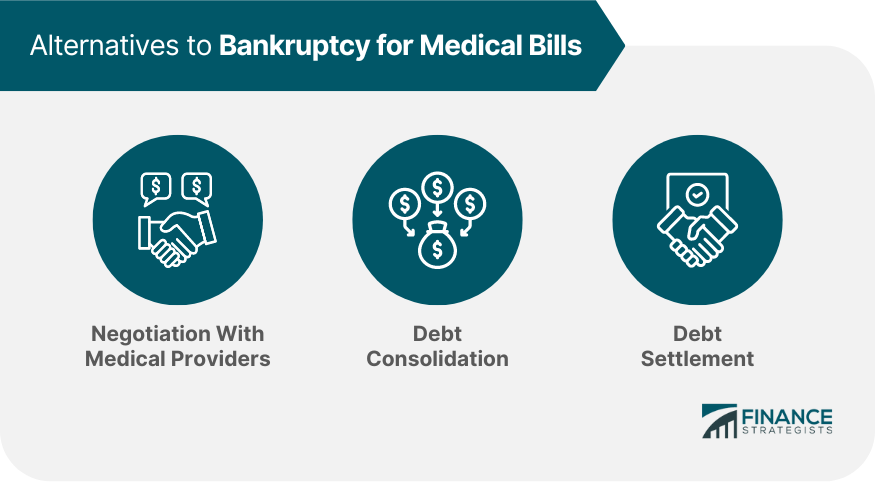

Alternatives to Bankruptcy for Medical Bills

Negotiation With Medical Providers

This alternative requires effective communication and timely payments based on the agreement with the medical provider. It can help to spread out the cost of medical bills over a longer period of time.Debt Consolidation

Debt Settlement

The Bottom Line

Key steps that need to be taken include credit counseling, filing the petition and schedules, meeting with creditors, and completing of debtor education.

Can You File Bankruptcy on Medical Bills? FAQs

Bankruptcy is a legal process that provides relief to individuals struggling with overwhelming debt, including medical bills. Bankruptcy can eliminate or reduce medical debt, stop creditor collection efforts, and provide a fresh start for an individual's finances.

There are two types of bankruptcy available for medical bills: Chapter 7 bankruptcy and Chapter 13 bankruptcy. Chapter 7 bankruptcy involves the liquidation of non-exempt assets to pay off debts, while Chapter 13 bankruptcy allows individuals to keep their assets and create a repayment plan to pay off debts over a period of three to five years.

To be eligible to file for bankruptcy on medical bills, individuals must meet certain eligibility requirements, including passing a means test to determine their income level, and submitting pertinent documentation to the bankruptcy court, including proof of income, tax returns, bank statements, and a list of assets and liabilities.

The length of time it takes to resolve medical debt through bankruptcy depends on the type of bankruptcy filed. Chapter 7 bankruptcy typically takes four to six months from the filing date to the discharge of debts, while Chapter 13 bankruptcy can take three to five years to complete the repayment plan and receive a discharge of debts.

Yes, there are several alternatives to filing for bankruptcy for medical bills, including negotiation with medical providers to reduce medical bills or establish a payment plan, debt consolidation, and debt settlement. It is important to consider all options and seek professional advice before making a decision.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.