When it comes to tax debt, there are some specific requirements that must be met in order for it to be discharged. It’s important to understand the ins and outs of filing bankruptcy on taxes before making any decisions. Ultimately, each situation is unique so researching all your options thoroughly is recommended if you’re considering filing for bankruptcy on your tax debts. Filing for bankruptcy does not automatically wipe away your tax debt. Depending on the type of bankruptcy you file, some of your tax debt may be discharged and some may remain. It is also significant to note that in order to qualify for most bankruptcies, there are some requirements that must be met. The requirements for tax discharge through bankruptcy include: By requiring that the debt be at least three years old, the government is essentially making sure that taxpayers don’t use bankruptcy as a way to avoid paying taxes that are due. Additionally, this rule also gives taxpayers time to carefully consider if discharging the tax debts through bankruptcy is really their best option. Filling a valid tax return two years prior ensures that your taxes have been accounted for and that all of your information is up-to-date and correct. Additionally, if you’ve failed to file taxes in the past, this requirement helps ensure that those returns are taken care of before any discharge of debts can occur. This requirement helps ensure that all debts owed to the IRS have been accounted for, and thus any discharges of debts will not lead to any surprises down the line. It's also crucial to note that this requirement applies even if the taxpayer is unaware of a tax debt – if it was incurred but not reported, the debt must still be recorded with the IRS before it can be discharged. This condition ensures that the taxpayer is not trying to evade their tax obligations, and it also serves as proof that they have no fraudulent intentions when filing for bankruptcy. This helps to ensure that the taxpayer's assets are not going to be seized by the IRS, and that they will still have access to them after the bankruptcy has taken place. When it comes to filing bankruptcy against tax debt, these are the main types: Chapter 7 is a type of bankruptcy in which the debtor's assets are liquidated to pay off creditors. This is usually not a good option for dealing with tax debt since the IRS will take precedence over other creditors and you may not have enough assets to pay the full amount. Chapter 13 allows for the restructuring of debts into an alternate repayment plan, with payments spread out over three to five years. This is often beneficial for those who owe more in taxes than they are able to pay immediately and need more time to pay it all off. Chapter 12 is specifically designed to provide relief for family farmers or fishermen whose income fluctuates yearly, allowing them to restructure their taxes into a payment plan that they can handle. Lastly, Chapter 11 is intended for corporations and business entities only, allowing them to reorganize their debts and restructure their obligations under the protection of the court system. Here are some important tips for filing bankruptcy against tax debt: Understand the different types of bankruptcies and decide which type suits your situation best. Calculate how much money you owe in taxes in order to determine if filing bankruptcy would be beneficial. Make sure that all applicable forms and documents have been filled out accurately before submitting them to the court. Seek professional advice from a tax attorney or accountant if you are unsure about anything related to the process. File as soon as possible; delaying filing could result in harsher penalties and put your financial future at risk. Before filing for bankruptcy against tax debt, you should consider other alternatives. Some alternatives include: One option is to set up an IRS installment plan. This allows the taxpayer to make regular payments on the total amount owed rather than making a single lump sum payment. Depending on individual circumstances and income level, this may be an easier way to manage the debt without resorting to bankruptcy. The IRS also offers its “Offer in Compromise” program as another alternative. Through this program, qualified taxpayers may be able to settle their tax debts for less than they owe by making a one-time payment or setting up a payment plan with the IRS. The terms of this agreement will depend on individual financial situations, so it is essential that any offers made are accurate and realistic. It is possible to file bankruptcy on taxes, though it should only be done in certain circumstances and after exploring all other available options. It is a serious decision that requires proper guidance from an experienced professional. Certain types of tax debt may qualify for discharge under bankruptcy. However, it's crucial to recognize that not all types are eligible for this type of relief. Furthermore, some additional requirements must be met in order to take advantage of these options. A qualified attorney or financial advisor can provide insight into which type of debt qualifies and what other steps must be taken in order to receive the maximum benefit from filing bankruptcy against taxes.Bankruptcy and Tax Debt Basics

Does Filing for Bankruptcy Wipe Your Tax Debt?

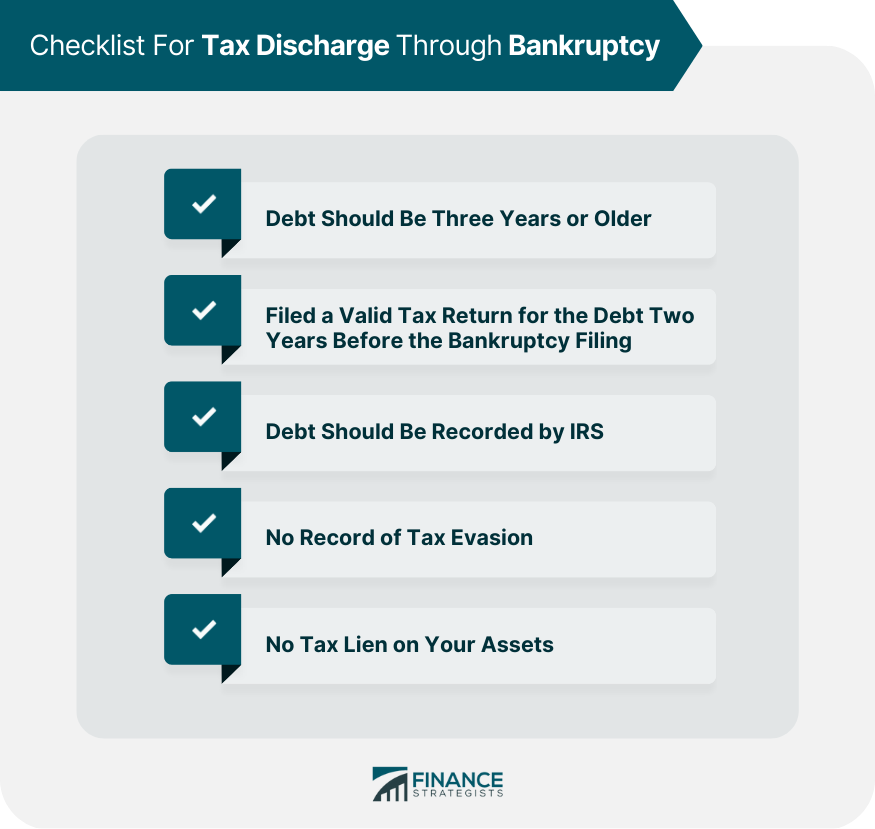

Requirements for Tax Discharge

Debt Should Be Three Years or Older

Filed a Valid Tax Return for the Debt Two Years Before the Bankruptcy Filing

Debt Should Be Recorded by IRS

No Record of Tax Evasion

No Tax Lien on Your Assets

Types of Bankruptcy to Be Filed Against Tax Debt

Chapter 7

Chapter 13

Chapter 12

Chapter 11

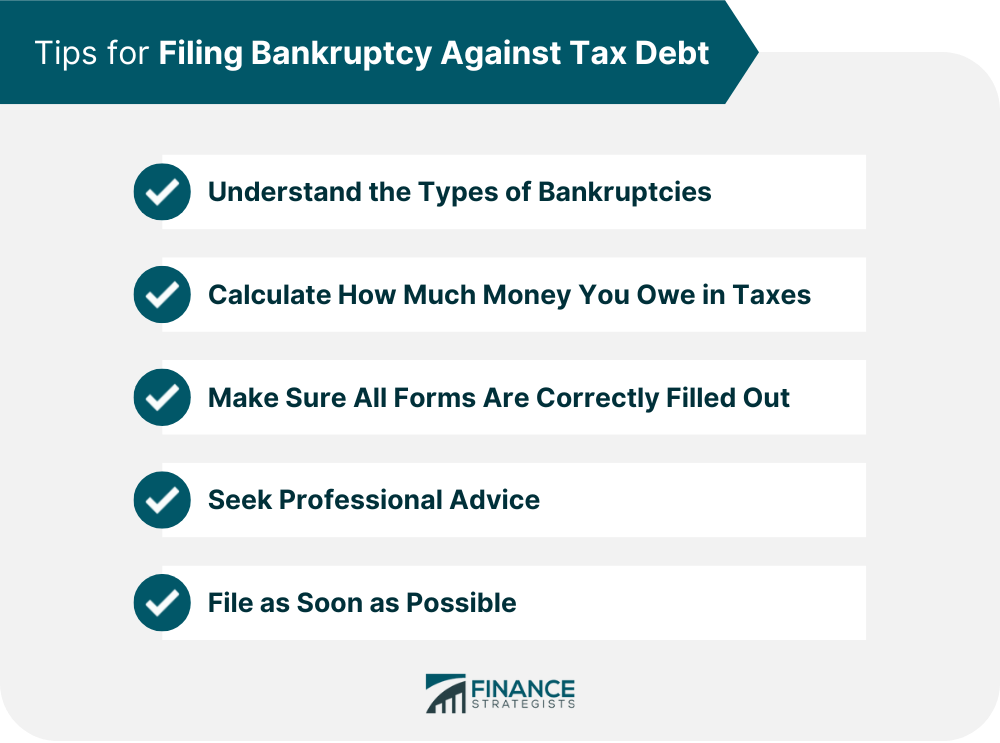

Tips for Filing Bankruptcy Against Tax Debt

Alternatives to Filing Bankruptcy Against Tax Debt

IRS Installment Plan

IRS “Offer in Compromise” Program

Final Thoughts

Can You File Bankruptcy on Taxes? FAQs

Yes, it is possible to file bankruptcy on taxes. However, It is vital to consult with a qualified attorney or financial advisor before making any decisions as this action can have a significant impact on your credit score and future financial health.

Alternatives to filing bankruptcy include setting up an IRS installment plan or pursuing an “Offer in Compromise” with the IRS. Depending on individual circumstances and income level, either of these may be more feasible than filing for bankruptcy against the tax debt.

The best way to determine which option is best for you is to discuss your specific situation with an experienced professional who can help guide you through the process. They will be able to assess your individual circumstances and advise you as to which course would be most beneficial for you in the long run.

Filing for bankruptcy affects your credit score significantly; however, this impact can vary depending on other factors, such as previous credit history and current liabilities or debts owed by the individual at the time they file their petition with the court.

Yes, there are additional requirements for filing bankruptcy against taxes that must be met in order to receive the maximum benefit from doing so. These will depend on the type of debt being discharged and the type of bankruptcy being filed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.