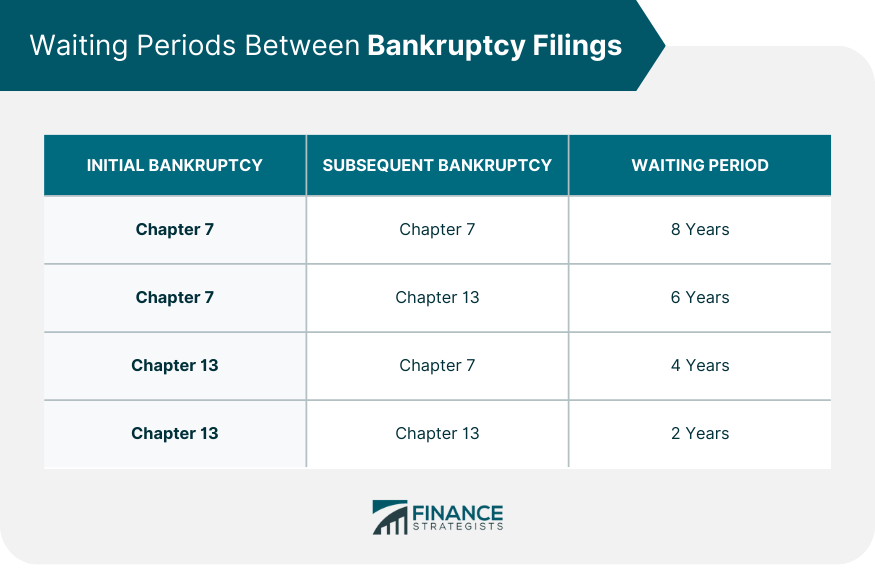

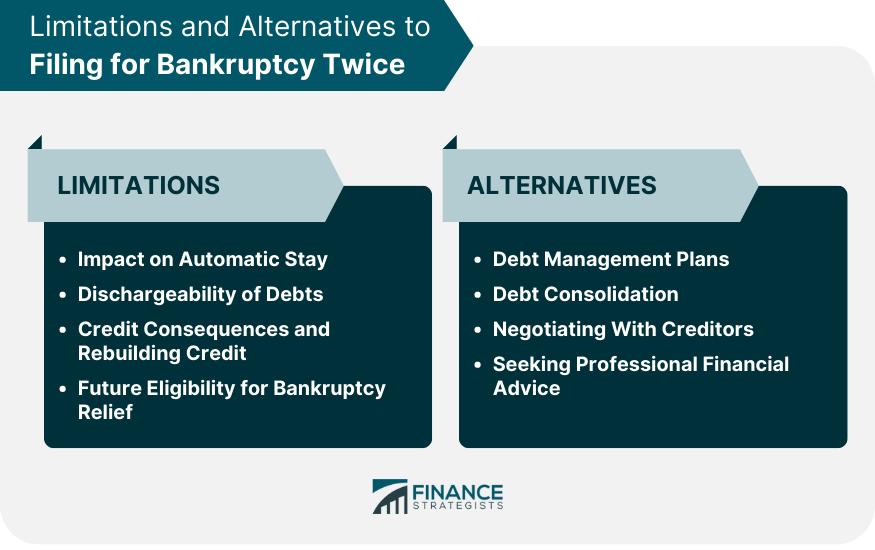

Bankruptcy is a federal legal process intended to help individuals and businesses eliminate or repay their debts under the protection of bankruptcy courts. It's a tool designed to provide financial relief to those who find themselves unable to meet their financial obligations. The main purpose of bankruptcy is to allow individuals or businesses a chance to start anew by discharging their debts or creating a manageable payment plan. It is not a license for financial irresponsibility but a lifeline for those who are struggling. Bankruptcy laws provide for the reduction, repayment, or elimination of certain debts, and can provide a timeline for the repayment of non-dischargeable debts over time. You can file for bankruptcy twice; however, there are limits to how often you can receive a discharge. In some cases, individuals might find themselves considering a second bankruptcy filing due to financial hardship. While it's indeed possible to file for bankruptcy more than once, certain rules and restrictions apply. The bankruptcy code provides specific time limits between bankruptcy filings, which can vary depending on the chapter under which you're filing. After receiving a discharge in a Chapter 7 bankruptcy, you must wait eight years from the date of your previous filing to file another Chapter 7 case. If you wish to file a second Chapter 13 case after receiving a discharge in the first, you need to wait two years from the date of the previous filing. To file a Chapter 13 after receiving a Chapter 7 discharge, commonly referred to as "Chapter 20," you must wait four years from the date of the Chapter 7 filing. In case you plan to file a Chapter 7 case after receiving a Chapter 13 discharge, a six-year waiting period applies, with some exceptions. The timetable is as follows: Chapter 7 after Chapter 7: every 8 years Chapter 7 after Chapter 13: after 6 years Chapter 13 after Chapter 7: after 4 years Chapter 13 after Chapter 13: every 2 years If you have waited the appropriate amount of time since your last bankruptcy, then the worst effect of filing twice will be the hit to your credit score. Bankruptcy usually affects high scores more than already low scores, so you may need to investigate for yourself how your credit will be impacted. Filing for bankruptcy twice comes with certain limitations and consequences, which include the impact on the automatic stay, dischargeability of debts, credit consequences, and future eligibility for bankruptcy relief. The automatic stay, a court order that temporarily halts creditors from collecting debts, has a limited duration if you file for bankruptcy again within one year. Not all debts are dischargeable in a second bankruptcy. For instance, if a debt was not discharged in a previous bankruptcy, you cannot discharge it in a subsequent bankruptcy case. A second bankruptcy will have a more severe impact on your credit and can remain on your credit report for up to 10 years. Rebuilding credit after a second bankruptcy will require discipline, patience, and sound financial practices. Frequent bankruptcy filings can affect your eligibility for future relief. Some courts might deny a discharge if they find that the debtor has abused the bankruptcy process. Before deciding to file for bankruptcy a second time, it's important to explore other possible alternatives, which could be more beneficial in the long term. Debt management plans, facilitated by credit counseling agencies, can help you manage your debt by reducing interest rates and eliminating late fees. Debt consolidation involves taking out a new loan to pay off your current debts. This could help you manage your debts more effectively if you secure a lower interest rate or monthly payment. In some cases, creditors might be willing to negotiate the repayment terms of your debt. They may agree to reduce the overall amount of debt, lower the interest rate, or extend the repayment period. Professional financial advisors can provide personalized advice on debt management based on your financial situation. They can help you devise a realistic budget, negotiate with creditors, and explore alternatives to bankruptcy. The U.S. Bankruptcy Code provides for various types of bankruptcy, each suited to different circumstances and financial situations. Chapter 7, also known as "liquidation" bankruptcy, is designed to erase most types of unsecured debt. The trustee (the individual overseeing the bankruptcy) may sell certain property to repay creditors. To qualify for Chapter 7, you must pass the "means test," which compares your income to the median in your state for a household of your size. If your income is too high, you may have to file under Chapter 13 instead. Chapter 13, or "wage earner's" bankruptcy, is aimed at individuals who earn regular income but struggle to pay their debts. It allows them to propose a plan to repay all or part of their debts over three to five years. To be eligible for Chapter 13, you must have regular income and debts within certain limits set by the bankruptcy code. Your proposed repayment plan must account for secured debts and priority unsecured debts like alimony, child support, and certain tax obligations. It is possible to file for bankruptcy twice; however, there are restrictions and considerations to keep in mind. Additionally, frequent bankruptcy filings may impact your future eligibility for bankruptcy relief. The U.S. Bankruptcy Code provides various bankruptcy options, such as Chapter 7 and Chapter 13, each with specific eligibility criteria. The time restrictions for filing a second bankruptcy depend on the chapter under which you previously filed. It is crucial to be aware of the impact on debts, credit consequences, and limitations of a second bankruptcy filing. Your credit score will be affected, and the bankruptcy can remain on your credit report for up to 10 years. Exploring alternatives, such as debt management plans, debt consolidation, negotiating with creditors, or seeking professional financial advice, may provide more beneficial long-term solutions.What Is Bankruptcy?

Possibility of Filing for Bankruptcy Twice

Time Restrictions for Filing a Second Bankruptcy

Chapter 7 to Chapter 7 Bankruptcy

Chapter 13 to Chapter 13 Bankruptcy

Chapter 7 to Chapter 13 Bankruptcy

Chapter 13 to Chapter 7 Bankruptcy

How Bad Is It to File Bankruptcy Twice?

Limitations and Consequences of Second Bankruptcy Filing

Impact on Automatic Stay

Dischargeability of Debts

Credit Consequences and Rebuilding Credit

Future Eligibility for Bankruptcy Relief

Alternatives to Filing for Bankruptcy Twice

Debt Management Plans

Debt Consolidation

Negotiating With Creditors

Seeking Professional Financial Advice

Filing for Bankruptcy

Chapter 7 Bankruptcy

Means Test for Chapter 7 Bankruptcy

Chapter 13 Bankruptcy

Income Requirements for Chapter 13 Bankruptcy

Conclusion

Can You File Bankruptcy Twice? FAQs

Yes, it is possible to file for bankruptcy more than once. However, the timing between filings must comply with certain guidelines established by federal law in order to be approved by the court.

The minimum waiting period required between two filing of Chapter 7 is 8 years and 4 years for Chapter 13. It’s important to note that if your first filing was dismissed because of fraud or failure to appear in court, you may need to wait longer before filing again.

Attempting to file a second bankruptcy before the required waiting period is over can result in your filing being denied or dismissed. In some cases, the court may find that you acted in bad faith and deny any further bankruptcy filings for up to 10 years.

Filing for bankruptcy a second time can provide relief from debt that was not discharged in the first filing. It may also be beneficial if your income has increased since the last filing or your financial situation has changed significantly.

Yes, it is possible that your credit score will drop after filing for bankruptcy multiple times, however this is dependent on other factors such as using credit responsibly after filing. Additionally, your credit score will start to improve over time as you manage and pay off debts diligently.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.