Chapter 11 bankruptcy is a legal process that allows businesses and individuals to restructure their finances and repay their debts over time. It gives debtors a chance to continue operating their businesses or retain control of their assets while they work on a plan to repay their debts. One of the main differences between Chapter 11 bankruptcy and other bankruptcy chapters is that Chapter 11 is designed for businesses and individuals with considerable debt. There is no debt limit for Chapter 11 bankruptcy, which means that businesses of any size can file for this type of bankruptcy. Chapter 11 bankruptcy is an attractive option for businesses that need to restructure their finances and continue operating. To qualify for Chapter 11 bankruptcy, the debtor must be an individual, corporation, or partnership. The debtor must also be engaged in commercial or business activities, and have a substantial amount of debt. Chapter 11 bankruptcy is typically used by businesses with complex financial structures or sizeable debts, but it can also be used by individuals with high levels of personal debt. There is no debt limit for Chapter 11 bankruptcy, which means that businesses of any size can file for this type of bankruptcy. However, the process can be complex and expensive, so it may not be appropriate for all debt-ridden businesses or individuals. The Chapter 11 bankruptcy process allows the debtor to retain control of their assets and continue operating their business while they work on a plan to repay their debts over time. Consider how Chapter 11 bankruptcy works: To start the Chapter 11 bankruptcy process, the debtor must prepare and file a bankruptcy petition with the bankruptcy court. The petition must include information about the debtor's assets, liabilities, income, expenses, and other financial information. Additionally, the debtor must provide a detailed plan for restructuring their finances and repaying their debts over time. It is one of the key features of Chapter 11 bankruptcy and starts once the bankruptcy petition is filed. The automatic stay prohibits creditors from taking any legal action against the debtor, including foreclosure, repossession, or lawsuits. This feature gives the debtor time to develop a reorganization plan without the pressure of ongoing legal action. The debtor then has the opportunity to construct a reorganization plan, which outlines how they will restructure their finances and repay their debts. The creditors will be given a chance to review the debtor’s proposed reorganization plan. If the plan is approved by a majority of the creditors, it will be submitted to the bankruptcy court for confirmation. Once approved, the bankruptcy court will review the reorganization plan to ensure that it meets the requirements of the bankruptcy code. After the plan is confirmed by the court, the debtor will be required to make payments according to the plan terms. The bankruptcy court plays a crucial part in overseeing the Chapter 11 bankruptcy process. The court's primary responsibility is to ensure that the debtor is complying with the requirements of the bankruptcy code and that the interests of the creditors are protected. The court may appoint a trustee to oversee the debtor's assets and operations during the bankruptcy process, and it must approve the reorganization plan developed by the debtor before it can be implemented. Additionally, the court may mediate disputes between the debtor and the creditors, approve major transactions, and provide guidance and assistance to the parties involved throughout the process. Described below are the advantages that Chapter 11 bankruptcy provides qualified businesses and individuals: Unlike other bankruptcy chapters, Chapter 11 lets the debtor continue operating their business while they work on a plan to repay their debts. This feature can help to preserve the value of the business and maintain the confidence of customers, suppliers, and employees. It gives the debtor a better chance of rebuilding their credit and settling their substantial debt. The automatic stay that goes into effect when the Chapter 11 bankruptcy petition is filed gives the debtor time to develop a reorganization plan. It prohibits creditors from taking any legal action against the debtor, including foreclosure, repossession, or lawsuits. Chapter 11 bankruptcy grants the debtor time to develop a reorganization plan without the pressure of ongoing legal action. It can help to prevent the loss of assets and the disruption of the debtor's operations during the bankruptcy process. The reorganization plan developed by the debtor may include provisions for reducing the debtor's debt, which can make it easier for them to repay their obligations over time. For example, the debtor may negotiate with their creditors to reduce the amount of debt owed, or they may seek to have unsecured debts discharged through the bankruptcy process. Chapter 11 bankruptcy provides debtors with a chance to restructure their finances and emerge from bankruptcy with a fresh start. It can be particularly valuable for businesses that have experienced financial difficulties but have the potential for long-term success. For individuals, Chapter 11 bankruptcy can provide a way to restructure their finances and establish a manageable repayment schedule. It can help alleviate financial stress and provide a path to a stronger financial future. Businesses and individuals with considerable debt must also consider the following before deciding to file for Chapter 11 bankruptcy: Chapter 11 bankruptcy is typically more expensive than other bankruptcy chapters due to the complex legal and financial requirements of the process. Debtors may need to hire attorneys, accountants, and other professionals to help them navigate the process, and these costs can add up quickly. Additionally, the bankruptcy court may require the debtor to pay various fees and costs associated with the bankruptcy process. All of these expenses can make Chapter 11 bankruptcy a costly and burdensome process. The Chapter 11 bankruptcy process can be lengthy, often taking months or even years to complete. It can be particularly challenging for businesses that need to restructure their finances quickly. Developing a reorganization plan, negotiating with creditors, and complying with the bankruptcy court may require significant time and resources. It can add strain for debtors already struggling to manage their finances and operations. While the debtor retains control of their assets and operations during the Chapter 11 bankruptcy process, the court may appoint a trustee to oversee their activities and ensure that they are complying with the provisions of the bankruptcy code. The bankruptcy court may also require the debtor to make significant changes to their operations or personal finances as part of the reorganization plan. It can be disruptive and may require giving up control over certain aspects of a debtor’s operations or personal life. Despite the debtor's and their advisors' efforts, the reorganization plan may not be successful. The case may ultimately result in a conversion to a Chapter 7 liquidation. It can be devastating for businesses and individuals who have invested time and resources in the bankruptcy process. Emerging from Chapter 11 bankruptcy may require ongoing effort to maintain financial stability. Debtors must be willing to comply with the requirements of the bankruptcy court and continue to manage their finances and operations carefully to ensure long-term success. While Chapter 11 bankruptcy is specifically designed for businesses and individuals with substantial debt, other bankruptcy chapters may be more appropriate depending on the debtor's financial situation. For example, Chapter 7 bankruptcy involves liquidating assets to pay off creditors and is typically used by individuals with little or no income or assets. Chapter 7 bankruptcy is commonly the quickest and least expensive form of bankruptcy. Still, it also involves the loss of many assets and can significantly impact the debtor's credit score. Chapter 13 bankruptcy, on the other hand, is a form of "reorganization" bankruptcy designed for individuals with regular income. Under Chapter 13 bankruptcy, the debtor develops a repayment plan that allows them to repay their debts over three to five years. Unlike Chapter 11 bankruptcy, Chapter 13 does not involve the appointment of a trustee, and debtors typically retain control over their assets and operations during the process. There are other options to Chapter 11 bankruptcy that debtors may consider, depending on their circumstances. These alternatives may be more appropriate for debtors with a smaller amount of debt or who do not have the resources to pursue a Chapter 11 bankruptcy. Consider the following: It involves negotiating with creditors to restructure the debt and reduce payments. Debt restructuring may involve extending the repayment period, reducing interest rates, or forgiving a portion of the debt. Debt restructuring can be a good option for debtors who have a steady income but are struggling to keep up with their payments. This alternative involves negotiating with creditors to settle the debt for less than the full amount owed. Debt settlement can be a good option for debtors who are unable to make their payments and are facing the possibility of bankruptcy. However, it can also hurt one’s credit score and may result in tax consequences. This process involves working with creditors to develop a repayment plan outside of the bankruptcy court. This option can be suitable for debtors who have a good relationship with their creditors and can negotiate a reasonable repayment plan. An out-of-court workout can be less expensive and time-consuming than Chapter 11 bankruptcy, but it may not provide the same legal protections and may be more difficult to enforce. Chapter 11 bankruptcy is a legal process that allows businesses and individuals with considerable debt to restructure their finances and repay their debts over time. It has no debt limits, making it suitable for all companies and individuals burdened with debt. While it has several advantages, such as continued business operation, an automatic stay of legal action from creditors, more time to develop a plan, and the chance for debt reduction, it also has some drawbacks. Chapter 11 bankruptcy can be expensive, time-consuming, and may result in losing control over certain aspects of one’s operations or personal life. Individuals and businesses with substantial debt must consider their options before filing for Chapter 11 bankruptcy. Alternatives to Chapter 11 bankruptcy include debt restructuring, settlement, and out-of-court workouts. Each alternative has its pros and cons, and debtors should weigh them diligently before choosing which one is best for their financial situation. If you or your business is struggling with debt, it is crucial to seek the advice of a qualified bankruptcy attorney or financial advisor. You can find the best path to financial stability and long-term success with careful consideration and professional assistance.What Is Chapter 11 Bankruptcy?

Eligibility for Chapter 11 Bankruptcy

How Chapter 11 Bankruptcy Works

Bankruptcy Petition

Automatic Stay

Reorganization Plan

Role of the Bankruptcy Court

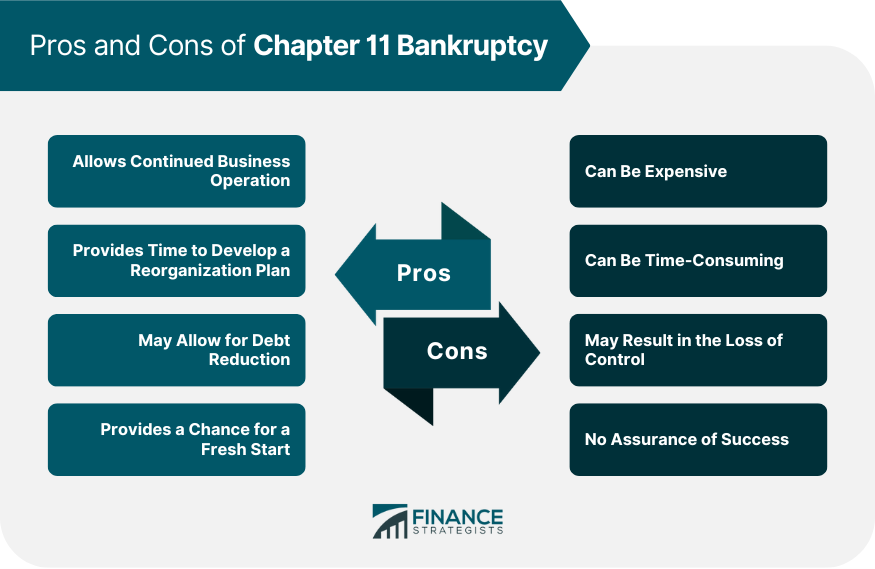

Benefits of Chapter 11 Bankruptcy

Allows Continued Business Operation

Provides Time to Develop a Reorganization Plan

May Allow for Debt Reduction

There are several ways that debt reduction can be achieved through Chapter 11 bankruptcy. Provides a Chance for a Fresh Start

Drawbacks of Chapter 11 Bankruptcy

Can Be Expensive

Can Be Time-Consuming

May Result in the Loss of Control

No Assurance of Success

Comparison to Other Bankruptcy Chapters

Alternatives to Chapter 11 Bankruptcy

Debt Restructuring

Debt Settlement

Out-Of-Court Workout

The Bottom Line

Chapter 11 Bankruptcy FAQs

An individual, corporation, or partnership can file for Chapter 11 bankruptcy as long as they are engaged in commercial activities and have a substantial amount of debt.

The automatic stay is a feature of Chapter 11 bankruptcy that prohibits creditors from taking any legal action against the debtor, including foreclosure, repossession, or lawsuits. This feature gives the debtor time to develop a reorganization plan without the pressure of ongoing legal action.

Chapter 11 bankruptcy allows the debtor to continue operating their business while they work on a plan to repay their debts. It provides time to develop a reorganization plan, may allow for a reduction of debt, and provides a chance for a fresh start.

Chapter 11 bankruptcy is designed for businesses and individuals with considerable debt, while other bankruptcy chapters are designed for debtors with less debt or different financial circumstances.

Some alternatives to Chapter 11 bankruptcy include debt restructuring, debt settlement, and out-of-court workouts. These alternatives may be more appropriate for debtors who have a smaller amount of debt or who do not have the resources to pursue a Chapter 11 bankruptcy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.