Chapter 12 bankruptcy is a specific type of insolvency protection created for "family farmers" and "family fishermen." The law, which was first enacted in 1986, is an amendment to the Bankruptcy Code that provides a streamlined and less expensive process for family farming operations to reorganize their debts and continue operations. The purpose of Chapter 12 bankruptcy is to give family farmers and fishermen an opportunity to restructure their finances and avoid liquidation or foreclosure. It's important because it helps to preserve family farming and fishing operations that might otherwise be lost due to high debt loads and tight profit margins. To qualify for Chapter 12 bankruptcy, a debtor must be engaged in a farming or commercial fishing operation. Further, more than 50% of the debtor's gross income from the preceding tax year must come from farming or fishing operations. The debtor also must have regular annual income that can be used to make plan payments. The process of filing for Chapter 12 bankruptcy involves several steps. The debtor must first file a petition with the bankruptcy court, which triggers an automatic stay that prevents creditors from collecting debts. Then, the debtor must submit a detailed list of assets and liabilities, along with a statement of financial affairs. In a Chapter 12 bankruptcy, the trustee plays a crucial role. The trustee is responsible for overseeing the case, reviewing the proposed repayment plan, and making recommendations to the court. The trustee also collects payments from the debtor and distributes them to creditors. Under Chapter 12 bankruptcy, the debtor must propose a plan to repay creditors over a period of three to five years. This plan must be confirmed by the court and must provide for the full payment of certain priority debts. The length of the repayment plan depends on the debtor's regular income. If the debtor's income is less than the state median, the plan will be for three years unless the court approves a longer period. If the debtor's income is greater than the state median, the plan will be for five years. Chapter 12 bankruptcy allows for the restructuring of secured and unsecured debts. Secured debts may be modified or restructured under the plan, while unsecured debts may be partially or fully discharged. One of the main advantages of Chapter 12 bankruptcy is the ability to restructure debts. This can provide much-needed relief for farmers and fishermen who are struggling with high debt loads and tight profit margins. Another benefit of Chapter 12 bankruptcy is the automatic stay, which protects the debtor from collection actions by creditors. This allows the debtor to continue operations while the bankruptcy case is pending. Finally, Chapter 12 bankruptcy allows family farmers and fishermen to continue their operations. This is important because it helps to preserve these businesses, which are often vital to rural economies. Although Chapter 12 is designed to be more streamlined than other forms of bankruptcy, it can still be a complex process. The debtor must submit detailed financial information and propose a feasible repayment plan, all while continuing to run the business. The legal fees associated with Chapter 12 can also be substantial. Chapter 12 bankruptcy is available only to family farmers and fishermen. This means that individuals and businesses that do not meet the specific criteria cannot use this form of bankruptcy. Like any form of bankruptcy, Chapter 12 can have a negative impact on the debtor's credit rating. This can make it more difficult to obtain financing in the future. Chapter 12 bankruptcy can have a significant impact on debt levels. Through the restructuring of secured debts and the potential discharge of unsecured debts, the debtor can significantly reduce their overall debt burden. By allowing for the continuation of business operations, Chapter 12 can help farmers and fishermen make necessary changes to improve profitability. This may include selling unproductive assets, renegotiating contracts, or making other operational changes. While some Chapter 12 cases are successful, not all are. The success of a Chapter 12 case depends on many factors, including the debtor's income, the feasibility of the proposed plan, and the cooperation of creditors. For those who do not qualify for Chapter 12, other forms of bankruptcy may be available. Chapter 11 bankruptcy, which is typically used by larger businesses, allows for the restructuring of debts, while Chapter 13 bankruptcy, which is used by individuals, also allows for debt restructuring but has different eligibility criteria and processes. There may also be non-bankruptcy options available for managing debt. This could include negotiating with creditors, consolidating debts, or working with a credit counseling agency. Financial advisors can play a critical role in bankruptcy proceedings. They can provide advice on the feasibility of different options, assist with the preparation of financial statements, and provide guidance throughout the process. Not all financial advisors are equal. It's important to choose an advisor who has experience with bankruptcy, understands the specific challenges facing farmers and fishermen, and has your best interests at heart. Chapter 12 bankruptcy offers a lifeline to family farmers and fishermen overwhelmed by debt, facilitating the restructuring of their financial obligations and enabling the continuation of their operations. This specialized bankruptcy process, though complex and costly, presents numerous advantages, such as protection from creditors' actions and the potential for business continuity. However, drawbacks such as restrictions on eligibility and potential impacts on future creditworthiness cannot be overlooked. As every financial situation is unique, other forms of bankruptcy, as well as non-bankruptcy debt management options, may prove to be more suitable alternatives. Therefore, it's vital to seek the counsel of a qualified financial advisor experienced in bankruptcy proceedings to guide one's decision-making process, ensuring the chosen path aligns best with their financial needs and future aspirations.What Is Chapter 12 Bankruptcy?

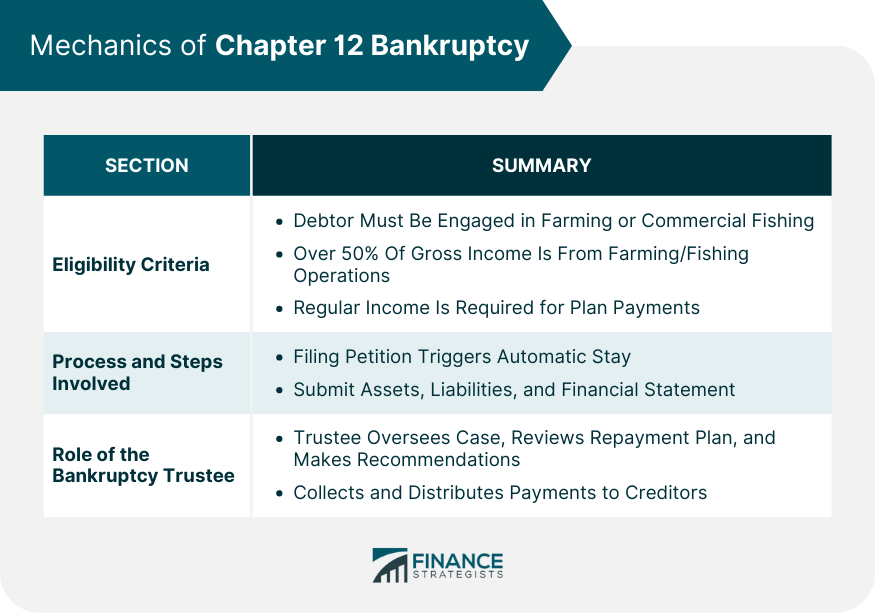

Mechanics of Chapter 12 Bankruptcy

Eligibility Criteria

Process and Steps Involved

Role and Responsibilities of the Bankruptcy Trustee

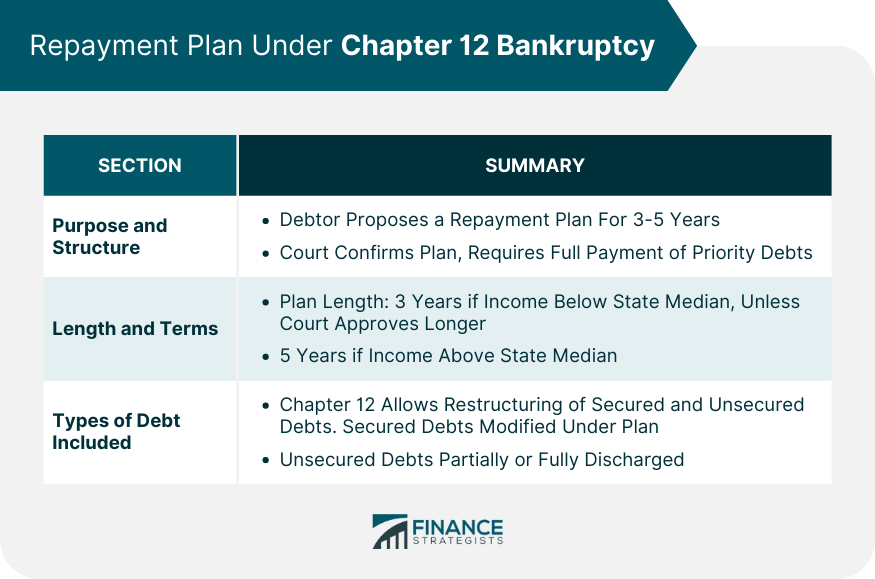

Repayment Plan Under Chapter 12 Bankruptcy

Purpose and Structure

Length and Terms

Types of Debt Included

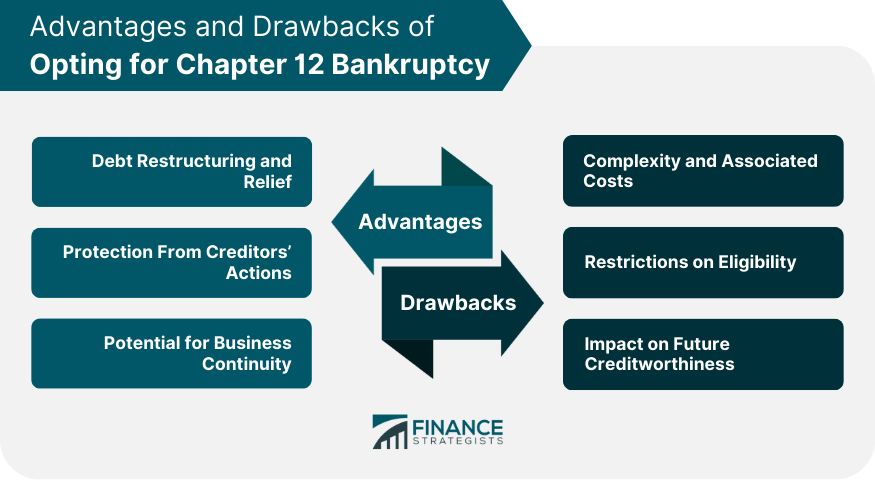

Advantages of Opting for Chapter 12 Bankruptcy

Debt Restructuring and Relief

Protection From Creditors’ Actions

Potential for Business Continuity

Drawbacks and Limitations of Chapter 12 Bankruptcy

Complexity and Associated Costs

Restrictions on Eligibility

Impact on Future Creditworthiness

Effectiveness of Chapter 12 Bankruptcy

Impact on Debt Levels

Changes in Business Operations

Success and Failure Rates

Alternatives to Chapter 12 Bankruptcy

Comparison of Chapter 11 and Chapter 13 Bankruptcy

Non-bankruptcy Debt Management Options

Importance of Professional Financial Advice in Bankruptcy Proceedings

Role of Financial Advisors

Choose the Right Financial Advisor for Financial Needs

Conclusion

Chapter 12 Bankruptcy FAQs

Chapter 12 bankruptcy is a type of insolvency protection specifically designed for "family farmers" and "family fishermen." It enables them to reorganize their debts and continue their operations.

To be eligible for Chapter 12 bankruptcy, an individual must be engaged in a farming or commercial fishing operation. Additionally, more than 50% of their gross income from the preceding tax year must come from these operations. They must also have a regular annual income that can be used to make plan payments.

Filing for Chapter 12 bankruptcy involves submitting a petition to the bankruptcy court, providing a detailed list of assets and liabilities, and submitting a statement of financial affairs. Once the petition is filed, an automatic stay is triggered, protecting the debtor from creditors.

The main advantages of Chapter 12 bankruptcy include the ability to restructure debts, protection from creditors, and the potential to continue business operations. Disadvantages include its complexity, associated costs, limited eligibility, and potential negative impact on the debtor's future creditworthiness.

For those not qualifying for Chapter 12, other forms of bankruptcy, like Chapter 11 or Chapter 13, may be considered. Non-bankruptcy options, such as negotiating with creditors, debt consolidation, or working with a credit counseling agency, may also be feasible.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.