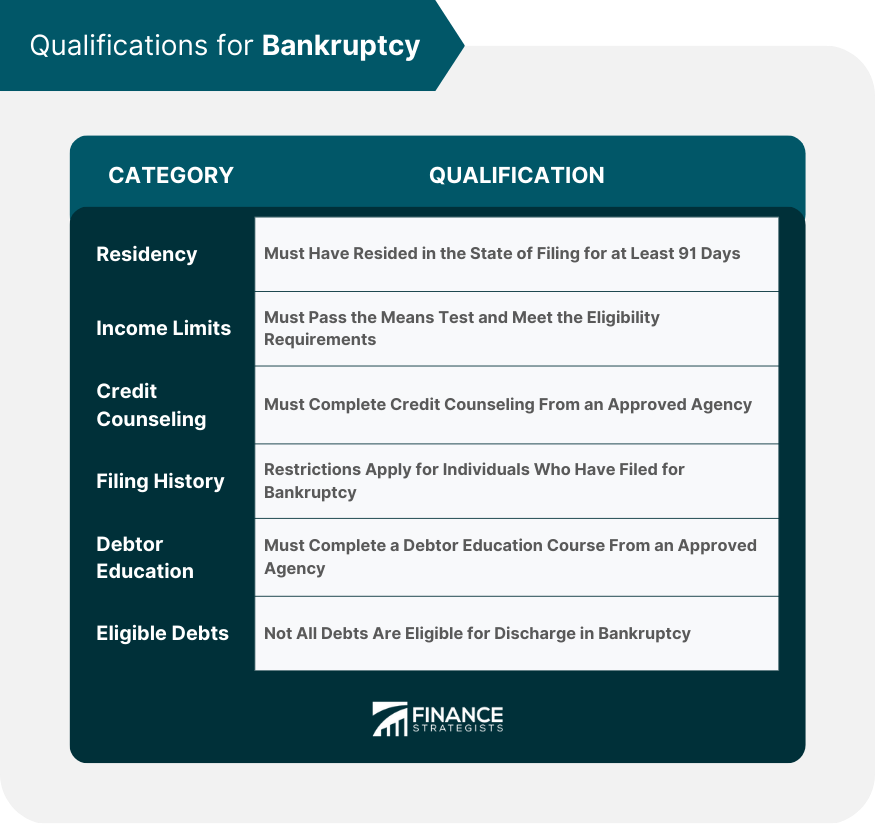

To qualify for Chapter 7 bankruptcy you must earn less than the median income for your state and pass a means test, which is available on the US Bankruptcy Court's website. To qualify for Chapter 13 you must be within certain debt limitations and have a sufficiently high income to make monthly payments, as the court determines. To be eligible for bankruptcy, individuals and businesses must meet certain qualifications. These qualifications include residency requirements, income limits, credit counseling requirements, filing history, debtor education requirements, and eligible debts. To file for bankruptcy, individuals must have resided in the state where they are filing for at least 91 days prior to filing. This requirement is in place to prevent individuals from filing in states where bankruptcy laws are more favorable. Income limits are an important factor in determining whether individuals are eligible to file for bankruptcy. The means test is used to determine whether individuals have enough disposable income to repay their debts. If their income is below the median income for their state, they may be eligible for Chapter 7 bankruptcy. If their income is above the median income, they may be required to file for Chapter 13 bankruptcy. Before filing for bankruptcy, individuals are required to complete credit counseling from an approved agency. This counseling is designed to provide individuals with information about their financial situation and help them determine whether bankruptcy is the right option for them. Individuals who have filed for bankruptcy in the past may be subject to certain restrictions on their ability to file for bankruptcy again. For example, individuals who have filed for Chapter 7 bankruptcy in the past may be required to wait eight years before filing again. After filing for bankruptcy, individuals are required to complete a debtor education course from an approved agency. This course is designed to provide individuals with the skills and knowledge they need to manage their finances and avoid future financial problems. Not all debts are eligible for discharge in bankruptcy. Debts that are not eligible for discharge include child support, alimony, most taxes, and student loans (with some exceptions). The purpose of bankruptcy is to provide relief to those who are overwhelmed by debt and unable to repay it. By filing for bankruptcy, individuals and businesses can eliminate or restructure their debts, which can provide a fresh start and allow them to move forward financially. The qualifications for bankruptcy are important to understand because not everyone is eligible to file for bankruptcy. Filing for bankruptcy can have significant consequences, so it is important to understand the qualifications and whether bankruptcy is the right option for your financial situation. There are several types of bankruptcy available, including Chapter 7 bankruptcy, Chapter 11 bankruptcy, and Chapter 13 bankruptcy. Chapter 7 bankruptcy is a liquidation bankruptcy that allows individuals to eliminate most of their unsecured debts, such as credit card debt and medical bills. To be eligible for Chapter 7 bankruptcy, individuals must pass the means test, which is used to determine whether they have enough disposable income to repay their debts. To be eligible for Chapter 7 bankruptcy, individuals must meet the following criteria: Have a monthly income below the median income for their state Pass the means test Not have filed for Chapter 7 bankruptcy in the past eight years The means test is used to determine whether individuals have enough disposable income to repay their debts. The test takes into account the individual's income, expenses, and debt to determine whether they qualify for Chapter 7 bankruptcy. If the individual's income is below the median income for their state, they automatically pass the means test. If their income is above the median income, they may still be eligible for Chapter 7 bankruptcy, but they will need to provide additional information to prove that they don't have enough disposable income to repay their debts. Chapter 11 bankruptcy is a reorganization bankruptcy that allows businesses to restructure their debts and continue operating. It is also available to individuals who do not qualify for Chapter 13 bankruptcy. Chapter 11 bankruptcy is typically more complex and expensive than other types of bankruptcy, and it is usually only used by businesses with significant assets and debts. To be eligible for Chapter 11 bankruptcy, individuals and businesses must meet the following criteria: Have debts exceeding the debt limits for Chapter 13 bankruptcy Be able to demonstrate that they have a viable plan for reorganizing their debts Be able to pay their ongoing expenses while they are in bankruptcy Chapter 11 bankruptcy requires a significant amount of documentation and legal work, and it is typically more expensive than other types of bankruptcy. The process involves filing a bankruptcy petition, a disclosure statement, and a reorganization plan, as well as negotiating with creditors to obtain approval for the plan. Chapter 13 bankruptcy is a reorganization bankruptcy that allows individuals with regular income to restructure their debts and repay them over a three to five-year period. It is typically used by individuals who are not eligible for Chapter 7 bankruptcy or who want to keep certain assets, such as their home or car. To be eligible for Chapter 13 bankruptcy, individuals must meet the following criteria: Have a regular income Have unsecured debts below the debt limits for Chapter 13 bankruptcy Have secured debts below the debt limits for Chapter 13 bankruptcy Be able to demonstrate that they can make the required monthly payments under the plan The debt limits for Chapter 13 bankruptcy are adjusted periodically and vary by state. As of 2024, an individual's combined total secured and unsecured debts are less than $2,750,000 as of the date of filing for bankruptcy relief. The bankruptcy process can be complex and time-consuming, and it typically involves several steps, including hiring a bankruptcy lawyer, filing for bankruptcy, attending a creditors meeting, and receiving a discharge. A bankruptcy lawyer can provide valuable guidance and support throughout the bankruptcy process. They can help individuals determine whether bankruptcy is the right option for their financial situation, help them complete the required paperwork, and represent them in court. To file for bankruptcy, individuals must complete a bankruptcy petition and file it with the bankruptcy court in their district. The petition must include information about the individual's income, expenses, assets, and debts. Once the bankruptcy petition is filed, an automatic stay goes into effect, which prohibits creditors from taking any further collection actions against the individual. This means that creditors must stop all collection calls, lawsuits, and other collection activities. Within 20 to 40 days after filing for bankruptcy, individuals must attend a creditors meeting, where they will be asked questions by the bankruptcy trustee and any creditors who wish to attend. The purpose of the meeting is to verify the information in the bankruptcy petition and ensure that the individual has provided all the required documentation. If the bankruptcy trustee determines that the individual is eligible for a discharge, they will receive a discharge order from the court, which eliminates their eligible debts. The discharge order typically comes several months after the creditors meeting. Filing for bankruptcy can have significant consequences, including effects on credit score, difficulty obtaining credit, possible loss of assets, and impact on employment. Filing for bankruptcy can have a negative impact on an individual's credit score, which can make it more difficult to obtain credit in the future. Bankruptcy can remain on an individual's credit report for up to 10 years, and it can significantly lower their credit score. After filing for bankruptcy, it may be more difficult for individuals to obtain credit, as they will be viewed as a higher risk by lenders. However, it is still possible to obtain credit after bankruptcy, although it may be at a higher interest rate and with more strict terms. In some cases, individuals may be required to liquidate some of their assets in order to repay their debts. This can include selling their home, car, or other assets. However, exemptions are available in most states that allow individuals to keep certain assets, such as their home or car. In some cases, filing for bankruptcy can impact an individual's employment. Employers may view bankruptcy as a negative mark on an individual's financial history, which could impact their job prospects. However, employers are not legally allowed to discriminate against individuals who have filed for bankruptcy. The qualifications for bankruptcy are an important consideration for anyone who is considering filing for bankruptcy. It is important to understand the different types of bankruptcy available, as well as the eligibility requirements and the consequences of filing for bankruptcy. Working with a bankruptcy lawyer can provide valuable guidance and support throughout the process, and can help individuals make informed decisions about their financial future. Ultimately, filing for bankruptcy can provide a fresh start and a path toward a more stable financial future.Qualifying for Bankruptcy Overview

Qualifications for Bankruptcy

Residency Requirements

Income Limits

Credit Counseling Requirement

Filing History

Debtor Education Requirement

Eligible Debts

Purpose of Bankruptcy

Importance of Qualifications for Bankruptcy

Types of Bankruptcy

Chapter 7 Bankruptcy

Chapter 7 Bankruptcy Eligibility Criteria

Chapter 7 Bankruptcy Means Test

Chapter 11 Bankruptcy

Chapter 11 Eligibility Criteria

Chapter 11 Requirements for Filing

Chapter 13 Bankruptcy

Chapter 13 Eligibility Criteria

Chapter 13 Debt Limits

The Bankruptcy Process

The Role of a Bankruptcy Lawyer

Filing for Bankruptcy

Automatic Stay

Creditors Meeting

The Discharge

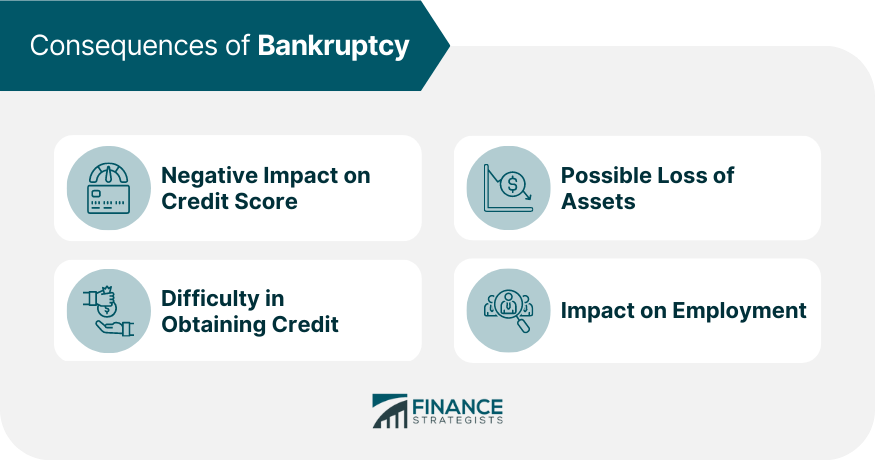

Consequences of Bankruptcy

Effects on Credit Score

Difficulty in Obtaining Credit

Possible Loss of Assets

Impact on Employment

Conclusion

Do I Qualify for Bankruptcy? FAQs

Individuals or businesses that are unable to repay their debts and meet certain qualifications, including residency requirements, income limits, credit counseling requirements, filing history, debtor education requirements, and eligible debts.

The types of bankruptcy available include Chapter 7 bankruptcy, Chapter 11 bankruptcy, and Chapter 13 bankruptcy.

The bankruptcy process typically involves hiring a bankruptcy lawyer, filing for bankruptcy, attending a creditors meeting, and receiving a discharge.

Filing for bankruptcy can have significant consequences, including effects on credit score, difficulty obtaining credit, possible loss of assets, and impact on employment.

Working with a bankruptcy lawyer can provide valuable guidance and support throughout the bankruptcy process, and can help individuals make informed decisions about their financial future.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.