Does Bankruptcy Remove Judgments?

Bankruptcy can be a tool to manage or eliminate certain debts and can potentially affect judgments. When a person files for bankruptcy, an automatic stay is enacted, which temporarily prevents most creditors from pursuing collection efforts, including enforcing judgments.

If the bankruptcy results in a discharge of the underlying debt that led to the judgment, then the judgment is effectively voided, and the creditor cannot take action to collect it.

However, not all judgments are dischargeable in bankruptcy. For example, judgments stemming from fraud, willful injury, certain tax obligations, family support, and other specific categories may not be eliminated.

If a judgment is not discharged, the creditor can resume collection efforts once the bankruptcy case concludes.

Additionally, while the obligation to pay might be discharged, the bankruptcy might not automatically remove the judgment lien from a property.

In such cases, the debtor may need to take additional legal steps to clear the lien. It's essential to consult with a bankruptcy attorney to understand the specific implications of one's situation.

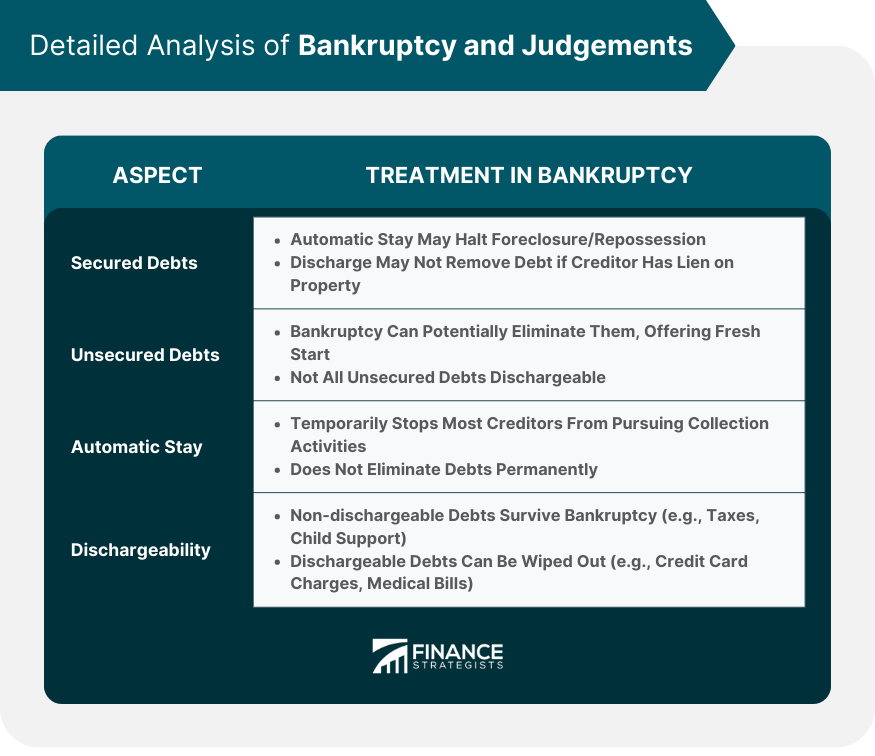

Detailed Analysis of Bankruptcy and Judgements

The effect of bankruptcy on judgments is nuanced and hinges on understanding the different types of debt, the concept of automatic stay, and the discharge ability of debts in bankruptcy.

Type of Debt

Secured Debts and Bankruptcy

Secured debts are obligations backed by an asset or collateral. Examples include mortgages and car loans, where the creditor can take the property if the debtor fails to repay the debt.

In bankruptcy, these debts are typically treated differently. While the automatic stay in bankruptcy may temporarily halt foreclosure or repossession, the discharge might not remove the debtor's obligation if the creditor has a lien on the property.

Unsecured Debts and Bankruptcy

Unsecured debts, on the other hand, are not linked to any specific property. Bankruptcy often provides a more definitive way of handling unsecured debts.

It can potentially eliminate them, offering the debtor a fresh financial start. However, not all unsecured debts are dischargeable, which leads us to the next important concept in bankruptcy—the dischargeability of debts.

Automatic Stay

An automatic stay is a fundamental aspect of bankruptcy law. Once a bankruptcy petition is filed, an automatic stay goes into effect, which temporarily stops most creditors from pursuing collection activities.

This means that any judgments, garnishments, or collection efforts are halted, offering the debtor some breathing space. However, the stay is not permanent and does not by itself eliminate the debts.

Dischargeability of Debts in Bankruptcy

Non-dischargeable Debts in Bankruptcy

While bankruptcy can be a powerful tool for debt management, it does not erase all types of debt. Certain obligations, known as non-dischargeable debts, survive the bankruptcy process.

These include debts for most taxes, child or spousal support, student loans (unless undue hardship is proven), debts for personal injury caused by driving while intoxicated, and debts not listed in the bankruptcy petition.

Dischargeable Debts in Bankruptcy

On the other hand, many debts are dischargeable under bankruptcy. Most unsecured debts like credit card charges, medical bills, and personal loans can be wiped out in bankruptcy.

When these debts are associated with judgments, the bankruptcy process might effectively eliminate the judgments tied to them.

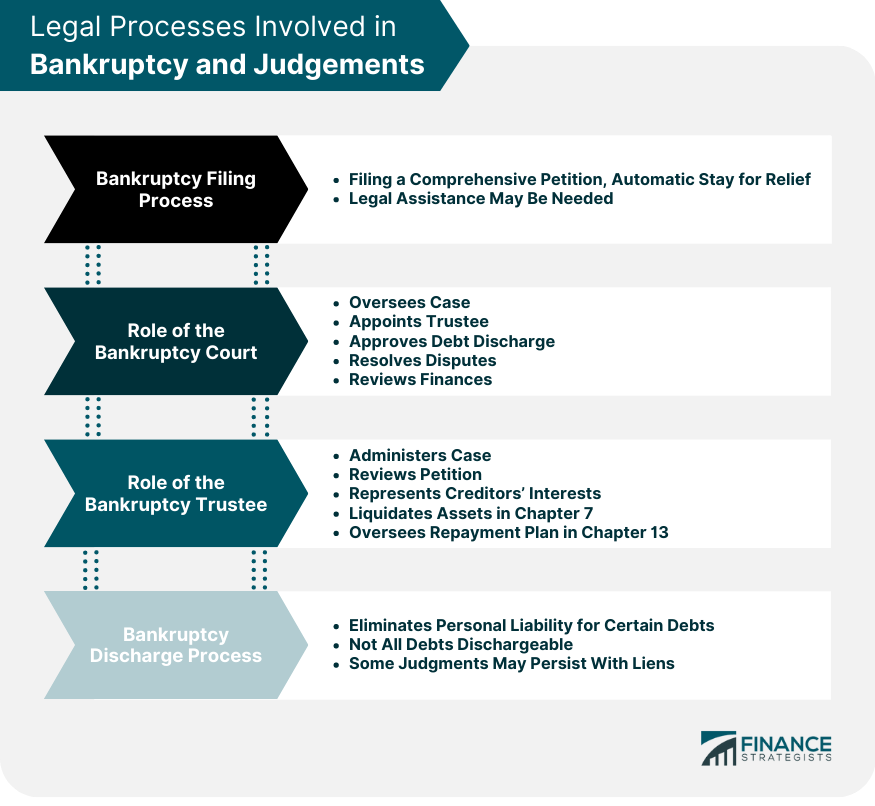

Legal Processes Involved in Bankruptcy and Judgements

The intertwining of bankruptcy and judgments is deeply legalistic, involving several processes and parties, all of which play crucial roles in determining the final outcome.

Bankruptcy Filing Process

The journey begins with filing a bankruptcy petition. This comprehensive document details the debtor's financial status, including debts, assets, income, and expenses.

Once filed, the automatic stay comes into effect, providing immediate relief to the debtor. It's important to note that the bankruptcy filing process is complex and often requires legal assistance to navigate.

Role of the Bankruptcy Court

The bankruptcy court plays a pivotal role in the process. It oversees the case, appoints the bankruptcy trustee, and ultimately approves the discharge of debts.

Any disputes between the debtor and creditors are resolved here. The court also reviews the debtor's finances and the legitimacy of their bankruptcy filing.

Role of the Bankruptcy Trustee

The bankruptcy trustee is appointed by the court to administer the bankruptcy case. They review the bankruptcy petition, challenge any inaccuracies, and represent the interests of the creditors.

In a Chapter 7 case, the trustee may liquidate non-exempt assets to repay creditors. In a Chapter 13 case, they oversee the debtor's repayment plan.

Bankruptcy Discharge Process

The discharge process is the final step in a bankruptcy case. It effectively eliminates the debtor's personal liability for certain debts.

However, not all debts are dischargeable, and certain judgments may persist post-discharge, particularly if they have resulted in liens against the property.

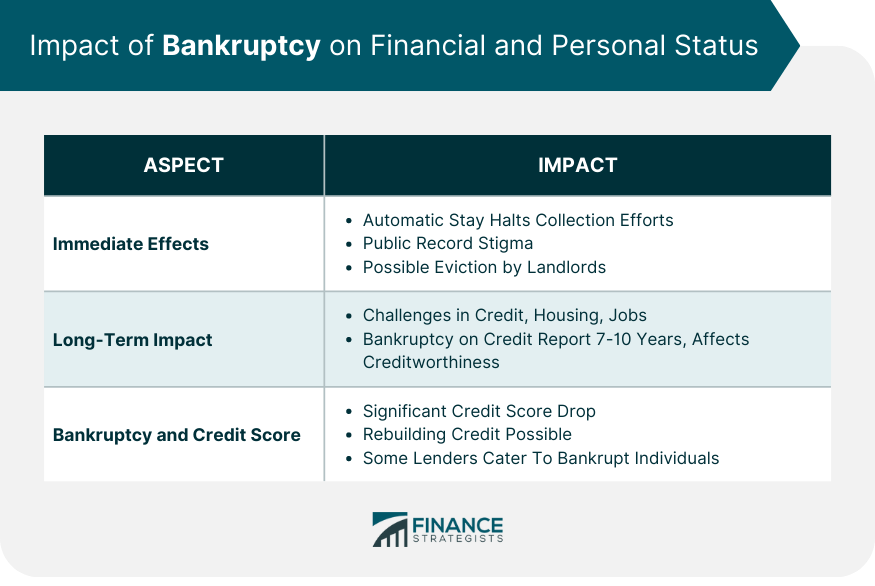

Impact of Bankruptcy on Financial and Personal Status

While bankruptcy can offer relief from crippling debt, it comes with substantial consequences that can impact one's financial and personal life.

Immediate Effects of Filing for Bankruptcy

Immediately after filing, the debtor can enjoy the benefits of the automatic stay, halting most collection efforts.

However, bankruptcy filings are public records, which may lead to social stigma. Moreover, bankruptcy can disrupt current living situations, as landlords might have the right to evict tenants who file.

Long-Term Impact of Bankruptcy

Over the long haul, bankruptcy can make it challenging to secure credit, housing, and even certain jobs. While the bankruptcy discharge provides a fresh start, it comes with the cost of remaining on the credit report for seven to ten years, affecting creditworthiness.

Bankruptcy and Credit Score: What to Expect

Bankruptcy typically results in a significant drop in credit scores. This effect can last for many years and make it difficult to get new credit.

It's worth noting, however, that credit can be rebuilt over time, and some lenders specialize in offering credit to individuals with bankruptcy on their records.

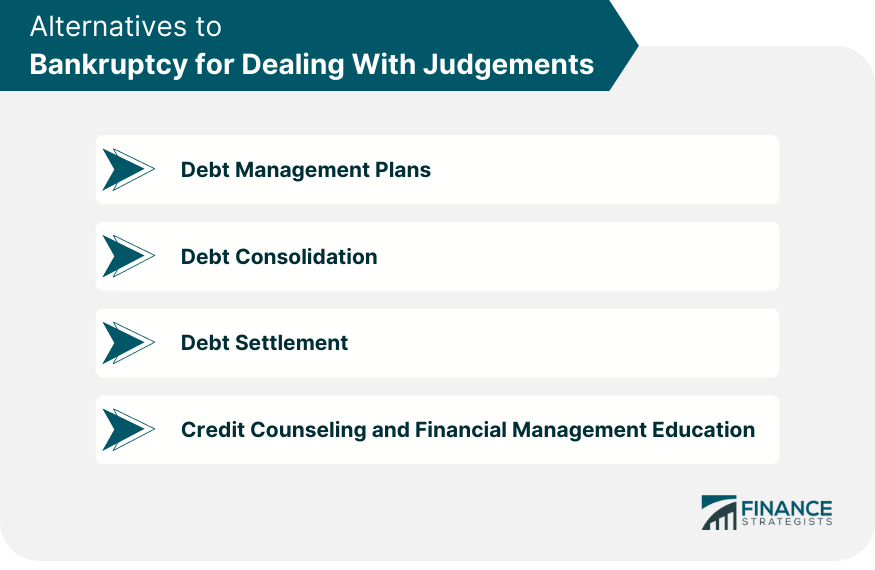

Alternatives to Bankruptcy for Dealing With Judgements

Given the significant repercussions of bankruptcy, it's wise to consider alternatives. These can help deal with judgments without the need for bankruptcy.

Debt Management Plans

Debt management plans involve working with a credit counseling agency to create a repayment plan that works for your budget. This approach keeps you in control of your assets and doesn't have the long-term impact on your credit that bankruptcy does.

Debt Consolidation

Debt consolidation combines multiple debts into one larger debt with lower interest rates, making it easier to manage repayments. This could be an option for those with a steady income and manageable debt levels.

Debt Settlement

Debt settlement involves negotiating with creditors to allow you to pay a "settlement" to resolve your debt — a lump sum that is less than the full amount that you owe. However, this approach can have tax implications and negatively affect your credit score.

Credit Counseling and Financial Management Education

Credit counseling organizations offer education and assistance to individuals struggling with debt. They can provide practical advice, help negotiate with creditors, and even create debt management plans.

Bankruptcy and Judgements: Critical Factors and Considerations

Given the complex relationship between bankruptcy and judgments, there are several factors and considerations that debtors should bear in mind.

Role of Legal Counsel in Bankruptcy Proceedings: Navigating bankruptcy proceedings is a complex process that often requires legal expertise.

A bankruptcy attorney can provide guidance based on an understanding of bankruptcy law and personal financial circumstances.

Understanding the Cost of Bankruptcy: Filing for bankruptcy comes with costs, including court fees and attorney fees. These costs can be substantial and should be factored into the decision-making process.

Rebuilding Credit After Bankruptcy: While bankruptcy can significantly impact your credit, rebuilding it is possible. Steps such as securing a secured credit card, paying all bills on time, and keeping balances low on credit cards can all help.

Preventing Future Judgements Post-bankruptcy: After navigating bankruptcy, it's crucial to prevent future judgments and stay financially healthy. This often involves strict budgeting, responsible credit use, and timely payment of all debts.

Bottom Line

Bankruptcy provides a mechanism for addressing debts, including some judgments, offering debtors potential relief from financial burdens.

Once filed, the automatic stay temporarily halts most creditor actions, such as enforcing judgments.

While many judgments, particularly those tied to dischargeable unsecured debts, can be voided through bankruptcy, others remain intact, especially if they pertain to non-dischargeable obligations like child support or certain taxes.

A significant distinction exists between secured and unsecured debts, influencing their treatment in bankruptcy proceedings. Moreover, while bankruptcy might offer a fresh start, it carries implications for creditworthiness, lasting on a credit report for up to a decade.

Due to its complexities and repercussions, seeking legal counsel is crucial, and considering alternatives like debt management plans or consolidation can be beneficial.

Ultimately, after navigating bankruptcy, proactive financial management is essential to prevent future judgments and maintain fiscal health.

Does Bankruptcy Remove Judgements? FAQs

No, bankruptcy cannot remove all types of judgments. It typically eliminates judgments related to dischargeable unsecured debts like credit card debts, personal loans, or medical bills. However, it doesn't remove judgments related to non-dischargeable debts such as student loans, certain taxes, child support, alimony, or debts due to personal injury caused by intoxicated driving.

The bankruptcy court oversees the case, resolves disputes between the debtor and creditors, and approves the discharge of debts. The bankruptcy trustee, appointed by the court, administers the case, reviews the bankruptcy petition for any inaccuracies, and represents the interests of the creditors. They may also liquidate non-exempt assets to repay creditors in a Chapter 7 case or oversee the debtor's repayment plan in a Chapter 13 case.

Bankruptcy typically results in a significant drop in credit score, and it stays on the credit report for seven to ten years, affecting the individual's creditworthiness. However, it is possible to rebuild credit over time with responsible financial habits.

Alternatives to bankruptcy include debt management plans, debt consolidation, debt settlement, and credit counseling. These methods can help manage debts without the significant financial and personal impact that comes with bankruptcy.

Preventing future judgments after bankruptcy often involves maintaining strict budgeting, using credit responsibly, and making timely payments of all debts. It is also recommended to seek financial management education or counseling to better navigate financial obligations and avoid getting into overwhelming debt.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.