Student loans are generally not dischargeable in Chapter 7 bankruptcy. This is because Congress has determined that student loan debt is in the public interest and should not be easily discharged. However, there are some limited circumstances under which student loans may be discharged. The Bankruptcy Code treats student loans differently from other types of debt. In order to discharge a student loan, the debtor must prove that repayment would impose an undue hardship on themselves and their dependents. This is known as the "undue hardship" standard. Before 1976, student loans were dischargeable in bankruptcy just like any other unsecured loans. However, changes to the law in the late 1970s and early 1980s made it increasingly difficult to discharge student loans. In 1998, Congress made most student loans non-dischargeable in bankruptcy unless the debtor could prove undue hardship. The "undue hardship" standard for student loan discharge is determined by the courts using a three-part test known as the Brunner test. Under the Brunner test, the debtor must prove the following: That they cannot maintain a minimal standard of living if forced to repay the student loan That their financial situation is unlikely to improve in the future That they have made a good faith effort to repay the loan There have been recent efforts to make it easier to discharge student loans in bankruptcy. In 2019, the American Bankruptcy Institute's Commission on Consumer Bankruptcy recommended that Congress amend the Bankruptcy Code to allow for the discharge of private student loans. Private student loans are not backed by the government and often have higher interest rates and fewer borrower protections than federal student loans. If student loans cannot be discharged in Chapter 7 bankruptcy, there are still options available for borrowers struggling with debt. Loan modification involves negotiating with the lender to change the terms of the loan, such as the interest rate, payment amount, or repayment period. This can help make the loan more affordable for the borrower. Loan consolidation involves combining multiple loans into a single loan with a fixed interest rate and payment amount. This can simplify the repayment process and may result in lower monthly payments. Income-driven repayment plans are available for federal student loans. These plans adjust the borrower's monthly payment based on their income and family size. In some cases, the borrower's payment may be as low as $0 per month. There are several programs that offer student loan forgiveness to borrowers who meet certain criteria, such as working in a public service job or teaching in a low-income school district. These programs can help borrowers reduce or eliminate their student loan debt. Not all debts are dischargeable in Chapter 7 bankruptcy. Certain debts, such as taxes, child support, and alimony, are generally not dischargeable. However, most unsecured debts, such as credit card debt and medical bills, can be discharged. Dischargeable debts are those that can be eliminated through bankruptcy. These debts are no longer legally enforceable, and the debtor is not required to pay them. The discharge of debts is the primary goal of Chapter 7 bankruptcy. Some examples of dischargeable debts include credit card debt, medical bills, personal loans, and payday loans. These debts are typically unsecured, meaning there is no collateral backing them. Non-dischargeable debts are debts that cannot be eliminated through bankruptcy. These debts remain legally enforceable, and the debtor is still required to pay them after bankruptcy. Non-dischargeable debts are typically those that are considered to be in the public interest or are the result of the debtor's wrongdoing. Some examples of non-dischargeable debts include taxes, child support, alimony, fines and penalties owed to government agencies, and debts resulting from fraud or willful misconduct. While student loans are generally not dischargeable in Chapter 7 bankruptcy, there are still options available for borrowers struggling with debt. Does Chapter 7 Bankruptcy Include Student Loans?

Explanation of the Bankruptcy Code’s Treatment of Student Loans

The History of Student Loans and Bankruptcy

The Brunner Test and Its Application to Student Loans

Recent Changes to Student Loan Dischargeability in Bankruptcy

Alternatives to Discharging Student Loans in Chapter 7 Bankruptcy

Loan Modification

Loan Consolidation

Income-Driven Repayment Plans

Student Loan Forgiveness Programs

Which Debts Are Dischargeable in Chapter 7 Bankruptcy?

Explanation of Dischargeable Debts

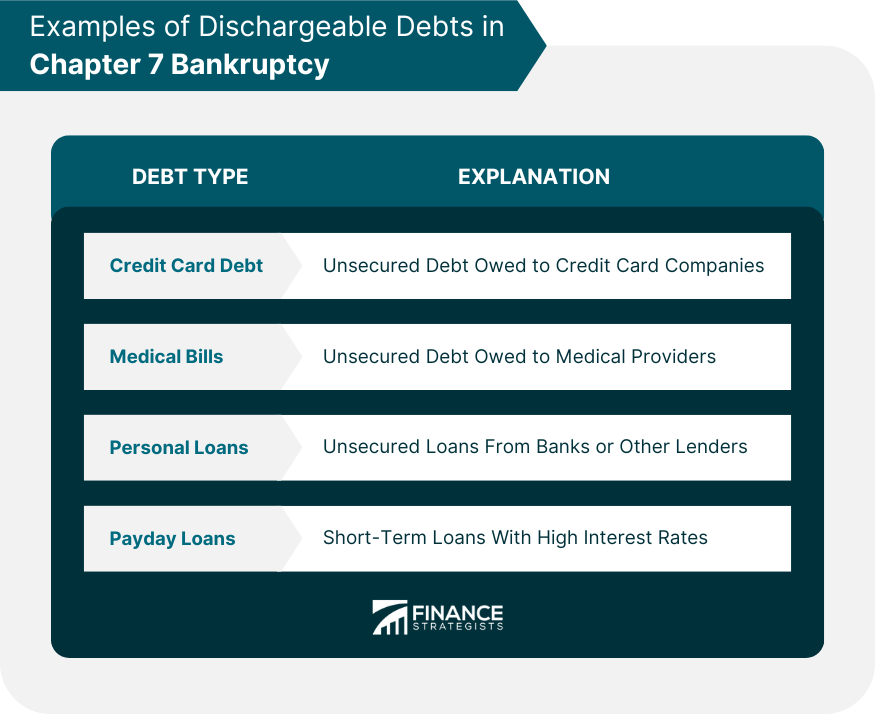

Examples of Dischargeable Debts

Explanation of Non-dischargeable Debts

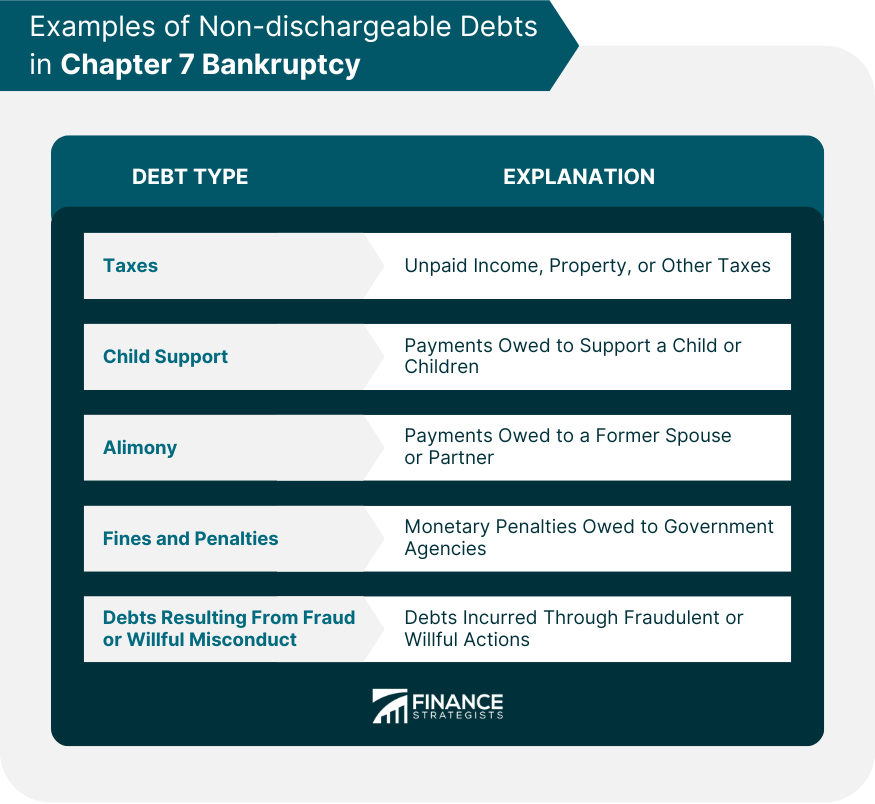

Examples of Non-dischargeable Debts

Conclusion

It is important to explore all available options and to consult with an experienced bankruptcy attorney or financial advisor before making any decisions about how to manage student loan debt.

Does Chapter 7 Bankruptcy Include Student Loans? FAQs

Generally, student loans are not dischargeable in Chapter 7 bankruptcy. However, there are some limited circumstances under which they may be discharged.

The "undue hardship" standard requires the debtor to prove that repayment of the student loan would impose an undue hardship on themselves and their dependents.

Currently, most private student loans are not dischargeable in bankruptcy. However, there have been recent efforts to change this.

Alternatives to discharging student loans in Chapter 7 bankruptcy include loan modification, loan consolidation, income-driven repayment plans, and student loan forgiveness programs.

Yes, it is highly recommended to consult with an experienced bankruptcy attorney before filing for bankruptcy. They can help guide you through the process and determine the best course of action for your specific situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.