Bankruptcy is a legal process that provides relief to individuals and businesses overwhelmed by insurmountable debt. It offers a structured framework for resolving financial difficulties, protecting debtors from aggressive collection actions, and facilitating the equitable distribution of assets among creditors. However, the effects of bankruptcy extend far beyond the immediate relief it provides. The automatic stay, a powerful legal tool that comes into effect as soon as the bankruptcy petition is filed, serves as a shield against aggressive collection actions initiated by creditors. Creditors are barred from garnishing debtors' wages or salary to collect outstanding debts during the bankruptcy process. This safeguard ensures that debtors can continue to receive their full paycheck, allowing them to meet their essential living expenses and focus on the bankruptcy process. Additionally, the automatic stay prohibits creditors from repossessing debtors' vehicles, appliances, or other secured collateral. When an individual files for bankruptcy, it becomes a major negative entry on their credit report, signaling to potential lenders and creditors that they faced severe financial difficulties and were unable to repay their debts as agreed. As a result, bankruptcy can significantly lower debtors' credit scores, making it challenging to obtain new credit or loans in the immediate aftermath of the filing. The negative effects of bankruptcy on credit scores can vary depending on the type of bankruptcy filed. Chapter 7 bankruptcy, which involves the liquidation of assets to repay debts, tends to have a more severe impact on credit scores than Chapter 13 bankruptcy, which involves a repayment plan. In either case, bankruptcy can remain on the credit report for up to ten years, further exacerbating the challenges of obtaining new credit during this period. As a consequence of the lower credit scores, debtors may face limited borrowing opportunities immediately after bankruptcy. Bankruptcy serves as a lifeline for debtors facing overwhelming financial burdens, offering them rehabilitation and debt repayment options tailored to their unique circumstances. Chapter 7 bankruptcy, often referred to as liquidation bankruptcy, allows debtors to discharge unsecured debts, such as credit card debt and medical bills, through the liquidation of non-exempt assets. On the other hand, Chapter 13 bankruptcy, known as reorganization bankruptcy, provides a structured repayment plan that spans over three to five years. Debtors with a steady income can develop a repayment plan, which is submitted to the court for approval. The plan outlines how they will repay a portion of their debts over the designated period. This bankruptcy structure enables debtors to retain their assets while gradually paying off their debts, offering a more manageable and structured path to financial recovery. When a debtor files for bankruptcy, the bankruptcy structure establishes a carefully crafted hierarchy for the repayment of creditors, ensuring a fair distribution of available funds or assets. At the top of the priority list are priority debts, which hold a special status in bankruptcy proceedings. These debts are considered of utmost importance and must be paid in full before any other creditors receive payment. Priority debts typically include certain taxes owed to government agencies, alimony, child support obligations, and certain administrative expenses associated with the bankruptcy process itself. Following priority debts, secured creditors hold the next level of priority. Secured debts are debts that are backed by collateral, such as a mortgage loan secured by a home or an auto loan secured by a vehicle. In the event of bankruptcy, secured creditors have the right to seize and sell the collateral to satisfy the debt owed to them. Unsecured creditors, on the other hand, have a lower priority in the repayment hierarchy. These creditors lack collateral to secure their debts and, as a result, face a higher level of risk. Unsecured creditors include credit card companies, medical service providers, and unsecured personal loan lenders. In Chapter 7 bankruptcy, the debtor's non-exempt assets are sold and the proceeds are distributed among creditors to satisfy outstanding debts. While Chapter 7 offers a relatively swift resolution to the debtor's financial challenges, it often results in substantial losses for unsecured creditors. Unsecured creditors, such as credit card companies and medical providers, are at a higher risk of facing significant losses in Chapter 7 bankruptcy. Since there is no collateral to secure their debts, they have a lower priority in the distribution of assets. Chapter 13 bankruptcy offers a different approach to resolving debts. Instead of liquidating assets, debtors create a repayment plan to pay off a portion of their debts over a three to five-year period. This structure provides a more structured and sustainable path for debtors to manage their financial obligations. Secured creditors tend to fare better in Chapter 13 bankruptcy as they can participate in the repayment plan and have a higher chance of recovering their debts in full. Similarly, priority creditors, such as those owed taxes or child support, have a higher chance of recovering their debts in Chapter 13 bankruptcy. The debtor has the opportunity to propose a restructuring plan to address its financial difficulties while continuing its operations. This chapter is commonly used by businesses to reorganize and develop a plan that allows them to repay creditors over time. Creditors' negotiation power in Chapter 11 bankruptcy is often influenced by the amount of debt they hold, their position in the capital structure, and the degree of support they can garner from other creditors. In Chapter 13 bankruptcy, which is primarily designed for individual debtors with regular income, the debtor creates a repayment plan to address outstanding debts over a three to five-year period. Unlike Chapter 11, Chapter 13 is not commonly used by businesses. While Chapter 13 bankruptcy does not involve the same level of negotiations as Chapter 11, creditors still have an opportunity to review and provide input on the debtor's proposed repayment plan. The bankruptcy court evaluates the plan's feasibility and fairness to both the debtor and creditors. When a company or organization faces financial distress and seeks bankruptcy protection, it may resort to layoffs or restructuring measures to address financial challenges. However, bankruptcy laws are designed to safeguard employees' rights and provide certain protections during these difficult times. Under the Worker Adjustment and Retraining Notification (WARN) Act in the United States, employers with a certain number of employees are required to provide advance notice of mass layoffs or plant closings. The required notification period typically ranges from 60 to 90 days, depending on the jurisdiction and the extent of the layoffs. Additionally, bankruptcy laws address the issue of severance pay for employees who are laid off or terminated as a result of bankruptcy-related actions. In Chapter 11 bankruptcy, which is commonly used for corporate reorganizations, the company continues its operations while seeking to restructure and repay debts. During this process, employees generally retain their jobs unless layoffs or restructuring are necessary for the company's successful reorganization. In Chapter 11, employees' rights are protected under the Bankruptcy Code, which mandates fair treatment and prohibits discriminatory actions based on age, race, gender, or other protected characteristics. The Bankruptcy Code requires that employees be paid for services rendered up to the date of the bankruptcy filing. Additionally, employees may be entitled to severance pay if it was previously agreed upon in their contracts or collective bargaining agreements. Employees who lose their jobs due to Chapter 7 bankruptcy may also be eligible for unemployment benefits to help them during their job search. In some instances, companies undergoing bankruptcy may opt to modify or terminate existing employee benefit plans to alleviate financial pressures. These benefit plans may include health insurance, retirement savings plans (such as 401(k)s), pension plans, life insurance, disability coverage, and other employee perks. Termination of pension plans, in particular, can be a major concern for employees who rely on these plans for their retirement income. The Employee Retirement Income Security Act (ERISA) is a federal law that establishes minimum standards for employee benefit plans offered by private employers. Under ERISA, employers are required to fulfill certain fiduciary duties when managing employee benefit plans. This includes acting in the best interests of plan participants and beneficiaries, ensuring that plan assets are prudently managed, and providing accurate and timely information about the plan's features and financial status. Furthermore, ERISA provides safeguards for employees' pension plans. If a pension plan is terminated, the Pension Benefit Guaranty Corporation (PBGC), a government agency, may step in to assume responsibility for the plan and ensure that participants receive their vested benefits up to certain limits. ERISA sets limits on the termination of pension plans and provides guidelines for how such terminations should be handled. In some cases, employers may seek to terminate underfunded pension plans, but this must be done in accordance with ERISA's rules and regulations. Layoffs and restructuring are among the most common cost-cutting measures employed during bankruptcy. Layoffs involve the reduction of the workforce by terminating employment for certain positions or employees. Restructuring, on the other hand, focuses on reorganizing the company's structure, operations, or even product lines to achieve greater efficiency and competitiveness. In some bankruptcy cases, layoffs and restructuring are aimed at preserving the core business of the company. By eliminating non-essential or underperforming departments or divisions, the company can focus its resources on its most profitable and viable areas. During bankruptcy proceedings, creditors may demand evidence of a viable business plan that demonstrates the company's ability to repay its debts. Implementing layoffs and restructuring can be a critical aspect of such a plan, as it showcases the company's commitment to regaining financial stability and meeting its obligations. While layoffs and restructuring are often driven by financial considerations, it is essential for companies to balance the need for cost-cutting with the well-being of their employees. Implementing layoffs and restructuring should be done with careful consideration and sensitivity to minimize the impact on the workforce. Companies undergoing bankruptcy should consider providing support and assistance to affected employees. This may include offering severance packages, providing access to career transition services, and offering guidance on reemployment opportunities. Such measures can help alleviate the stress and uncertainty experienced by affected employees. As a company navigates through bankruptcy proceedings, various actions are taken to address its financial challenges, which often includes the issuance of new shares. This issuance can lead to the dilution of existing shareholders' equity, significantly impacting their ownership stakes in the company. Bankruptcy structures offer a unique avenue for a specific type of investing known as distressed investing. Distressed investing involves acquiring assets or securities of financially troubled companies that are undergoing bankruptcy or facing significant financial challenges. Distressed investors may target a variety of assets, such as stocks, bonds, or real estate, that belong to companies undergoing bankruptcy. These assets are often undervalued due to the uncertainties surrounding the company's financial health. Distressed debt refers to the bonds or loans of a company that are trading at significant discounts to their face value due to perceived risks associated with the company's financial health. Distressed investors view these discounted debt instruments as opportunities to make profits if the company is able to successfully reorganize and repay its debts, leading to potential gains for bondholders. Distressed investors often see the post-bankruptcy period as an opportunity for companies to restructure and implement operational improvements. A successful reorganization can lead to increased operational efficiency, reduced debt burdens, and improved financial performance. Under different bankruptcy structures, bondholders may have the opportunity to negotiate new terms for their debt holdings. These negotiations typically occur during Chapter 11 bankruptcy, which involves the reorganization of the company. The debt restructuring process requires a delicate balancing act between the company's need for financial relief and the bondholders' interests in maximizing their returns. Bondholders, as creditors, want to ensure that they receive as much of their principal and interest payments as possible. On the other hand, the company seeks to reduce its debt burden to become financially viable again. Debt restructuring can have implications for bondholder returns. While negotiating new terms may reduce the immediate cash flow from the bonds, it is intended to enhance the likelihood of the company's long-term financial recovery. Systemic risk arises when the failure of a single financial institution or a few interconnected institutions can severely disrupt the entire financial system. Large financial institutions often play critical roles in providing essential services, such as lending and payment processing, to other financial entities. Their failure can lead to a loss of confidence in the financial system, freezing credit markets, and causing severe liquidity shortages. Contagion refers to the spread of financial distress from one entity to other related entities or markets. In the context of bankruptcy events, the distress experienced by a defaulting company or financial institution can quickly spread to its counterparties, suppliers, and customers. Contagion can extend beyond national borders, affecting global financial markets. The interconnectedness of the global financial system means that distress in one region can quickly transmit to other regions, potentially causing a worldwide economic downturn. Given the potential catastrophic consequences of systemic risk and contagion effects, governments and central banks are often compelled to intervene during bankruptcy events. Government interventions may include providing liquidity support to troubled institutions, injecting capital, facilitating mergers or acquisitions, or implementing temporary guarantees to restore market confidence. Central banks may use monetary policy tools to influence interest rates and maintain financial stability. Additionally, regulators may impose stricter supervision and prudential regulations to enhance the resilience of the financial system against future shocks. The uncertainties surrounding bankruptcy proceedings, especially when involving prominent companies or financial institutions, can trigger a range of reactions from investors and market participants. Investors may react with panic or uncertainty, leading to rapid fluctuations in asset prices, such as stocks, bonds, and commodities. This heightened volatility can create challenges for investors in making informed decisions and can result in sudden market swings. During periods of uncertainty and distress, investors may seek safe-haven assets to protect their capital from potential losses. Common safe-haven assets include government bonds, gold, and other low-risk investments. Bankruptcy events can also affect consumer and business confidence. In cases where a bankrupt company is a significant employer or a major player in a specific industry, there may be concerns about potential job losses and the overall health of the sector. Governments and regulatory authorities often closely monitor bankruptcy events and their potential effects on the broader economy. In response to market disruptions and instability, authorities may implement measures to restore market confidence and mitigate adverse impacts. Such measures may include increased market oversight, financial support to affected industries, or regulatory changes to address vulnerabilities in the financial system. Bankruptcy is a legal process that offers relief to individuals and businesses overwhelmed by insurmountable debt. It shields debtors from aggressive creditor actions and ensures the equitable distribution of assets. Bankruptcy provides immediate relief and protection from creditors, safeguarding debtors' wages and assets during the process. However, it negatively impacts credit scores, making it challenging to obtain new credit. Different bankruptcy structures, like Chapter 7 and Chapter 13, offer distinct rehabilitation and debt repayment options. For creditors, bankruptcy structures prioritize claims, leading to potential losses for unsecured creditors in Chapter 7. Distressed investing opportunities arise for investors, enabling them to acquire undervalued assets. Bankruptcy also has systemic risks, potentially spreading financial distress and affecting market confidence.Definition of Bankruptcy

Effects of Bankruptcy on Debtors

Immediate Relief and Protection From Creditors

Consequences on Credit Scores and Future Borrowing Opportunities

Rehabilitation and Debt Repayment Options Based on Bankruptcy Structure

Effects of Bankruptcy on Creditors

Prioritization of Creditors' Claims Based on Bankruptcy Structure

Potential Losses and Recovery Rates for Different Types of Creditors

Chapter 7 Bankruptcy

Chapter 13 Bankruptcy

Influence on Negotiation Power and Settlement Options

Chapter 11 Bankruptcy

Chapter 13 Bankruptcy

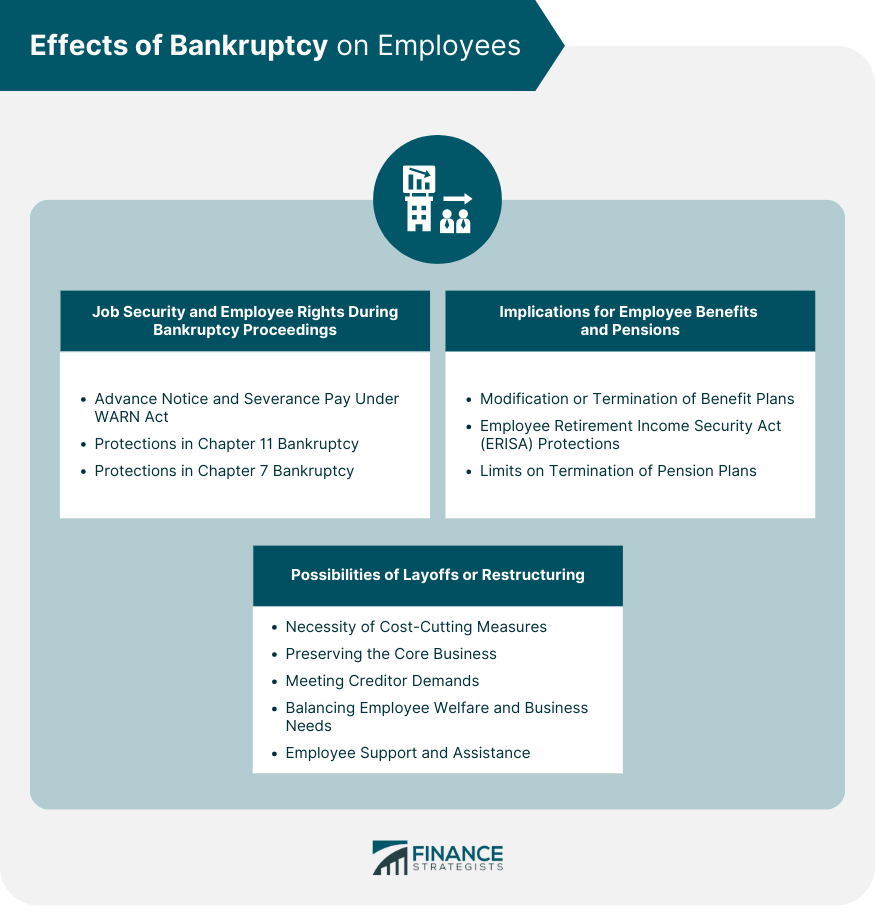

Effects of Bankruptcy on Employees

Job Security and Employee Rights During Bankruptcy Proceedings

Notification and Severance Pay

Employee Protections in Chapter 11 Bankruptcy

Employee Protections in Chapter 7 Bankruptcy

Implications for Employee Benefits and Pensions

Modification or Termination of Benefit Plans

Employee Retirement Income Security Act (ERISA) Protections

Limits on Termination of Pension Plans

Possibilities of Layoffs or Restructuring

Necessity of Cost-Cutting Measures

Preserving the Core Business

Meeting Creditor Demands

Balancing Employee Welfare and Business Needs

Employee Support and Assistance

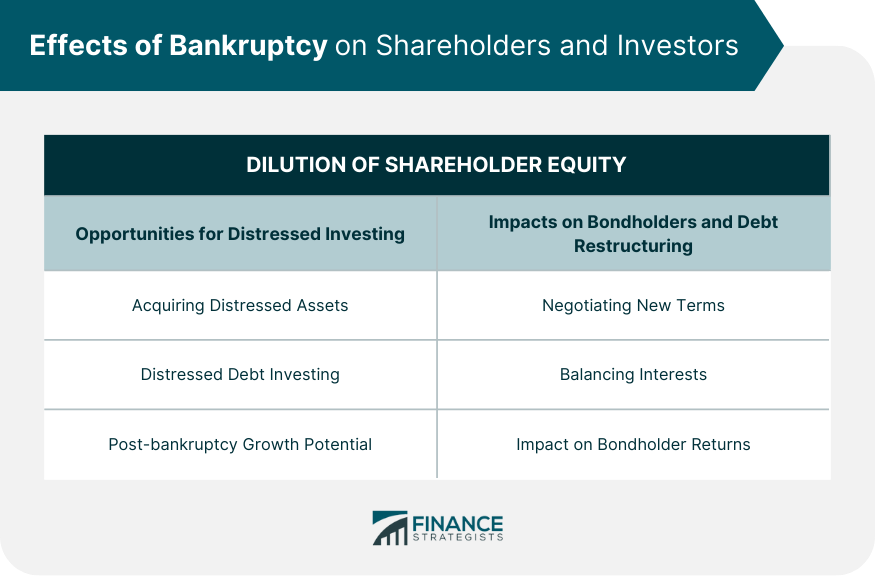

Effects of Bankruptcy on Shareholders and Investors

Dilution of Shareholder Equity and Stock Price Fluctuations

Opportunities for Distressed Investing

Acquiring Distressed Assets

Distressed Debt Investing

Post-bankruptcy Growth Potential

Impacts on Bondholders and Debt Restructuring

Negotiating New Terms

Balancing Interests

Impact on Bondholder Returns

Effects of Bankruptcy on the Economy

Systemic Risk and Contagion Effects of Bankruptcy Events

Systemic Risk

Contagion Effects

Government Interventions and Regulatory Measures

Impact on Market Confidence and Investor Sentiment

Volatility in Financial Markets

Flight to Safety

Impact on Consumer and Business Confidence

Regulatory and Policy Responses

Conclusion

Effects of Bankruptcy FAQs

Bankruptcy can result in potential losses for creditors, with different bankruptcy structures determining their recovery rates based on the type of debts they hold.

Bankruptcy can significantly lower a debtor's credit scores, making it challenging to access new credit or loans immediately. However, responsible financial management can help rebuild credit over time.

Bankruptcy may lead to layoffs or restructuring, impacting job security for employees. However, bankruptcy laws safeguard employee rights, ensuring appropriate notice and severance pay in certain cases.

Bankruptcy can lead to the dilution of shareholder equity and fluctuations in stock prices due to the issuance of new shares. However, it also presents distressed investing opportunities for investors.

Bankruptcy events can create systemic risks, where the failure of a significant financial institution or interconnected entities disrupts the entire financial system, affecting markets globally.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.