Bankruptcy Basics

Bankruptcy is a legal procedure for individuals or businesses unable to repay debts, offering a financial reset under federal bankruptcy court protection.

Chapter 7, 'liquidation bankruptcy,' sells off a debtor's non-exempt assets to clear debts. In contrast, Chapter 13, 'reorganization bankruptcy,' lets debtors with steady income create a repayment plan over three to five years.

Bankruptcy eligibility depends on the debtor's income, debt types, and previous bankruptcy filings. Notably, high-income earners may only qualify for Chapter 13.

While bankruptcy provides temporary financial relief, it significantly impacts your credit score, making future loan or credit card approval more challenging.

A bankruptcy filing can linger on your credit report for up to ten years, emphasizing its long-term consequences.

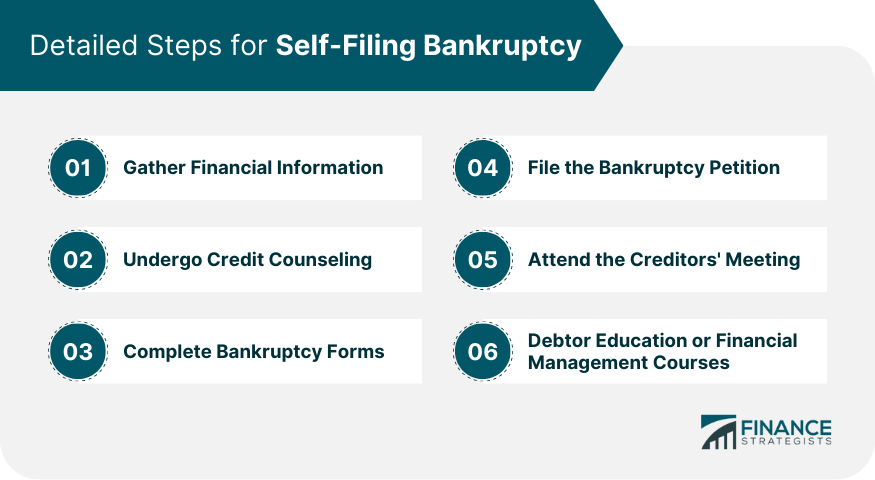

Detailed Steps for Self-Filing Bankruptcy

To successfully file bankruptcy without a lawyer, you must be thorough and accurate in completing the necessary paperwork and fulfilling court requirements.

1. Gather Financial Information: Collect comprehensive data about your financial status, including income sources, monthly expenses, a list of your assets (like real estate, cars, savings, and valuable items), and a detailed list of all debts.

2. Undergo Credit Counseling: Federal law mandates that within 180 days before filing, you must receive credit counseling from a government-approved organization. Once completed, you’ll receive a certificate of completion.

3. Complete Bankruptcy Forms: Fill out the required forms accurately, detailing your financial information. These forms include various schedules and statements, where you'll list your assets, liabilities, income, and expenses.

4. File the Bankruptcy Petition: Submit your completed bankruptcy forms to the court along with the filing fee. This formally starts your bankruptcy case.

5. Attend the Creditors' Meeting: Known as a 341 meeting, you'll answer questions from your bankruptcy trustee and any creditors who choose to attend. You'll need to provide the requested documents verifying your identity and financial information.

6. Follow Additional Requirements: You may need to fulfill additional requirements, such as attending debtor education or financial management courses. These are necessary to receive a bankruptcy discharge, effectively wiping out your qualifying debts.

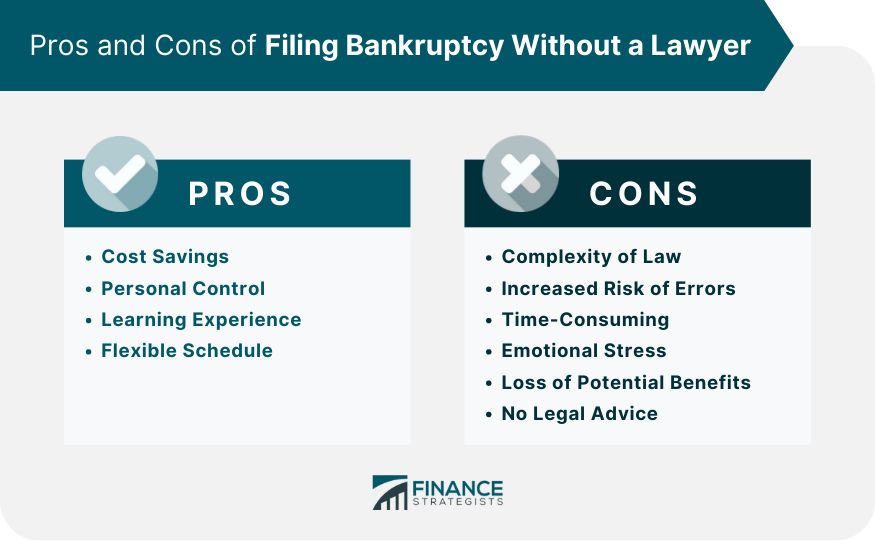

Pros and Cons of Filing Bankruptcy Without a Lawyer

Pros

Cost Savings: Hiring a bankruptcy attorney can be expensive. If you're already in financial distress, saving on legal fees can be a significant advantage.

Personal Control: You have complete control over your case, its presentation, and the details that you choose to disclose.

Learning Experience: You get to learn about the bankruptcy process, laws, and procedures. This might be beneficial for future financial planning.

Flexible Schedule: You can work on your case whenever you have time without having to coordinate schedules with a lawyer.

Cons

Complexity of Law: Bankruptcy laws can be complicated and hard to understand. Legal representation can help navigate these complexities.

Increased Risk of Errors: There's a higher chance of making errors in your paperwork, which could lead to the dismissal of your case or other negative outcomes.

Time-Consuming: Understanding the legal procedures, filling out forms, and meeting the court's requirements can take up a significant amount of time.

Emotional Stress: Handling a bankruptcy case on your own can be stressful, as you're dealing with your financial struggles directly without the help of a professional.

Loss of Potential Benefits: A good bankruptcy lawyer can help you protect more of your assets, reduce your debt, or even find alternatives to bankruptcy that you may not be aware of.

No Legal Advice: You won't have the benefit of professional advice on how to optimize your bankruptcy, such as using exemptions effectively and deciding which type of bankruptcy is right for you (Chapter 7 or Chapter 13).

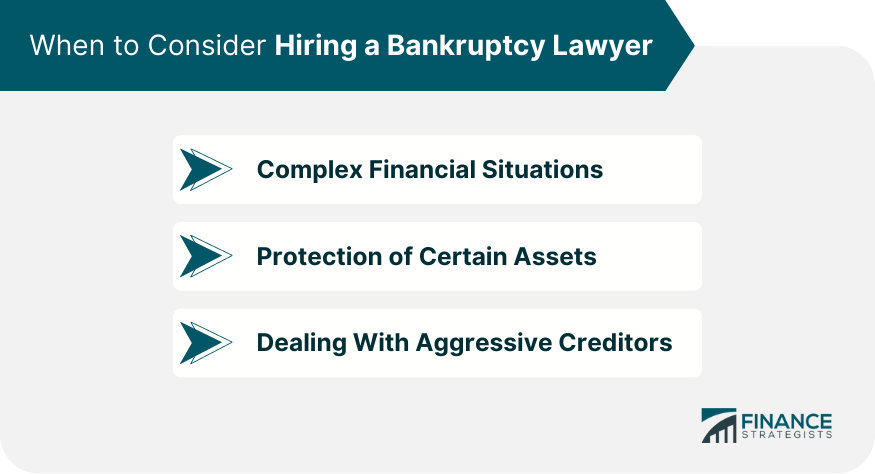

When to Consider Hiring a Bankruptcy Lawyer

While self-filing is an option, there are situations where hiring a bankruptcy lawyer becomes crucial for a smoother and more successful bankruptcy process.

Complex Financial Situations

If your financial situation involves many different types of debt, large assets, and a significant number of creditors, or if you own a business, it can be difficult to navigate bankruptcy proceedings on your own.

A bankruptcy lawyer can help you understand how different types of debt are treated in bankruptcy and can devise a strategy that's best for your unique situation.

Protection of Certain Assets

Certain assets may be exempt from bankruptcy proceedings, meaning they cannot be used to pay off debt. This might include your home, car, personal belongings, or retirement accounts, depending on your state’s laws.

A bankruptcy lawyer can guide you through the process of declaring exemptions, helping you protect as many of your assets as possible.

Dealing With Aggressive Creditors

If you are dealing with aggressive creditors, hiring a bankruptcy lawyer can help. Once you hire a lawyer, creditors are legally required to communicate only with your attorney, which can alleviate stress.

An attorney can also address any illegal or unethical behavior from creditors, such as harassment or violations of the Fair Debt Collection Practices Act.

Resources for Assistance With Self-Filing

Various resources are available to assist individuals filing for bankruptcy without a lawyer. These resources can provide guidance, software, and support throughout the process.

Bankruptcy Software and Online Tools

Various software programs and online tools can assist with the process of self-filing for bankruptcy. These tools help you organize your financial information, fill out the required forms accurately, and guide you through the filing process.

Free Legal Aid Clinics and Resources

Many areas have free legal aid clinics that offer advice or assistance to people who are filing for bankruptcy. Some law schools also have programs where law students provide free legal aid under the supervision of their professors.

Additionally, there are a number of online resources and forums where you can find free advice and information about bankruptcy proceedings.

Books, Guides, and Reputable Online Sources

Numerous books and guides can help you understand the bankruptcy process, your rights, and how to fill out the required paperwork correctly.

There are also many reputable online sources that provide comprehensive information about bankruptcy laws, different types of bankruptcy, and the consequences of filing for bankruptcy.

Non-profit Credit Counseling Agencies

Non-profit credit counseling agencies offer a range of services, including budget counseling, financial education workshops, and debt management planning.

These agencies can help you understand your financial situation better, explore potential alternatives to bankruptcy, and plan for a financially stable future.

In fact, attending a credit counseling session is a requirement before filing for bankruptcy in the U.S.

The Bottom Line

Navigating bankruptcy independently is feasible, but it also carries inherent complexities and potential pitfalls.

Although you can save on legal fees and gain a valuable learning experience, the stakes are high, and the legal landscape can be difficult to traverse without professional help.

Missteps can lead to severe repercussions, including case dismissal, loss of potential benefits, or unoptimized asset protection. Moreover, bankruptcy carries long-term consequences for your credit score and future financial opportunities.

Therefore, seeking professional advice can be a wise investment, even in trying financial times. As you consider whether to self-file or hire a bankruptcy lawyer, take into account the complexity of your situation, your comfort with the legal process, and your tolerance for risk.

A financial advisor can be an invaluable resource in making this difficult decision. Remember, the path to financial recovery can be challenging, but you don't have to walk it alone.

Filing Bankruptcy Without a Lawyer FAQs

Yes, you can file bankruptcy without a lawyer, but it's crucial to understand the legal complexities involved.

The steps to file bankruptcy without a lawyer include gathering financial information, undergoing credit counseling, completing bankruptcy forms, filing the bankruptcy petition, attending the creditors' meeting, and following additional requirements like debtor education or financial management courses.

The advantages of filing bankruptcy without a lawyer include cost savings, personal control over the case, a valuable learning experience, and a flexible schedule.

You should consider hiring a bankruptcy lawyer if you're dealing with complex financial situations, need to protect certain assets, or are facing aggressive creditors. A lawyer can provide critical advice and navigation through the bankruptcy process.

You should consider hiring a bankruptcy lawyer if you're dealing with complex financial situations, need to protect certain assets, or are facing aggressive creditors. A lawyer can provide critical advice and navigation through the bankruptcy process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.