Bankruptcy is a federal court process designed to assist consumers and businesses in eliminating their debts or repaying them under the protection of the bankruptcy court. There are two primary types for consumers: Chapter 7 and Chapter 13 bankruptcy. They have different purposes, requirements, and outcomes, but both can have a significant impact on your financial future. Filing for bankruptcy can have serious implications. It can impact your credit score, making it difficult to secure credit, buy a home, or even find employment. However, it also offers a way out for people who are unable to repay their debts. Bankruptcy law is designed to balance these hardships with the fresh start it provides to debtors. Under federal and state bankruptcy laws, certain property is "exempt" or protected from creditors. The goal of these exemptions is to allow bankrupt individuals to restart their financial lives without being totally stripped of their assets. In a bankruptcy case, a debtor can protect certain assets, such as their home, through exemptions. The specifics vary by state, but the concept remains the same: up to a certain value, the debtor's house is safeguarded from liquidation. The home exemption is especially critical because, for many people, their home is their most valuable asset. In Chapter 7 bankruptcy, assets are sold or liquidated to repay creditors. However, every state has a homestead exemption that allows you to exempt some equity in your primary residence. If your equity doesn't exceed the exemption amount, you'll likely be able to keep your home. While Chapter 7 can help discharge unsecured debts, it poses risks for homeowners with significant equity. However, if you're behind on your mortgage payments and you can't afford a repayment plan, Chapter 7 might offer the relief you need. Unlike Chapter 7, Chapter 13 bankruptcy involves a repayment plan for debts over three to five years. It doesn't require liquidation of assets, and it can offer benefits to those facing foreclosure. Under Chapter 13, past-due mortgage payments can be rolled into the repayment plan, offering homeowners an opportunity to catch up over time. The debtor proposes a plan to repay their creditors over a three to five-year period. This period can give homeowners time to get current on their mortgages, preventing foreclosure. A reaffirmation agreement is a legal contract that states you will repay all or a portion of a debt that might otherwise have been discharged in your bankruptcy case. Homeowners can reaffirm their mortgage, effectively excluding the mortgage debt from bankruptcy proceedings and keeping the property. In Chapter 13 bankruptcy, if you have second or third mortgages and your home’s value is less than the balance on your first mortgage, you might be able to remove, or "strip," these additional mortgages. Stripping these liens can make it easier to keep up with mortgage payments and retain the house. In bankruptcy, redemption is the right to buy back your property by paying the lender the current replacement value of the property rather than the full amount owed on the loan. This is more commonly used for personal property, like vehicles, but can apply to houses in certain circumstances. "Cramdown" is a Chapter 13 bankruptcy provision that allows debtors to reduce the principal balance of a debt to the current market value of the collateral property. This is commonly used for underwater properties—when more is owed on the property than it's worth. Staying current with mortgage payments is crucial. While bankruptcy can discharge the debt obligation, it does not remove the lender's lien on the property. Falling behind on payments can lead to foreclosure, even after filing for bankruptcy. Some companies may offer to help you keep your home by giving a cash advance or loan and requiring your home as collateral. This practice, known as equity stripping, often results in more debt, and the risk of losing your home increases. Before filing for bankruptcy, review other assets that could be liquidated to pay debts or negotiate with creditors for lower payments. It's important to understand how different types of debts and assets will be treated in bankruptcy. Understanding all the legal intricacies of bankruptcy is a daunting task. Bankruptcy attorneys can help navigate these complexities, and it's advisable to consult one before making any decisions. A financial advisor can play a crucial role in managing finances before and after bankruptcy. They can provide advice on budgeting, saving, and investing, and can help you plan a financial strategy that prevents future financial distress. Transparency with your financial advisor is key. By understanding your complete financial picture, including the risks and potential rewards of different strategies, an advisor can provide guidance tailored to your specific needs and goals. Bankruptcy can be a challenging process with significant implications for one's financial future. However, there are ways to protect your home during bankruptcy proceedings. Chapter 7 bankruptcy may discharge unsecured debts while posing risks for homeowners with substantial equity, but it can provide relief for those struggling with mortgage payments. On the other hand, Chapter 13 bankruptcy offers a repayment plan that allows homeowners to catch up on their mortgage payments over time, preventing foreclosure. Additionally, legal mechanisms like reaffirmation agreements, lien stripping, redemption, and cramdown can further help homeowners retain ownership of their homes. It is crucial to take practical steps, such as paying your mortgage on time, avoiding equity stripping, and reviewing your assets and debts before filing for bankruptcy. Lastly, seeking guidance from a financial advisor can provide invaluable assistance in navigating the complexities of bankruptcy and developing a financial strategy to ensure a stable future.Overview of Bankruptcy

Possibility of Keeping Your House in Bankruptcy

Bankruptcy Exemptions

How Exemptions Work to Protect Your Home

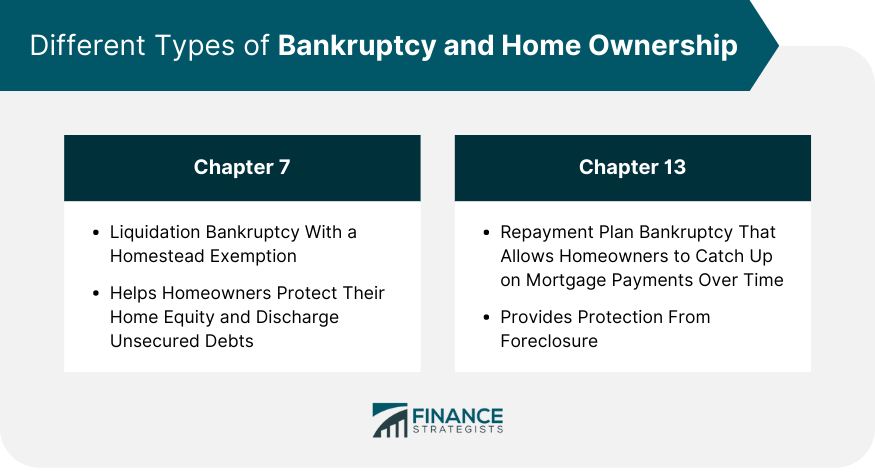

Different Types of Bankruptcy and Home Ownership

Chapter 7 Bankruptcy

Understanding the Chapter 7 Homestead Exemption

Risks and Benefits of Chapter 7 for Homeowners

Chapter 13 Bankruptcy

How Chapter 13 Protects Your Home

Process of Chapter 13 Bankruptcy for Homeowners

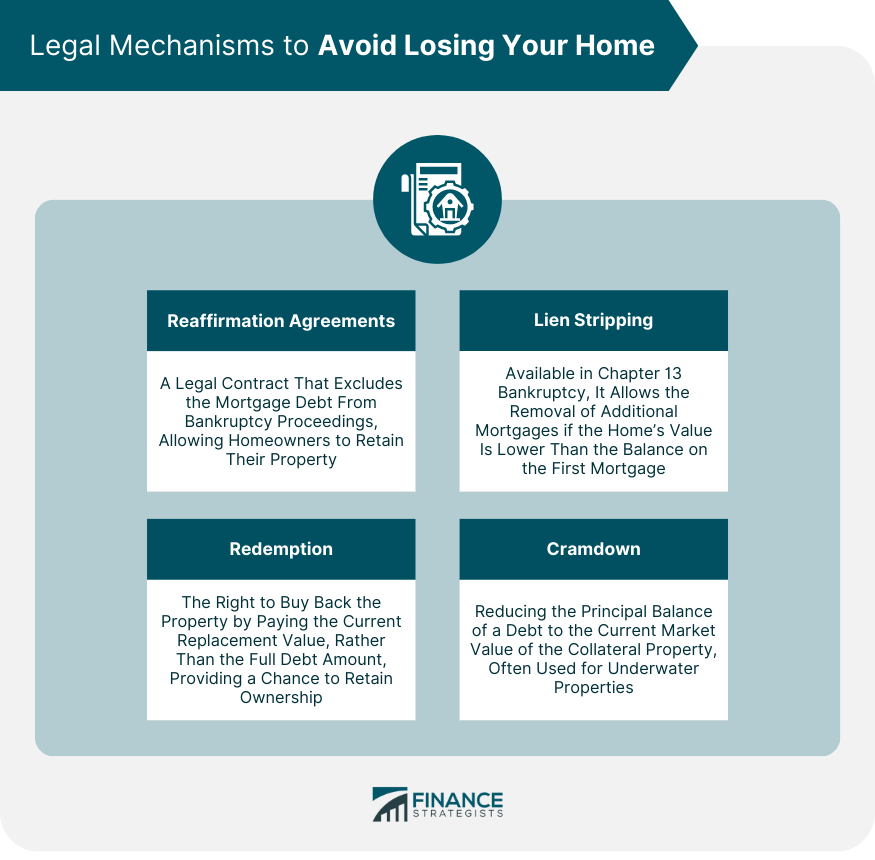

Legal Mechanisms to Avoid Losing Your Home

Reaffirmation Agreements

Lien Stripping

Redemption

Cramdown

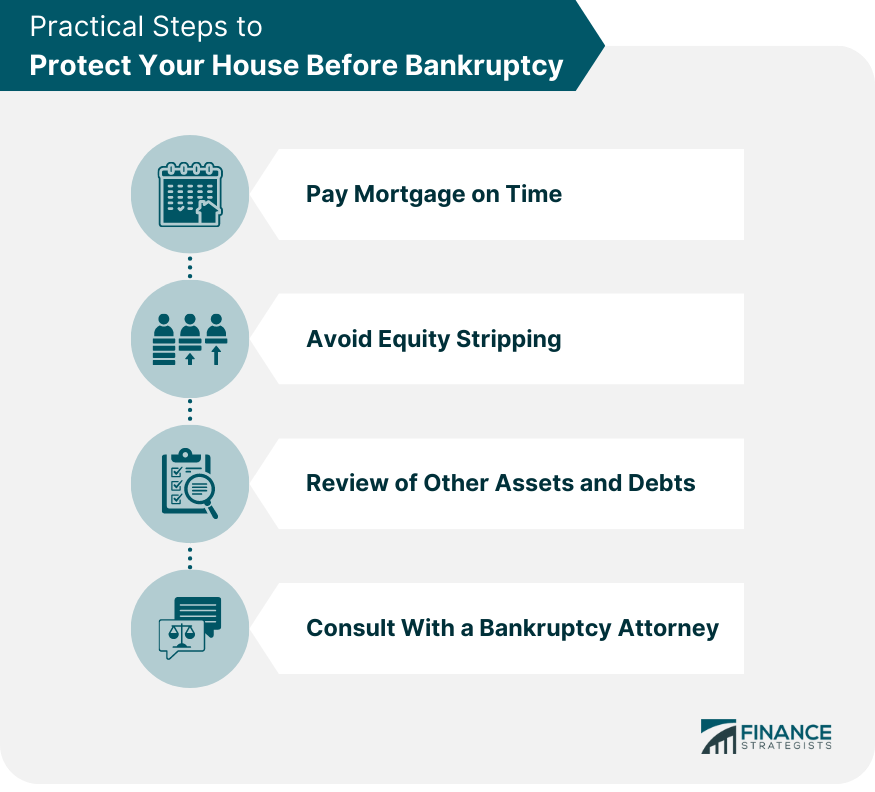

Practical Steps to Protect Your House Before Bankruptcy

Pay Mortgage on Time

Avoid Equity Stripping

Review Other Assets and Debts

Consult With a Bankruptcy Attorney

Role of a Financial Advisor in Navigating Bankruptcy

How a Financial Advisor Can Help

Importance of Honest Communication With Your Advisor

The Bottom Line

Filing Bankruptcy Without Losing One's House FAQs

Bankruptcy offers exemptions and legal mechanisms such as reaffirmation agreements, lien stripping, redemption, and cramdown to safeguard your home.

A reaffirmation agreement is a legal contract that allows you to exclude mortgage debt from bankruptcy, helping you keep your home.

Lien stripping in Chapter 13 bankruptcy enables you to remove second or third mortgages if your home's value is lower than the balance on your first mortgage.

A financial advisor can provide guidance on budgeting, saving, and creating a financial strategy to navigate bankruptcy and prevent future financial distress.

Honest communication with your financial advisor is crucial to ensure they have a complete understanding of your financial situation and can provide tailored guidance for your needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.