Getting credit after bankruptcy may seem daunting, but it's an essential step toward financial recovery. Post-bankruptcy, your credit score typically takes a hit and lenders may perceive you as high-risk, leading to potential high-interest rates or limited credit opportunities. However, by strategically acquiring and managing new credit, you can gradually rebuild your score. Starting with secured credit cards or credit-builder loans is often the first step. Consistently making timely payments, managing your finances responsibly, and steadily improving your credit score can eventually open up opportunities for more types of credit, like personal loans or mortgages. Consultation with a financial advisor or credit counseling services can further guide your journey toward creditworthiness, helping to ensure you regain control over your financial life. It's a process that requires time and disciplined financial habits, but with patience, getting credit after bankruptcy is achievable. A bankruptcy discharge is a court order that releases the debtor from personal liability for certain types of debts. This means the debtor is legally free from paying these debts. After a bankruptcy discharge, obtaining new credit becomes a key part of the individual's financial recovery. Your credit score is a numerical representation of your creditworthiness, based on an analysis of your credit files. Lenders use credit scores to assess the likelihood that you will repay your debts. A bankruptcy can cause your credit score to plummet, but it’s possible to rebuild your credit score following bankruptcy. Each type of credit has different eligibility criteria and timeframes following bankruptcy. For instance, some lenders might approve a secured credit card immediately after a bankruptcy discharge, whereas others might require a waiting period. Rebuilding credit after bankruptcy requires a strategic approach, which may include a combination of secured credit cards, credit-builder loans, or even a co-signer on a loan. Secured credit cards require a cash deposit as collateral, which usually determines your credit limit. These cards are often easier to obtain after bankruptcy and, when used responsibly, can be a useful tool to rebuild your credit. Unsecured credit cards do not require a security deposit but are more difficult to qualify for after bankruptcy. They may come with higher interest rates and fees, but can be obtained with time and a demonstrated history of financial responsibility. Personal loans can also be an option after bankruptcy, though it may take some time before you're able to qualify for a reasonable interest rate. Personal loans can be used for a wide range of purposes and can help build credit when payments are made consistently and on time. Auto loans might be available shortly after a bankruptcy discharge, but they typically come with high interest rates. As your credit improves, you may be able to refinance to a loan with a lower interest rate. Qualifying for a mortgage after bankruptcy can take several years and depends on the type of bankruptcy filed. FHA and VA loans have the shortest waiting periods, while conventional loans generally require more time. Securing credit post-bankruptcy and making timely payments is a crucial step in repairing a credit score. A higher credit score can translate into lower interest rates on future loans and can open up opportunities for better credit options. Getting credit after bankruptcy can also broaden financial opportunities. Over time, as credit scores improve, individuals may qualify for mortgages, auto loans, and other types of credit that may have been unattainable immediately following bankruptcy. Credit obtained after bankruptcy can help an individual reestablish financial stability. It allows the debtor to create a fresh start, work towards financial goals, and gradually regain control over their financial situation. One of the major challenges of obtaining credit after bankruptcy is the potential for high interest rates. Lenders often see individuals with a bankruptcy history as a risk, and they mitigate this risk by charging higher interest rates. Bankruptcy can limit your credit opportunities. Some lenders may be unwilling to provide credit to someone who has a recent bankruptcy. In these cases, secured credit cards or loans can be an alternative, though they require a cash deposit or collateral. After bankruptcy, lenders often scrutinize loan applications more closely. This can lead to more rejections or approvals with less favorable terms. There's a risk of falling back into the cycle of unmanageable debt if one is not careful about managing the new credit. Regularly checking your credit report can help you keep track of your progress and promptly correct any inaccuracies. Consistently making payments on time and keeping debt levels low can help improve your credit score. By keeping your spending in check and meeting all your credit obligations, you can demonstrate financial responsibility, which can increase your chances of obtaining more credit in the future. Consulting with a financial advisor can provide you with personalized advice to help manage your finances and build a roadmap to improve your creditworthiness. Secured credit cards are often a viable option for individuals who have gone through bankruptcy. They require a security deposit, which sets the limit for your credit. Responsible use of a secured card can help build your credit over time. Having a well-planned budget is crucial for maintaining financial health. It allows you to live within your means, prevents overspending, and can help you prioritize paying off any existing debts. It's important to build a healthy savings account and an emergency fund. This provides a safety net for unexpected expenses and reduces the need to rely on credit. Closely tracking your spending habits and debt can help you understand your financial behavior, making it easier to adjust and improve. The more you understand about credit, debt, and personal finance, the better equipped you'll be to make sound financial decisions and avoid falling back into debt. Credit counseling is a service that provides guidance and support for individuals struggling with debt. Credit counselors can provide valuable advice on money and debt management, budgeting, and generally improving your financial situation. Credit counseling after bankruptcy can be a useful resource for learning how to manage your finances, rebuild your credit, and stay out of debt. Not all credit counseling services are created equal. It's important to research and select a reputable organization that provides transparent, personalized, and affordable services. Through education and guidance, credit counseling can help you develop the financial habits and skills necessary to avoid bankruptcy in the future. They can help you understand the root causes of your previous financial troubles and provide strategies to prevent similar issues from happening again. Getting credit after bankruptcy is a crucial step toward financial recovery and stability. Despite the initial hit to your credit score and potential high-interest rates, there are strategies to rebuild your credit health. These include regularly monitoring your credit report, demonstrating financial responsibility, and starting with secured credit cards or credit-builder loans. Leveraging the guidance of professional financial advisors or credit counseling services can also be beneficial. In time, consistent financial discipline can lead to improved credit scores, opening up a range of financial opportunities such as personal loans, auto loans, and mortgages. It's also important to develop sustainable habits like budgeting and savings to avoid falling back into unmanageable debt. Remember, while bankruptcy may mark a challenging period in your financial history, it's not the end. With patience and consistent effort, regaining creditworthiness after bankruptcy is an achievable goal.Getting Credit After Bankruptcy: Overview

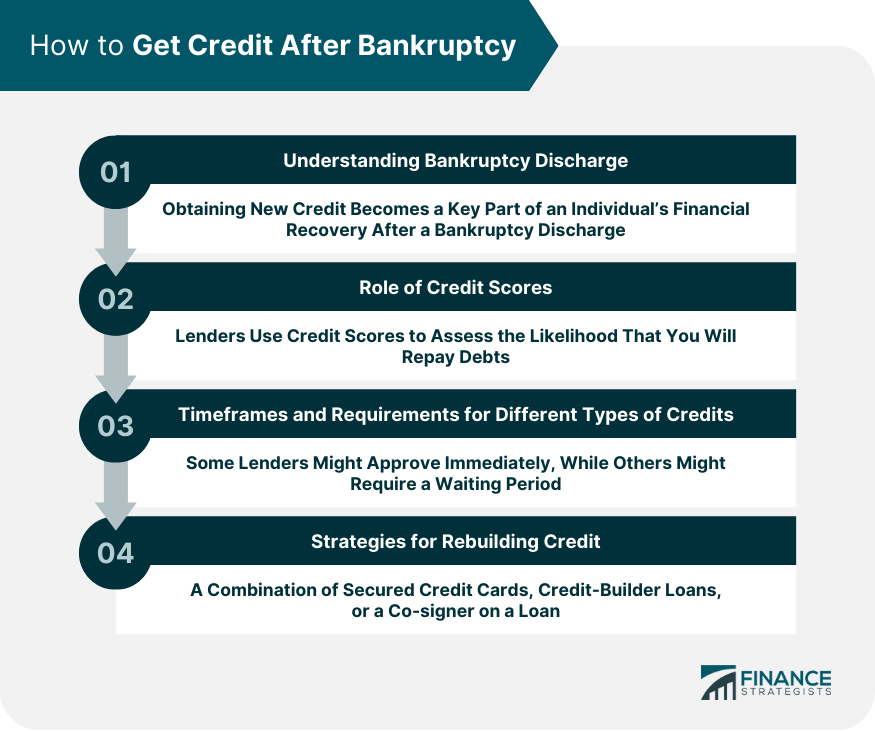

How to Get Credit After Bankruptcy

Understanding Bankruptcy Discharge

Role of Credit Scores

Timeframes and Requirements for Different Types of Credits

Strategies for Rebuilding Credit

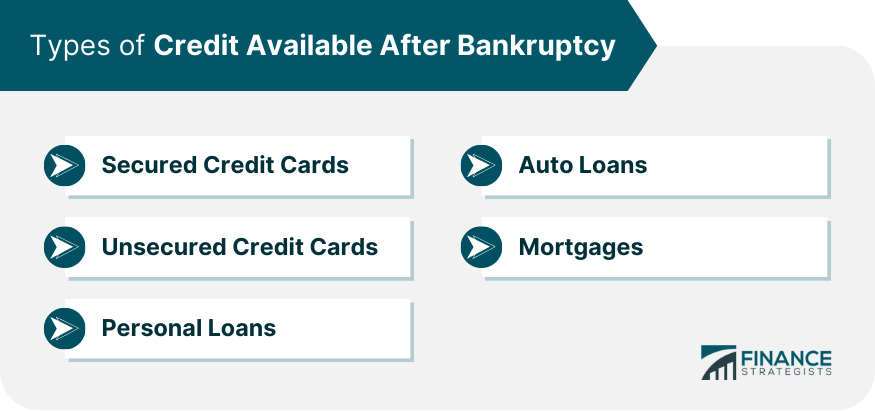

Types of Credit Available After Bankruptcy

Secured Credit Cards

Unsecured Credit Cards

Personal Loans

Auto Loans

Mortgages

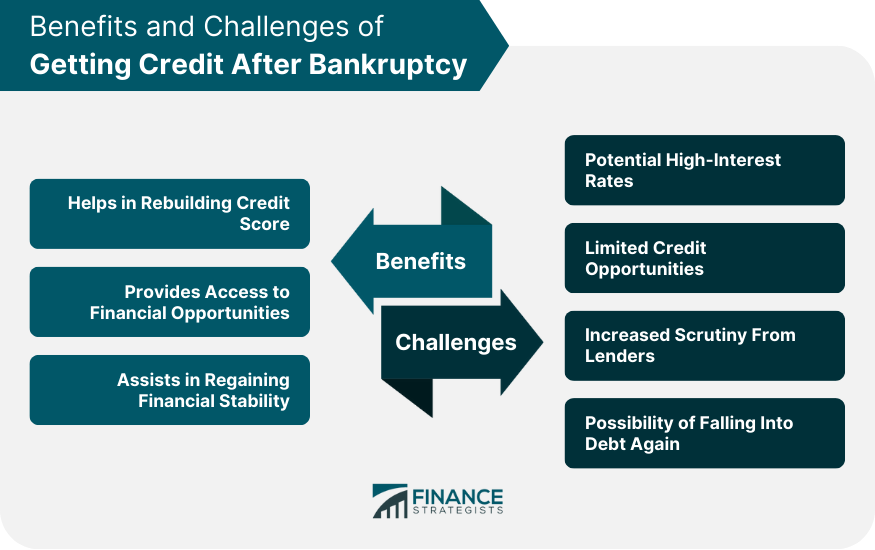

Benefits of Getting Credit After Bankruptcy

Helps in Rebuilding Credit Score

Provides Access to Financial Opportunities

Assists in Regaining Financial Stability

Risks of Getting Credit After Bankruptcy

Potential High-Interest Rates

Limited Credit Opportunities

Increased Scrutiny From Lenders

Possibility of Falling Into Debt Again

Preparing to Get Credit After Bankruptcy

Regularly Check and Improve Credit Score

Demonstrate Financial Responsibility

Seek Professional Financial Advice

Use Secured Credit Cards

Strategies for Staying Debt-Free After Bankruptcy

Build a Sustainable Budget

Prioritize Savings and Emergency Funds

Monitor Spending and Debt

Seek Continual Financial Education

Role of Credit Counseling in Post-bankruptcy Credit Acquisition

What is Credit Counseling?

Benefits of Credit Counseling After Bankruptcy

Finding Reputable Credit Counseling Services

How Credit Counseling Can Prevent Future Bankruptcies

Conclusion

Getting Credit After Bankruptcy FAQs

The first step is understanding your bankruptcy discharge and how it impacts your credit score. You should review your credit report, correct any inaccuracies, and start working on strategies to improve your credit score.

Consistently demonstrating financial responsibility can improve your chances. This includes making all payments on time, keeping debt levels low, sticking to a budget, and building an emergency fund. You can also seek professional financial advice or credit counseling.

Getting credit after bankruptcy is important because it allows you to rebuild your credit score and regain financial stability. Improved credit scores can provide access to financial opportunities such as mortgages, auto loans, and other types of credit in the future.

The types of credit available after bankruptcy typically start with secured credit cards and credit-builder loans. As your credit improves, you may be able to qualify for unsecured credit cards, personal loans, auto loans, and eventually, mortgages.

Some challenges include potential high-interest rates, limited credit opportunities, increased scrutiny from lenders, and the risk of falling back into unmanageable debt. Regular monitoring of your financial situation, seeking professional advice, and practicing sound financial habits can help manage these challenges.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.