Bankruptcy discharge refers to the legal process that absolves a debtor from the responsibility of paying certain debts, providing them with a fresh financial start. The exact process varies depending on the type of bankruptcy filed—Chapter 7, Chapter 11, or Chapter 13. In a Chapter 7 bankruptcy, assets are liquidated to repay creditors, and any remaining eligible debts are discharged, usually within a few months. In contrast, a Chapter 13 bankruptcy requires a 3-5 year repayment plan, after which the remaining eligible debts are discharged. Chapter 11 bankruptcy typically applies to businesses where a reorganization plan is proposed to repay creditors while continuing operations. Post-discharge, the debtor is released from personal liability for discharged debts. However, it's important to note that not all debts can be discharged in bankruptcy. These are debts that can be eliminated in a bankruptcy discharge, freeing the debtor from personal liability. They often include credit card debt, medical bills, personal loans, utility bills, and some types of tax debt. Upon discharge, creditors have no legal recourse to collect these debts. Certain debts cannot be eliminated by the bankruptcy discharge. These include student loans, certain tax obligations, alimony, child support, and debts incurred through fraudulent activities. It's crucial for the debtor to understand this distinction to set realistic expectations from the bankruptcy process. Some debts are considered partially dischargeable. In these cases, bankruptcy may eliminate some but not all of the debt. This is often the case with tax lien debts, where the lien portion of the debt may remain after the bankruptcy discharge. In a Chapter 7 bankruptcy, often called "liquidation bankruptcy," discharge is typically granted a few months after filing. This type of discharge wipes out most unsecured debts, allowing a debtor a fresh start. However, non-exempt assets may be sold off to repay the creditors. A Chapter 13 bankruptcy, or "wage earner's plan," results in a discharge after the successful completion of a 3 to 5-year repayment plan. This type of discharge is broader and can eliminate some debts that cannot be discharged under Chapter 7, such as certain tax obligations and debts from a divorce settlement. Chapter 11 bankruptcy discharge primarily applies to businesses. It allows them to reorganize their debts and continue operating. After the reorganization plan is confirmed and implemented, the business receives a discharge relieving them from further liability on their pre-bankruptcy debts. Offers financial relief to debtors. It removes the burden of debts that have become overwhelming. However, the discharge often comes with the cost of a significantly lowered credit score, which can have long-term financial consequences, including higher interest rates on loans and credit cards. The emotional impact of bankruptcy discharge can be liberating. Overwhelming debts cause significant stress and anxiety, and their discharge can bring a sense of relief and a fresh start. However, some people may also feel a sense of failure or shame. Bankruptcy can affect a debtor's reputation, especially if the debtor is a business. It can also limit future borrowing options due to the mark on the debtor's credit report. Moreover, a discharge can affect legal standings, such as in court proceedings or legal judgments. After discharge, debtors often experience newfound financial freedom. This fresh start allows for the rebuilding of credit and a new perspective on financial health. Despite the hit to their credit report, debtors can start taking steps to regain financial stability. Even after discharge, non-dischargeable debts remain a responsibility. It's essential to create a plan to address these debts to avoid future financial difficulties. Consulting with financial advisors or credit counseling agencies can be a beneficial step in this process. Rebuilding credit after bankruptcy is a slow but crucial process. Starting with small, manageable lines of credit and making consistent, on-time payments can gradually improve credit scores. This process requires discipline and patience, but with diligence, recovery is achievable. To avoid future bankruptcies, individuals should implement sound financial management practices. These may include creating a realistic budget, saving for emergencies, reducing unnecessary expenses, and seeking financial advice when needed. There are many resources available to help individuals improve their financial literacy. These can be found in books, online courses, personal finance websites, and free workshops. These resources can provide valuable information and strategies for managing money and avoiding financial pitfalls. Planning for the future is a crucial aspect of financial health. It includes retirement planning, setting financial goals, and creating a plan to achieve these goals. This process can be complex and may require professional assistance, but it's an investment in one's financial future. Bankruptcy discharge can provide considerable relief for individuals or businesses overwhelmed by unmanageable debts. This legal process, whether through Chapter 7, 11, or 13, eliminates or restructures debts, offering a fresh start for the debtor. However, it's crucial to understand the distinctions between dischargeable and non-dischargeable debts, as not all obligations can be absolved. While the bankruptcy discharge can alleviate financial and emotional stress, it does have significant impacts on one's credit score and societal perception. Post-discharge, the journey to rebuild credit and financial stability requires discipline and strategic planning. Utilizing financial literacy resources, applying sound financial management practices, and planning for future financial goals can aid in avoiding future bankruptcies. While the process may be challenging, it serves as a stepping stone towards financial recovery and independence.How Bankruptcy Gets Discharged

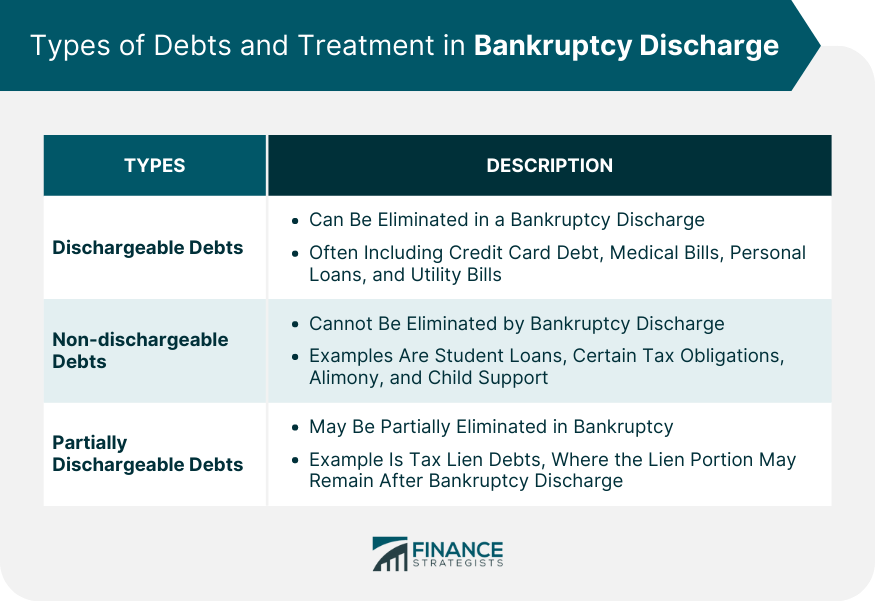

Types of Debts and Treatment in Bankruptcy Discharge

Dischargeable Debts

Non-dischargeable Debts

Partially Dischargeable Debts

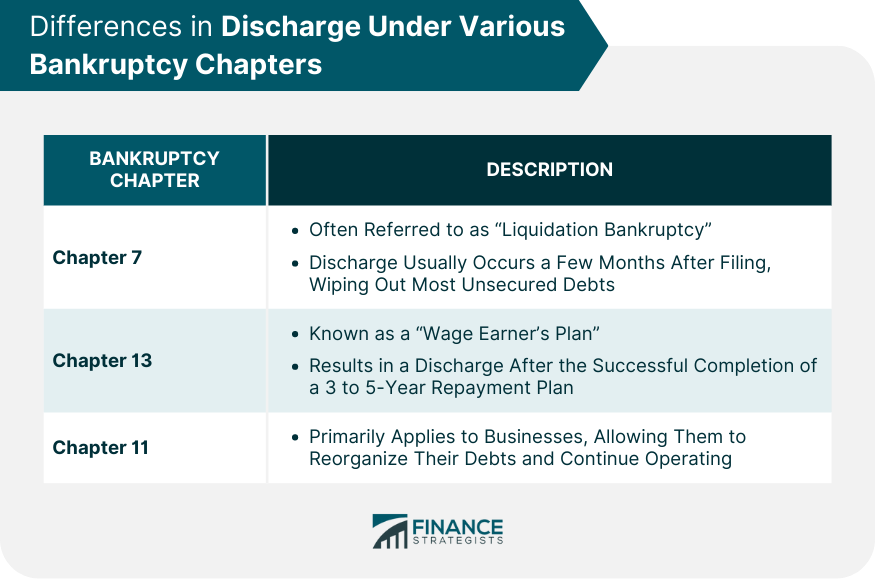

Differences in Discharge Under Various Bankruptcy Chapters

Chapter 7 Bankruptcy Discharge

Chapter 13 Bankruptcy Discharge

Chapter 11 Bankruptcy Discharge

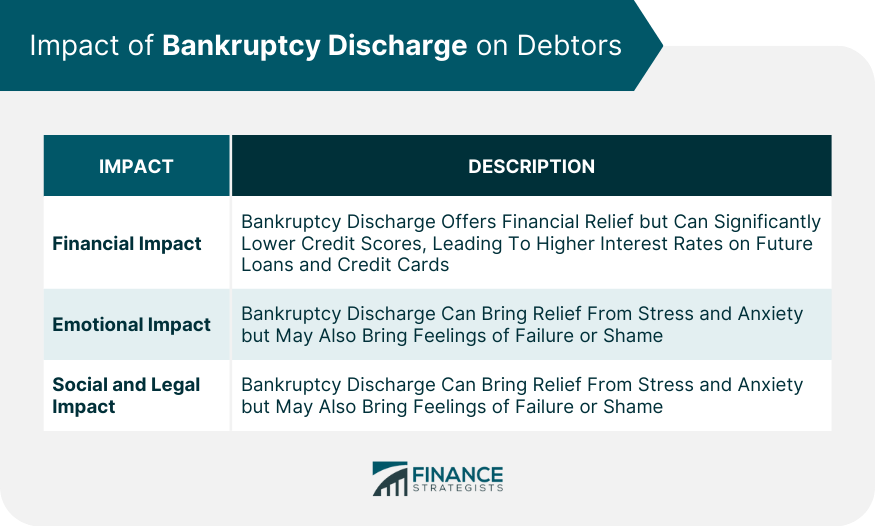

Impact of Bankruptcy Discharge on Debtors

Financial Impact of Bankruptcy Discharge

Emotional Impact of Bankruptcy Discharge

Social and Legal Impact of Bankruptcy Discharge

After the Bankruptcy Discharge

Fresh Start Post Bankruptcy Discharge

Dealing With Non-dischargeable Debts

Rebuilding Credit Post Bankruptcy Discharge

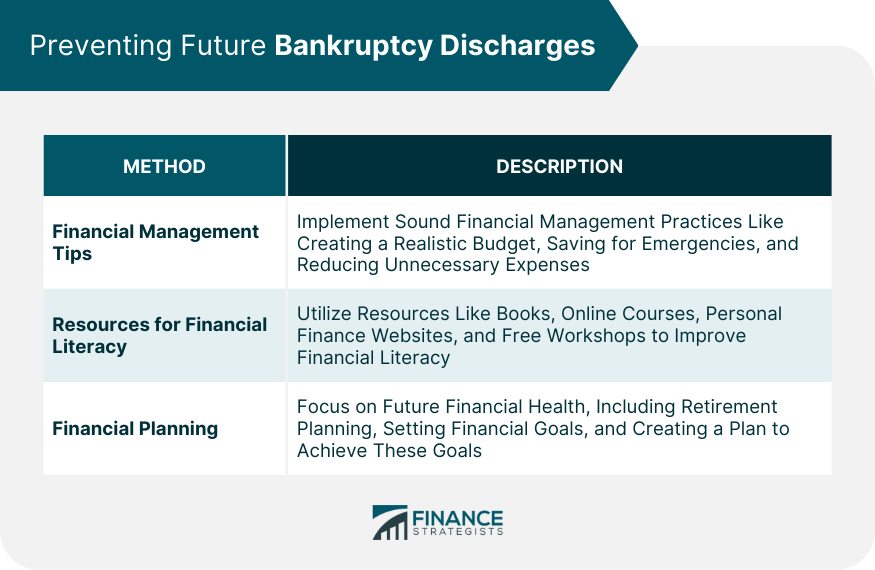

Preventing Future Bankruptcy Discharges

Financial Management Tips

Resources for Financial Literacy

Financial Planning

Conclusion

How Bankruptcy Gets Discharged FAQs

A bankruptcy discharge is a court order that eliminates certain debts, thus releasing the debtor from the obligation to pay them. The debtor is no longer legally required to pay any debts that are discharged.

The bankruptcy court plays a pivotal role in the bankruptcy discharge process. It verifies the debtor's information, assesses their financial situation, confirms their eligibility for bankruptcy, oversees the distribution of assets to creditors, and eventually issues the discharge order.

A Chapter 7 bankruptcy discharge typically occurs a few months after filing and eliminates most unsecured debts. A Chapter 13 bankruptcy discharge happens after completion of a 3-5 year repayment plan and can remove some debts that Chapter 7 cannot. A Chapter 11 bankruptcy discharge applies primarily to businesses, allowing them to reorganize their debts and continue operating.

A bankruptcy discharge often significantly lowers the debtor's credit score. This can lead to long-term financial consequences, such as higher interest rates on loans and credit cards.

A debtor can rebuild their credit after a bankruptcy discharge by starting with small, manageable lines of credit, making consistent, on-time payments, and practicing financial discipline. Over time, this can lead to an improved credit score.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.