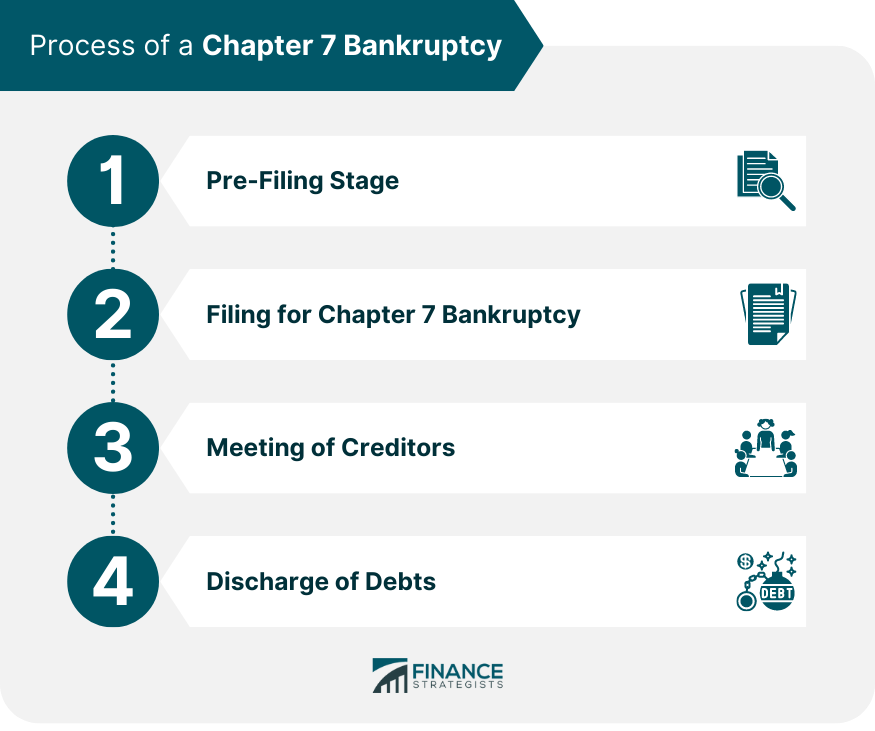

Chapter 7 bankruptcy, also known as liquidation bankruptcy, is a legal process under the United States federal law that allows individuals and businesses to eliminate their unsecured debts. By filing for Chapter 7, a debtor seeks relief from debts they cannot repay, offering a fresh financial start. However, they may have to surrender some property to pay off their creditors. Knowledge of the timeline of Chapter 7 bankruptcy offers an organized view of the steps involved, allowing those in the process to anticipate their obligations and deadlines. Furthermore, it provides an understanding of how long the bankruptcy process might last, allowing debtors to plan for life after bankruptcy. The average Chapter 7 bankruptcy case takes four to six months to complete from the initial filing to discharge. You can help the process go as quickly as possible by providing the most complete and accurate information you can in your paperwork and by fully disclosing all your assets. This duration, however, is not absolute and can vary based on case complexity, court schedules, and the debtor's compliance with legal requirements. The process involves several stages, starting with pre-filing tasks and concluding with the discharge of debts. In preparation for a Chapter 7 bankruptcy filing, it's essential to gather all relevant documents and financial information. This process may include compiling information about income, expenses, debts, assets, and financial transactions. Also, tax returns for the previous two years are required. The accuracy of this information is vital, as it forms the basis of the bankruptcy petition. It's highly recommended to consult a bankruptcy attorney before filing for Chapter 7 bankruptcy. These legal experts can provide invaluable advice, ensuring a debtor's rights are protected and guiding them through the complex legal process. A bankruptcy attorney can also evaluate a debtor's financial situation and provide advice on whether filing for Chapter 7 bankruptcy is the most suitable option. Before filing, debtors must complete a credit counseling course from a government-approved organization. This course is designed to help individuals understand their financial situation better, evaluate their options, and plan for future financial stability. A certificate of completion is issued at the end of the course, which must be submitted with the bankruptcy petition. Once all the necessary documents have been compiled and the credit counseling course is complete, the next step is to file the bankruptcy petition. The petition consists of several official forms where the debtor provides details about their financial affairs. Filing the petition triggers the bankruptcy case and affords the debtor certain protections. Upon the filing of a bankruptcy petition, an automatic stay is imposed, which temporarily halts most actions by creditors to collect debts. This stay offers immediate relief to debtors, stopping lawsuits, wage garnishments, and even phone calls demanding payments. The stay remains in place until the bankruptcy case is closed or until the court lifts the stay at a creditor's request. After filing the petition, the court appoints an impartial bankruptcy trustee to oversee the case. The trustee's primary responsibilities include reviewing the bankruptcy paperwork, selling the debtor's non-exempt assets, and distributing the proceeds to creditors. The meeting of creditors, also known as the 341 meeting, is a mandatory procedure in the Chapter 7 bankruptcy process. The meeting allows the bankruptcy trustee and creditors to ask the debtor questions under oath about their finances and property. This meeting is typically straightforward and concludes relatively quickly if the debtor has provided accurate and complete information. The bankruptcy trustee plays a central role during the meeting of creditors. They review the debtor's identification and verify the accuracy of the bankruptcy documents. The trustee asks the debtor questions to understand better their financial situation and ensure that all non-exempt assets are accounted for. While creditors are invited to the meeting of creditors, they rarely attend. If they do, they are given an opportunity to question the debtor, usually about the nature and location of the debtor's assets. However, they cannot engage in abusive behavior or demand payment from the debtor during the meeting. This is usually done by the bankruptcy trustee based on the debtor's disclosures in their bankruptcy documents and any other pertinent information the trustee may uncover during their investigation. Bankruptcy laws allow debtors to keep certain "exempt" property for a fresh start after bankruptcy. The exemptions vary from state to state and can include items such as homestead property, vehicles, and personal belongings. Non-exempt assets, on the other hand, are sold in the liquidation process to pay back creditors. The bankruptcy trustee sells the debtor's non-exempt assets and distributes the proceeds among creditors according to the priorities set by bankruptcy law. Unsecured creditors typically receive a portion of their claims from these proceeds, but it's rare for them to receive the full amount owed. Not all debts are dischargeable in Chapter 7 bankruptcy. Generally, unsecured debts like credit card debt, medical bills, and personal loans can be discharged. However, certain types of debts, such as student loans, child support, and recent tax debts, are typically not dischargeable. To qualify for a discharge, debtors must also meet specific eligibility criteria, including passing the means test and not having received a Chapter 7 discharge in the past eight years. The discharge in a Chapter 7 bankruptcy case usually occurs about four months after the debtor files the petition with the clerk of the bankruptcy court. The court sends a notice of discharge to the debtor and all creditors. This notice informs them that the dischargeable debts have been eliminated and that creditors should no longer attempt to collect them. A successful discharge effectively releases the debtor from personal liability for most debts. It signals the end of the bankruptcy case and gives the debtor a financial fresh start. However, it's important to note that a bankruptcy discharge does not erase the debtor's credit history. Bankruptcy can remain on a credit report for up to 10 years, potentially affecting future creditworthiness. Chapter 7 bankruptcy stays on your credit for ten years. After this time, credit bureaus should stop reporting it. The effects of a bankruptcy on your credit report my be more moderate for an already low score and more severe on a higher score. However, after bankruptcy, it may be easier to rebuild your credit without having debts drag down your score. Typically, a Chapter 7 bankruptcy case takes about four to six months from filing to discharge, although the duration may vary based on various factors. The process involves stages such as the pre-filing stage, filing the petition, the meeting of creditors, the liquidation process, and the discharge of debts. Debtors must gather necessary documents, consult a bankruptcy attorney, and complete a credit counseling course before filing. The filing triggers an automatic stay that protects debtors from creditor actions. A bankruptcy trustee oversees the case, and a meeting of creditors allows for questioning. The liquidation process involves identifying assets, distinguishing exempt and non-exempt assets, selling non-exempt assets, and distributing proceeds to creditors. Finally, a successful discharge relieves debtors from personal liability for most debts, offering them a new financial beginning while considering the long-term impact on credit history.What Is a Chapter 7 Bankruptcy?

How Long Does Chapter 7 Bankruptcy Take?

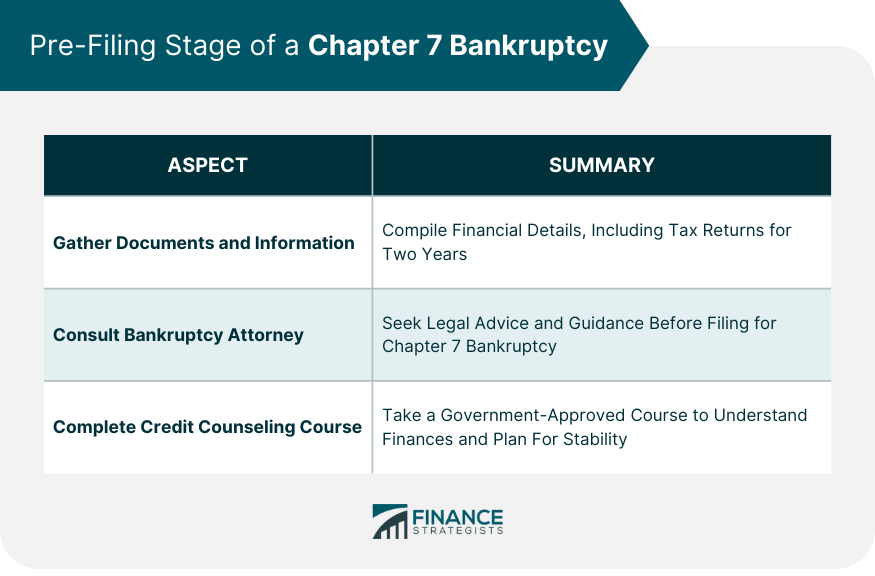

Pre-filing Stage

Gathering Necessary Documents and Information

Meeting With a Bankruptcy Attorney

Completing Credit Counseling Course

Filing for Chapter 7 Bankruptcy

Submitting the Petition and Necessary Forms

Automatic Stay and Protection from Creditors

Appointment of a Bankruptcy Trustee

Meeting of Creditors

Explanation of the Meeting's Purpose

Role of the Bankruptcy Trustee

Potential Creditor Participation

Liquidation Process

Identifying and Valuing Assets

Exempt vs. Non-exempt Assets

Sale of Non-exempt Assets and Distribution of Proceeds

Discharge of Debts

Eligibility Criteria for a Discharge

Waiting Period for Debt Discharge

Consequences of a Successful Discharge

How Long Does Chapter 7 Bankruptcy Stay on Your Credit?

Conclusion

How Long Does Chapter 7 Bankruptcy Take? FAQs

The entire process of Chapter 7 Bankruptcy typically takes an average of 4 to 6 months from filing to discharge.

To file for Chapter 7 Bankruptcy, you will need all financial documents such as income statements and bills, any assets like vehicles or real estate that are owned, and a list of creditors with the amount owed.

Yes, there are certain court costs and attorney's fees associated with filing for Chapter 7 Bankruptcy.

Filing for Chapter 7 Bankruptcy can have a significant negative impact on your credit score, and you may see a drop of 200 to 300 points or more.

While many types of debt are eligible for discharge in a chapter 7 bankruptcy, some types such as student loans and child support obligations cannot be discharged through bankruptcy. Additionally, not all debts are eligible; if the creditor successfully objects to the discharge then it may remain after bankruptcy is complete.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.