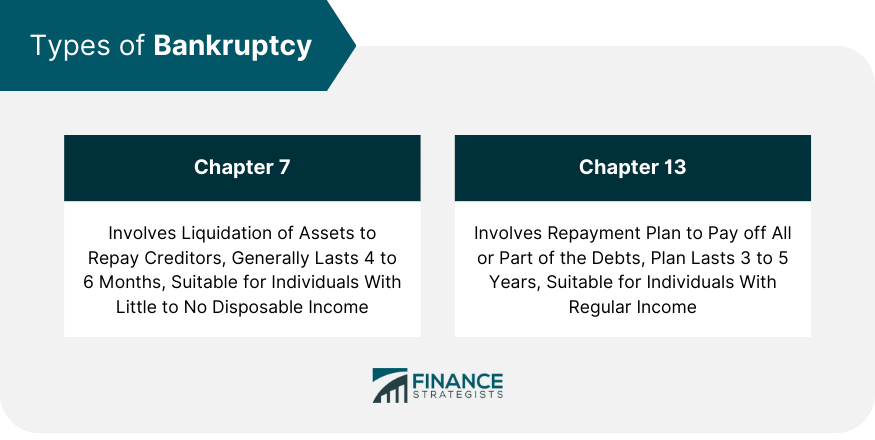

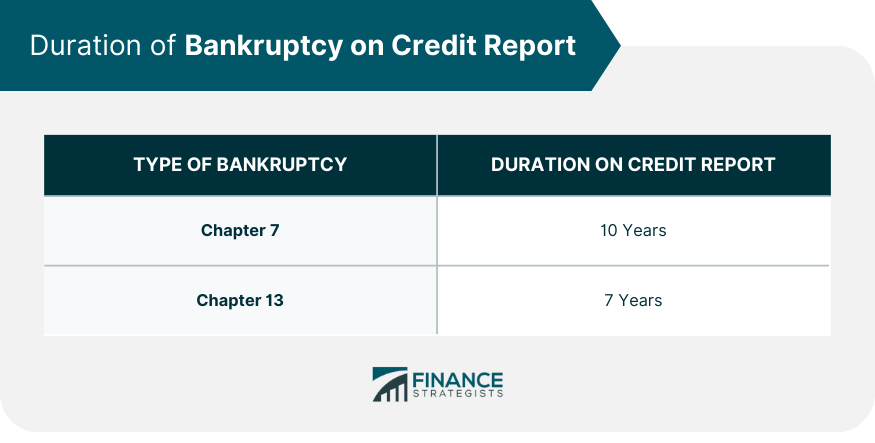

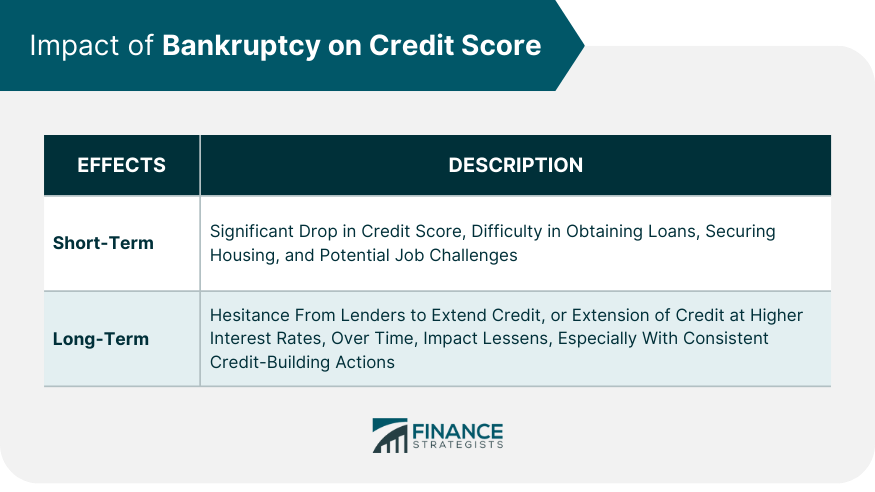

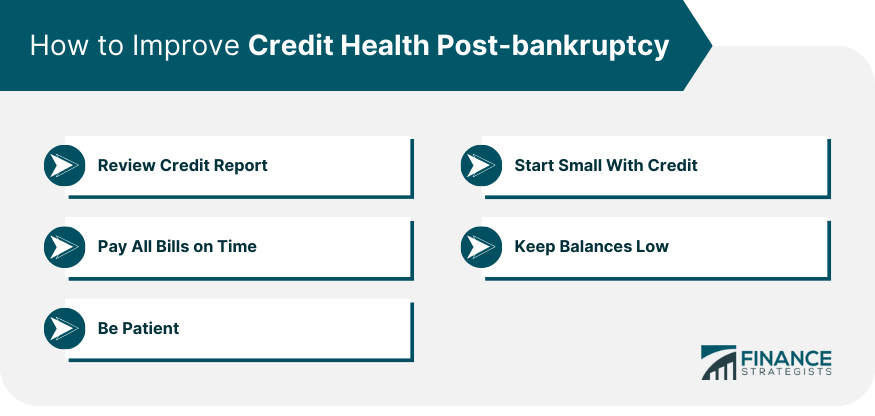

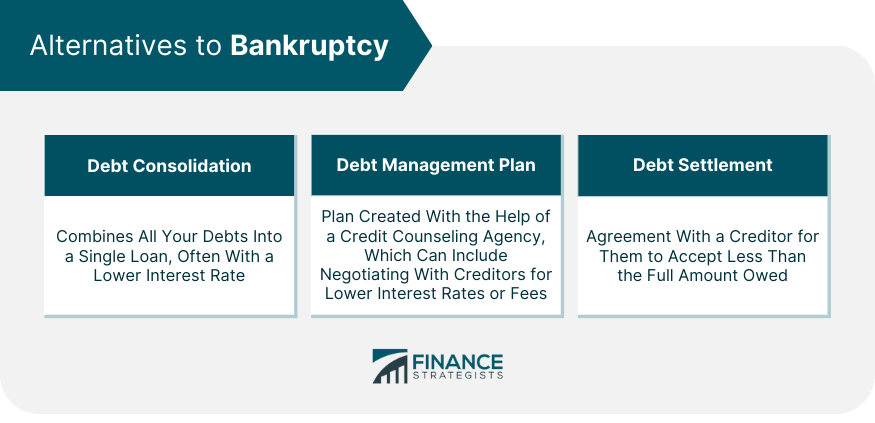

Bankruptcy is a legal process designed to provide debt relief to individuals or businesses unable to repay their obligations. It's not a decision to be made lightly, given the profound impact it has on one's financial standing and future borrowing capabilities. In the United States, the two most common types of bankruptcy are Chapter 7 and Chapter 13. Chapter 7 bankruptcy, also known as "liquidation bankruptcy," involves the sale of the debtor's non-exempt property by a trustee to repay creditors. It's typically filed by individuals with limited income who cannot pay back their debts. Chapter 13 bankruptcy, on the other hand, is often referred to as a "wage earner's plan." It allows individuals with regular income to develop a plan to repay all or part of their debts over three to five years. Each type of bankruptcy carries its own implications and durations of impact on your credit report, which we'll explore in the following sections. Chapter 7 bankruptcy is quite severe, and its effects linger longer on your credit report. If you've filed under Chapter 7, the bankruptcy will stay on your credit report for ten years from the filing date. It's important to note that individual accounts included in the bankruptcy will be deleted from the report earlier, typically seven years from the date the lender first reported it as delinquent. Chapter 13 bankruptcy, while still significant, is viewed a bit more favorably by credit reporting agencies given its commitment to debt repayment. As such, a Chapter 13 bankruptcy will remain on your credit report for seven years from the filing date. The difference in duration between Chapter 7 and Chapter 13 bankruptcies can be attributed to the nature of each bankruptcy type. In Chapter 7, the debtor isn't obligated to repay any of their dischargeable debts, which essentially results in the creditors taking a loss. Given the severity of this action, it stays on the credit report for a longer duration. Conversely, in a Chapter 13 bankruptcy, debtors agree to a repayment plan, which means creditors receive at least some of what they're owed. This commitment to repay debt is viewed more favorably, hence, its shorter duration on the credit report. In the short term, filing for bankruptcy can cause a significant drop in your credit score. Depending on the strength of your credit before bankruptcy, the decline can be by 100 points or even more. The higher your initial credit score, the more you stand to lose. Additionally, a bankruptcy record may deter lenders, landlords, and sometimes employers, who view this as an indicator of financial irresponsibility, making it more challenging to obtain loans, secure housing, or even land certain jobs. While the impact of bankruptcy diminishes over time, it can have lasting effects on your ability to secure future credit opportunities. Lenders, for example, might be hesitant to extend credit to someone with a bankruptcy on their record or may only do so at a higher interest rate or with additional conditions. However, it's worth noting that the effect of bankruptcy on your credit score isn't permanent. Over time, as bankruptcy ages, its impact on your credit score lessens, especially if you take steps to rebuild your credit. Review Credit Report: Regularly check your credit report for errors and discrepancies. Make sure that all debts discharged in bankruptcy are reported as such. Start Small With Credit: Apply for a secured credit card or a credit-builder loan to start the process of rebuilding your credit. Pay All Bills on Time: On-time payment is the most significant factor affecting your credit score. Ensure all your bills, not just credit cards and loans, are paid promptly. Keep Balances Low: High balances can affect your credit utilization rate—one of the key components of your credit score. Try to keep your credit card balances low. Be Patient: Rebuilding credit doesn't happen overnight. It requires patience and consistent, responsible credit habits. Bankruptcy offers a chance for a fresh start. However, to make the most of this new beginning, financial planning and discipline are crucial. Developing and adhering to a realistic budget, curbing unnecessary spending, and building an emergency fund can help prevent future financial distress. Filing for bankruptcy is a significant decision that should only be made after carefully considering all your options and understanding the implications. Bankruptcy can offer much-needed relief for those drowning in unmanageable debt. However, it's a serious step that can affect your ability to obtain future credit, rent housing, and sometimes even affect your job prospects. It's advisable to consult with a financial advisor or credit counselor to fully understand the implications of bankruptcy and explore all other options before making this decision. Bankruptcy isn't the only route to debt relief. Depending on your financial situation, you might be able to avoid bankruptcy through other methods like: Debt Consolidation: This involves combining all your debts into a single loan, often with a lower interest rate. Debt Management Plan: A credit counseling agency can help you create a debt management plan, which can include negotiating with creditors for lower interest rates or fees. Debt Settlement: This is an agreement with a creditor for them to accept less than the full amount you owe. The length of time that bankruptcy stays on your credit report—ten years for Chapter 7 bankruptcy and seven years for Chapter 13 bankruptcy—is a significant factor to consider when weighing your options for bankruptcy. While bankruptcy can offer relief from overwhelming debt, it comes with significant and long-lasting repercussions on your credit health. However, this shouldn't discourage you from embarking on your financial recovery journey. With patience, strategic steps, and discipline, rebuilding your credit post-bankruptcy is certainly achievable. A financial advisor or credit counselor can provide invaluable guidance as you navigate the complexities of bankruptcy and its aftermath. Reach out to a professional today to explore all your options and develop a strategy that's tailored to your specific needs and circumstances.Overview of the Basics of Bankruptcy

How Long Does Bankruptcy Stay on Your Credit Report?

Duration for Chapter 7 Bankruptcy

Duration for Chapter 13 Bankruptcy

Explanation of Why the Durations Are Different

Impact of Bankruptcy on Credit Score

Short-Term Effects of Bankruptcy

Long-Term Effects and How It Influences Future Credit Opportunities

How to Improve Credit Health Post-bankruptcy

Importance of Financial Planning and Discipline

Other Considerations Regarding Bankruptcy

Decision to File for Bankruptcy

Alternatives to Bankruptcy

Bottom Line

How Long Does Bankruptcy Stay on Your Credit Report? FAQs

Chapter 7 bankruptcy stays on your credit report for ten years from the date of filing.

Chapter 13 bankruptcy stays on your credit report for seven years from the date of filing.

Yes, the type of bankruptcy you file does impact the duration it stays on your credit report. Chapter 7 bankruptcy stays for ten years, while Chapter 13 bankruptcy stays for seven years.

Yes, you can take steps to improve your credit score even while the bankruptcy record is on your report, such as paying bills on time, maintaining low credit card balances, and managing new credit responsibly.

No, bankruptcy is not the only option for debt relief. Alternatives include debt consolidation, debt management plans, and debt settlement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.