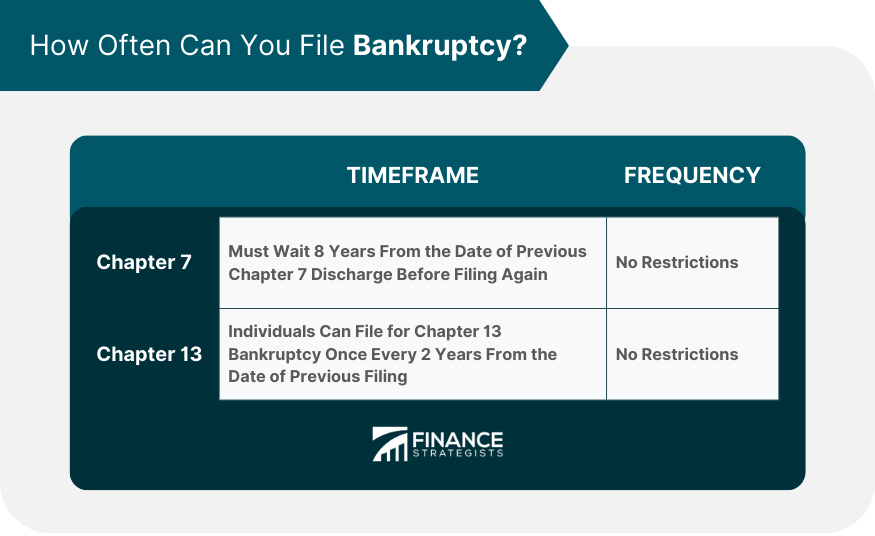

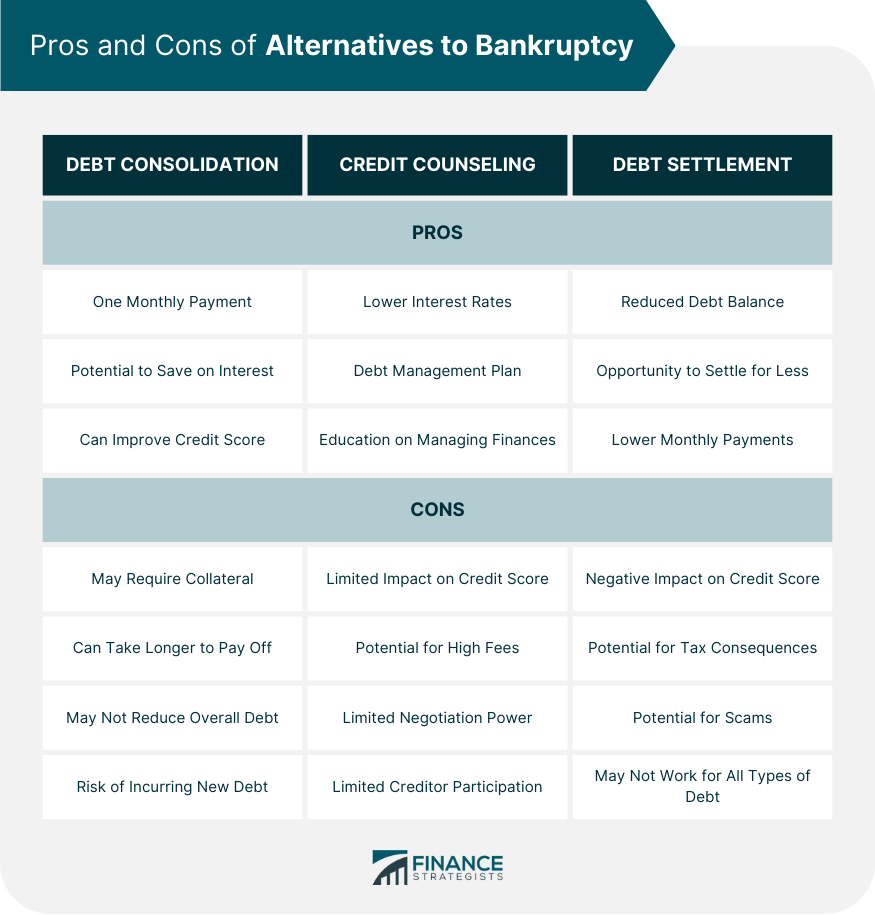

You can file for bankruptcy as often as you like; however, there are limits to how often you can receive a discharge. The timetable is as follows: Chapter 7 after Chapter 7: every 8 years Chapter 7 after Chapter 13: after 6 years Chapter 13 after Chapter 7: after 4 years Chapter 13 after Chapter 13: every 2 years Chapter 7 bankruptcy is the most common form of bankruptcy for individuals. It is also known as liquidation bankruptcy, as it involves selling non-exempt assets to repay creditors. The process typically takes 4-6 months to complete, and it allows individuals to discharge most of their unsecured debts. To be eligible for Chapter 7 bankruptcy, individuals must meet certain criteria. Firstly, they must pass the means test, which compares their income to the median income in their state. If their income is lower than the median, they are eligible for Chapter 7 bankruptcy. If their income is higher than the median, they may still be eligible if they pass the second part of the means test, which considers their expenses and other factors. Additionally, individuals must have completed credit counseling within 180 days before filing for bankruptcy. They must also have not received a discharge in a Chapter 7 bankruptcy case within the past 8 years, or a Chapter 13 bankruptcy case within the past 6 years. There are no restrictions on how often individuals can file for Chapter 7 bankruptcy, but there are timeframes that must be met to file Chapter 7 bankruptcy. Individuals must wait 8 years from the date of their previous Chapter 7 discharge before they can file for Chapter 7 bankruptcy again. If they have filed for Chapter 13 bankruptcy previously, they must wait 4 years from the date of their Chapter 13 discharge before they can file for Chapter 7 bankruptcy. While there are no restrictions on how often individuals can file for Chapter 7 bankruptcy, it is important to note that filing for bankruptcy can have long-lasting consequences on credit score, employment opportunities, and future borrowing. As such, it is generally recommended to only file for bankruptcy when all other options have been exhausted. Chapter 13 bankruptcy is a reorganization bankruptcy for individuals who have a regular income but are unable to repay their debts. It allows individuals to create a repayment plan to pay off their debts over a period of 3-5 years. Chapter 13 bankruptcy is often used by individuals who are behind on mortgage or car payments and want to keep their assets. Individuals must have a regular income that is sufficient to pay their living expenses and their debt repayments under the repayment plan. Additionally, their debts must be within the limits set by the bankruptcy code, which is currently an individual's combined total secured and unsecured debts are less than $2,750,000 as of the date of filing for bankruptcy relief. Individuals must have also completed credit counseling within 180 days before filing for bankruptcy. They must also have not received a discharge in a Chapter 7 bankruptcy case within the past 4 years, or a Chapter 13 bankruptcy case within the past 2 years. There are restrictions on how often individuals can file for Chapter 13 bankruptcy. Individuals can file for Chapter 13 bankruptcy once every 2 years from the date of their previous filing. However, if their previous filing was dismissed due to a failure to comply with court orders or due to their own misconduct, they may have to wait 180 days before filing again. Similar to Chapter 7 bankruptcy, there are no restrictions on how often individuals can file for Chapter 13 bankruptcy. However, filing for bankruptcy can have long-lasting consequences, and it is important to consider alternatives to bankruptcy and to seek professional advice before making a decision. Both Chapter 7 and Chapter 13 bankruptcy provide relief from debt collectors and allow individuals to discharge or restructure their debts. Additionally, both types of bankruptcy have automatic stays, which stop wage garnishments, foreclosures, and other collection actions while the bankruptcy case is pending. The main difference between Chapter 7 and Chapter 13 bankruptcy is the way in which debts are handled. Chapter 7 bankruptcy involves liquidating non-exempt assets to repay creditors, while Chapter 13 bankruptcy involves creating a repayment plan to pay off debts over a period of 3-5 years. Additionally, eligibility requirements for Chapter 7 and Chapter 13 bankruptcy differ. While Chapter 7 bankruptcy is available to individuals with low incomes and limited assets, Chapter 13 bankruptcy is only available to individuals with a regular income who can afford to make debt repayments under the repayment plan. When choosing between Chapter 7 and Chapter 13 bankruptcy, individuals should consider their income, assets, and debt types. If an individual has a low income and few assets, Chapter 7 bankruptcy may be a better option. However, if an individual has a regular income and wants to keep their assets, Chapter 13 bankruptcy may be a better option. While bankruptcy can provide relief from debt collectors, it is not always the best option. There are several alternatives to bankruptcy that individuals can consider, including debt consolidation, credit counseling, and debt settlement. Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can make debt repayment more manageable and can potentially lower monthly payments. Credit counseling involves working with a credit counselor to create a budget and a debt repayment plan. Debt settlement involves negotiating with creditors to settle debts for less than the full amount owed. Debt consolidation can make debt repayment more manageable and can potentially lower monthly payments, but it may not be available to individuals with low credit scores or high debt-to-income ratios. Credit counseling can help individuals create a budget and a debt repayment plan, but it may not be able to negotiate lower interest rates or settle debts for less than the full amount owed. Debt settlement can potentially reduce the amount owed on debts, but it can also have negative impacts on credit scores and may result in taxes on forgiven debt. Filing for bankruptcy can have long-lasting consequences on credit scores, employment opportunities, and future borrowing. Bankruptcy can remain on credit reports for up to 10 years, and it can make it difficult to obtain credit, rent an apartment, or find employment in certain industries. Filing for bankruptcy can have a negative impact on credit scores, which can make it difficult to obtain credit or obtain credit at favorable rates. Bankruptcy can remain on credit reports for up to 10 years, and it can lower credit scores by up to 200 points or more. Filing for bankruptcy can also have an impact on employment opportunities, particularly in industries that require security clearance or fiduciary responsibilities. Employers may view bankruptcy as a sign of financial irresponsibility, which may affect an individual's chances of obtaining a job. Filing for bankruptcy can make it difficult to obtain credit or obtain credit at favorable rates. Lenders may view individuals who have filed for bankruptcy as high-risk borrowers, and they may require higher interest rates or additional collateral to approve a loan. Bankruptcy can remain on credit reports for up to 10 years, depending on the type of bankruptcy filed. Chapter 7 bankruptcy remains on credit reports for 10 years from the date of filing, while Chapter 13 bankruptcy remains on credit reports for 7 years from the date of filing. Filing for bankruptcy can provide relief from debt collectors and allow individuals to discharge or restructure their debts. However, it is important to understand how often you can file for bankruptcy and to consider alternatives to bankruptcy before making a decision. Bankruptcy can have long-lasting consequences on credit scores, employment opportunities, and future borrowing, and it is important to seek professional advice before making a decision.How Often Can You File Bankruptcy?

Chapter 7 Bankruptcy

Eligibility Requirements

Timeframe for Filing

Frequency of Filing

Chapter 13 Bankruptcy

Eligibility Requirements

Timeframe for Filing

Frequency of Filing

Comparison of Chapter 7 and Chapter 13 Bankruptcy

Similarities

Differences

Factors to Consider When Choosing Between Chapter 7 and 13

Alternatives to Bankruptcy

Pros and Cons of Each Option

Repercussions of Filing Bankruptcy

Impact on Credit Score

Effects on Employment Opportunities

Effects on Future Borrowing

How Often Bankruptcy Appears on Credit Report

Conclusion

How Often Can You File Bankruptcy? FAQs

The answer depends on the type of bankruptcy you previously filed and the type you intend to file. For Chapter 7 bankruptcy, you can file again after eight years of your previous filing. For Chapter 13 bankruptcy, you can file after two years of your previous filing.

Yes, you can file for bankruptcy multiple times, but there are limitations to how often you can do so. You cannot file for Chapter 7 bankruptcy again within eight years of your previous filing. Similarly, you cannot file for Chapter 13 bankruptcy again within two years of your previous filing.

Filing for bankruptcy can negatively impact your credit score. The exact impact depends on your credit history and the type of bankruptcy you filed. A Chapter 7 bankruptcy will stay on your credit report for ten years, while a Chapter 13 bankruptcy stays on your credit report for seven years.

Yes, you can file for bankruptcy even if you have a pending lawsuit or judgment against you. However, filing for bankruptcy will not automatically stop the lawsuit or judgment. You will need to seek additional legal advice on how to proceed with the lawsuit or judgment.

No, bankruptcy cannot wipe out all types of debts. Some debts, such as student loans, taxes, and child support payments, are generally not dischargeable in bankruptcy. Additionally, bankruptcy may not discharge debts that were obtained fraudulently or through illegal means.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.